This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

Sukanya Samriddhi Yojana has received a great initial response from the general public. As the scheme offers 9.1% tax-free rate of interest, investors are finding this scheme to be extremely attractive and want to invest in it as soon as possible. They also need handholding to invest in this scheme. But, due to lack of required information with the post offices and authorised bank branches, people are finding it difficult to do so.

I have posted two articles about this scheme and both have received over hundred comments from the visitors. I have been getting many queries regarding the maturity value of this scheme. People want to know the value of their investment as the scheme gets matured after 21 years.

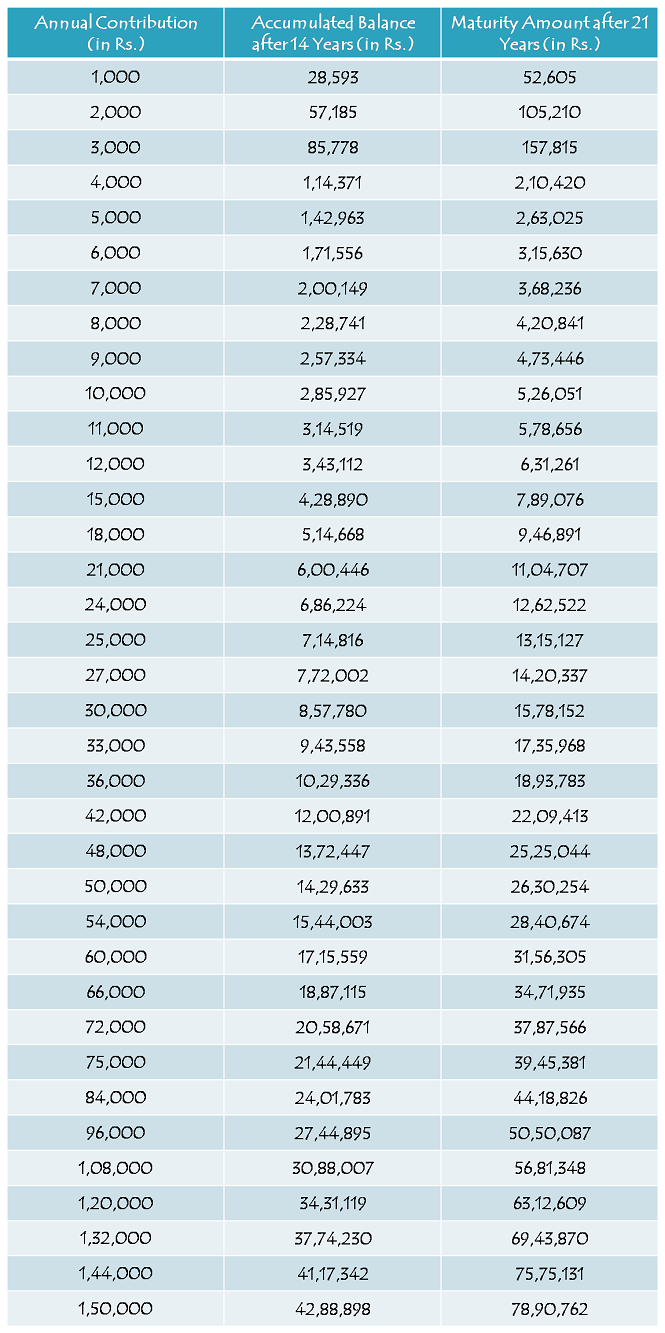

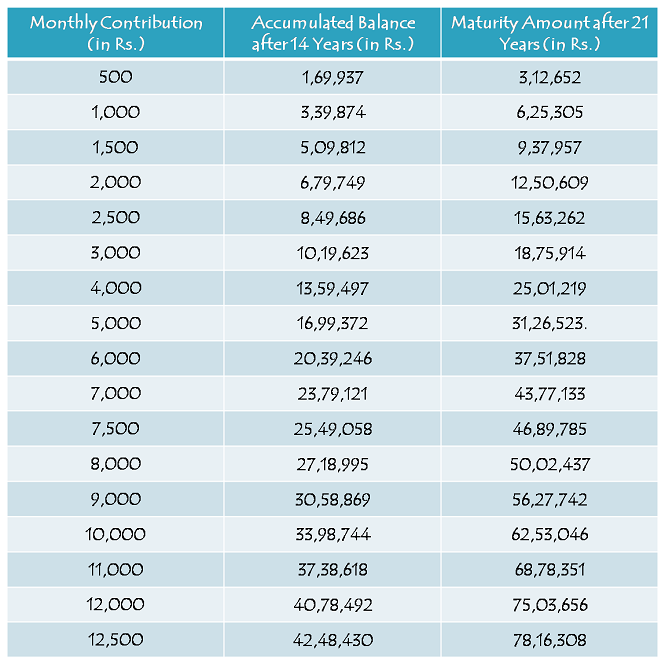

Though it is almost impossible to calculate a precise maturity value of this scheme as there are many variables on which its maturity value will depend, I have tried to make a couple of tables in which the maturity value has been calculated keeping those variables to be constant and yearly & monthly contribution to be the only variable.

Certain assumptions have been made for calculating these maturity values and those assumptions are:

* Rate of Interest has been assumed to be 9.1% for all these 21 years.

* Yearly contributions have been assumed to be made on April 1 every year i.e. the beginning of the financial year.

* Monthly contributions have been assumed to be made on 1st day of every month.

* Although it is not mandatory, a fixed amount of yearly/monthly contribution has been assumed.

* It is also assumed that no withdrawal is made throughout these 21 years.

Here you have the tables:

Yearly Contribution Table

Monthly Contribution Table

I hope these two tables help people in deciding how much amount they would like to contribute to this scheme in order to achieve their girl child’s marriage and/or higher education goals.

Before you go ahead and plan to get an account opened, I would like to again highlight the main features of this scheme:

Who can open this account? – Parents or a legal guardian of a girl child up to the age of 10 years, can open this account in the name of the girl child. Up to December 1, 2015, one year grace period has been provided to allow this account to get opened for a girl child who is born on or after December 2, 2003.

9.1% Tax-Free Rate of Interest – This scheme offers 9.1% rate of interest, which has also been exempted from tax in this year’s budget. But, this rate is not fixed at 9.1% for the whole tenure and is subject to a revision every financial year.

Scheme Matures in 21 years or on Girl’s Marriage, whichever is earlier – The scheme gets matured on completion of 21 years from the date of opening of the account or as the girl child gets married, whichever is earlier. Please note that the girl attaining the age of 21 years has no relevance to maturity of this scheme.

Deposit for 14 years only – You need to deposit a minimum of Rs. 1,000 and a maximum of Rs. 1,50,000 only for the first 14 years, after which you are not required to deposit any amount. Your account will keep earning the applicable interest rate for the remaining 7 years or till it gets matured on your daughter’s marriage.

Documents Required – You need birth certificate of the girl child, along with the identity proof and residence proof of the guardian, to open an account under this scheme. You can approach any post office or authorised branches of some of the commercial banks to get this account opened.

You can check the rest of the features of this scheme from this post – Sukanya Samriddhi Yojana – Tax-Free Small Savings Scheme for a Girl Child

You can also download the application form to open an account from this post – Sukanya Samriddhi Yojana – Application Form & List of Banks to Open an Account. If you still have any query or something related to discuss, please share it here.

sir, i want to know that my daugher is 8and 1/2 years old, if i deposit rs -12000p.a the what maturity amt may she get at the age of 21 years(suppose getting marriiage)( 13 yrs of policy, secondly can i increase the amt in future

Yes, you can increase the amount in future. Your maturity amount will vary according to your contributions every year and the rate of interest in future years.

if I manage 1st year 1000Rs & next year I have sufficient money to deposit approx. 12000Rs. this condition is tolerable. please clear this confusion?

Yes, this is perfectly acceptable.

We can invest upto 14 years of age of the kid or upto 14 years from the date of opening of account???

Say, my kid is 5 years. If I start now, do I have to invest till 2029, or till she attains 14 years, i.e., till 2024?

You need to invest for 14 years from the date of opening this account. Age of the girl child has nothing to do with 14 years. So, you’ll have to contribute till 2029.

Res sir ,

How can I withdraw full money before her (my daughter ) marriage ?

Pls clear withdrawl procedure before her marriage ….

It is not possible to withdraw 100% balance before your daughter’s marriage or maturity date on completion of 21 years from the date of opening this account.

Res sir,

My daughter date of birth is 20-06-2008

How many years I have to deposit money in this scheme?

When I withdraw full money?

You need to deposit money for 14 years and you can withdraw money when your daughter gets married or when your account completes 21 years.

who can receive money or can withdraw money after 18/21 years daughter hersely only or father too? pls clear with the rule position because in this part only so much ambiguity is there

The girl child will have the right to claim the balance amount after 21/18 years or whenever she gets married.

Res sir,

Pls clear my one confusion more.. Can I withdraws full money from this account after complete the age 21 years of my daughter ?

No, you cannot. You can withdraw the balance only if your daughter gets married on or before that.

who can withdraw money at maturity as it is not clear ,daughter by herself or natural\legal guardien if he\she survives till that time as in form he is giving name as subscriber of this scheme for her daughter..please clear with rule position

The girl child will have the right to the balance amount as she completes 18 years of age and becomes major.

Sir merit beti 1 saal ki h. Main agar abi 1000/- rs. Deposit karu n next months se 500/-rs. Per month deposit karu to chalega kya? N Usk naam se 2 accounts open kr sakti hu kya? Thnxs

Is scheme mein har mahine deposit karna zaroori nahin hai, saal mein ek baar paisa deposit karne se bhi chalega. Ek girl child ke naam se 2 accounts nahin khol sakte.

yaar Mere mind main sirf ek question h agar main monthly 1000 rs add karta hu to mujhe 21 saal baad 607000 ke around fully amount milega ya usmain se bhi govt kuch % cut karege.

plz baatao

21 saal baad government kuch deduct nahin karegi.

meri beti ki age 9 saal h or 1000 per month ke hisab se 14 saal tak m 168000 rs jama karwa dunga or beti us time 23 saal ki ho jayegi mujhe us time withdrawal karna h mujhe kitne rs. milenge plz tell me thanks

Hemrajji, aap is scheme se do baar paisa withdraw kar sakte ho, ek baar aapki beti ke 18 saal complete hone pe balance amount ka 50% aur doosri baar, uski shaadi ke time ya is scheme ke 21 saal complete hone par 100% balance. 21 saal ki calculation upar table mein di hui hai, please check.

my baby birth 06.06.2007 per month 1000/= deposit after 21 year maturity value……..

Please check the table above, it should be approximately Rs. 6,25,305.

hello shiv

i need to no 1 thing jab ye scheme metaured ho jayegi after 21 years

so iske jo returns hoge usme koi tax deductd hoha ya nahi?

Hi Vinod,

As this scheme stands tax-free now, there is no question of any tax getting deducted. So, no TDS would be applicable.

my daughter her dob is 10-12-2005 can i open an account for her now in the post office

Yes, your daughter is eligible for this scheme. You can get an account opened for her.

i had one quires about how much should be paid per month to my daughter can i open an account now for her, she is just 1 year child .

Yes, you can get an account opened for her. Your other query is not clear to me.

I would Like to know, whether scheme provide additional tax saving above the previous limit of 1.5 Lac. for Ex. if I am depositing Rs. 20,000/ per year, so can I avail 1.5 lac+ 20, 000 = 1.7 Lac as tax saving amount.

No, total exemption u/s 80C stays at Rs. 1.50 lakh. It is just that this scheme qualifies for 80C deduction.

Thank you Shiv..!

You are welcome!

I have two girls and want to open account for each one. is 150,000 total limit of all accounts or each account. I mean to say can i add 150000 for each girls account i.e 3 lacs per annum.

As per the wordings of the Circular – “the total money deposited in an account on a single occasion or on multiple occasions shall not exceed one lakh fifty thousand rupees in a financial year”, I think you can deposit a total of Rs. 3 lakh in two accounts.

Source: http://www.indiapost.gov.in/dop/Pdf%5CCirculars%5Csukanya_samriddhi_SB_Order_2.pdf

So, I hope the government keeps it Rs. 1.5 lakh for each account and Rs. 3 lakhs for two accounts.

Nice encouragement & expectation is highly solicited by me.

sir mere beti 27-12-14 ko hui hai to kya mai bhi sukanya samriddhi yojana se jur sakte hai

Yes, aap bhi ye account khulwa sakte hain.

Hello sir, meri beti ki dob 4.01.2006 hai.main agar aaj a/ c open karti hu aur per month 5000 deposite karti hu to uski shadi ke samay (2028) main a/c balance approx kya hoga. Aur us time main sara balance withdrawl kar sakti hu.aur agar sara balance nahi kar sakti to balance amount ka kitna % withdrawl kar sakti hu?

Hi Neetu,

Aap apni beti ki shaadi ke time saara balance withdraw kar sakte ho.

Maturity value ke liye upar pasted table check keejiye.