This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

People are calling it a Pre-Diwali gift by Dr. Raghuram Rajan. Yes, I am talking about the Repo Rate cut of 50 basis points (or 0.50%) by the RBI Governor today. Indeed, it is a surprisingly positive move by Dr. Rajan for overall incremental growth of the Indian economy. Stock market and bond market, both cheered with joy after the announcement came in at 11 O’Clock in the morning. While Sensex closed up 162 points, the benchmark 10-year G-Sec yield fell sharply lower to close at 7.611% as against Monday’s 7.727%.

While it is an extremely cheerful event for the existing investors, it is not so good news for the investors waiting on the sidelines to invest in the upcoming tax-free bond issues, as it would mean the coupon rates would now fall further from here. Investors, who invested in these bonds in FY 2013-14, were already finding the current offered rates to be unattractive as compared to the rates offered at that time. So, a further fall from the rates offered during the NTPC issue last week would leave more disappointment for the investors.

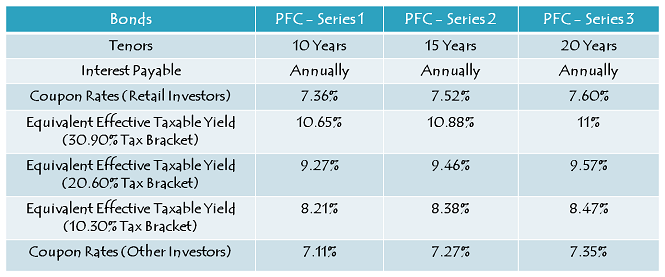

But, before an impact of the Repo rate cut starts getting reflected in future issues, Power Finance Corporation (PFC) would be giving you an opportunity to lock-in your investible surplus at a relatively higher rates. PFC is coming out with its issue of tax-free bonds from the coming Monday i.e. October 5th and it would be offering 7.60% rate of interest for the 20-year option, 7.52% for the 15-year option and 7.36% for the 10-year option.

Before we take a decision to invest in this issue or not, let us first quickly check the salient features of this issue:

Size of the Issue – PFC is authorized to raise Rs. 1,000 crore from tax free bonds this financial year out of which the company has already raised Rs. 300 crore by issuing these bonds in private placement. The company will raise the remaining Rs. 700 crore from this issue.

Coupon Rates on Offer – As mentioned above as well, PFC will offer yearly rate of interest of 7.36% for its 10-year option, 7.52% for the 15-year option and 7.60% for the 20-year option to the retail investors investing less than or equal to Rs. 10 lakh.

As always, these rates would be lower by 25 basis points (or 0.25%) for the non-retail investors.

Rating of the Issue – CRISIL, ICRA and CARE have assigned ‘AAA’ rating to the issue considering PFC to be a government company with reasonably good fundamentals. Also, these bonds are ‘Secured’ in nature and in case of any default, the bondholders would carry a right to make claim on certain assets of the company.

NRI Investment Allowed – Non-Resident Indians (NRIs) are also eligible to invest in this issue, on a repatriation basis as well as non-repatriation basis.

QFI Investment – Qualified Foreign Investors (QFIs) are not allowed to invest in this issue.

Investor Categories & Allocation Ratio – The investors have been classified in the following four categories and each category will have certain percentage of the issue size reserved during the allocation process:

Category I – Qualified Institutional Bidders (QIBs) – 10% of the issue is reserved i.e. Rs. 70 crore

Category II – Non-Institutional Investors (NIIs) – 25% of the issue is reserved i.e. Rs. 175 crore

Category III – High Net Worth Individuals including HUFs & NRIs – 25% of the issue is reserved i.e. Rs. 175 crore

Category IV – Resident Indian Individuals including HUFs & NRIs – 40% of the issue is reserved i.e. Rs. 280 crore

Allotment on First Come First Served Basis – Subject to the allocation ratio, allotment will be made on a first come first serve (FCFS) basis in each of the investor categories, based on the date of upload of each application into the electronic system of the stock exchanges.

Listing & Allotment – PFC has decided to get these bonds listed only on the Bombay Stock Exchange (BSE). The bonds will get allotted and listed within 12 working days from the closing date of the issue.

Demat/Physical Option – Unlike NTPC, it is not mandatory to have a demat account to apply for these bonds. You can subscribe to them in physical/certificate form as well. Interest payment will still get credited to your bank account through ECS.

Moreover, even if you get these bonds allotted in an electronic form, you have the option to rematerialize your holding in physical/certificate form if you decide to close your demat account in future.

No Lock-In Period – Many investors get these bonds confused with the tax-saving infrastructure bonds, which used to provide tax benefits, but carried a lock-in period of five years. So, here is the clarification – These tax-free bonds are freely tradable and do not carry any lock-in period. The investors may sell them at the market price whenever they want after these bonds get listed on the BSE.

Interest on Application Money & Refund – Successful allottees will earn interest at the applicable coupon rates on their application money, from the date of realization of application money up to one day prior to the deemed date of allotment. Unsuccessful allottees will get interest @ 5% per annum on their refund money.

Minimum & Maximum Investment – Investors are required to put in a minimum investment of Rs. 5,000 in this issue i.e. at least 5 bonds of face value Rs. 1,000 each. There is no upper limit for the investors to invest in this issue. However, an investor investing more than Rs. 10 lakhs will be categorized as a high networth individual (HNI) and will get a lower rate of interest as applicable.

Interest Payment Date – PFC will make its first interest payment exactly one year after the deemed date of allotment and the deemed date of allotment will be announced just before the listing date. I will update this post as and when it gets announced.

Should you invest in this issue?

This is what I mentioned during the NTPC bonds issue last week – “Personally, I feel there is a good scope of 50 basis points (0.50%) rate cut by the RBI in the next 6-9 months and as a result, the 10-year G-Sec yield should fall below 7% by April-June next year”. What I expected from Dr. Rajan to do in the next 6-9 months, he has done it within 6-9 days itself. Dr. Rajan has taken the decision to cut the Repo rate, now it is your time to take a decision, whether to invest in this issue with falling G-Sec yield or wait for some kind of panic to have a spiked G-Sec yield again.

One thing would be there for sure, with this Repo rate cut of 50 basis points and PFC providing investors the option to get bonds allotted in physical/certificate form, there would be a similar or even greater demand for PFC tax-free bonds than it was there for the NTPC bonds.

I think the investors are left with no choice, but to invest in this issue and again if it gets oversubscribed, which I think it will, to invest the refund amount in other upcoming issues. This way they can diversify their investments and get to invest in bonds with a relatively higher coupon rates.

Application Form for PFC Tax Free Bonds

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in PFC tax-free bonds, you can contact me at +919811797407

Any news on allotment basis and allotment date for PFC2015 Bonds?

Hi Shiv,

Thanks for the info and also when and where can we check allotment of PFC, f you could please guide.

Thanks in advance.

Hi DCW,

I hope you have been allotted PFC tax-free bonds by now. If not, please check this link for the allotment status – http://www.bigshareonline.com/BSSIPOApplicationStatus.aspx

Shiv any idea abt pfc allotment??

Hi Shiv/Manushu,

The option to subscribe to comments is missing. Earlier there was a way to get new comments as email updates but now the option is not there.

Please do update about PFC tax free bond status and let us know when do you expect NHAI issue. Many thanks.

Hi Bhaskar,

We are trying to get the comments subscription issue resolved, I hope it will be there soon.

Hi Anand,

I hope you have been allotted PFC tax-free bonds by now. If not, please check this link for its status – http://www.bigshareonline.com/BSSIPOApplicationStatus.aspx

Hi Shiv,

I have not got any allotment message, neither have i got any refund till now. Also, the above link that you shared for checking the allotment status is not working.

Any suggestions?

Hi Jinay,

I hope you have been allotted PFC tax-free bonds by now. If not, please check this link for its status – http://www.bigshareonline.com/BSSIPOApplicationStatus.aspx

NHAI to come up with its issue of tax-free bonds worth Rs. 11,200 crore by this month-end:

http://www.hindustantimes.com/india/nhai-set-to-tap-bond-market-to-fund-projects/story-vrbolwYMDCapnfhXrTxjpJ.html

Hi Shiv

I have got NTPC allotment which is 15.6%

Hi George,

Yes, NTPC bonds have got allotted. It is 15.6% to 15.7% allotment.

Hi guys – Is there any online allotment status link to check NTPC allotment status? How did you get to know about your final allotment. Thanks.

Hi Bhaskar,

Investors are getting SMS for their allotments. You can check the allotment status on this link once the allotment data gets incorporated by Karvy Computershare – http://karisma.karvy.com/investor/jsp/IDFC-APP.jsp

Hello Shiv,

Where can we get the news in advance as soon as the date is finalized for next TFB ? I generally get it just one /two days in advance and some times I miss it.

I also subscribed to your news letter but that also publish news for upcoming TFB just one/two days in advance.

Thanks

Krishna

Hi Krishna,

I try to share the news/info regarding these tax-free bond issues as soon as I get such info. You can find the info if you are subscribed to the comments of these posts. Analysing an issue takes time, that is why the PFC issue post got late.

Day 1 (October 5) subscription figures:

Category I – Rs. 1520.46 crore vs. Rs. 70 crore reserved – 21.72 times oversubscribed

Category II – Rs. 3414 crore vs. Rs. 175 crore reserved – 19.51 times oversubscribed

Category III – Rs. 1457.67 crore vs. Rs. 175 crore reserved – 8.33 times oversubscribed

Category IV – Rs. 2069.04 crore vs. Rs. 280 crore reserved – 7.39 times oversubscribed

Total Subscription – Rs. 8461.17 crore vs. total issue size of Rs. 700 crore – 12.09 times oversubscribed

Response has been better than the NTPC issue, probably due to Repo rate cut by the RBI. Retail Investors will get 13-14% allotment i.e. Rs. 1.30-1.40 lakh worth of bonds as against Rs. 10 lakh application amount.

Shiv,

is there a news on next Tax free bond issue?

Retail Portion Subscribed by 51.73 times of the base issue size. This means over subscription of 7.39 times (with Over Subscription). So everyone should get roughly 14-16% allocation on the applied amount.

it may end up anytimes 50-100x subscribed on Day 1. small investors who wish to subscribed 5000-50000 will not get anything and will just end up blocking money for 15 days for nothing

Hi Ashish,

If it gets oversubscribed by 50 times in the retail category, then it will effectively be 7.14 times, which is not bad considering the demand and the issue size. But, I think it will be more than 50 times. 🙂

Can you explain above line ” 50 times in the retail category, then it will effectively be 7.14 times”?

Base issue size is Rs. 100 crore, total issue size is Rs. 700 crore i.e. 7 times the base issue size. So, if it gets oversubscribed by 50 times, that effectively means 50/7 times oversubscription i.e. 7.14 times.

Can you please share link of NSE where we can see the subscription status? Its too early but what is your sense how much prorated allotment would happen in retail category?

Bidding is not happening on the NSE, as the bonds will get listed on the BSE only.

Yes Shiv. retail is more than 10 times and we will get less than 10% allocation which is not good enough for the fund locked.

retail portion is already 6.64 times subscribed at 10:14 AM. what is use to subscribed if you are small investors. better keep away and wait for next big issue

already over subscribed by 5 times

5 times is against the base issue size of Rs. 100 crore, and not Rs. 700 crore.

Hi,

Any idea when the online brokers submit the application/ bid to the exchange? Even if one may apply first thing in the morning. Does the time matter whether its ASBA or non-ASBA?

Thanks

Hi Ash,

It doesn’t help if your bid gets submitted at 10 AM in the morning or 5 PM in the evening, your application will be considered to have been submitted on the first day. You will be allotted bonds on a proportionate basis. ASBA or Non-ASBA also doesn’t matter, it is the day of your bid which matters.

Hello Shiv,

Please clarify me few more things..

1. What if I apply for 10 years bond and I sell it just after 2 months..Can I do that ? If yes, will the interest amount gain for the 2 months will be tax free or I will pay tax on the interest earn ?

Also, if i gain any capital gain while selling the bond after 2 months..will it be a short term capital gain?

Please make me understand if some one sell if before 1 year, after 1.5 years and after 10 years..what is the tax he/she needs to pay.

Hi Sanjay,

1. Yes, you can sell your PFC bonds anytime after allotment is made.

2. Interest is paid only once a year for the full year from the date of allotment. It is not paid for 2 months or 6 months or 9 months for holding these bonds. Moreover, interest is tax-free, so there is no question of any tax to be paid on the interest income.

3. However, selling it before holding your bonds for 12 months attracts short-term capital gain tax (STCG) and it is taxed at your tax slab rate.

4. Selling your bonds after holding them for 12 months makes it long term capital gain (LTCG) which is taxed at 10% flat.

Hi Shiv,

does the indexation apply for long term capital gain?

Shiv,

Thanks for some very valuable & timely advice on PFC tax free issue.

Thanks Vkc for your kind words!

which is best going for pfc bonds of 20 lacks by full cash or investing in a flat of 20 lack by full cash and rent it out

Hi Nitesh,

In the present scenario, I think it is better to invest in PFC tax-free bonds rather than making a real estate investment. Probably 1-2 years down the line, real estate investments will become attractive again.

someone with 30% tax bracket who just wants to Park some of surplus funds into these Tax free bonds, what is suggested option year wise ? 10 Y,15 Y , 20 Y

do it make a difference in secondary market sales? do you get more buyers of 10 Y compare to 20 Y?

Hi Ashish,

Traditionally, 20-year bonds get maximum subscriptions and that is why, get maximum trading volumes too.

As mentioned by Mr. George is it possible to monitor how the issue is getting filled up ?? pl explain

Yes, it is possible to monitor the bidding volumes. Once the PFC issue opens on Monday, you can track it here – http://www.bseindia.com/markets/publicIssues/BSEcumu_demand.aspx?ID=1004

Thanks for submersing well on PFC Issue

Can you explain ” biddiing process before banking the application ”

How and who does that . Is it compulsory for retails investors in Category IV investors

Hi MB,

Bidding Process is as follows – In case of a physical application, you need to submit the bid/application details with the stock exchange. When you submit your application details to your broker, it is done by the broker. In case somebody wants our assistance in the bidding process, we do the bidding for those investors. Moreover, it is compulsory for the Retail Investors.

I guess every online channel like icicidirect take care of this bidding process for retail customers automatically.

I am pleasantly surprized that PFC decided to continue with the issue with the earlier declared interest rates, despite a very recent 50 bps rate cut.

Dear Shirish, I am not surprsied and will expect more issues to come with average of pre-reduction G-Sec rates. There was so much of interest for NTPC due to the credibility of the organization and low amount available. I am not sure if the coupon goes down further how many people will show similar enthusiasm for remaining 43 K crore issues. PFC coupon for 10 yrs is only 7.36%. The scenarios will change and there can be 100 basis points interest rate going up 3 years down the line and no one can be sure about this. So investing at low coupon rate in TF bonds is a risk game. Some of the issues which came in 2012 offered 6.8 to 7.2% and they are still trading below par.

Hi George,

None of the companies have even filed its Draft shelf Prospectus after NTPC & PFC, so it would be very difficult to have the benefit of pre-reduction G-Sec rates. But, you are right, future bond issues will get more & more unattractive if the rates continue to fall in a similar fashion. Moreover, rates can move in either direction 2-3 years down the line, so waiting for higher rates could be a risk too. 🙂

Shiv , I am in agreement with you. But for retail investors to commit for such low returns is risky if they are not in the business of taking benefit of capital gains at the right time. India is a developing economy and the interest rates cycle will keep changing based on geopolitical, climate changes, Commodity prices, war etc. The risk factors are many. One can not commit for 15 or 20 years at such very low rates in bonds. 7.6% is still attractive, but think if this comes down to 6.8% or 7%. Again if someone invests 10 L in PF and gets a return of 8.5L, if he would have funded this from reasonable return source, he will find it difficult to re-invest if subsequent issues are with low interest coupons.

Better to invest in EPF as interest rates are higher. It is also tax free and no tension of non -allotment. if we get 10% of what we invest what is point in blocking money.

Just to add, I am sure PFC will be over subcribed on first day itself. I have decided to wait till 2PM to check on status before applying. It is not worth blocking amount if there is no chance of reasonable allotment and it gets subscribed more than 5 times. NHAI will come up with large trache and it will give opportunity for more allotment.

I don’t expect any other issue to come before PFC issue refunds come back to bank accounts. That is why I think one should invest to the maximum possible limit, if funds are available.

Hi Shirish,

Once announced, it was not allowed for PFC to cut coupon rates.

Thanks Shiv. As usual you have summarised it very well.

I just hope that the NTPC refund comes on time and we can apply in the PFC issue.

Thanks AB!

I don’t think NTPC refunds would reach bank accounts before 7th of October and it is almost certain that PFC issue would leave no scope of allotment for 2nd day bidding.