There is a common notion that the older you get, the lesser equity you should own, and the rationale for this is you shouldn’t be invested in too much equity when you’re retired or towards retirement because a drop in the market may not leave you enough time to recover from it, and you may be forced to sell your stocks while you are still at a loss.

I don’t quite agree with this idea in the sense that you can’t just say that if you’re old you should have less of equity, and if you’re young you should have more of equity disregarding your knowledge and comfort with owning such a volatile asset in the first place.

In fact, in a lot of cases it makes sense to have a higher level of equity in your portfolio when you are older because your experience teaches you to deal with the volatility that is inherent in this game, and your longer term outlook to owning assets may be a lot more developed than someone much younger.

In a sense, someone who is forty years old and has owned shares for the last decade can easily see herself hold on to those shares for the next decade compared with someone who is 25 and has just started investing in shares, and can’t really develop that kind of outlook right away.

More than age, I think how much equity you own depends on the following three factors:

1. How well funded are your medium term goals? If you have have a wedding or an education expense coming up in the next five to seven years, how well are you preparing for that? Do you know how much that is expected to cost, and do you have a good sense of where you can find the money to fund that? These calculations are often simple, and quite eye opening as well, and if you do these calculations and say fund most of your child’s education through a simple RD then you will be able to invest the rest of your money in more volatile equity with a lot more peace of mind.

2. How knowledgeable are you with the stock market? A lot of people equate this to trading, or following the market closely, or reading a lot about it. But that’s not necessary, if you are grounded on solid long term principles, and reasonably aware of what is going on in the economy in general then that’s all it needs. Additionally, you shouldn’t be dabbling in penny stocks or shady companies the likes of which can go down to zero. In fact, for a lot of people, there is no reason to buy stocks directly at all, and it is good enough to buy a few good mutual funds.

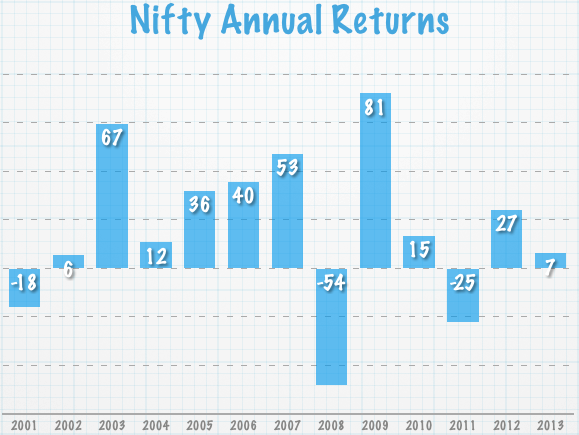

3. How patient are you with the market? There are plenty of good funds that have given just three, four, five percent return in the last three years. Some have even given negative returns, and someone who started investing when the market was relatively higher would surely not even be seeing positive returns right now, let alone returns that beat a simple FD. That’s just the nature of Indian stock markets, and I don’t think it is going to change any time soon no matter who comes to power. If you are in the market, you have to be in the market with the mentality that you are in it for five, ten, twenty years, and in that time frame, the market will at least have one up cycle which will let you cash out (if nothing else). My experience is that the cycle is much shorter, but giving yourself that much time, and ensuring that you don’t need the money in the next few years ensures that you don’t sell in panic.

So, my answer to the question of age affecting portfolio is — it should have very little impact, if anything at all, and instead you should seek yourself to educate on the market in general and also about your finances and upcoming goals.