This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

New Post for FY 2016-17 – Post Office Small Savings Schemes – FY 2016-17 Interest Rates – PPF @ 8.10% & Sukanya Samriddhi Yojana @ 8.60%

The Finance Ministry on March 31st announced the applicable interest rates for all the Post Office Small Savings Schemes, including PPF, Sukanya Samriddhi Yojana and Senior Citizens Savings Scheme (SCSS). These rates would be applicable for the current financial year, 2015-2016 and have come into effect immediately from 1st April, 2015.

Positive Surprise for Small Savers

To make these schemes more attractive, the interest rate for Sukanya Samriddhi Yojana has been increased to 9.2% from 9.1% earlier and for Senior Citizens Savings Scheme, the rate has been hiked to 9.3% from 9.2% earlier. The interest rates on all other schemes have been left unchanged, including PPF which is going to earn 8.7% for you this financial year.

At a time when interest rates are falling sharply and the Government is putting considerable pressure on the RBI to lower down its policy rates, this move of keeping small savings rates higher/unchanged has left me stunned. I did not expect such a move from a government which seems to me a progressive government as far as its economic reforms are concerned.

If there is a scientific method of calculating interest rates on these small saving schemes, then I think the current rates have been fixed abnormally higher. In the last 12 months or so, the yields on Government Securities (G-Secs) have fallen from a high of around 9.1% to 7.65% recently. Though keeping interest rates higher has left me disappointed, this move by the government would make small savers & senior citizens happier, for at least one more year.

The increase of 0.10% interest rate on Sukanya Samriddhi Yojana (SSY) should encourage more and more investors and parents to join this scheme now. In fact, the interest rate differential of 0.50% between PPF and SSY would make some of the investors to contribute more towards SSY now.

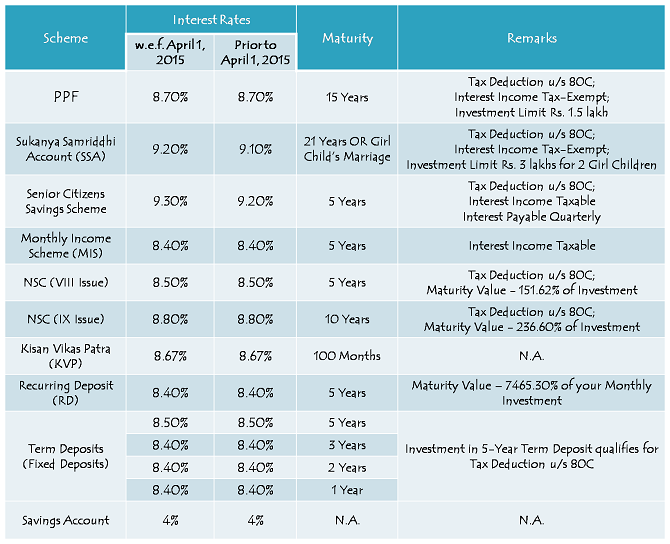

Here you have the table having all the small saving schemes with their applicable interest rates and tax benefits for the current financial year:

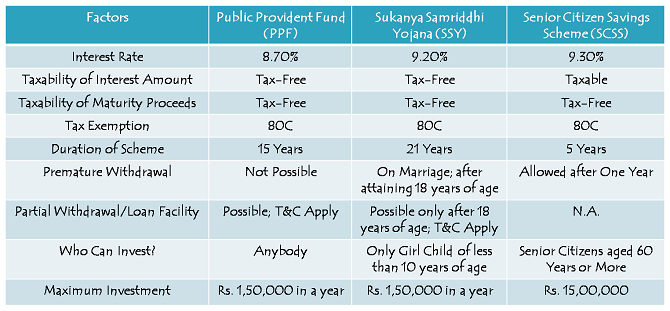

Public Provident Fund (PPF) – There has been no change in the interest rate offered by PPF, India’s most popular small savings scheme. PPF will earn you 8.70% for the current financial year as well. Interest rate will continue to remain tax-exempt on maturity and investment up to Rs. 1,50,000 will keep getting exemption under section 80C.

Sukanya Samriddhi Accounts (SSA) – Sukanya Samriddhi Yojana accounts will carry 9.20% for the current financial year, 2015-16. I was expecting the government to marginally reduce the rate here, say between 8.80% to 9%. But, in a surprise move, they have actually gone ahead and increased the rate to 9.20% from 9.10% till March 31st. I think the government’s move will increase the popularity of this scheme.

Moreover, like PPF, the interest earned will be tax-free on maturity and the investment amount up to Rs. 1,50,000 will get you tax deduction under section 80C.

PPF vs. Sukanya Samriddhi Yojana vs. Senior Citizen Savings Scheme

Senior Citizens Savings Scheme (SCSS) – Senior citizens will also feel happy about the changes announced by the Government as the interest rate on Senior Citizen Savings Scheme has also been increased by 0.10% to 9.30% from 9.20% earlier. Though your investment amount will get you deduction under section 80C, the interest earned is taxable and subject to TDS as well.

Post Office Monthly Income Scheme (POMIS) – Once quite popular with a terminal bonus of 10% and then 5%, Post Office Monthly Income Scheme is getting more and more unpopular these days. As against MIS, investors are getting attracted towards bank fixed deposits (FDs) these days as they get a higher rate of interest, better liquidity and quarterly interest payments. Interest rate has been kept unchanged at 8.40% for MIS.

National Savings Certificates (NSCs) – 5-year NSCs & 10-year NSCs will keep earning 8.50% and 8.80% respectively in the current financial year. Also, your investment will earn you tax exemption under section 80C.

Kisan Vikas Patra (KVP) – Your investment in KVP can double your money in 100 months, which makes its effective annual return to be 8.67% if held till maturity. Investment certificates in this scheme bear no name and can easily be transferred from one person to another.

Recurring Deposits (RDs)/Term Deposits (TDs) – Interest rates on recurring deposits and term deposits have also been kept unchanged at 8.40% for all tenures, except term deposit of 5 years tenure which will yield 8.50% per annum. 5-year term deposit with a lock-in clause will provide you tax deduction under section 80C.

Post Office Savings Account – Your savings account in a post office will continue to earn 4% annual interest and interest amount up to Rs. 10,000 will be tax exempt under section 80TTA.

At a time when banks are already struggling to keep their credit growth in double digits, I think keeping interest rates higher on these small savings schemes is not a wise move. It will make it really difficult for the banks to lower their deposit rates and hence there will be pressure on their net interest margins (NIMs) and profitability. I don’t know what exactly is the logic behind this move, but small savers will definitely benefit out of it. You should take full advantage of these high rates till the time the government realises its mistake.

TDS deduction on SCSS in Post Office can save by submitting 15H ?

PO FIXED DEPOSIT INTEREST RATE IS SIMPLE OR COMPOUND?HOW IT IS CALCULATED?WHAT IS THE INTEREST OF RS.1000 IN ONE YEAR AND TWO YEARS?

Hi Mr. Prasad,

Interest rate on Post Office term deposits is compounded quarterly. For 1-2 years, rate of interest is 8.4%.

hello sir

i want invest 1000 or 1500(monthly) in post office which schema is best for me in short-term goal (2years or 5 years)

Hi Kranthi,

It depends on your risk appetite and financial goals which scheme you should invest in.

dear shiv my post rd account of 6000 monthly is maturing next year can I extend it by another 5 years and I am getting 8.40 % from 2011 so will the interst rate will change or it will remain same

Hi Nitesh,

RD account cannot be extended. You can start a fresh RD account.

Thank you for your comments.

I have been going through various articles and came across the news that the Interest rate on SCSS was increased to 9.3% from 9.2% from April 1, 2015. What does this mean. Is the Interest rate now fixed for 5 years for those who join in this Financial Year? Then those who joined last year would continue to get 9.2% only.

Another site informs that this Scheme is also availed in 24 Banks including 1 private bank viz. ICICI Bank.

Kindly clarify.

Thanks

Hi PC,

The interest rate will remain fixed at the ongoing rate for the duration of 5 yrs in SCSS. In case the rate is changed in the next FY, it wont affect your current investment.

You are right; SCSS can also be done via the 24 banks you mentioned. Please contact the banks for detailed info.

m sure FD is best, with small amount.if a person plan to get a bike after one year, he should open FD, before one year, because then he will be prepare for the installment,tension free.

sir i want fix rupee1,20,000 in indian postal . what will be the rate percent and what will be the charges ? sir if i wish to withdraw my money before tenure what amount will be deducted. i want for 3 years.

Which scheme you want to invest in Alok?

My father being a Senior Citizen wants to invest Rs. 15 lakhs. Would it be better to invest in Senior Citizen Saving Scheme in Post Office? How much can the interest rate come down in this Scheme in future? Is this Scheme also available in Banks and is the Interest rate the same in Banks?

Hi PC,

1. SCSS is a good scheme, but it is an individual decision to invest or not in this scheme which you people need to take.

2. Rate of interest remains fixed in this scheme for the whole tenure.

3. This scheme is not available in banks.

Hi Shiv,

Regarding the last point you mentioned,

SCSS can be done via designated banks as well.

Oh Sorry, yes it is available in banks, it just slipped off my mind. Thanks Prasun for pointing that out!

If you invest 100 rs in nsc 5 years bond, after the specified 5 years your bond certificate which was issued by postoffice will give you rs.151.62. If you invest the same 100 rs in nsc 10 years bond after 10 years you will get 234.35 rs. To encash the certificate you have to go to the post office and have to give the certificate and copy of your id proof on or after the maturity date specified on the certificate. Date of maturity and the amount you will receive will be mention in the certificate while you purchase it

few years ago…i had open an acount of 50000 rupees in postofffice(dont know the scheme name). i am getting per month 999 rupees as interest. i want to know is this exicts now..? if yes then i want to know can i deposit 2 lakh under this scheme to get more interest..?

plz tell me sir, i am waiting for your response..else tell me another best option as best monthly interest scheme point of view

It must be Post Office Monthly Income Scheme (MIS) as only post office MIS provides monthly interest payments. This scheme still exists and you can invest in that.

sir, i have around 2 to 2.25 lakhs rupees. i want to invest it in postoffice but dont know what is the best for me because i belong from medium class family.so kindly tell me whats the best saving scheme for me in postoffice.i want at least 20-25 thousand per year as interest. is it posssible? then tell me…else tell me best interest rate point of view..

thanks.

Sorry Vikash, we do not entertain such individual queries here on this forum.

Sir, ppf 15 year k liye hi hota h ya 25 year ka bhi hota h. M 10000 rs per month invest kr skta hu ppf jyada best hoga ya Rd.

Ppf me 15 year or 25 year pr final kitna rs milega or Rd me 5 year after kitna milega if 10000 rs per month invest kru to.

Hi Naveen,

1. PPF 15 years ke liye hota hai, but aap apne PPF account ko 5-5 years ke liye extend kar sakte hain.

2. I think PPF investment is better than an RD.

3. PPF aur RD ke maturity amounts aapki contributions, rate of interest aur deposit timing pe depend karte hain.

What is known as nsc 5 yrs and 10 yrs I don’t get to know correctly is it safe and after maturity within how many months I can expect my amount

It is safe if you keep the certificates safe. Makesure to note the nsc certificate number and the date of issue and keep it safe. By chance if you miss the original certificate the certificate number details will help you get the duplicate certificates

Hi Baranish,

It is 100% safe and on the maturity date itself, you can get the maturity cheque made.

Sir

I am investments for Rs.1000 per month SSY.

Sir want 30000 taka per month for my family support but i don’t know how can do it . First i want to save money from my salary for those amount per month. Plz tell me how can i do this. I may be help me. Thanks.

is it possible to ssy account .I am 30 years old my child about 6years

Yes Suryajeet, aapki beti SSY account ke liye eligible hai.

Sir

I am investments for Rs -1000 per month

i had a 3 years girl child and i can save minimum 500 rupees per month so what type of savings can i do my future . If save rs 1000 per year in ssy what amount did i get after 18 years so please suggest me how i can save for my future

Hi Afroz,

Sukanya Samriddhi Yojana (SSY) is a good scheme for girl children. So, you can go with that. But, with SSY, you’ll get the maturity amount after 21 years from the account opening date and not 18 years.

Good morning sir.

I want to know best saving scheme with max interest rate if i want to deposit 1k-3k per month and if i have need of money in this deposit period then i can get my saving with good interest rate.

Hi Akash,

None of the Post Office savings schemes allow you to withdraw money in-between easily. So, it is better to invest money with a bank for easy liquidity.