Welcome to this edition of OneMint – economy and your finances.

Marcus Arkan presents Understand The A To Z Of Home Mortgage Canada posted at SMI Blog, saying, “Syndicate Mortgages provides Mortgage Canada News, and updates! And the Best Mortgage Canada Rates in today’s Market, no wonder more and more Canadians choose Syndicate Mortgages for all their Canada Mortgage needs!”

Sheryl Owen presents Change of Address: The Origin of the Ponzi Scam posted at Change of Address.

Leave Debt Behind.com presents Renting VS Buying a Home – Is Buying Always Better? posted at Leave Debt Behind.

Debt

Roshawn Watson presents 8 Questions for the Constantly Broke posted at Watson Inc, saying, “Recently, Yahoo Finance republished an article from US News entitled the “8 Questions for the Constantly Broke.” I enjoyed reading it. I wanted to highlight the major points from the article, provide some rationale and context for the advice given, provide some helpful and relevant rules of thumb for some of the various topics discussed, and share some personal anecdotes.”

Silicon Valley Blogger presents Citi Credit Cards Review: From Citi Platinum Select To Citi Forward posted at The Digerati Life

PT presents Excessive Credit Card Debt: How Much is Too Much? posted at Prime Time Money.

Hussein Sumar presents How to Negotiate Debt Obligations with Creditors posted at Debt Consolidation, saying, “If creditors do not receive on time payments from you, they will often report your delinquency status to the major Credit Bureaus (Experian, Equifax and TransUnion). But what if you are willing to make payments to the creditors, but not the full amount they are asking for? For example, you have $15,000 of credit card debt and your minimum monthly payment is $375. However, you can only afford to pay $200 a month at the moment. How do you negotiate with your creditors so as to get the payment terms to your advantage and get negative items deleted off your credit report? That is the purpose of this article.”

Tom @ Canadian Finance Blog presents Fixed or Variable, Why Not Both? posted at The Canadian Finance Blog, saying, “Combination mortgages offer exposure to both the security and predictable payments of fixed rate mortgages and the lower interest rates of variable rate mortgages.”

Economics

Kaushik Chokshi presents World Trends posted at Beyond Karma, saying, “World trends point to a deflationary depression…”

Sun presents How to Find a Summer Intern Job in Recession posted at The Sun’s Financial Diary.

Investments

Dividend Growth Investor presents Four Characteristics of The Best Dividend Growth Stocks posted at Dividend Growth Investor, saying, “Dividends provide investors with a return on investment even when markets are down. As a result investors get paid to hold their stocks through thick and thin.”

Infernios The Hoarding Dragon presents Hoarding Dragon Basics – Investing in Precious Metals posted at ThunderDrake, saying, “This website, through the guise of a dragon, offers investing lessons. This post entails a rather verbose introduction to the basics of precious metals. Those who walk away from this article should become more familiar with gold and silver as an investment!”

Madison DuPaix presents Comparing Different Types of Treasury Securities posted at My Dollar Plan.

The Investor presents Preference shares posted at Monevator.com, saying, “What are preference shares, and what advantages and disadvantages do they offer over normal common stock?”

Albie presents What is Impact Investing? – Social Business Tips posted at Matthew Alberto .com.

Mike Piper presents How Much Money Do I Need to Retire? (In 2 Easy Steps) posted at The Oblivious Investor, saying, “People think it’s a tricky question with complicated calculations. It really isn’t.”

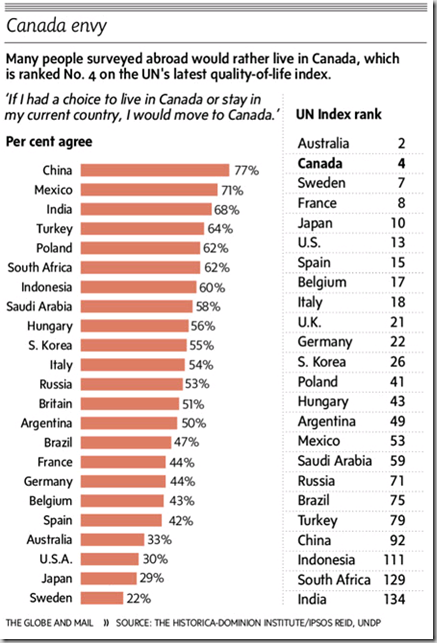

FMF presents Avoid the “Ring-of-Fire” Countries posted at Free Money Finance, saying, “If you want to make the most of your investments, avoid these countries.”

Personal Finance

Consumer Boomer presents How to Compare Life Insurance Policies posted at Consumer Boomer, saying, “Let’s look at closer look at all the options when we compare the different types of life insurance policies and which might be best for your situation.”

Jessica Bosari presents 11 Spring Cleaning Tips for Your Wallet | billeater.com posted at Billeater, saying, “11 yearly financial routines”

The Financial Blogger presents 4 Tax Refund Strategies posted at The Financial Blogger, saying, “Receiving money from the government is always a lot of fun. However, you must have a tax refund strategy in place”

Mike @ Green Panda presents Friend or Foe: The Credit Card posted at Green Panda Treehouse, saying, “The Credit Card: Friend or Foe? The problem is not the credit card, it is you! Let’s be honest for a second. Stop reading, grab your car keys and jump in. Look at the speedometer. It probably says that the machine can go over 100 mph. Do you really drive at that speeds?”

LeanLifeCoach presents Combating the Closing Techniques – The Assumptive Close posted at Eliminate The Muda!, saying, “Understanding the assumptive closing technique means you will be prepared to prevent yourself from falling for it. When a salesperson begins asking questions that require a positive answer be wary. When they try to hand you a pen be prepared.”

Steven and Debra presents The Homeowner’s Dilemma: To Amputate or To Suck-it-Up and Take One for the Team posted at The END TIMES Hoax, saying, “It’s probably about time homeowners who have decided to not walk away from their mortgages to man up to their decision and quit bellyaching about those who are walking away.”

Kim Luu presents Financial Security Takes More Than Being Frugal posted at Money and Risk, saying, “Most PF blogs focuses on saving money and investment, there are many other issues that still put people at risk despite a lifetime of savings.”

Jaqueline Dornbach presents How to Spend Less on Groceries posted at The Young Pastor’s Wife.

Rob presents Family Wealth Management posted at Stock Tips, saying, “Finances are an important issue among most families. Learning about family wealth management can help you stay on track with your goals.”

Jeff Rose, CFP presents How To Get The Best Rates For Term Life Insurance posted at Jeff Rose.

Richard Adams presents Four Steps For Decreasing Your Monthly Outgoings posted at Debt Assistance Guru.

Matt Mason presents Romance Without Finance is a Nuisance posted at FYMO Personal Finance Blog.

Tom Tessin presents 7 Steps When Negotiating for New / Used Cars posted at FGC Auto Blog, saying, “Are you thinking about purchasing a new or used car? 7 steps you can take in order to negotiate for one.”

Big Cajun Man presents Found Money Trap posted at Canadian Personal Finance Blog, saying, “If you find money, pay off debt!”

Super Saver presents Disputed Price Increase on Phone Bill and Won posted at My Wealth Builder, saying, “Last month, our phone bill was up 12%, with no changes made on our part.”

That concludes this edition. Submit your blog article to the next edition of onemint – economy and your finances using our carnival submission form. Past posts and future hosts can be found on our blog carnival index page.