This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

Infrastructure development company, Capacite Infraprojects Limited, is launching its initial public offer (IPO) of Rs. 400 crore in the price band of Rs. 245-250 a share. Subscription to the issue is starting today and will remain open for three days to close on September 15.

Here are some of the salient features of this issue:

Price Band – Capacite Infra has fixed its price band to be between Rs. 245-250 per share and the company has decided not to offer any discount to the retail investors and/or its employees.

Size & Objective of the Issue – Capacite Infra is targeting to raise Rs. 400 crore from this IPO, out of which the company plans to use Rs. 250 crore for funding its working capital requirements, Rs. 51.95 crore for funding its purchase of capital assets and the remaining Rs. 98.05 crore for general corporate purposes.

Retail Allocation – 35% of the issue size is reserved for the retail individual investors (RIIs), 15% is reserved for the non-institutional investors and the remaining 50% shares will be allocated to the qualified institutional buyers (QIBs).

No Discount for Retail Investors & Employees – The company has decided not to offer any discount to the retail investors and its employees.

Anchor Investors – The company has sold 48 lakh shares to the anchor investors @ Rs. 250 a share, which makes their investment to be Rs. 120 crore. These anchor investors include Goldman Sachs India, HSBC Global Investment Funds – Indian Equity, HDFC Trustee Company, Birla Sun Life Trustee Company, Reliance Capital Trustee Company and DSP BlackRock India T.I.G.E.R. Fund, among others.

Bid Lot Size & Minimum Investment – Investors need to bid for a minimum of 60 shares and in multiples of 60 shares thereafter. So, a retail investor would be required to invest a minimum of Rs. 15,000 at the upper end of the price band and Rs. 14,700 at the lower end of the price band.

Maximum Investment – Individual investors investing up to Rs. 2 lakh are categorised as retail individual investors (RIIs). As a retail investor, you can apply for a maximum of 13 lots of 60 shares each @ Rs. 250 i.e. a maximum investment of Rs. 1,95,000. At Rs. 245 per share as well, you can apply only for 13 lots of 60 shares, thus making it Rs. 1,91,100.

Listing – The shares of the company will get listed on both the stock exchanges i.e. National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) within 6 working days after the issue gets closed on September 15th. Its shares are expected to get listed on September 21st.

Here are some other important dates after the issue gets closed on September 15:

Finalisation of Basis of Allotment – On or about September 21, 2017

Initiation of Refunds – On or about September 22, 2017

Credit of equity shares to investors’ demat accounts – On or about September 22, 2017

Commencement of Trading on the NSE/BSE – On or about September 25, 2017

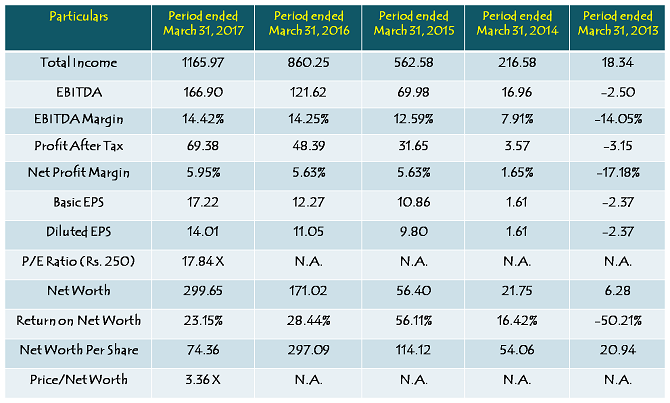

Financials of Capacite Infraprojects Limited

(Note: Figures are in Rs. Crore, except per share data & percentage figures)

Should you invest in Capacite Infraprojects at Rs. 245-250 a share?

Incorporated in August 2012, Capacit’e Infra has grown itself extremely fast. Revenues of the company have grown from Rs. 216.58 crore (FY14) to Rs. 1,165.97 crore (FY17), i.e. a growth of 438% in 3 years. Its profit after tax (PAT) has grown from Rs. 3.57 crore to Rs. 69.38 crore in the same period, i.e. a growth of 1,843% in 3 years.

On a YoY basis, while its revenues jumped 36% from last year’s Rs. 860 crore, EBITDA registered a growth of 37%, from Rs. 122 crore to Rs. 167 crore, and PAT jumped 43% as compared to Rs. 48.39 crore. As on May 31, 2017, the company has a very healthy order book of Rs. 4,602 crore, comprising 56 residential, commercial and institutional projects. At Rs. 1,166 crore of revenues for FY17, the current order book of Rs. 4,602 crore itself is equivalent to 4 years of revenues, which is very encouraging.

The company has a long list of reputed clients, such as Oberoi Realty, Prestige Group, Lodha Developers, Kalpataru, Wadhwa Group, Rustomjee, Godrej Properties, Saifee Burhani Upliftment Trust and Brigade Enterprises, among others. Working for such kind of big developers and earning repeat orders from them provides a great comfort as far as company’s credentials are concerned.

At Rs. 250 a share, Capacit’e Infra is valued at 18 times its trailing 12-months diluted EPS and carries a market cap of around Rs. 1,700 crore. Though nobody expects its current growth to repeat itself in the next 3-5 years, but even if the company continues to keep a similar momentum going forward, the price of Rs. 250 a share the company is seeking seems extremely attractive for listing gains, as well as for medium to long term wealth creation. I would put this one in the same basket as Dmart was and hope this one too generates similar kind of returns for its successful allottees.

Very Nice and amazing post.

Thanks for sharing.

Hi Shiv ji, Please advise if we can purchase in secondary market as a long term investment. People focus mainly on allotment and listing gains but if the company is good one can make more money than IPO Allotment by buying in secondary market and hold for medium/ long term.

Based on your analysis at the time of PNB HF, I invested and in one year the price doubled. I plan to do same with Capacite..

Many thanks for helping lot of retail investors. Keep up the good work with unbiased analysis.

Last Day (September 15) Subscription Figures:

Category I – Qualified Institutional Buyers (QIBs) – 131.32 times

Category II – Non Institutional Investors (NIIs) – 638.05 times

Category III – Retail Individual Investors (RIIs) – 17.57 times

Total Subscription – 183.03 times

Bumper response to the issue, should list at a healthy premium to its issue price.

Day 2 (September 14) Subscription Figures:

Category I – Qualified Institutional Buyers (QIBs) – 5.53 times

Category II – Non Institutional Investors (NIIs) – 0.28 times

Category III – Retail Individual Investors (RIIs) – 5.96 times

Total Subscription – 4.62 times

Would like the have the analysis..to invest or not

Hi Vanita,

It is updated now, please check.

Day 1 (September 13) Subscription Figures:

Category I – Qualified Institutional Buyers (QIBs) – 1.74 times

Category II – Non Institutional Investors (NIIs) – 0.11 times

Category III – Retail Individual Investors (RIIs) – 1.55 times

Total Subscription – 1.30 times

Looks a good one and the big sharks may skip this for ICICI Lombard issue(hoping).IPOs have been spectacular disappointments otherwise with zero allottment most of the times.

This one too should attract big subscription from QIBs, NIIs, as well as Retail Investors, thus chances of allotment would be very bleak.

What do u think about SBI Life and ICICI Lombard? Both are coming so close on heels, people will be forced to make a choice on what to apply.

Thanks

Working on both the issues, find ICICI Lombard unnecessarily expensive, will definitely skip it. SBI Life too looks expensive to me, might avoid that too.

Zero Allottment! IPOs are completely unavailable nowadays to average investor, useless to apply.

Yes, same here, no allotment. It is undue exuberance all over the place.

Where is the advice or suggestion, to invest or not?

Hi Srombi,

Please revisit the post, it stands updated now.

Shiv, I was looking for you call, whether to invest in this or not ?

Hi Rohit,

This post stands updated now, please check.