This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

Having gained 20-30% on their investments made in tax-free bonds a couple of years back, investors’ hunger for tax-free bonds has grown considerably. With IRFC issue worth Rs. 4,532 crore getting 2.38 times oversubscribed on the first day itself, there seems to be no slowdown in the subscription demand for these bonds.

To cash-in on this huge demand and ending a long wait for its tax-free bonds, NHAI, which filed its draft shelf prospectus in the first week of October, will be launching its first tranche of tax-free bonds from the coming Thursday i.e. 17th December. As the issue size is considerably quite big at Rs. 10,000 crore, I hope most of the retail investors are able to get their share of bonds allotted at least this time around. The issue is officially scheduled to remain opened for two weeks and will get closed on December 31st.

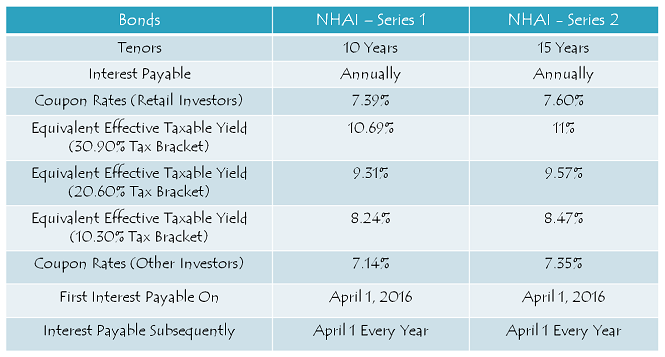

Before we analyse it further, let us first quickly check the salient features of this issue:

Size of the Issue – NHAI is authorized to raise Rs. 24,000 crore from tax free bonds this financial year, out of which the company has already raised Rs. 3,872 crore by issuing these bonds through a private placement. Out of the remaining Rs. 20,128 crore, the company will raise Rs. 10,000 crore in this issue.

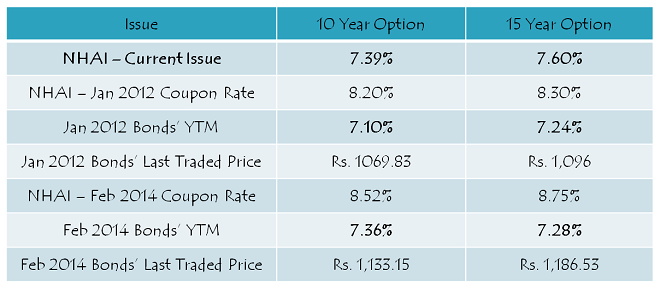

Coupon Rates on Offer – With rising G-Sec yield, earlier IRFC and now NHAI, both have been able to offer higher coupon rates as compared to PFC and REC. While IRFC offered 7.53% for the 15-year period and 7.36% for the 10-year period, NHAI is offering an even higher rate of interest at 7.60% for 15 years and 7.39% for 10 years.

For the non-retail investors, these rates would be lower by 25 basis points (or 0.25%).

Rating of the Issue – CRISIL, ICRA, CARE and India Ratings consider investing in these bonds to be safe and as a result, have assigned ‘AAA’ rating to the issue. Also, these bonds are ‘Secured’ in nature i.e. in case of any default, the bondholders would carry a right to make claim on certain assets of the company.

NRI/QFI Investment NOT Allowed – Unlike PFC, REC & IRFC issues, Non-Resident Indians (NRIs) won’t be able to make investment in this issue. Qualified Foreign Investors (QFIs) are also not eligible to invest in this issue.

Investor Categories & Allocation Ratio – The investors have been classified in the following four categories and each category will have certain percentage of the issue size reserved during the allocation process:

Category I – Qualified Institutional Bidders (QIBs) – 20% of the issue is reserved i.e. Rs. 2,000 crore

Category II – Non-Institutional Investors (NIIs) – 20% of the issue is reserved i.e. Rs. 2,000 crore

Category III – High Net Worth Individuals including HUFs – 20% of the issue is reserved i.e. Rs. 2,000 crore

Category IV – Resident Indian Individuals including HUFs – 40% of the issue is reserved i.e. Rs. 4,000 crore

Allotment on First Come First Served Basis – Subject to the allocation ratio, allotment will be made on a first come first serve (FCFS) basis in each of the investor categories, based on the date of upload of each application into the electronic system of the stock exchanges.

Listing & Allotment – NHAI has decided to get these bonds listed on both the stock exchanges, National Stock Exchange (NSE) as well as Bombay Stock Exchange (BSE). The company will allot the bonds and get them listed within 12 working days from the closing date of the issue.

Demat A/c. Not Mandatory – It is not mandatory to have a demat account to apply for these bonds. Investors have the option to subscribe to these bonds in physical form as well. Whether you apply for these bonds in demat or physical form, the interest payment will still get credited to your bank account through ECS.

Also, even if you get these bonds allotted in your demat account, you have the option to rematerialize your holding in physical/certificate form if you decide to close your demat account in future.

No Lock-In Period – These tax-free bonds are freely tradable and do not carry any lock-in period. The investors may sell them at the market price whenever they want after these bonds get listed on the stock exchanges within 12 working days of the closing date.

Interest on Application Money & Refund – Successful allottees will earn interest at the applicable coupon rates i.e. 7.39% p.a. for 10 years and 7.60% p.a. for 15 years, on their application money, from the date of realization of application money up to one day prior to the deemed date of allotment. Unsuccessful allottees will get interest @ 5% per annum on their refund money.

Minimum & Maximum Investment – Investors are required to put in a minimum investment of Rs. 5,000 in this issue i.e. at least 5 bonds of face value Rs. 1,000 each. There is no upper limit for the investors to invest in this issue. However, an investor investing more than Rs. 10 lakhs will be categorized as a high networth individual (HNI) and will get a lower rate of interest as applicable.

Interest Payment Date – NHAI will make its first interest payment on April 1st next year and subsequent interest payments will also be made on April 1 every year, except the last interest payment, which will be made to the bondholders along with the redemption amount on the maturity date.

Record Date – For the payment of interest or the maturity amount, record date will be fixed 15 days prior to the date on which such amount is due to be payable.

Should you invest in this issue?

NHAI tax-free bonds issued in February 2014 are quoting at a yield to maturity (YTM) of 7.28% with the closing market price of Rs. 1,186.53. Also, bonds issued in January 2012 are carrying 7.24% yield and last traded at Rs. 1,096 on Friday.

Taking a clue from these already listed bonds, I think subscribing to the 15-year option makes more sense. Risk-averse investors with a long term view should definitely invest in these bonds. In the short-term as well, you can expect some listing gains with these bonds.

Application Form for NHAI Tax Free Bonds

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in NHAI tax-free bonds, you can contact me at +919811797407

Mr. Shiv, Please clarify on the ‘taxation aspects of off market transfer of tax free bonds between family members. Could you provide a few pointers please?

Thank you.

Hi S.K.,

Please consult your tax advisor/CA for more clarity on taxation aspects of these securities.

Day 9 (December 30) subscription figures:

Category I – Rs. 8,160.03 crore as against Rs. 2,000 crore reserved – 4.08 times

Category II – Rs. 7,096.22 crore as against Rs. 2,000 crore reserved – 3.55 times

Category III – Rs. 3,492.96 crore as against Rs. 2,000 crore reserved – 1.74 times

Category IV – Rs. 3,360.64 crore as against Rs. 4,000 crore reserved – 0.84 times

Total Subscription – Rs. 22,109.85 crore as against total issue size of Rs. 10,000 crore – 2.21 times

Last day tomorrow.

Day 8 (December 29) subscription figures:

Category I – Rs. 8,160.03 crore as against Rs. 2,000 crore reserved – 4.08 times

Category II – Rs. 7,055.72 crore as against Rs. 2,000 crore reserved – 3.53 times

Category III – Rs. 3,492.16 crore as against Rs. 2,000 crore reserved – 1.74 times

Category IV – Rs. 3,313.19 crore as against Rs. 4,000 crore reserved – 0.83 times

Total Subscription – Rs. 22,021.10 crore as against total issue size of Rs. 10,000 crore – 2.20 times

Hi,

Just wanted to know, if there is any restriction on Institutions to Buy bonds which were originally issued to a Retail Investor.

I mean, can a Institution buy this new Bond which will list on BSE with ID similar to this 7.60NHAI30 ???

Hi Rohit,

Institutional investors can buy these bonds from the retail investors and there is no such restriction on such transactions.

Dear Shiv, i have 1100 hundred PFC tax Free bond for 20 years

so i am in the category of HNIS & the interest rate for this is 7.35%.

when i am trying to add this in demat A/c it is not appearing its showing only 7.60 % which is for retail investor .

please guide me to add this in my portfolio .

Hi Nisar,

Sorry, I won’t be able to help you in your problem, you should contact your broker for such issues.

Kindly let me know how to calculate the YTM & IRR. What is the difference between the two? Which is more accurate/helpful?

Hi S.K.,

For bonds/NCDs, YTM has significance. Please check this link for YTM calculation – http://www.onemint.com/2012/07/25/how-to-calculate-yield-to-maturity-of-a-bond-or-ncd/

Mr. Shiv, Could you please advise how to speedily transfer TFB’s from a family member’s DEMAT Account to my own without incurring any charges like brokerage/fees? Please elaborate if there are any sort of restrictions/disadvantages in such transfer.

Hi S.K.,

You can transfer the securities from one account to another using the Speed-e facility of your depository OR submitting the delivery instruction slip with your DP. You can avoid the brokerage in this case, but I don’t think you can avoid transaction charges of the DP, which would be very low. There are no restrictions in such transfers, but you need to consider taxation aspects of such transfer.

Sorry, could Mr. George explain his response of 29.12.15 regarding ‘paying capital gains @10% + brokerage if he were to buy bonds’. Why would a buyer need to pay capital gains tax?

SK, I told selling old Bonds he has to pay. Rohit is talking about arbitrage opportunity of selling old bolds at premium and buying. When you take into account the capital gain tax and selling charges of all bonds, it is better to hold old bonds.

Exactly, there is no sense in selling old tax free bonds and buying the new ones. ET had published an article saying there is arbitrage opportunity but there is none. Read – http://www.moneylife.in/article/sell-old-tax-free-bonds-for-new/44391.html

Hi Shiv,

Can somebody still get allocation if applied today.

Thanks

Yes Ash, Category IV investors will get 100% allotment in this issue, even if applied for these bonds on the last day i.e. tomorrow.

Hi Shiv,

For someone who has applied on Day-1 in retail category and get’s 100% allocation. How is the interest payment calculated compared to someone who has applied on Day-7 (in retail) and also get’s 100% allocation?

thanks,

Hemant

Hi Hemant,

The day the funds get deducted from your bank account for these investments, you start earning interest on your investment. So, Day-1 applications will earn higher interest as compared to Day-7 applications.

Thanks Shiv.

Been a long time since i invested in one of these.. But the concept is of interest on allotment money.. From the date of debit to your account to the allotment date.

The tax free interest starts from the date of allotment of bonds.

Day 7 (December 28) subscription figures:

Category I – Rs. 8,160.03 crore as against Rs. 2,000 crore reserved – 4.08 times

Category II – Rs. 7,055.71 crore as against Rs. 2,000 crore reserved – 3.53 times

Category III – Rs. 3,491.45 crore as against Rs. 2,000 crore reserved – 1.74 times

Category IV – Rs. 3,273 crore as against Rs. 4,000 crore reserved – 0.82 times

Total Subscription – Rs. 21,980.19 crore as against total issue size of Rs. 10,000 crore – 2.20 times

Last 3 days of the issue left, but doesn’t seem that the retail portion will get oversubscribed.

Thanks Shiv Kukreja for updating subscription figures. it helped me for my investment..thanks once again.

You are welcome P.S.!

NHAI bond, Amount has been deducted today which was on hold. 100 % allotment. I think in Dmat it will reflect within day or two.!! thanks Shiv ji.

Do SBi provide bonds

Hi Ravinder,

SBI came out with a couple of bond issues for general public in FY 2010-11 and received a very good response for both of them. But, subsequent to that, SBI hasn’t launched any such public issue.

If I remember correctly, these were not tax free bonds. In fact the concept of tax free bonds was not in vogue at that point of time.

Yes NN, that’s right, these were not tax free bonds. Tax-Free bonds got introduced subsequently.

Rohit,

NHAI bonds with 8.75 % interest were issued in February 2014. Interest is paid on 15th March every year. While calculating yield youwill have to take into aaccount the accrued interest on these bonds. We will have to reduced the accrued interest amount and then calculate the yield. It would be then close to 7.6%. However, Shiv may be able to give a better reply.

In IRR Calculations, it automatically get considered.

CMP is my Outflow.

All future Interest Payments are Inflows.

Starting Inflow is Rs 87.50 on 15th Mar 16.

Ending is on 15th Feb 29 Rs 80.20 (for 11 month) + Principal of Rs 1000. In between every year Rs 87.50 on 15th Mar.

You are perfectly right. YTM is calculated after considering the interest accrued only. But you can not assume that NHAI 8.75 yielding is selling at yield of 7.12 and you can expect the same for the new issue. It will always depend on the demand and supply. As far as 8.75% is considered, the buyer can get his interest part by Mar 15th. He may even sell after that also based on market condition.The price which you mentioned the qty sold is just 50 and that’s the qty for whole day. When new bond gets listed considering that 4000 crore retail, the volume of supply can be high and demand will depend on the interest rate at that time. This is the reason why, one need not expect very high premium for IRFC and NHAI immediately.l

To add, Yesterday the IRFC 15 year bond was selling below par. (Rs 997-1001 range).

Yes George, seeing that I become curious to know why this is happening.

I thank you for pointing out other aspects also.

Thanks Shiv & Gurdeep.

Given the scenario, I feel that a person who is holding earlier NHAI bonds must Sell them and Buy from Primary market or through Exchange New bonds. Looking at the current order book at NSE, atleast Rs 10 lac worth N6 bonds will get sold out in no time till yield comes at 7.17%.

An arbitrage opportunity for people who are holding old bonds.

May not be that attractive if he were to buy new bonds. He has to pay 0.7-1% brockerage+tax and capital gain tax of 10%.

Actually IRFC rate is 10 basis points lower than the NHAI rate (Rs 1 less interest per bond per year). Given a choice, a “small “investor would try to subscribe to NHAI rather than pay Rs 1000 (same price) for the lower yielding security + brokerage. The volumes on NSE are quite low for the tax free bonds and debt in general so be prepared to sacrifice liquidity.

For some one exceeded limit in NHAI and have more to invest, IRFC at current rate with Brokerage still offers 7.45% for 15 years bond which is good or on par with any public issue.Those who are selling are having -ve capital gain or say loss.

Hi George,

I don’t think it makes sense to buy from the secondary market at or above Rs. 1,000 and paying brokerage unnecessarily. It would be better to wait for HUDCO, IREDA or NHAI Tranche II for such investments.

Yes , I agree with you considering 3 issues in the offing, it is better to wait. I was only suggesting for those who wants to top it up in IRFC to 10 Lakh retail limit if they have enough funds to invest in remaining issues also. I feel IRFC is trading on par only due to under subcription in NHAI retail which is to my mind due to the retail customers interested in it exceeded their limit. Still there is a large section of retail investors who are unaware or so not want to venture into TFB. If HUDCO or IREDA comes out with issues there will be enough interest considering that the same retail investors already invested in issued bonds will further invest. Once the NHAI gets closed , we will see some improvements in IRFC pricing in secondary market.

IRR considers the time value between payout of “accrued interest” to the buyer and receipt of interest from the debtor.

Yield formula does not do that. The price (buy price – accrued interest) is considered which may lead to a slight difference.

Thanks Gurdeep and George for your inputs!

Hi,

Pls let me know what Mathematical error I m committing.

On NSE site, I see price of NHAI-N6 as Rs 1204 around, which has coupon Rate of 8.75. Remaining Tenure is 14 years. (It was also issued to retail investors).

Its Yield as calculated by me using IRR method comes 7.12%. (similar is displayed by NSE site).

Now, these NEW bonds with coupon rate of 7.60%, will yield 7.12% at price of Rs 1042. (Using Same IRR methodology).

However, as per other ppl (including shiv), these bonds should have gains around 1-2%, that is should be priced at Rs 1010-1020.

I ll b thankful, if anybody can explain this to me.

Hi Rohit,

It is a matter of demand & supply due to which we are expecting these NHAI bonds to list at a premium of 1-2% only. As the older 8.75% bonds are trading at a YTM of 7.12%, 7.60% bonds should also ideally trade at a YTM close to 7.12% only. But, due to profit booking and lack of demand on the day of its listing, these bonds will not have 4%+ listing premium for sure. Don’t be surprised to have even no premium at all.

IREDA filed Draft prospectus on 18th Dec. We can expect HUDCO or IREDA very soon. IREDA is expected to have 15 Basis points higher coupon since it is AA+ rated.

wants to apply on 28th Dec. under retail category. can i get my 100% allotment. Awaiting your updates on the subscription figures.

Sir,

I applied 200/ IRFC bonds vide app no 77660272.The amount was blocked by my bank. Upto 22nd Dec amt was blocked but I did not receive any bond.I went to Karvy site the registrar of the issue it showed there is no such application.pls guide how can I enquire.I submitted app.at Delhi.

Regards

Jyoti

Hi Jyoti,

You should contact your broker through whom you submitted the application. Only they would be able to help you in this case.

Day 6 (December 24) subscription figures:

Category I – Rs. 8,160.03 crore as against Rs. 2,000 crore reserved – 4.08 times

Category II – Rs. 7,055.67 crore as against Rs. 2,000 crore reserved – 3.53 times

Category III – Rs. 3,489.43 crore as against Rs. 2,000 crore reserved – 1.74 times

Category IV – Rs. 3,199.40 crore as against Rs. 4,000 crore reserved – 0.80 times

Total Subscription – Rs. 21,904.53 crore as against total issue size of Rs. 10,000 crore – 2.19 times

When will the amount in bank account get Blocked for NHAI TFB Retail ASBA application?

Hi H.D.,

Whenever the application reaches your bank for further processing, the amount gets blocked by your bank. So, it depends on your broker when it processes your application.

I think SBI bonds are not TFB. It is only for private placement. Shiv – kindly confirm.

That’s correct Vineet, thanks for your inputs!