This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

Budget 2018 has reintroduced the long-term capital gain tax on equity shares and equity mutual funds. There were speculations about its comeback, but I never expected it to materialise, at least in this budget. Personally I believe cons of having it outweigh pros of having it, but it doesn’t matter at all. What really matters is how harsh this LTCG tax is and why there was no panic selling in the markets today. Let us try to find out.

Firstly, this is what the Finance Minister Arun Jaitley announced in his budget speech today – “I propose to tax such long term capital gains exceeding Rs. 1 lakh at the rate of 10% without allowing the benefit of any indexation. However, all gains up to 31st January, 2018 will be grandfathered. For example, if an equity share is purchased six months before 31st January, 2018 at Rs. 100 and the highest price quoted on 31st January, 2018 in respect of this share is Rs. 120, there will be no tax on the gain of Rs. 20 if this share is sold after one year from the date of purchase. However, any gain in excess of Rs. 20 earned after 31st January, 2018 will be taxed at 10% if this share is sold after 31st July, 2018. The gains from equity share held up to one year will remain short term capital gain and will continue to be taxed at the rate of 15%.

In view of grandfathering, this change in capital gain tax will bring marginal revenue gain of about Rs.20,000 crores in the first year. The revenues in subsequent years may be more.”

What seems a simple thing to read carries many ifs and buts behind it, and the most important here is the “Grandfathering Clause”. We’ll try to clear all these ifs and buts here, so let us take it one by one.

What is this ‘Grandfathering’ clause?

As per Wikipedia, “A grandfather clause is a provision in which an old rule continues to apply to some existing situations, while a new rule will apply to all future cases”.

In our case, whatever gains we have earned on our investments in equity shares or equity mutual funds (including balanced funds) till January 31, 2018 will be grandfathered, or will not be taxed at all. So, whether you sell your equity shares or equity mutual funds tomorrow, or between now and March 31, 2018, or even anytime after March 31, 2018, you will not have to pay any LTCG tax on your gains earned till January 31, 2018, if your holding period is more than 12 months.

So, please keep in mind, there is no need to panic in this situation, as there is nothing which is going to affect your gains till 31 January. There is only one thing that could affect your gains (future gains) adversely in this situation and that is your panic behaviour and nothing else. You should take your ‘sell’ decisions only if you think that other investors will panic and markets will move down sharply from here. Even in this case, your previous gains are not taxable and you would be able to protect your gains from probable future losses.

When will this 10% LTCG Tax come into effect?

It will come into effect from April 1, 2018 onwards. It is still a proposal and not applicable for the gains you book on or before March 31, 2018.

So, should we book our gains before it gets applicable with effect from April 1, 2018?

Absolutely NOT, there is no point doing it for this reason. Your long term capital gains earned till January 31 are 100% safe from this tax and it makes absolutely no difference to that portion of LTCG, whether you sell it tomorrow, or after April 1, or even after 2 years from today.

How would our long term capital gains be taxed if we sell them on or after April 1?

There will be 2 portions of your LTCG when your actually book your gains on or after April 1 – first, LTCG earned till January 31, 2018 and second, LTCG earned between February 1 and the date you sell your holding(s). First portion will be tax exempt, and second portion will be taxed at 10.4%, including 4% health and education cess.

What will be our cost of acquisition for the gains made after January 31, 2018?

There is a formula for determining your cost of acquisition for the shares or mutual funds bought on or before January 31, 2018, LTCG gains earned after January 31, 2018 and gains booked after holding them for more than 1 year. Here you have the formula:

The cost of acquisition will be HIGHER of:

a) Actual cost of acquisition, and

b) LOWER of:

(i) Fair Market Value of the shares/units as on January 31, 2018

(ii) Actual consideration received at the time of transfer

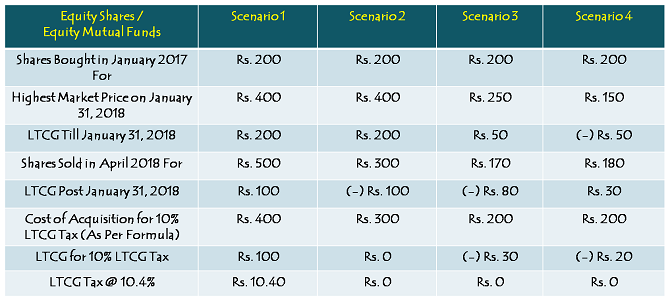

Let us take a look at the table below to understand it with four different scenarios:

How much LTCG is tax exempt?

LTCG upto Rs. 1 lakh per financial year is not liable to any tax, and you will have to pay 10% tax only on your long term gains over & above Rs. 1 lakh of exempt LTCG.

Like debt mutual funds, is there any indexation benefit available for calculating LTCG tax?

No, as the LTCG tax rate of 10% is considered to be on a lower side, indexation benefit to incorporate inflation effect has not been provided for in the budget.

Dividend Distribution Tax (DDT) @ 10% on Equity & Balanced Mutual Funds

Finance Minister Arun Jaitley has decided to tax your dividend income also which you get on your investments in equity mutual funds or balanced mutual funds. Here is what he announced in the budget:

“I also propose to introduce a tax on distributed income by equity oriented mutual fund at the rate of 10%. This will provide level playing field across growth oriented funds and dividend distributing funds.”

The onus of paying it to the government will not be on you. It will be the responsibility of the mutual fund which has announced to pay you this dividend, and it will be in the form of dividend distribution tax of 10%. This 10% will be deducted from the dividend announced and then dividend will be paid to you.

What’s your view on this reintroduction of LTCG tax and dividend distribution tax? Do you think it is going to have a substantial impact on our markets? Please share your views here. Also, if you have any query regarding any of the points mentioned in this post, please share it here.

Hi Shiv,

Thanks for the brilliant explanation especially the table part, but i would like to draw your attention to Scenario 3, where the cost of acquisition is wrongly mentioned as 200 whereas it should be 250 since its is the highest between actual buy and grandfather date and since it was sold in APRIL for 170 , there will be a loss of (250 buy -170 sell) = rs. 80. Pls review and revert.

Also please simplify the rule (one before the table) if possible, in writing else the table was very helpful.

Thanks

Your New Subscriber

Hi Jinu, we welcome you as our New Subscriber! 🙂

I have rechecked it and found no error in the table, including the 3rd scenario. First, we need to pick the ‘Lower’ of the selling price and the price on January 31st. Then, we need to pick the ‘Higher’ of the price of Step 1 and the actual cost of acquisition. This would be our ‘Cost of Acquisition’ for calculating LTCG.

It is not entirely correct to tell that Jan 31st price will be grand fathered and we dont have to panick and sell before mar 31. Cosnider this scenario:

You bought shares one year back for Rs 100.

Price on Jan 31 is Rs 200.

Company issues 1:1 bonus before mar 31. So, price falls to Rs 100 post bonus.

Now, for the original share, your purchase price is Rs 100. But since you cannot use Jan 31 price of Rs 200 to book LTC-Loss, you do not pay tax, nor can offset LTCL (scenario 3 mentioned in your article).

For the new shares, purchase price is zero and if you sell after one year, you will pay LTCG tax on it. You will do it even if price remains at Rs 100 (which is equivalent to grand fathered price of Rs 200).

Bhuashan

Your logic is incorrect. When bonus is issued your purchase price gets reset to 100 and the Jan 1 price of 200 was for the pre-bonus share and hence no LTCG is payable (to the extent of Rs 100 as per Jan 31 highest price) on either the original shares or bonus shares.

Dear Mr shiv,

can you please let me know the web site from where i can get highest prices of equity shares on 31 jan, 2018.

Thanks & regards

v k suri

Hi Mr. Suri,

Here is the link of the NSE where you can check historical share prices:

https://www.nseindia.com/products/content/equities/equities/eq_security.htm

4 Step Process to make payment through WhatsApp Pay.

1. SELECTION OF PAYMENT OPTION:

In the very first step the Android user have to tap the “Attach” button and look for the option saying “Payment”. In case of iOS tap the option saying “Plus” sign and look for payment option.

2. SELECT PAYMENT OPTION:

In this step “payment option” is available on individuals chat screens. Through this option you can also send money to specific user on a group chat forum.

3. ENTER UPI PIN:

Once the payment option is selecting, you have to enter the required amount which you need to transfer and enter your UPI PIN. Once the UPI PIN is entered accept to send the payment to the receiver.

4. RECEIVER :

In order to make the success payment the receiver must be also having WhatsApp Pay feature. In case the user is not having this feature the payment would be failed.

More @ http://www.sharpcareerfinancialupdates.in/banking-updates/4-step-process-make-payment-whatsapp-pay/

Dear Shiv can you please write on the present issue of NCDs pf SREI Infrasturcture Finance- its closing by 7th march,’2018

Sir,

1. I found it difficult to understand the formula – “higher of” and ” lower of”. But have I understood it right through your example?

In Scenario 2, I’m not paying anything because I sold my shares at a loss of Rs 100 on the whole – Rs 200 before Jan 31 and Rs 200 after, but lost Rs 100 of the gain after Jan 31.

In Scenario 3, I lost Rs 80 due to selling it for Rs 170, less than the acquisition price of Rs 200 and highest Jan 31 price of Rs 250.

In Scenario 4, I gained Rs 30 though the share price had dropped to Rs 150 in January from Rs 200. But as I bought the shares for Rs 200, which is a higher price than the price on Jan 31 or the final transaction price, I do not incur LTCG.

2. Also, are you saying that there is nothing to be gained by selling the shares now just to avoid LTCG – and it would actually be a drawback as you will incur transaction charges? What should be one’s next steps if there is no need for money at the moment? Should we hold on to our shares or leave them alone? What do you advise for senior citizens?

3. I didn’t understand this question and answer:

“Moreover, if that is the case then if I sell now to save LTCG then it’ll make sense only if I’m planning take money out of Equity, else it won’t make any sense, correct? because if I sell now, and re-enter again then also at exit anyway I’ll have to pay LTCG (or STCG if further holding is < 1 yr), correct?

"It makes no sense at all to sell now and purchase again, now or later. This way you are going to gain nothing and only increase your transaction costs. If you sell now and purchase again, you’ll have to again wait for one year to qualify for long term.

It sounds to me as if qualifying for long term is a desirable thing. Why?

Thank you for your patience.

Hi Secur Sri,

1. Yes, it seems that you have understood it right.

2. If there is no need of money at the moment, and you think that the markets are going to rise going forward, then you should stay invested. Selling now and buying later will have zero benefit for you, except in case of a sharp rise in your stock prices till March 31, 2018. Moreover, there is no change in my strategy for my senior clients.

3. Qualifying for long term is a desirable thing in equities as it attracts zero taxation on your gains till March 31, 2018, and preferential treatment even after that, i.e. 10% LTCG tax as compared to 15% STCG tax.

Hi Siva,

Earlier, as per my understanding, Mutual Funds used to pay dividend tax @ 28% and dividend was tax free for customers .

Now that 10% will be paid by customer on dividend, do Mutual Funds needs to pay dividend tax @ 28%?

Can you please share your comments?

Hi Ajit,

Both of your understandings are incorrect. Firstly, Equity MFs were not subject to DDT prior to this budget, and it was also tax-free for the investors, as you mentioned.

Moreover, even now the investors are not required to pay any dividend tax. DDT will be deducted & deposited with the government by the fund houses on equity & equity oriented schemes @ 10%.

Hi Shiv,

Yet another well explained article… thanks!

If I bought a stock for Rs 100 couple of years ago which is currently in long term, and the high on 31st January was Rs 150, it’s understood that my LTCG of Rs 50 is tax-free no matter when I sell the stock in future.

Is my understanding correct that if I sell the stock for say Rs 175 before 31st March, I don’t have to pay LTCG on additional gain of Rs 25, but I’ll have to pay LTCG on Rs 25 if I sell the stock for Rs 175 on or after 1st April?

If true, it would be difficult for stocks to break their 31st January high until 31st March… isn’t it?

Regards,

PP

Thanks PP!

1. Yes, your understanding is correct.

2. Not necessarily. Your decision to book your 2 months’ profits would depend on many factors – your date of purchase, how much percentage gain you have made in these 2 months, the brokerage you need to pay on selling & buying back your stock(s) again, your investment horizon and your investment outlook on the stock(s)/markets. Practically, I would not like to sell a fundamentally strong company which trades above its January 31, 2018 highs (especially after 3 days of big falls after the budget), just to save a 10% tax on my gains. Even if my stock moves 20% up in these 2 months, I’ll save just 2.08% LTCG tax by selling it on or before March 31, 2018. But, then I’ll have to hold it for another 1 year to make it long term again. Personally, I would prefer paying 2.08% in taxes (10.4% of 20% gains) rather than paying 0.25% to 1% brokerage and extending my holding period to make it LTCG again.

Dear Mr Shiv,

Whether the mutual fund houses have to pay 10% LTCG tax on their corpus gain as an AMC?

Do you foresee any impact on the price of the NAV of the equity MF Growth plans, due to any of the proposed provisions in this budget?

Hi Shubh,

1. No, MFs do not pay LTCG or STCG.

2. No, I do not foresee any impact on the equity MF growth plans due to any of the provisions in this budget. Their tax treatment would be similar to a situation in which you buy a share, keep holding it and no tax is payable till the time you sell it.

Thank you very much Mr Shiv. Your straight reply helps and clears all the doubts.

I ‘ll appreciate, if you can write some article or give your opinion about the Debt FMPs. Present market behavior and rising bond yields may make FMPs attractive.

Some information about the forthcoming FMPs with details about the portfolio quality and the indicative yield should help. Also you may please mention about the opportunities (if any) in the tax efficient fixed income segment.

Thank you very much….

Thanks Shubh!

I’ll try to write a post on FMPs and other debt investment options.

Dear Shiv,

I have two more follow up queries:

1. can I adjust carried forward STT paid short term capital losses (already booked before 31/1/18) against the STT paid Long term capital gains that will accrue henceforth?

2. Example

date 1/4/15 31/1/18 30/3/18 31/3/19

price of share Rs 100 (cost) Rs 300 Rs 400 Rs 500

scenario 1

If I sell on 30/3/18 (before 1/4/18), LTCG= Rs400-Rs 300= Rs100 no tax to be paid

if I buy back on 30/3/18 assuming 2% transaction cost of selling and buying then my new cost of acquisition is Rs 408. if I sell on 31/3/19 then

LTCG is Rs 500-Rs 408= Rs92 and tax is 10.4%*92=Rs 9.6. The total outflow is Rs 9.6 tax+Rs8 transaction cost= Rs 17.6

scenario 2

if I sell on 31/3/19 then my LTCG is Rs 500-Rs300= Rs 200 and tax thereon is 10.4%*200= Rs 20.8

In the above case if the share price rises between 1/2/18 and 31/3/18, is it advisable to book gains (tax Rs 20.8 compared to outflow Rs17.6) keeping in mind that the holding period will increase by a year and taking into account transaction costs? Am I missing something?

I know this might be complicated to illustrate but would appreciate a response to the above two queries. thanks in advance.

Hi Sonal,

1. Yes, you can set-off your STT paid STCL against STT paid LTCG booked after March 31, 2018.

2. No, you are not missing anything in your example. However, this kind of difference would accrue only in case you earn a reasonable gain on your stock holding between February 1, 2018 and March 31, 2018.

Thanks so much Shiv for taking the trouble to reply. Much appreciated!

Thanks Sonal!