This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

Sukanya Samriddhi Yojana has received a great initial response from the general public. As the scheme offers 9.1% tax-free rate of interest, investors are finding this scheme to be extremely attractive and want to invest in it as soon as possible. They also need handholding to invest in this scheme. But, due to lack of required information with the post offices and authorised bank branches, people are finding it difficult to do so.

I have posted two articles about this scheme and both have received over hundred comments from the visitors. I have been getting many queries regarding the maturity value of this scheme. People want to know the value of their investment as the scheme gets matured after 21 years.

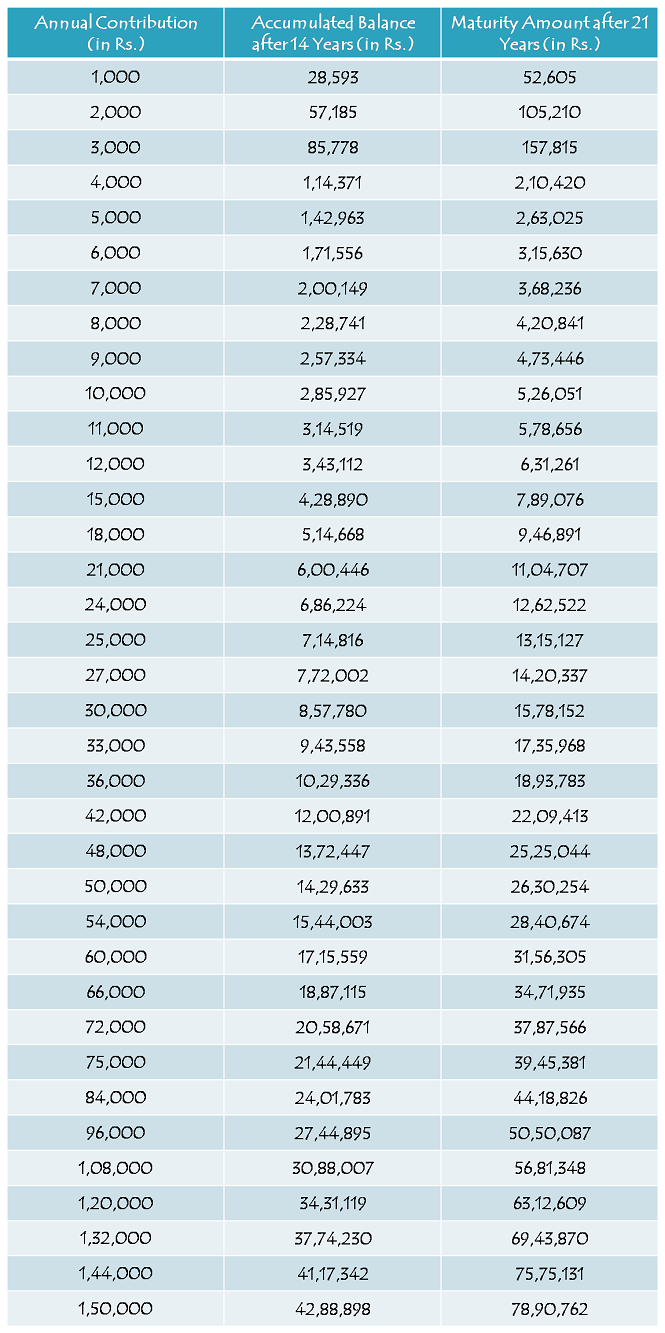

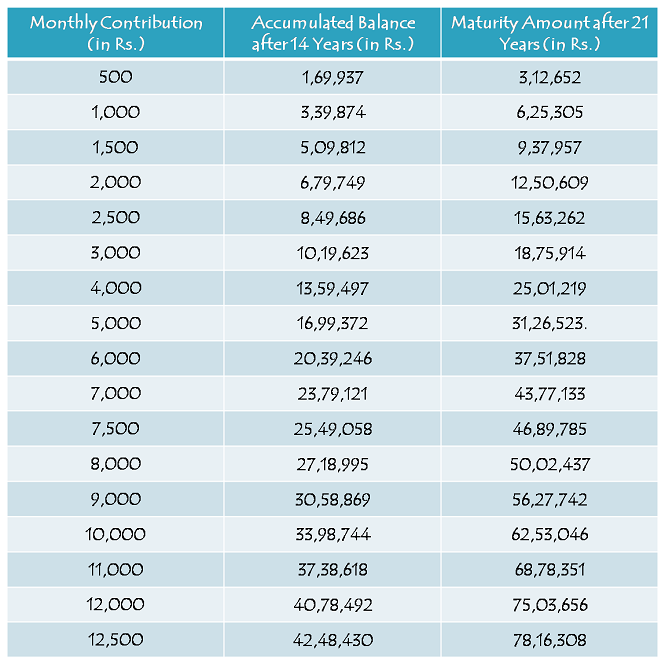

Though it is almost impossible to calculate a precise maturity value of this scheme as there are many variables on which its maturity value will depend, I have tried to make a couple of tables in which the maturity value has been calculated keeping those variables to be constant and yearly & monthly contribution to be the only variable.

Certain assumptions have been made for calculating these maturity values and those assumptions are:

* Rate of Interest has been assumed to be 9.1% for all these 21 years.

* Yearly contributions have been assumed to be made on April 1 every year i.e. the beginning of the financial year.

* Monthly contributions have been assumed to be made on 1st day of every month.

* Although it is not mandatory, a fixed amount of yearly/monthly contribution has been assumed.

* It is also assumed that no withdrawal is made throughout these 21 years.

Here you have the tables:

Yearly Contribution Table

Monthly Contribution Table

I hope these two tables help people in deciding how much amount they would like to contribute to this scheme in order to achieve their girl child’s marriage and/or higher education goals.

Before you go ahead and plan to get an account opened, I would like to again highlight the main features of this scheme:

Who can open this account? – Parents or a legal guardian of a girl child up to the age of 10 years, can open this account in the name of the girl child. Up to December 1, 2015, one year grace period has been provided to allow this account to get opened for a girl child who is born on or after December 2, 2003.

9.1% Tax-Free Rate of Interest – This scheme offers 9.1% rate of interest, which has also been exempted from tax in this year’s budget. But, this rate is not fixed at 9.1% for the whole tenure and is subject to a revision every financial year.

Scheme Matures in 21 years or on Girl’s Marriage, whichever is earlier – The scheme gets matured on completion of 21 years from the date of opening of the account or as the girl child gets married, whichever is earlier. Please note that the girl attaining the age of 21 years has no relevance to maturity of this scheme.

Deposit for 14 years only – You need to deposit a minimum of Rs. 1,000 and a maximum of Rs. 1,50,000 only for the first 14 years, after which you are not required to deposit any amount. Your account will keep earning the applicable interest rate for the remaining 7 years or till it gets matured on your daughter’s marriage.

Documents Required – You need birth certificate of the girl child, along with the identity proof and residence proof of the guardian, to open an account under this scheme. You can approach any post office or authorised branches of some of the commercial banks to get this account opened.

You can check the rest of the features of this scheme from this post – Sukanya Samriddhi Yojana – Tax-Free Small Savings Scheme for a Girl Child

You can also download the application form to open an account from this post – Sukanya Samriddhi Yojana – Application Form & List of Banks to Open an Account. If you still have any query or something related to discuss, please share it here.

My daughter d.o.b is 07/10/2007. Maine aaj hi (01/04/2015) account khulwaya h. Sir pls tell me, kis saal aur kis date ko last payment jayegi. And also tell me maturity date.

Hi Anuj, aap saal mein kabhi bhi amount deposit kar sakte ho. Iski deposit date fixed nahin hai. Indicative maturity amount upar table mein check keejiye.

my doughter d.o.b. is 18-6-2014 if I deposite rs 150000 in 3 years what is maturity date and maturity amount

This scheme is for 21 years, you need to deposit money for 14 years. Maturity amount will depend on several factors, including the deposited amount, rate of interest and timing of your deposits.

R/sir

My daughter d.o.b is 07/10/2007, Maine aaj hi (1/04/2015) SSY me ? 3500/ ka monthly account khulwaya h.

How much money I get at the time of maturity?

Hi Anuj,

Maturity amount will depend on several factors including the applicable rate of interest every year. Please check the indicative maturity values from the table above.

My daugter d.o.b.is 11-11-2005 if i deposite rs.100000.00 yearly from today (01-04-2015) then what is the maturity date and maturity amount plz help me

Maturity date would be 31.03.2036 or when your daughter gets married, whichever is earlier. Maturity amount would depend on the timing of your deposits and the applicable interest rate every year.

Dear Shiv Sir,

Thank You for the value able updates on the PM SSY scheme.

Sir I would like to have answer on one query. After all this mess regarding forms availability/time-frame is cleared up with the banks authorized to open public accounts under this scheme, after opening an account under this scheme with the authorized bank can one transfer funds online directly into this account from one’s saving bank account held with the same bank (though the branch may be different)?

Sir do you have any information on the same?

Thank & Regards

Rajan Sarpal

Thanks Rajan for your encouraging words!

Yes, you would be able to make online transfers from your bank account to this SSY account.

Sir my daughter is 8 year’s old. I opened an account in March 2015. I will deposit 1000 per month. Kindly help me how much I will deposit and how much I will receive in how much time.

Hi Vandana,

You need to deposit your desired amount for 14 years, so you can calculate the deposited amount yourself. For maturity values, please check the tables above.

This ssy skim is not at all worth…the amount get double after 21 year ,,,while in FD it get double in 10 years.. Pls share the same to or ministry’s so that …the lower middle class can get at least 3 times of what they invest

Sorry Mr. Samir, we do not have access to any Ministry, so we won’t be able to communicate your message.

This ssy skim is not at all worth…the amount get double after 21 year ,,,while in FD it get double in 10 years..

Mr. Samir

Now for financial year 2015-16 the interest rate for sukanya samridhi yojana is 9.2 %. Be happy.

This information of amount getting doubled in 21 years is incorrect. Firstly, you are not depositing money in one go and also, if you are depositing say Rs. 1.5 lakh for 14 years, you’ll get approx. 78-79 lakhs after 21 years.

Sir kya hum 12000 yearly scheme me 2sal kapisa ek hi baar jama kar sakta hu.or usaka intrest kitana milega

Aap ek saal mein Rs. 1.5 lakh tak amount deposit kar sakte hain.

Good scheme for girls

Now for financial year 2015-16 the interest rate for sukanya samridhi yojana is 9.2 %. Be happy.

This scheme seems to be a big hit. Everywhere I go people are praising this.

Now for financial year 2015-16 the interest rate for sukanya samridhi yojana is 9.2 %. Be happy.

sir sunne me aa raha hai ki agar ham march mahine me Acount khulwate hai to keval 13 saal hi pesa dena hoga hame..kya yah sahi hai

Aapko 14 saal paise deposit karne honge.

sir..????? ??? ? ??? ?? ?? March ??? ???? ??????? ??? ?? ???? 13 ??? ?? ???? ???? ???? ????! !

Meri beti ki dob 29/03/06 hai to mujhe kitne saal paisa jama karna hoga

14 years

Thanks Mr. Rajesh!

Dear Sir,

I want to invest amount for my daughter but i have a quiry.

1.If i deposit Rs.15,000 in first annum & Next annum should be deposit 15,000 Or any of amount.

Sir, if I deposit 12000 in first year can deposit more less than 12000 in next year?

Yes Kiran, you can deposit any amount of your choice, subject to a minimum deposit of Rs. 1,000.

my daughter age is 8 years i want to open account 1000 per month , when my daughter age 21 year can i get maturity

No, you can withdraw the balance when your daughter gets married or after 21 years from the account opening date, whichever is earlier.

sir yojana ki last date kab tak hai

Dear Sir,

I am the elder one in my family and two little sisters. I just wants to know that can i open this account for my susters with my Id proofs, one sisters is 9 years old and the other one is 5 years old. When should i can register for this scheme.?… pls sir guide me .

I am very thankful to you.

Dear sir,

Meri beti ki DOB 19″10″2010 hai or wo abhi 5 year ki hai agar me had 3 mhine bad JMA krta hu to 2025 me mai I ski sadi krta hu to muje use wait kitna amount milega

Anilji,

10 saal baad aapki beti ki shaadi ke time milne wala amount aapke quarterly contribution ke timings aur rate of interest pe depend karega.

SSY ki last date kya hai….

Is scheme ki koi last date nahin hai.