This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

New Post for FY 2016-17 – Post Office Small Savings Schemes – FY 2016-17 Interest Rates – PPF @ 8.10% & Sukanya Samriddhi Yojana @ 8.60%

The Finance Ministry on March 31st announced the applicable interest rates for all the Post Office Small Savings Schemes, including PPF, Sukanya Samriddhi Yojana and Senior Citizens Savings Scheme (SCSS). These rates would be applicable for the current financial year, 2015-2016 and have come into effect immediately from 1st April, 2015.

Positive Surprise for Small Savers

To make these schemes more attractive, the interest rate for Sukanya Samriddhi Yojana has been increased to 9.2% from 9.1% earlier and for Senior Citizens Savings Scheme, the rate has been hiked to 9.3% from 9.2% earlier. The interest rates on all other schemes have been left unchanged, including PPF which is going to earn 8.7% for you this financial year.

At a time when interest rates are falling sharply and the Government is putting considerable pressure on the RBI to lower down its policy rates, this move of keeping small savings rates higher/unchanged has left me stunned. I did not expect such a move from a government which seems to me a progressive government as far as its economic reforms are concerned.

If there is a scientific method of calculating interest rates on these small saving schemes, then I think the current rates have been fixed abnormally higher. In the last 12 months or so, the yields on Government Securities (G-Secs) have fallen from a high of around 9.1% to 7.65% recently. Though keeping interest rates higher has left me disappointed, this move by the government would make small savers & senior citizens happier, for at least one more year.

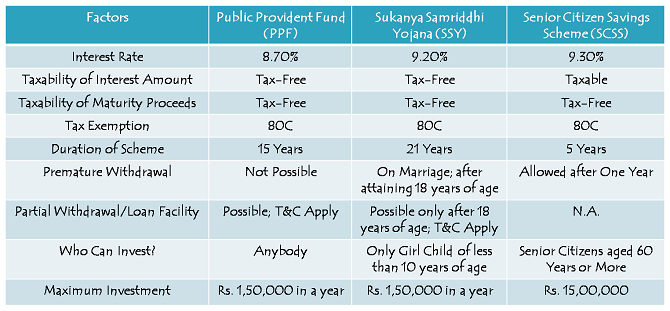

The increase of 0.10% interest rate on Sukanya Samriddhi Yojana (SSY) should encourage more and more investors and parents to join this scheme now. In fact, the interest rate differential of 0.50% between PPF and SSY would make some of the investors to contribute more towards SSY now.

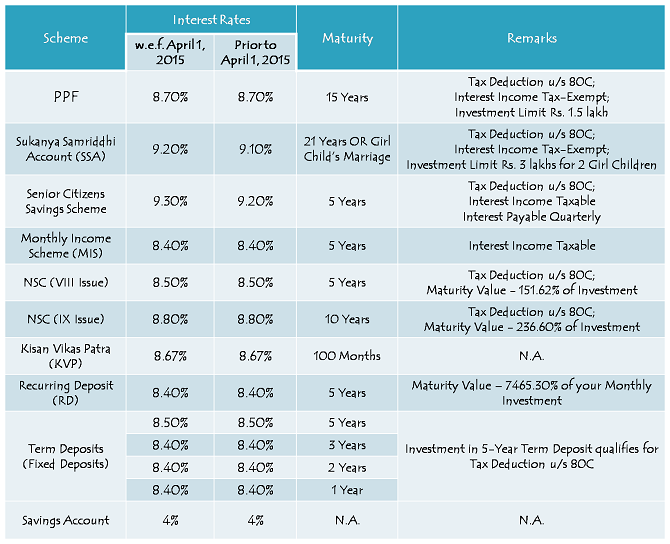

Here you have the table having all the small saving schemes with their applicable interest rates and tax benefits for the current financial year:

Public Provident Fund (PPF) – There has been no change in the interest rate offered by PPF, India’s most popular small savings scheme. PPF will earn you 8.70% for the current financial year as well. Interest rate will continue to remain tax-exempt on maturity and investment up to Rs. 1,50,000 will keep getting exemption under section 80C.

Sukanya Samriddhi Accounts (SSA) – Sukanya Samriddhi Yojana accounts will carry 9.20% for the current financial year, 2015-16. I was expecting the government to marginally reduce the rate here, say between 8.80% to 9%. But, in a surprise move, they have actually gone ahead and increased the rate to 9.20% from 9.10% till March 31st. I think the government’s move will increase the popularity of this scheme.

Moreover, like PPF, the interest earned will be tax-free on maturity and the investment amount up to Rs. 1,50,000 will get you tax deduction under section 80C.

PPF vs. Sukanya Samriddhi Yojana vs. Senior Citizen Savings Scheme

Senior Citizens Savings Scheme (SCSS) – Senior citizens will also feel happy about the changes announced by the Government as the interest rate on Senior Citizen Savings Scheme has also been increased by 0.10% to 9.30% from 9.20% earlier. Though your investment amount will get you deduction under section 80C, the interest earned is taxable and subject to TDS as well.

Post Office Monthly Income Scheme (POMIS) – Once quite popular with a terminal bonus of 10% and then 5%, Post Office Monthly Income Scheme is getting more and more unpopular these days. As against MIS, investors are getting attracted towards bank fixed deposits (FDs) these days as they get a higher rate of interest, better liquidity and quarterly interest payments. Interest rate has been kept unchanged at 8.40% for MIS.

National Savings Certificates (NSCs) – 5-year NSCs & 10-year NSCs will keep earning 8.50% and 8.80% respectively in the current financial year. Also, your investment will earn you tax exemption under section 80C.

Kisan Vikas Patra (KVP) – Your investment in KVP can double your money in 100 months, which makes its effective annual return to be 8.67% if held till maturity. Investment certificates in this scheme bear no name and can easily be transferred from one person to another.

Recurring Deposits (RDs)/Term Deposits (TDs) – Interest rates on recurring deposits and term deposits have also been kept unchanged at 8.40% for all tenures, except term deposit of 5 years tenure which will yield 8.50% per annum. 5-year term deposit with a lock-in clause will provide you tax deduction under section 80C.

Post Office Savings Account – Your savings account in a post office will continue to earn 4% annual interest and interest amount up to Rs. 10,000 will be tax exempt under section 80TTA.

At a time when banks are already struggling to keep their credit growth in double digits, I think keeping interest rates higher on these small savings schemes is not a wise move. It will make it really difficult for the banks to lower their deposit rates and hence there will be pressure on their net interest margins (NIMs) and profitability. I don’t know what exactly is the logic behind this move, but small savers will definitely benefit out of it. You should take full advantage of these high rates till the time the government realises its mistake.

2.2.2008birthday h to useuse to use passs kb milega ???

sir maine post office me ek rd khola tha jisme mai monthly 2000 rs deposit krta tha.kuch din dposit kiya uske bad kisi reson se kr nhi paya.sir kya mai wo depisit paisa nikal skta hu ya nahi

Sir mujhe 4 sal me apbi sister ki shaadi ke liye 10lac rupay chahiye ap btaye mai kitna investment kru

Plz suggested me sir

HI SIR PLEASE TELLME 5OR 6YEARS SAVINGDEPOSIT SCHMES .MORE INTREST AND 1LAKH ABOVE SCHMES.PLEASE REPLY

HI SIR MERI SISTER SHE IS 10 TH COMPLETE 5YEARS DEPOSITS KOUNSI BENFIT RAHEGA PLEASE REPLY

Dear Mr. Shiv Kumar,

Thank you for compilng aii the details re post office saving schemes, though it is overdue for updation.

However one finds glaring omissions of ” NSS 1992″ as well as “NSS 1987”

I had sent an Email one month ago to ‘pmg_mr’ enquiring about NSS1987 status and details re taxability but there is no responce till date inspite of reminders. Local post office also is not in position to give the details barring updating its pass book with the interest accrued for the previous year.

Sir,meri daughter abi 1year ki hai uske liye kon si scheme me invest kiya jye .jisse uske feature me kam aaye ..please guide me…

I have opened SSA account in post office during last year (2015). monthly installment is Rs.1000.00. whether this scheme is applicable for Income tax deduction????.

hi,

me apni didi ke beti jo 9 years ke hai uske liye Sukanya Samriddhi Yojana me account open karna chathi hu kya me kar sakti hu?? procedure and minimum amount bata sakte ho??… .

Interest rates reduced. Check out http://blog.webcalculatorz.com/2016/04/07/ppf-interest-rate-reduced-from-8-7-to-8-1-effective-april/ for more details

sir

I was open RD acct in post office rs 3000/-pm on

31mar 2011.may I know what is the amount after 5 yr (after maturity(.

Sir,

I want to know that what can i open an account under SCSS by INDIA POST as I am a retired person (VRS holder) at the age of 54 and VRS benifits has been recieved by me on 31/03/2016 from U.P government

Firstly I really appreciate your efforts to guide ppl like us to do the small savings wisely .

But I have a problem that my daughter is 13 years of age now and is not eligible for sukanya Samriddhi yojna which is really impressive so can you please suggest me sth parallel to it which is tax exempted and helps me to do good savings for her college years . An investment for 5 years . I will be really thankful to you

Dear Sir meri beti ki age 01 month hai agar main 1000 per month Sukanya Samriddhi Yojana mein 14 saal tak jama krta hoon to mature kab hogi

Dear Sir

I have deposit under RD scheme Rs-8000/- PM for 5 yr. from may-2013. I want to know how much amount deducted from my maturity value under taxation at the time of maturity. And how much amount I get during Maturity.

Please say how can I save the deducted amount (taxable amount) if deducted under rule.

thanks

p.s.deo

i want know five year saving plan

sir my daughter age is 7 years and i opened the ssaccount if i save yearly 12000 rupees, so how much i can earn the age of her marriage. Is it possible if her marriage age is in 20years, so the policy runs only 13 years can i get that ammount proper marriage time. Please given me the details.

which is better… savings account or RD??