This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

It seems like the hunger for tax-free bonds is just growing unabated and whatever the issue size be it would be gobbled up by the investors on the first day itself. HUDCO will launch its second issue of tax-free bonds from 2nd of March i.e. the coming Wednesday and though the company has fixed March 10 to be the closing date of this issue, I think there is no need to emphasize here on this forum that nobody should expect to get any allotment if the bid is not made on the first day itself.

It will be the ninth such issue of tax-free bonds for the current financial year, but none of the issues has lasted for more than one day to get oversubscribed, except for the NHAI Tranche I in December. Though I think for any issue to last for more than one day the quota for the retail investors has to be more than Rs. 2,000-2,500 crore, this issue has only Rs. 715 crore for the individual investors investing Rs. 10 lakhs or less.

Here are the main features of HUDCO Tax-Free Bonds Tranche II:

Size of the Issue – Out of Rs. 5,000 crore allocated to HUDCO to be raised this financial year, 70% i.e. Rs. 3,500 crore should be raised through public issues. HUDCO raised Rs. 1,711.50 crore through its first public issue in January and it will raise the remaining Rs. 1,788.50 crore in this issue.

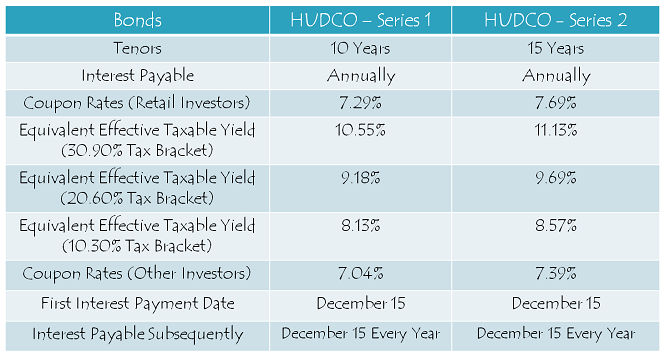

Coupon Rates on Offer – HUDCO issue will carry coupon rates which are absolutely same as offered by NHAI in its issue which got closed yesterday – 7.29% for the 10-year option and 7.69% for the 15-year option. Like the NHAI issue, this issue also will not offer the 20-year option.

For the non-retail investors, coupon rate will be lower by 25 basis points (or 0.25%) for the 10-year option and 30 basis points (or 0.30%) for the 15-year option, as it was the case in the NHAI issue as well.

Rating of the Issue – CARE and India Ratings have assigned ‘AAA’ rating to the issue, indicating that the issue is quite safe to invest and the company is highly likely to pay its debt obligations in a timely manner. Also, these bonds are ‘Secured’ in nature and in case of any default, the bondholders would carry a right to make claim on certain assets of the company.

NRI/QFI Investment Not Allowed – Again, Non-Resident Indians (NRIs) and Qualified Foreign Investors (QFIs) are not eligible to invest in this issue.

Investor Categories & Allocation Ratio – The investors have been classified in the following four categories and each category will have certain percentage of the issue size reserved during the allocation process:

Category I – Qualified Institutional Bidders (QIBs) – 20% of the issue is reserved i.e. Rs. 357.70 crore

Category II – Non-Institutional Investors (NIIs) – 20% of the issue is reserved i.e. Rs. 357.70 crore

Category III – High Net Worth Individuals including HUFs – 20% of the issue is reserved i.e. Rs. 357.70 crore

Category IV – Resident Indian Individuals including HUFs – 40% of the issue is reserved i.e. Rs. 715.40 crore

Allotment on First Come First Served Basis – Subject to the allocation ratio, allotment will be made on a first-come-first-served (FCFS) basis in each of the investor categories, based on the date of upload of each application into the electronic system of the stock exchanges.

Listing & Allotment – HUDCO bonds will get listed only on the Bombay Stock Exchange (BSE). The company will allot the bonds and get them listed within 12 working days from the closing date of the issue.

Demat A/c. Not Mandatory – It is not mandatory to have a demat account to apply for these bonds. Investors have the option to subscribe to these bonds in physical form as well. Whether you apply for these bonds in demat or physical form, the interest payment will still be credited to your bank account through ECS.

Also, even if you get these bonds allotted in an electronic form, you have the option to rematerialize your holding in physical/certificate form if you decide to close your demat account in future.

No Lock-In Period – These tax-free bonds are freely tradable and do not carry any lock-in period. The investors may sell them at the market price whenever they want after these bonds get listed on the stock exchanges within 12 working days of the closing date.

Interest on Application Money & Refund – Successful allottees will earn interest at the applicable coupon rates on their application money, from the date of realization of application money up to one day prior to the deemed date of allotment. Unsuccessful allottees will get interest @ 5% per annum on their refund money.

Minimum & Maximum Investment – Investors are required to put in a minimum investment of Rs. 5,000 in this issue i.e. at least 5 bonds of face value Rs. 1,000 each. There is no upper limit for the investors to invest in this issue. However, an investor investing more than Rs. 10 lakhs will be categorized as a high networth individual (HNI) and will get a lower rate of interest as applicable.

Interest Payment Date – HUDCO will make its first interest payment on December 15 this year and subsequent interest payments will also be made on December 15 every year, except the last interest payment, which will be made to the bondholders along with the redemption amount on the maturity date.

Record Date – For the payment of interest or the maturity amount, record date will be fixed 15 days prior to the date on which such amount is due to be payable.

Should you invest in this issue?

Budget 2016 will be presented in the parliament on February 29 and we will get to know whether we will have these tax-free bonds available or not for the next financial year. In case the finance minister Mr. Arun Jaitley decides against extending this facility to these public sector units, then I think there will be a rise in the demand for the already listed tax-free bonds and hence, we can expect a rise in their market value as well.

Also, a higher fiscal deficit number will result in an increase in bond yields, which in turn will result in a higher coupon rates for the IRFC and NABARD issues. So, in case there is a jump in bond yields, then you should wait for the these two issues to decide on your final investments. I’ll update this post on March 1 after the climax of Budget 2016 gets revealed.

Expected Launch Date of IRFC and NABARD Issues – 2nd week of March

Application Form for HUDCO Tax Free Bonds

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in HUDCO tax-free bonds, you can contact me at +919811797407

May pl check up cut off time reliance money trading.

In case cut off time has passed it will be processed as application of second day.

Thanks Mr. Varma for your inputs!

Hi Shiv ji,

I applied on 1st day (2/Mar, 2:45 p.m.) thru RelianceMoney trading account, but today I got full application money refunded along with interest.

Any idea, what could be the reason for Zero allocation, despite of applying on 1st day?

Regards,

CVS

Dear CVS, that is really bad. Sure, Shiv will give you some solution. We sincerely wish the issue gets resolved and you get your due share of allotment.

same position for me also.got full amount back with interest.

Hi CVS,

Reliance Money must have processed your application on the 2nd day of the issue. You should raise your voice and take up this matter to them. Also, as Mr. Varma pointed out, please check with them their Cut-Off time for online bidding.

all bank do credit

i have not received refund of hudco till now.is there any body else who have not received refund??

received few minutes back in icici bank account through neft

you should also receive in next few minutes as now NEFT refund are being credited

just got it.

I got refund credited in accout along with interest of 342

I use icicidirect for application of bond.

Thanks Mr. Varma for this info!

even I got less interest compared to last year for 8.75% NHAI bonds? It seems the interest rate computes as per 8.7261%

interest for 364 days is being paid.God knows why.

I have written a mail to karvy once I hear from them will post here.

Got a reply from Karvy, that last year 15-March-2015 was Sunday hence interest was paid on 16-March-2015 for 366 days.

Hence this year interest is paid for one day less.

I also received less interest.

Last year NHAI interest was credited on 16-Mar-15 and they gave 1 day extra interest. Thats the reason they gave interest for 1 day less. Last year I got 12 rupees extra. This yr I got 12 rupees less. Hope this clarifies doubt.

Even I got less interest compared to last year

i got 87261 as interest payment instead of 87500.(for 875nhai29)what could be the reason?infact i should have received more as this is a leap year.

Check your bank statement for 16-Mar-15. You must have got 87739 instead of 87500 on that day. last year you got 239 more. this yr you got 239 less.

Interest Formula for All tax free Bonds

Say : Paid Rs.100000.00

Allotted : A =Rs40000.00 and Refunded R=:Rs.60000.00

I1= Interest % for application refund = 5%

I2= Interest % for Allotment amount = 7.69% -Hudco 15 Year Retail

(similarly for categories)

d= No. of days including date application and excluding date of allotment

Interest Paid : (RxI1+A x I2) x d/365

d = No.days for which interest between application and a day before allotment.

However, I not able to understand why Karvy Computer calculates lower interest by at least a Rupee in each case.

So remember you are not being paid more.

DCA, I applied 03:05 am and still got 52.1%, I think Shiv has clarified in his earlier messages, all applications of first day are taken as one batch and processed accordingly, irrespective of the time we apply on that day. I agree with you fully, we are the early birds and we deserve better share, may not be 100%, at least 75%. What to do , they decide (lol)

That’s right Mr. Bala! 🙂

I HAVE APPLIED FOR HUDCO TFB ON FIRST DAY (10.02AM AND 10.05AM). WHY IT IS 52.1% ALLOTMENT.AS THERE IS CLAUSE OF “FIRST COME FIRST SERVE” FOR BASIS OF ALLOTMENT.I SHOULD HAVE GOT 100% ALLOTMENT.

All application of each day or treated at par.

First come first allotment is on day basis

So all applicat will be allotted ful if issue is not oversubscribed on first day.

The prorata rule will apply to second applicant

Hope this clarifies.

OPVarma

Yes I too got the amount . Demat not yet.

Please check it now.

Got the HUDCO Refunds credited just now in bank account through RTGS.

Are bonds credited to demat account?

Bonds must have got credited in all the demat accounts by now. Bonds will start trading from today on the BSE.

Recevid refund of HUDCO in ICICI Bank just now (Today, 15-March,8.50 am)

Thanks a lot Mr. Singh for this info, it helped a lot of people here!

ONLY for APPLICATION done through ASBA, unused funds have been released.

All other applicants are wanting.

ASBA is excellent way of applying.

You are first to know.

OPVARMA

Thank you Sir

Mr Verma – Which broker/bank you use for ASBA and how are their services?

I am using ICICIDIRECT

it does not offer ASBA option

But my refund with interest credited.

ASBA facility is offered by Banks only, brokers do not offer ASBA. But, going forward, I think ASBA will become mandatory, like IPOs.

hudco bonds and refund still not credited for application through cheque. Anybody received bonds or refund please update

Appeal to Mr. Shiv & other readers to please share Refunds related information with us as soon as they receive the refunds from HUDCO TAX FREEBONDS TRANCHE-2 in their own Accounts through RTGS.

Hi S.K.,

I might not be available tomorrow for your help, but I am sure others would do the needful as and when they get the refund amount credited in their accounts.

Applied for 1000 Bond & allotted 521. For everybody information please.

Regards

Thanks Shiv for time to time smart info

Thanks Smita for this info as well as your kind words!

Smita, thank you sharing this info. I have also applied for the same qty and expecting the allotment. We all, owe our thanks to Shiv Ji for nicely navigating us through the 4 TFBs with timely inputs, daily status update. As he had rightly mentioned few days ago, the print media reports were inaccurate and I don’t how many people lost the nice opportunity by staying away from these TFBs, on the assumption that the issues were already over subscribed. I also thank all the learned friends here.

Thanks Mr. Bala for being a part of this forum!

Smita – Which broker/bank you use for ASBA and how are their services?

any one who did not apply ASBA but got refund of hudco

Not yet Mr. Varma!

YES ABOUT 1.45PM HUDCO REFUND.

Thanks DCA for this info! Yours was an ASBA or a Non ASBA application?

ASBA

Ok, thanks DCA!

WITH ONLINE SBI A/C ONE CAN PLACE AS MUCH AS FIVE APPLICATIONS( SUBSCRIBER) UNDER ASBA FOR ANY IPO OR TFB ISSUE.

HUDCO refunds have come.

HUDCO refunds have come. I had applied ASBA. 52.1% allotment.

Oh that’s great, thanks a lot Pankaj for this info!