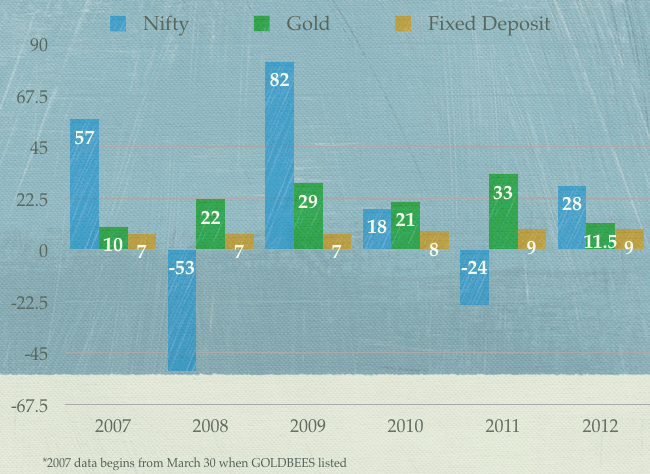

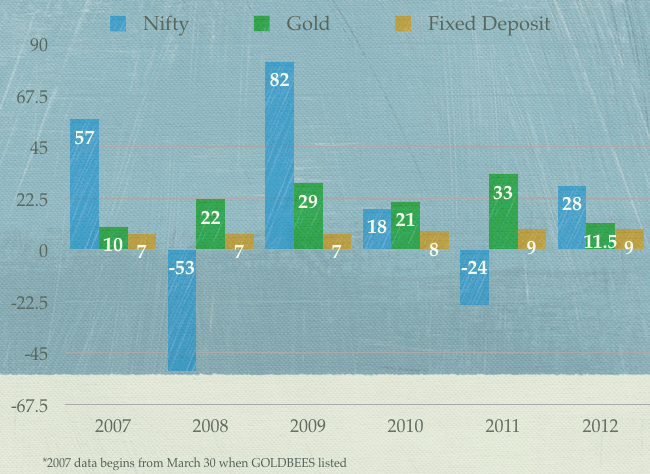

Gold has had the worst day today in 30 years as it tumbled 8.7% in a single day. There are several things that you need to consider about gold, but before you read any further, you need to consider how bad my record with gold price predictions has been. I said that you should stay away from gold as early as March 2009Â but if you had stayed away from gold for the last 4 years as I did that would have been bad for you as gold has grown quite a bit in that time.

GOLDBEES which is a popular Indian Gold ETF has grown almost 109% in the last 5 years, and at a CAGR of almost 16% that’s not bad at all.

2013 hasn’t been good for it though as it has gone down by 13.5% so far this calendar year, and it has gone down by 8% in the last 12 months or so, and it also looks like 2013 can be the first calendar year where gold returns could be negative when priced in INR.

I won’t be surprised by this and in fact if you read what I have written earlier it will be quite consistent with what I have been saying about gold over the past few years.

The main reason I’m not too bought into the gold theme is that every one is harping on the same story, and people are buying it because of all the same reasons. Everyone talks about central banks printing money, currencies getting debased and gold rising as a result. There is too much consensus and too many people talking the same language. That’s usually not a good sign, and portends bad days ahead. That’s what happened before when real estate stocks came down, same thing happened with infrastructure stocks, IT stocks, and perhaps even Tulips.

More than anything else this seems like a greater fool play where everyone is buying gold with the hope that someone else will be willing to buy it at a higher price a few months down the line. That has worked in the past, but I can’t see how that can work forever.

I’ve seen some very influential investors, and bloggers write about how they have the bulk of their portfolio in gold but I haven’t seen many updates from them to see what they are doing now that gold is trading down?

If you really had 40 – 50% of your portfolio in gold, you’re surely looking at tough times, and with the margin for gold and silver increased in the international markets, it should see some tough times going ahead as well.

I personally don’t feel that this is a good time to buy gold, and on the contrary, if you are sitting on big profits from your gold trade that has worked for the past few years, I’d say it is a good idea to book some of those profits, so that if the fall continues, not all of your profits are nullified.

Most importantly, view gold as any other asset, it’s not a hedge against inflation, and it is certainly not a safe haven, it’s just another asset that goes up and goes down, and if you have too much of your money tied into it – then you are well advised to diversify and reduce your exposure to it.

Also, I see some parallels here for the Indian real estate market. People say that real estate won’t go down because it has never gone down in the past, and guess where you have heard that argument before?

I probably don’t need to repeat this to regular readers, but it’s my duty to remind you that you shouldn’t take investment advice from random bloggers on the internet – your’s truly included.

The Nifty P/E is currently 19 which is not crazy high and if you have just made 15% on your portfolio, I don’t see a good reason to sell and lock in your gains because they aren’t very substantial gains to begin with.

However, this may not be a good time to begin fresh investments and in my own case I have sold some stocks in which there were sizable gains and am waiting for the next time of crisis to really step up investment.

If you have just ten years left for your retirement then I would say this is not the time to get aggressive, and it is much better for you to be conservative with your investing, and invest only a small part of your money in equities anyway which can be quite volatile, and if you want to increase that investment it should be during times of panic and crisis and not times such as these when everyone is excited about the markets, so conserve cash now and deploy it later when there is panic.