I just ended up paying MCD property tax (also called house tax) for our residential property in South Delhi. As there were various links which I required to calculate the tax, make online payment, print the payment receipts and check previous years’ tax payments, I thought of writing this post to help property owners in Delhi in this process.

First of all, June 30, 2016 is the last date for availing 15% tax rebate benefit which MCD offers to the property owners in Delhi on lump sum tax payments. So, if you haven’t paid your property tax till date, do it now to avail this 15% rebate.

If you are paying your property tax for the first time, it might be a time consuming job for you. But, if you have gone through such an exercise in any of the previous years, then I think it should not take more than 5 minutes for you to do it again with the help of various links I am going to share here in this post.

3 Municipal Corporations in Delhi – As of today, Delhi has got divided into three municipalities – South Delhi Municipal Corporation (SDMC), North Delhi Municipal Corporation (NDMC) and East Delhi Municipal Corporation (EDMC). But, only SDMC and EDMC are allowing their residents to pay their property tax online. Due to its ongoing website maintenance work, NDMC has suspended its online payment facility for some time. But, residents falling under North MCD can still avail tax rebate by making their tax payments through the offline mode visiting the MCD office in their respective areas.

Know Your Jurisdiction – In order to calculate & pay your tax, you need to first know the municipality under which your colony falls. Here is the link to the website of MCD through which you can get to know your jurisdiction. As mentioned above, there are three municipalities in Delhi and you’ll find the list of colonies under these three zones – SDMC, NDMC and EDMC.

Calculating Property Tax – Here is the link to the Delhi Government’s website through which you can calculate and pay your property tax – Link.

Click on Calculate Your House Tax on the link pasted above and choose your municipality under which your area falls – South Delhi Municipal Corporation or East Delhi Municipal Corporation. You will find various terms & conditions listed there, which you can read if you have time to do so. Just check the T&C box there and click on the tab to pay your property tax for the current financial year 2016-17.

Property ID – For you to pay your property tax online, you need to have a Property ID or Ledger Folio Number, which gets provided by the respective municipal corporations to their residents. You can find your Property ID on your previous years’ property tax challans/receipts.

However, even if you don’t have a property id or ledger folio number, you can still pay your tax directly through these links – SDMC, NDMC and EDMC.

UPIC Cards – To make the process easier, SDMC had started allotting Unique Property Identification Codes (UPIC) to the property owners in December 2015. While making your property tax payment this year, you’ll find an additional charge of Rs. 35 for a UPIC card. These UPIC cards will be issued to you this year and get delivered to your address in the coming days.

Use Factor & Property Tax Rates – Now you need to enter your Property ID in the space provided and it will take you to the page where you need to enter your personal details and property details. Residential and self-occupied properties will attract lower tax and commercial and let out properties will attract higher tax.

Also, you’ll have to pay a higher tax if your property falls in a posh urban area as compared to a rural area. Colonies/Areas have been categorised in eight different categories, from A to H, based on their locations and amenities available around. Property owners in Category A areas will have to pay a higher property tax as compared to Category B areas and likewise.

Here are the links to find the Use Factors and Property Tax Rates as per the end use of the property and its location – SDMC, NDMC and EDMC.

Finally, the property tax you need to pay will depend on the Annual Value of your property. Here is the formula for calculating the annual value:

Annual Value = Covered Area * Unit Area Value * Age Factor * Use Factor * Structure Factor * Occupancy Factor

Don’t get intimidated with this formula. You are not required to memorise this formula or do any manual calculations. You just need to put some basic details of your property and the system will do the harder work on its own. It will calculate the annual value, the amount of rebate, online payment rebate and all other figures as soon as you provide the inputs.

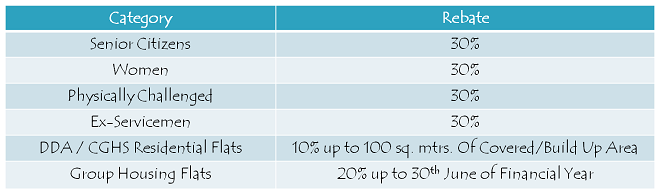

30% Rebate to Senior Citizens, Women, Physically Challenged & Ex-Servicemen – There are certain tax rebates which these corporations offer to certain categories of property owners. Here is the table having those categories of property owners:

Once the tax gets calculated, you just need to select the payment method and pay the tax and you are done. After the tax is paid, you’ll be asked to close the page as soon as possible. But, you would like to have a receipt/acknowledgement for the tax payment made. Don’t worry, here is the link to print your payment receipt – Payment Receipts Link

I hope this post makes it easy for you to pay your property tax online in Delhi. Please share it here if you have any query regarding property tax calculation or its payment or if you have any suggestion to make it an easier process for the property owners in Delhi.

We purchased a bldr.flatMay2007 and we

Paid H T every year from.2008-09 to 2017-18.but by mistake last one year i.e2016-17is not paid.pl.guide me how I deposit the previous year tax i.e 2016-2017

Can I calculate arrears of MCD Property Tax on MCD website. If yes, please tell me how ? or send me link for the same.

I have constructed a house in 2001 in Uttam Nagar. I have not paid any property tax. Please tell me, how to calculate arrears from 2001 to 2018 and deposit my property tax in South zone of MCD Delhi. please guide urgently, because last date of waiver of penalty is going to close.

kya 22yard ka tax jata h

How we check my outstanding property tax online ..

please suggest..

MCD has fixed in East Patel Nagar, G.F. commercial property, revised rateable value by A.C. MCD, for the F.Y. 2003-2004.

On the basis of R.V. how to calculate tax payable amount.

Part amount on account of tax has already deposited

Sir pls help me for house tex calculations.

My house in dda janta flat tri?ok puri .

I have only 22sqft area only singal flat.im ownor of this property.

I could not find property receipts for the years 2015-16, 2016-17 and 2017-18. I could find the link for paying the property tax for 2017-18. How to calculate and pay the property tax for 2015-16 and 2016-17

My friend Mr. R.D. of B 70, Amar Colony, Lajpat Nagar IV, New Delhi

has informed that all his papers relating to property tax has been eaten away by deemak and he has no record of his property I.D. How he can get property I.d. No to enable him to pay his property tax next year.

Kindly guide.

Property Id:173273413040 under NDMC Delhi. Due to some reason I did not pay property tax for year 2016-17. I paid taxes of year 2017-18 also.

How to pay house tax for year 2016-17?

I had face lot of problem to pay my property tax on line. Till night server was not working. Let me know what I have to do now. I am senior citizen. Please advice. Thks

Hi,

Very useful information. Thank you

By mistake last year I paid twice, and got a letter confirming receipt of both amounts. The relevant authority has confirmed that the extra amount will be used to set off the 2017-18 payment – except that I cant find any such online option for adjustment of extra paid previously.

How do I adjust this previously paid amount and pay the remaining balance due to square off current accounts?

Please advise.

Kindly rectify the problem soon

Dear Sir/madam,

i have made two payments through online credit card via payu.in

I did not get any receipts for the payment.

payU Id. 6246740810 Bank ref.201704766775 Rs. 520/- dt 28.6.2017

Payu Id 6245173556 bank ref.201708718114 Rs. 520.00 Dt 29.6.2017

Property Ref. ID 175115198510

Please let me know

Mob 9953521204

Payment of Rs.5358/- of house for the year 2017-18 has been made on line on 30.06.2017 after 0600 pm to SDMC, however on asking for receipt the site of sdmc shows receipt not available. The payment was made through credit card. Please guide what to do have the receipt of payment

I went to the MCD website and paid the property tax through their payment gateway for 2017-2018 on 30-June-2017. The amount was also deducted however I did not get any reference number and receipt is also not available. I have logged a complaint on their website and have been given a reference number. I don’t know what to do now since today was the last date of paying for this year.

I am filling the house/property tax on line for the last 5 years. I misplaced the receipts of these. Can you suggest how i can get the receipts again which were generated on line.

Thanks

sir i want to know the details of property tax no 170022101910plz send the detail year wise E-149 sec -3 Bawana Industrial Area delhi 110039 up to which year we have filed send the detail year wise thx

Please tell me Is there any rebate for women before 2004?

I have paid Rs.50/- last time for UPIC CARD but Card has not been received till date.Kindly arrange to send the card.

Property ID-200323103860

Address-174,Surya Apartment,

Sec.-6,Plot-14,Dwarka,New Delhi-110075