I read that HDFC is coming out with a new gold ETF, so I thought I’d check out how the existing ones are doing, and see what is the difference in returns between the gold ETFs that are already present in the market.

I went to the NSE website, and looked up the closing prices for all 7 existing gold ETFs for the past couple of years.

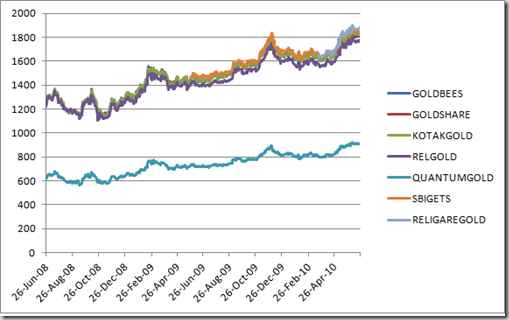

Here is how they have moved over the past two years.

As you would have probably expected, the prices move quite close together, and you can hardly notice any difference between the ETFs.

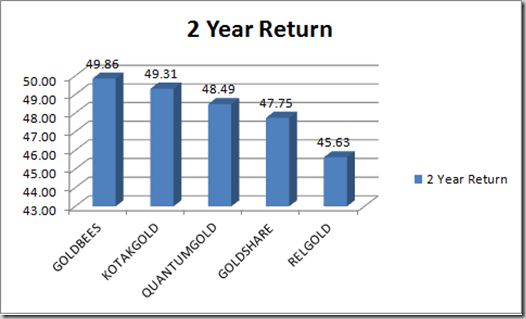

Next up, I did a chart of the absolute returns of the gold funds that have been in existence for the entire two year period.

Here is how that looks.

GOLDBEES does the best (and it does quite well in volumes also, as I mentioned in my best gold ETF post), and that is due to the fact that its expenses are lower than the competitors. More competition is always good for the customer, but unless someone comes up with an ETF with expenses lower than GOLDBEES, I can’t imagine them to be the best on this chart.

I have an observation which I want to share as well as validate.

Most of these gold ETF’s claim that 1 unit corresponds to approx 1 gram of gold. But, this can change very quickly. e.g. for an ETF which charges expenses of 2.5% per annum, 1 unit becomes 0.975 gram of gold after 1 year, 0.95 gram of gold after 2 years and so on. Within 20-22 years, 1 unit becomes equivalent to only about 0.5 gram of gold. To still say that 1 unit corresponds to approx 1 gram of gold is plain misleading.

Did i get this right? If so, shouldn’t there be a better way of accounting for the expense ratio?

why not create gold ETF units as multiples of Rs 10 or Rs 100, as is done by most mutual funds? That way there won’t be any pretense that a unit implies 1 gram of gold (which it clearly doesn’t).

Since ETFs track an underlying asset they need to be based on a certain unit of that asset. So if you hold one unit of an ETF you need to know how much of the underlying you own.

Aribitrageurs are present in the market who keep a close watch on the NAV of an ETF and the market price, and trade on the market to bring the value of the NAV and trading price close together. To know the NAV it has to be based on the underlying which in this case is gold. So you need to know what does unit of an ETF represent?

This is true of any index fund, so like Benchmark Nifty Index fund represents 1/10th of the Nifty. You need to know what one unit of the ETF represents the underlying asset to know how far away the traded value is from what the ETF actually holds.

MFs are a bit different because they don’t trade in the market, and the money they get from you is used directly to buy the index in the same proportion.

Hi Friend,

I want to purchase gold bees , what the stock code , will it listed under stocks or etfs? im using icicidirect ,how to buy through this site? kindly guide me thanks

GOLDEX is the code for it. Go to Equity -> Buy -> Enter GOLDEX in the quote, and say get quote.

It will show you the details, and you can transact if the price attract you. Thanks!

thanks friend.I bought today the goldbees @1991 rs but i want to track this etf thorugh any site ..im not able add this etf in my moneycontrol portfolio and when serached this etf in rediff money its showing different nav value ..totally confused 🙁

You can track this using the ICICI Direct Portfolio itself, as that should show it once it gets delivered to you, and at the price you bought it for. That will be more convenient, as everything is already done for you.

Hi

I would like to know t he gold price history of last 10 years.

How can I?

goldprice.org has got pretty good price data on gold. Here is the link that can get you started Ravi:

http://www.goldprice.org/gold-price-history.html

Hi ,

I have invested recently in Benchmark gold ETFS. @ price of 1923 per gm..i want to know how the expense ratio has affected my purhcase price.My brokerage & other stuff added upto 19296 for 10gms..Please let me know where are the calculations involved for expense ratio on purchasing as well as selling ETF’s.

Rohit,

The expense ratio will not directly be visible in your purchase price like the brokerage or STT. The expenses incurred by the funds are deducted from the NAV of the fund, and then through market activity the ETF price comes closer to the NAV.

So, though the expenses impact your purchase by the extent of 1% in this case – you can’t directly see it in the price.

I am a senier citizen. I have demat account in ICICI bank. I want invest Rs 1 lac in Gold ETF. What is the best option? And how to go about it? Please guide.Mrs pawar

Dear Mrs. Pawar,

The way to invest in ETFs is exactly the same as you would invest in stocks. Have you every invested in stocks? If you have then you can use the same method to invest in an ETF.

There is a good future for silver as rates are going up everyday.Is there silver ETF like gold ETF?

Sheela

No, there is no silver ETF in India. You can check out e-silver from NSEL. If you search this site for silver etf alternates and NSEL you will get two posts on those topics.

Dear Sheela ji,

In case you are keen on investing in Silver, you can invest in E-silver and also in E-Gold through National Spot Exchange. You are most welcome, if your need any help in buying or selling

Sorry, I have one more question 🙂

If I wish to buy ETFs over a period of time, does it help to buy from a variety of available ETFs or should I stick to just one ETF?

Thanks again.

Amar.

Hey Amar,

The only benefit could be that if you buy one ETF and for some reason it has a high tracking error, or the fund has some other issues then by spreading around your money you are slightly safer. So that is probably one thing going in its favor.

I can’t think of anything else right now, so if someone else has any ideas on why this could be compelling please let us hear it.

Hi,

From the first chart, the one depicting the movement for various ETFs over the past 2 years, I understand that Quamtum ETFs deal with smaller units of gold (1/2 gram?). Do any of the other ETFs deal with smaller units? Is there any advantage buying smaller units rather than one large unit?

Also, is it better to invest in gold ETFs or gold MFs? One advantage I can see with gold MFs is that I can set up a SIP, but other than that, is there any advantage with regards to returns, redemption etc?

Thanks,

Amar.

Hi Amar,

Let me see if I can answer all your questions here:

1. No, I don’t think anyone else has a smaller unit.

2. I can’t think of any real advantage other than the fact that you can buy with lower sums.

3. I want to address this in a little more detail so I will answer this separately later today. As for setting up SIP in ETF there are several ways of doing that discussed in this post:

http://www.onemint.com/2010/09/06/a-new-way-to-set-up-sip-in-etf/

Amar, I found only two mutual funds currently on offer that get you exposure to gold and both of them own companies engaged in gold mining rather than physical gold itself, so that way investing in Gold ETF is a lot different than investing gold mutual funds.

The two funds are: AIG World Gold Fund and DSP BR World Gold.

If you know of any other gold mutual funds then do let me know.

I am a senior citizen. I want to invest in companies investing in gold . Kindly suggest some of the probitable companies.

I am not sure what you mean by companies investing in gold….are you referring to jewelery exporters?

I want to invest in crude oil etf can you suggest any name for crude oil etf in india.

regards

manish gupta

mobile:-9211553555

want to invest in etf gold fund.suggest me the best return fund please

Hi,

I am planning to invest in gold ETF. I would like to know if there is any entry or exit load for investing in gold etf.

Rishi

This is like a stock so there is no entry or exit load, but the ETFs do charge expenses like other mutual funds.

dear sir, I want to know that, Can a persons can do BTST( buy today and sell tommorow) in gold etf.

second question is that , I want to invest in crude oil etf can you suggest any name for crude oil in india.

regards

manish gupta

mobile:-9211553555

Manish,

There is no crude oil ETF in India currently. Some time ago ICICI Prudential had launched an NFO for Oil Fund, but that never took off either. So, to the best of my knowledge there are no oil funds in India.

Sir i am having demat account can you let me know how can i invest in ETF , can i buy this through demat account or can you give your suggestion as how to buy this and can you let me know which time i should buy this ETF

Hi,

Most of these ETFs are Dividend schemes, except for SBI Gold ETF & Quantum Gold ETF. In Mutual Funds, I opt for a Growth fund because it’s returns over a period of time are much better than that of a Dividend fund.

Does the same principle apply for Gold ETF s as well?

Shameek, I did a comparison on two year returns on these gold ETFs and here are the results. http://www.onemint.com/2010/06/26/2-year-returns-of-existing-gold-etfs/

This data throws light on how these ETFs have performed with respect to each other.

Very Good Research. Thanks for providing such data.

Regards

I would like to invest about 1 lakh in Gold shares in India.Please advice which shares can give me best returns..

Gold shares – you mean companies that invest in the gold business or gold ETFs?

ETFs

In fact I would advise you to consider your investment in E-Gold and E-Silver as well before only thinking in terms of Gold ETF.

What is Expense Ratio ? What is its role in Gold ETFs ? How does Expense Ratio link/ affect my investment in Gold ETFs?

Thanks Ganesh. Your article is quite educative. I am sure that I coming days more and more people will be benefit from your experience and writings.

Dear sir,

Your website is very interesting and giving lots of information about gold ETFs. You have talked about expense ratios of the different gold ETFs and have mentioned that lower the expense ratio leaves good returns for the investors. How to find out the expense ratios of HDFC gold ETF and ICICI gold ETF? Is any of these funds attactive than Gold BEes? Is there any advantage in investing in gold ETFs during NFO period?

Thanks a lot in advance for your valuable comments.

Regards,

Ganesh.

Thanks Ganesh. Both these funds have an expense ratio of 2.50%, and to the best of my knowledge – there is no benefit of subscribing to a mutual fund during its NFO period.