Welcome to the May 9, 2010 edition of onemint – economy and your finances.

Rob presents X10 WS467 Remote Control Light Dimmer Switch Review posted at Energy Saving Gadgets.

Mike Piper presents Dave Ramsey Gives Bad Investment Advice posted at The Oblivious Investor, saying, “While Dave Ramsey has successfully helped many people get out of debt, his investment advice is downright awful.”

Debt

Christien presents How Much Does Bankruptcy Cost? posted at How Much Does Everything Cost?.

David presents List of 0% Balance Transfer Offers posted at Credit Card Offers IQ, saying, “Zero balance transfer cards are becoming easier to get with better terms.”

Silicon Valley Blogger presents Chase Credit Cards: Review of Freedom, Slate & Sapphire posted at The Digerati Life

Economics

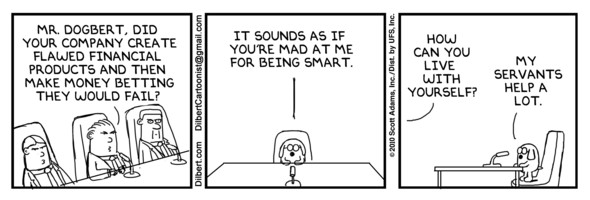

Jessica Bosari presents How Investment Bankers Contributed to the Financial Crisis | billeater.com posted at Billeater, saying, “Investment bankers and their contribution to the financial crisis.”

Matt Mason presents Blog Carnival – Submit an Article to a Carnival posted at FYMO Personal Finance Blog.

Alex Darr presents The Nastiest of Men Doing Good posted at Black Rock State of Mind, saying, “A brief opinion piece I wrote in response to a quote by Keynes regarding Capitalism. The piece may lack a little focus, but I think is redeemed by good structure.”

Investments

Hussein Sumar presents How a 401k Plan Increases your Savings Opportunities under the Economic Growth & Tax Tax Relief Reconciliation Act of 2001 (EGTRRA) posted at 401k, saying, “Many baby boomers who are nearing retirement and even young people who are interested in saving as much as they can for retirement visit their financial advisors each year to see how much they can contribute to their 401k plans for the current & upcoming tax years. Effective 2002 and thanks to Economic Growth & Tax Relief Reconciliation Act of 2001 (EGTRRA), annual limits on 401k contributions were raised for this exact purpose allowing working investors to contribute more tax-deferred contributions to their retirement plans and lower their current taxable income.”

Patty Pedersen presents Investing in Emerging Markets ETFs and Mutual Funds posted at AlphaProfit MoneyMatters – Investing Blog, saying, “Emerging markets have come a long way since the late 1990s when the title submerging markets was more apt. Becoming fiscally fit and offering higher growth prospects emerging economies have helped investments in such regions lead the post-recession recovery. This article outlines investment options, opportunities, and risks in emerging markets ETFs and mutual funds … factors investors need to examine before allocating assets to this increasing important investing category.”

Personal Finance

Tom @ Canadian Finance Blog presents Low Interest Rates: The Good, the Bad and the Ugly posted at The Canadian Finance Blog, saying, “Interest rates have been low for years now. Many assume that this is great for the economy but there are dangers that lurk when rates are kept too low for too long.”

Madeleine Begun Kane presents A Dog Of A Limerick posted at Mad Kane’s Humor Blog.

The Financial Blogger presents Home Security System Deal: Shopping for the Best Home Security System Reliance Protectron posted at The Financial Blogger, saying, “I realized that I didn’t have a home security system at my current house and that having an alarm system could be a great advantage. On top of that, the house we are buying already has the wiring for a home security system installed!”

PT presents How to Get a Health Insurance By Shopping Online posted at Prime Time Money, saying, “In this post I share my experience with getting individual health insurance online. It’s pretty easy.”

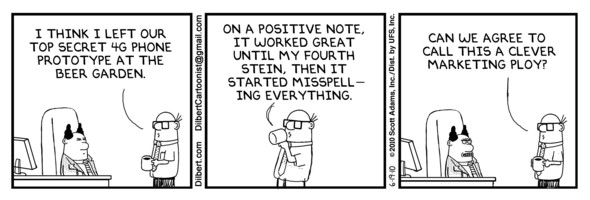

CreditCardAssist.com presents Marketing Gimmick of Free Credit Reports Costs Consumers posted at Credit Card Assist, saying, “Discussion about the marketing gimmick of the so-called “free” credit report websites and how costly they can truly be.”

LearnSaveInvest presents Your Car Is Making You Broke posted at Learn Save Invest, saying, “Cars are a sinkhole for money, and can destroy your net worth. Choosing an inexpensive used car can help you save money and become wealthy and rich.”

Roshawn Watson presents Through the Looking Glass posted at Watson Inc, saying, “Do you really believe in a world of financial abundance? Could you ever have too much money? Could you ever even conceive of summering in the Hamptons for $35,000 per night? Pregnant in your answer is a revelation of your core belief system regarding money.”

Editor @ Double My Net Worth presents Simple As Math : Calculate How Much You Need posted at Double My Net Worth, saying, “It is not that difficult to figure out how much money you need to replace if you are interested in an independent stream of income apart from your employer.”

FMF presents How to Ask for a Raise posted at Free Money Finance, saying, “One way to make more money is to ask for a raise. This post tells how to do this.”

David de Souza presents Claiming Back Overpaid Tax From the Inland Revenue posted at UK Tax Blog, saying, “A step by step guide on claiming overpayments of tax from the government.”

BWL presents Create A Monthly Household Budget posted at Christian Personal Finance, saying, “Some simple guidelines for developing a strong monthly budget system…”

Carlos Sera presents A Wealthy Tale; Financial Tales posted at Financial Tales, saying, “Today I am releasing two tales instead of the usual one. The first is called A Wealthy Tale and should be read first. The other is called A Challenging Tale and it will test your knowledge about wealth. Along with my recently released A Cyclical Tale, this trilogy of tales will give the reader a good understanding of what it means to be wealthy.”

PT presents Are Credit Cards to Blame? posted at Prime Time Money, saying, “A discussion on responsibility and credit card use.”

Stocks

Zach Scheidt presents Syniverse Exhibits Strength in a Tough Market posted at ZachStocks, saying, “Syniverse Holdings Inc. (SVR) is sharply higher after reporting strong earnings. Positive relative strength in a difficult market could lead to a sustained price advance.”

Praveen presents Three Good Stocks Made More Attractive By The Recent Market Activity posted at My Simple Trading System, saying, “Three stock picks made more attractive by the recent market drop.”

That concludes this edition. Submit your blog article to the next edition of onemint – economy and your finances using our carnival submission form. Past posts and future hosts can be found on our blog carnival index page.