This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

The Finance Ministry on March 31st announced the applicable interest rates for all the Post Office Small Savings Schemes, including PPF, Sukanya Samriddhi Yojana (SSY) and Senior Citizens Savings Scheme (SCSS). Except for SCSS and SSY, the government has kept all other interest rates unchanged, including 8.7% for its most popular scheme, PPF.

To encourage more and more people to get the Sukanya Samriddhi Account (SSA) opened, the Government has decided to ride against the tide and has increased its interest rate to 9.20% from 9.10% earlier, an increase of 0.10%.

As the interest rate on Sukanya Samriddhi Yojana is subject to a revision every financial year, this rate of 9.2% will remain applicable only for the current financial year, 2015-16 and will be further revised in March 2016 for the next financial year, 2016-17.

But, this move of keeping its interest rate higher makes me feel that the Modi Government will continue to keep its interest rate higher going forward as well. I think, like the current financial year, they will try to keep a differential of approximately 0.50% between PPF and Sukanya Samridhi Yojana.

I had posted an article last month in which maturity values were calculated with 9.1% rate of interest throughout its tenure of 21 years. But, as the interest rate has been updated to 9.2% and as most of the investors are yet to open this account, I thought there is a need to have a new post having maturity values calculated as per the new rate of 9.2%.

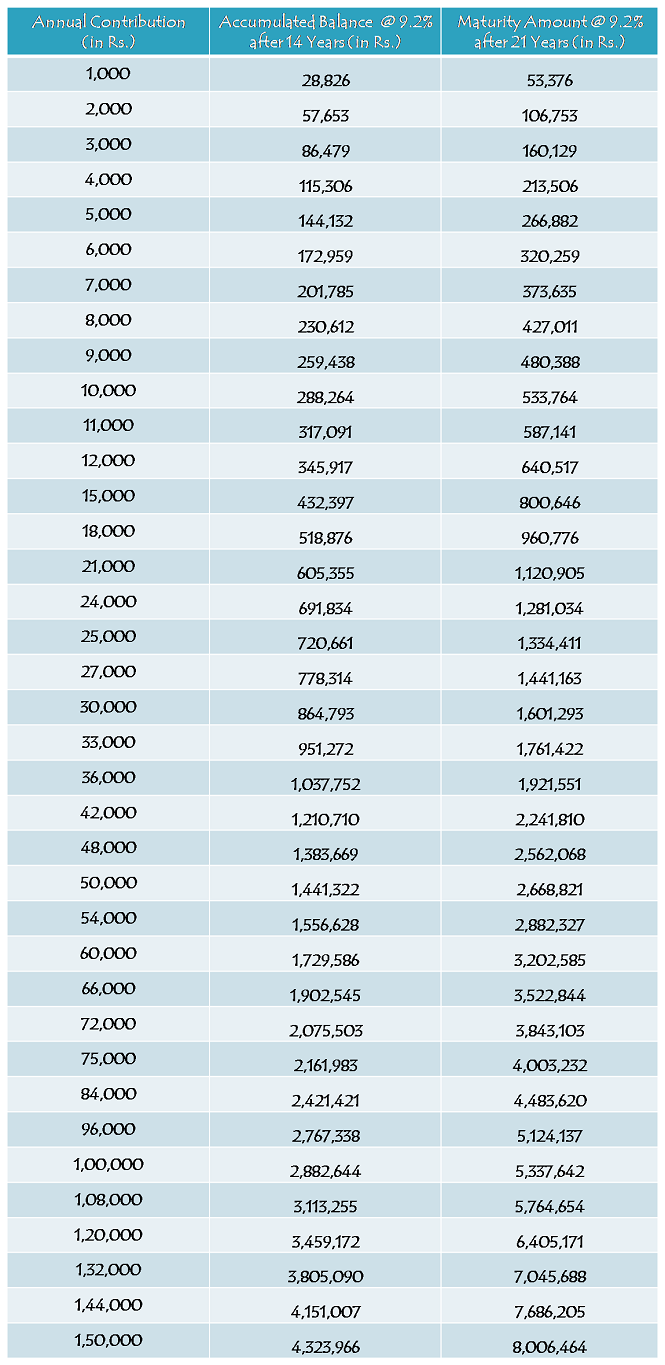

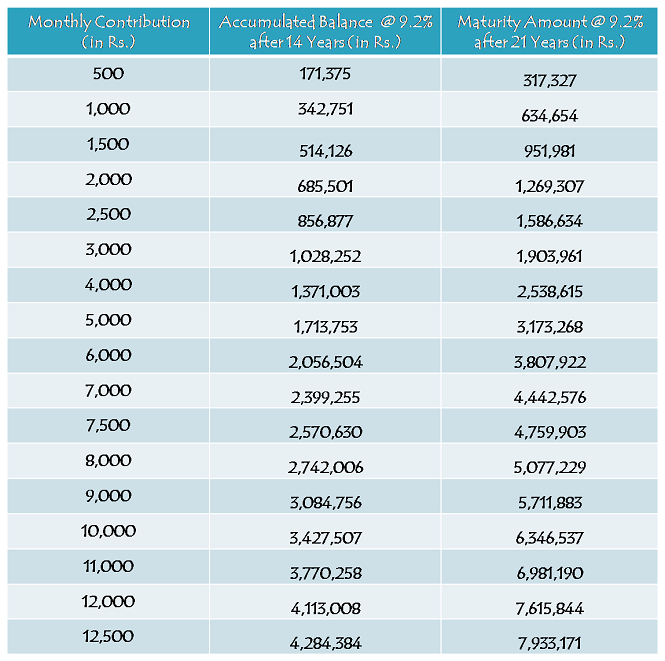

So, here you have the tables in which maturity values are given as per your annual contributions as well as monthly contributions:

Yearly Contribution Table

Monthly Contribution Table

As different investors will have have different amounts and different timings of their deposits, it is natural that their maturity values will also be different. So, these maturity values are only indicative based on certain assumptions and here you have those assumptions:

* Rate of Interest has been assumed to remain 9.2% for all these 21 years.

* Yearly contributions have been assumed to be made on April 1 every year i.e. the beginning of the financial year.

* Monthly contributions have been assumed to be made on 1st day of every month.

* Although it is not mandatory, a fixed amount of yearly/monthly contribution has been assumed.

* It is also assumed that no withdrawal is made throughout these 21 years.

As people are looking for more and more information about this scheme, I would like to again highlight the main features of this scheme here:

Who can open this account? – Parents or a legal guardian of a girl child up to the age of 10 years, can open this account in the name of the girl child. So, if your daughter is born on or after December 2, 2003, you can get this account opened for her in a post office or an authorised bank branch.

Which documents are required to open this account? – You need birth certificate of the girl child, along with the identity proof, residence proof and two photographs of the parents/legal guardian, to open an account under this scheme. You can approach any post office or a branch of any of the authorised banks to get this account opened.

9.2% Tax-Free Rate of Interest for FY 2015-16 – As mentioned above, this scheme will carry 9.2% rate of interest for the current financial year and it was 9.1% for the previous financial year. Similarly, interest rate will be revised every year in March and will be applicable for the applicable financial year afterwards.

Scheme Matures in 21 years or on Girl’s Marriage, whichever is earlier – The scheme gets matured on completion of 21 years from the date of opening of the account or as the girl child gets married, whichever is earlier. Please note that the girl attaining the age of 21 years has no relevance to maturity period of this scheme.

Deposit for 14 years only – You need to deposit a minimum of Rs. 1,000 and a maximum of Rs. 1,50,000 only for the first 14 years, after which you are not required to deposit any amount. Your account will keep earning the applicable interest rate for the remaining 7 years or till it gets matured on your daughter’s marriage.

NRI/OCI Investment – It is still not clear whether Non-Resident Indians (NRIs) or Overseas Citizens of India (OCI) are allowed to open an account under this scheme or not. But, as it is not allowed with most of the post office small saving schemes, I think the government will not allow them to invest in this scheme either. I’ll update this post as soon as I get any information regarding the same.

Partial Withdrawal – It is allowed to withdraw 50% of the balance for higher education as the girl child attains the age of 18 years. Except for this period, it is not allowed to withdraw any amount during the whole tenure of this scheme.

Nomination Facility – Nomination facility is not there with this scheme. In an unfortunate event of the death of the girl child, the balance amount will be paid to the parents/ legal guardian of the girl child and the account will be closed immediately.

You can check all the features of this scheme from this post – Sukanya Samriddhi Yojana – Tax-Free Small Savings Scheme for a Girl Child

You can also check the updated list of banks and download the application form to open an account from this post – Sukanya Samriddhi Yojana – Updated list of Authorised Banks to Open an Account, Specimen Application Form & Passbook. If you have any query or something related to all these posts, please share it here.

Sar mera naam ankitrajdubey hai mai Puchna chata tha ki 2500 mahina inwest karege to 21 saal mein kitna milega aur kuch mony bech milta hai naa meri beti ka dateh of births 13/01/2015 hai

Sir Ji paise monthly jama karane h ya 1 year me 1 bar

My daughter dob 15-3-2003 h kya sir account open kra sakte h

Hi Krishna,

Paisa saal mein ek baar deposit karna zaroori hai. But, your daughter is not eligible for this scheme.

sir, my daughter is 20months now & i want to open an account for her, but my confusion is that ” whether i can deposit monthly 1000 or annually ” & next thing whether can a increase the deposit amt in future

You are required to deposit Rs. 1,000 annually. You can increase the amount in future.

Dear sir

Agar 1000 monthly or 12k yearly

Ladki ki shadi k samay tak

Kareeb 10yrs tak deposite kiya to after 10yrs account close karte samay

9.1%intrst k hisab se (Jo ki yearly change hota rahega)

1,20,000+intrst =

round figure kitna ? tak milega

Hi Rohan,

I cannot do such calculations for individual cases.

Dear sir

Meri beti ki dob, 04.05.2004 hai

To kya ladki ki shadi k samay hum account close karwa sakte hain ya

Ladki k 18yrs hone baad Jo 50% Withdrawl ka scheme hai

Uske under 21yrs ki maturity ka 50% milega ya sirf Jo deposits kiya us samay tak usi ka 50% milega

Yrly 12k or kuchh jyada deposite karein to kya ladki ki shadi k samay

Account close kar k poore paise le sakte hain

Hi Rohan,

Shaadi ke time 100% balance (with interest) withdraw kar sakte hain. Girl ki age 18 saal hone pe 50% balance (with interest) withdraw kar sakte hain.

sir

meri girl ki dob 01.01.2007 hai

aur maine account 10.03.2015 ko khulbaya hai agar saadi 2028 me hoti hai lakin maturity date 2036 hai . to mujhe saadi ke time kitne paise milange. Rate of interest 9.2 % ke hisab se.

agar per month 1000 rupee jama karta hu to.

Sorry Yogesh, we cannot entertain such individual calculations.

sir

meri girl ki dob 01.01.2007 hai

aur maine account 10.03.2015 ko khulbaya hai agar saadi 2028 me hoti hai lakin maturity date 2036 hai . to mujhe saadi ke time kitne paise milange. Rate of interest 9.2 % ke hisab se.

Sir mere bati ki date of birth 30Jan 2005 h kiya mai uska account khulba skti hoo please give me answer

Yes Rajniji, aapki beti ka account khul sakta hai.

Sir

I want to know whether I will deposit 14 yrs from the date of account opening or my daughter attains 14 yrs. I opened account in March 2015′,my daughter ‘s DOB is 01.01.2011 and second thing is I deposit 3000 in initial opening.after that in every month i can deposit a fixed amount or different.

You’ll have to deposit money for 14 years from the account opening date. It is not a monthly deposit scheme and you can deposit whatever amount you want between Rs. 1,000 and Rs. 1,50,000.

sir

saadi ke time ke balance ki calculation kaise karenge

Exact calculation nahin kar sakte, kyunki hamein nahin pata ki shaadi kab hogi, kab aap paise deposit karenge, kitna rate of interest rahega.

sir

jo rupee maturity par mileage kya utne hi rupees ladki ki saadi par mileage agar saadi maturity se pahle hoti hai.

Nahin, jo balance shaadi ke time hoga, utna hi milega.

sir

meri girl ki dob 01.01.2007 hai aur maine account 10.03.2015 ko khulbaya hai

2028 ko girl 21 saal ki ho jayegi

to kya account band ho jayega.

Nahin Yogeshji, account 21 saal baad ya phir aapki beti ki shaadi hone pe mature hoga.

Sir,

I am having a small confusion over the minimum period 0f 14 years and the maturiy of this account on girls marriage. If a girl open this account on age of 10 and she will get married on 21 years the 14 years deposit is comes to 11 years only. Can you tell me the calculation for this ? she can eligible to pre close this account due to her marriage on 21. But minimum 14 years is not met in this situation. Can you please send the calculation for Girl’s age entry 10 and exit age is 21?

Sorry Seshu, I won’t be able to show you the calculation for this, but your daughter could withdraw the balance whenever she gets married, even if the account doesn’t complete 14 years of deposit.

Dear sir

Please tell me my Daughter age is 5 year old,shall i invest in SSA Scheme. and how much it maturity time ,please suggest

account opening -date-01.04.2015

Daughter age is 5

maturity -time————–01.04.20——?

Maturity date is 31.03.2036 or when your daughter gets married, whichever is earlier.

skim suru hue 3 mahine ho gaye

bank me abhi tak koi information nahi hai…kya bank me ye skim suru ho payegi. .

Hogi to zaroor, kab hogi, kisi ko nahin pata.

Sir,

Please tell me my Daughter age is 9 year old, shall i invest in SSA Scheme. and how much it maturity time ,

Hi Vipul,

Your daughter is eligible to invest in this scheme. This scheme matures after 21 years from the account opening date or when your daughter gets married, whichever is earlier.

Its good that govt has opened up schemes for girl child.

I am curious if any other private sector companies have such schemes?

If possible can you please do an article that throw light on schemes dedicated to girl child/only girl child ? Insurances/saving schemes?

Hi Darshit,

Insurance schemes are usually not good for investments, so you should not take insurance policies for meeting any of your financial goals. Moreover, I am not aware of any other good scheme which is specifically dedicated to girl children.

There is no guarantee for interest rate… It will be decrease or increase every year..

Sir Namaskar,

SSY schme me har saal 1000 se lekar 1.5lakh ke ander koi bhi amount jama kar sakte he kya?

Har saal alag alag amount suppose

1st year 5000,

2nd year 8000 aisa ho sakta he ya har saal amount fix rahega.

Postal me account kholunga to 1 saal me kitna baar amount suppose

100-100 karke ya 500-500 karke jama kar sakta hu?

Yes Mr. Suryakanta, aap ye sab kar sakte hai.

Can father and mother both open individual SSA account on there daughter name and invest 75k each.

Hi Rahul,

Only a single account can be opened in a girl child’s name. But, father and mother both can contribute Rs. 75K each to this single account and claim tax benefit u/s 80C as well.