This is another post from the Suggest a Topic page, and we’re going to look at the recently introduced 91 Day T – Bill (Treasury Bill) on NSE this time.

This is an interest rate derivative which means that the price of the contract depends on interest rate movements. Globally interest rate derivatives are a much bigger market than equity derivatives, and as the Indian financial markets develop we will see more such products launched in India as well.

The 91 Day T Bill futures are probably of a lot more interest to institutional investors than retail investors because I don’t see that many retail investors taking a position on interest rate movements. And of course, there have been news reports that say that most of the current trading is being done by PSUs, private banks, and corporate clients.

That said, there is a huge segment of retail investors who are interested in speculation, and a futures contract with relatively low margin requirements is as good a tool as any for speculative purposes.

Like any derivative, this Interest Rate Future (IRF) also has an underlying which is the 91 Day GOI T – Bill, so to understand this product better, let’s first understand the underlying of this product.

The Underlying or the 91 Day T Bill itself

91 Day T – Bills are issued by the Government of India to finance their short term funding requirements. They mature in 91 days, which is 13 weeks or about 3 months, and these are not interest bearing securities.

This means that they don’t pay interest, but are instead issued at a discount, and then mature at par value, so that’s why investors buy them even though they don’t get any interest.

RBI issues these T- Bills in auctions where market dealers can bid for these securities, and that’s how the price is determined. RBI announces these auctions, and the next one is going to happen on August 3rd 2011. The results of these auctions are announced the same day as well. The last auction was done on July 27th 2011, and both these auctions were for 91 Day T Bills worth Rs. 7,000 crores or Rs. 70 billion.

Now, let’s take a look at the T – Bill Future itself.

NSE T – Bill Future

There are 4 series of T – Bill Futures currently being traded on the NSE. Three of them are monthly series, and the fourth one is a quarterly series.

Right now the following series are trading:

- 91DTB300811 – The August Series

- 91DTB280911 – The September Series

- 91DTB251011 – The October Series

- 91DTB281211 – The December Series (Quarterly Series)

Every contract will expire on the last Wednesday of the month, but I see not all these series mentioned here are dated on the last Wednesday. For October, this series expires a day earlier because 26th is Diwali, and the same thing happens for August as well, because 31st is Ramzan Id.

From the NSE website I see that the near dated Future which is the August series has the maximum volumes right now.

Each contract will be worth 2,000 units, and the SEBI circular about NSE T Bills explains the pricing as follows:

Daily Contract Settlement value

2000 * (100 – 0.25 * yw)(Here yw is weighted average futures yield of last half an hour). In the absence of last half an hour trading, theoretical futures yield would be considered for computation of Daily Contract Settlement Value.

2,000 because that’s the number of units, 100 because that’s the face value, 0.25 because you are taking the annual yield and the maturity of this instrument is a quarter.

So based on that – a move of one percentage point will translate into a change of Rs. 500

Suppose yield moved from 5% to 6%.

2000 * (100 – 0.25 x 5) = 197,500

2000 * (100 – 0.25 x 6) = 197,000

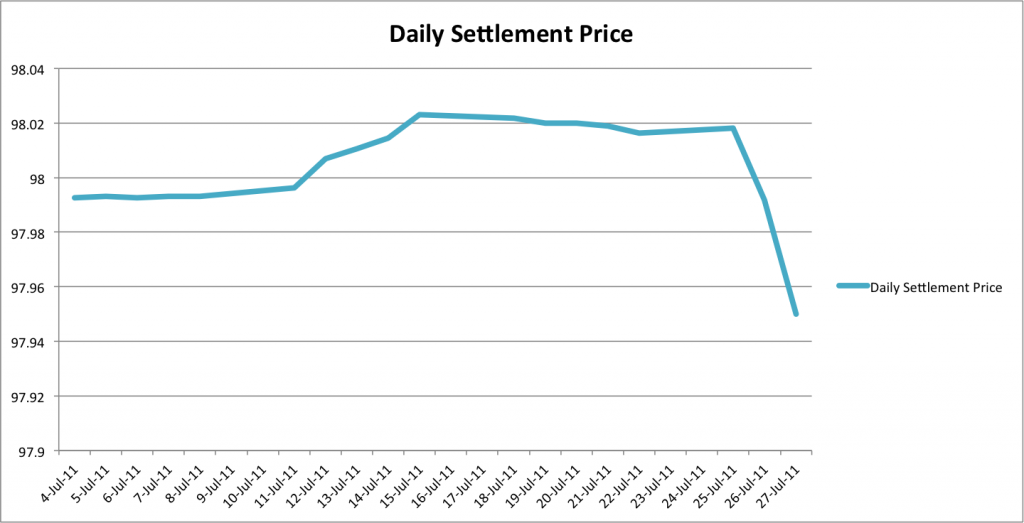

But, yield doesn’t move that much. Here is a chart of the daily settlement price movements of the 91DTB 270711

So, as far as this is concerned – you need to keep in mind that movement of a basis point results in change of Rs. 5 because the change in yield movements is small.

Bond yields and prices are inversely proportional which means if the interest rates increase then the price decreases and vice – versa. This means if you are betting for an interest rate increase then you should go and short the future, and vice – versa.

This is also cash settled, which means that you will either pay up or get paid at the expiry of the contract. It doesn’t have Securities Transaction Tax (STT) either.

This is an interesting product, and has already done much better in volumes than the other IRFs introduced in India. I’ll be keeping an eye on it and learning more about this as time goes because so far my knowledge about this is very theoretical – just based on the SEBI circular, and the NSE note it. There are many gaps in my knowledge that I’d like to plug, and understand them better not only because of the T – Bill trading itself, but also because the bond market is developing very rapidly in India, and I think the bond market landscape five or ten years from now will look completely different from what it is now.