I just ended up paying MCD property tax (also called house tax) for our residential property in South Delhi. As there were various links which I required to calculate the tax, make online payment, print the payment receipts and check previous years’ tax payments, I thought of writing this post to help property owners in Delhi in this process.

First of all, June 30, 2016 is the last date for availing 15% tax rebate benefit which MCD offers to the property owners in Delhi on lump sum tax payments. So, if you haven’t paid your property tax till date, do it now to avail this 15% rebate.

If you are paying your property tax for the first time, it might be a time consuming job for you. But, if you have gone through such an exercise in any of the previous years, then I think it should not take more than 5 minutes for you to do it again with the help of various links I am going to share here in this post.

3 Municipal Corporations in Delhi – As of today, Delhi has got divided into three municipalities – South Delhi Municipal Corporation (SDMC), North Delhi Municipal Corporation (NDMC) and East Delhi Municipal Corporation (EDMC). But, only SDMC and EDMC are allowing their residents to pay their property tax online. Due to its ongoing website maintenance work, NDMC has suspended its online payment facility for some time. But, residents falling under North MCD can still avail tax rebate by making their tax payments through the offline mode visiting the MCD office in their respective areas.

Know Your Jurisdiction – In order to calculate & pay your tax, you need to first know the municipality under which your colony falls. Here is the link to the website of MCD through which you can get to know your jurisdiction. As mentioned above, there are three municipalities in Delhi and you’ll find the list of colonies under these three zones – SDMC, NDMC and EDMC.

Calculating Property Tax – Here is the link to the Delhi Government’s website through which you can calculate and pay your property tax – Link.

Click on Calculate Your House Tax on the link pasted above and choose your municipality under which your area falls – South Delhi Municipal Corporation or East Delhi Municipal Corporation. You will find various terms & conditions listed there, which you can read if you have time to do so. Just check the T&C box there and click on the tab to pay your property tax for the current financial year 2016-17.

Property ID – For you to pay your property tax online, you need to have a Property ID or Ledger Folio Number, which gets provided by the respective municipal corporations to their residents. You can find your Property ID on your previous years’ property tax challans/receipts.

However, even if you don’t have a property id or ledger folio number, you can still pay your tax directly through these links – SDMC, NDMC and EDMC.

UPIC Cards – To make the process easier, SDMC had started allotting Unique Property Identification Codes (UPIC) to the property owners in December 2015. While making your property tax payment this year, you’ll find an additional charge of Rs. 35 for a UPIC card. These UPIC cards will be issued to you this year and get delivered to your address in the coming days.

Use Factor & Property Tax Rates – Now you need to enter your Property ID in the space provided and it will take you to the page where you need to enter your personal details and property details. Residential and self-occupied properties will attract lower tax and commercial and let out properties will attract higher tax.

Also, you’ll have to pay a higher tax if your property falls in a posh urban area as compared to a rural area. Colonies/Areas have been categorised in eight different categories, from A to H, based on their locations and amenities available around. Property owners in Category A areas will have to pay a higher property tax as compared to Category B areas and likewise.

Here are the links to find the Use Factors and Property Tax Rates as per the end use of the property and its location – SDMC, NDMC and EDMC.

Finally, the property tax you need to pay will depend on the Annual Value of your property. Here is the formula for calculating the annual value:

Annual Value = Covered Area * Unit Area Value * Age Factor * Use Factor * Structure Factor * Occupancy Factor

Don’t get intimidated with this formula. You are not required to memorise this formula or do any manual calculations. You just need to put some basic details of your property and the system will do the harder work on its own. It will calculate the annual value, the amount of rebate, online payment rebate and all other figures as soon as you provide the inputs.

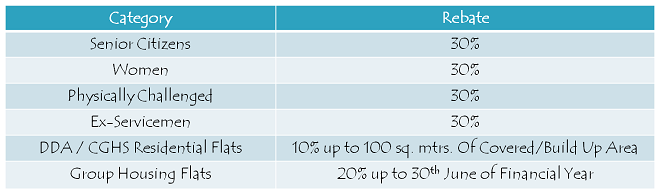

30% Rebate to Senior Citizens, Women, Physically Challenged & Ex-Servicemen – There are certain tax rebates which these corporations offer to certain categories of property owners. Here is the table having those categories of property owners:

Once the tax gets calculated, you just need to select the payment method and pay the tax and you are done. After the tax is paid, you’ll be asked to close the page as soon as possible. But, you would like to have a receipt/acknowledgement for the tax payment made. Don’t worry, here is the link to print your payment receipt – Payment Receipts Link

I hope this post makes it easy for you to pay your property tax online in Delhi. Please share it here if you have any query regarding property tax calculation or its payment or if you have any suggestion to make it an easier process for the property owners in Delhi.

I have paid tax in few years while skipped few in between. How can we get the tax calculated for past years and pay now.

I have paid house Tax of Rs.802.59 on line through my Credit Card on 26.05.17 to EDMC as per the demand in the form but could not generate any receipt as right click is not allowed. I do not know my property ID as it is not available in earlier receipts as so far I had been paying through cheque.

My House No. is : SFS Flat 22B, Pocket C, Mayur Vihar Phase III, Delhi-110096.

Kindly send a receipt.

Pranab Kumar Basu.

Mb. No: 9891744544

Reply

I have paid house Tax of Rs.802.59 on line through my Credit Card on 26.05.17 to EDMC as per the demand in the form but could not generate any receipt as right click is not allowed. I do not my property ID as it is not available in earlier receipts as so far I had been paying through cheque.

My House No. is : SFS Flat 22B, Pocket C, Mayur Vihar Phase III, Delhi-110096.

Kindly send a receipt.

Pranab Kumar Basu.

Mb. No: 9891744544

How can I get my Demand collection Register Number

Even I have the same query.. Where to get DCR Demand Collection Register Number

I didn’t pay the tax of previous year 2016-17. How can it be paid online again. What is the method?

Sir

I have not paid ndmc property tax for 2016-17, ow can I pay knoe, generate challan…..

Thanks

I am trying to pay property tax online but no site is opening properly and hence not able to make the payment. I have tried many a times but could not make. Today also tried four times but nothing happened.

Is there any issue with the online payment sites. Is there any quick way to

pay online . Kindly advice.

I want to calculate my cusin prperty tax who deposited his property tax manully for the year 2004-05,2005-06,2006-07 ,2007-08 , 2008-09 , 2009 10 ,.-2010-11 and 2011-12 1n 2011.

location is krishna nagar 3rd floor ,safdar jang enclave cvered area 124.15 sq m .owner mail age 42

Thanks for the detailed information! Quite helpful.

It is a shame though, as expected from a government department, that the website and online property tax payment system does not allow those who have paid one-time tax in the past to file their property tax online!

And I thought India had the best software minds in the world! Perhapd Delhi Govt. doesn’t !!!

Paid online property tax Ra.3666/- through debit card today in r/o 2017-18. Tax receipt no. G 8- 5031508 is shown not available at your link(111.93.49.17). Any reason?

I want to pay house tax for 2017-18 on line but not getting proper site or site not opening, please help. Thanks.

I have successfully updated all receipts from 2004 till 2017 on line. Now during Amnesty Scheme I had paid huge amount in year 2009,which was for the period before 2004. How to upload that amount manual receipt. Also I paid fee for Mutation of the same our society flat property. how to upload these documents. Your reply will be appreciated.

Thanks

UPIC card fees & postal charges Rs 35 has been charged in 2015-16 and I have already received it in Feb 2017. But again while paying on line charged Rs 35 in 2017-18.

UPIC card No 136175501620100

My father had died last year and he was the owner

Currently we do not change the owner name.so can we mention new bank details or remains the older one.can we pay tax in name of my mother???

I have remitted my property tax on line on May15 th The amount has been debited from my a/c But no receipt is generated,

I have a plot measuring 25.9 meters in rohini, sector 16, previous year I have paid rs. 1675 as house tax. House tax is waived off or still to pay ? Please clarify

After entering property I’d my property details open up. When I try to pay I am prompted to fill area of plot under vacant land. Then I am prompted to fill constructed area under vacant land. This far it is easy as my plot area and constructed area are the same. But problem arises when I am prompted to fill vacant land use under vacant land. As I have no vacant land I am not succeeding in paying my property tax in Delhi

Go andar and choose residential for the land use option. That does the trick.

I am facing similar issue even after selecting residential for the land use option. Please suggest way out.

I have got property ID of my Society Flat built about 20 years back. How to get into MCD’s website to find and fill form? Thanks. April 10, 2017.

i am residing at laxmi nagar east delhi.. I had paid propety tax 4-5 yaer ago.. I don’t have receipt and property id? where can i find propert id?

CHECK PROPERTY id ONLINE

Please provide option of entering date prior to 20013 in the case of manual payment property tax in the box “Link All Your Records” of your Official WEbsite.

I have paid property tax from 2004-05 t0 2008-09. I attempted to link my payments manually as per The BOx “Link All Your Records’ I have entered the amount and receipt No. (say, Rs 732 and 870045 respectively) but failed to enter the date of payment of tax (i.e. 14-06-2008)Because the Table does not have provision for the years earlier than 2013.Help me please to resolve this problem.