This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

It seems like the hunger for tax-free bonds is just growing unabated and whatever the issue size be it would be gobbled up by the investors on the first day itself. HUDCO will launch its second issue of tax-free bonds from 2nd of March i.e. the coming Wednesday and though the company has fixed March 10 to be the closing date of this issue, I think there is no need to emphasize here on this forum that nobody should expect to get any allotment if the bid is not made on the first day itself.

It will be the ninth such issue of tax-free bonds for the current financial year, but none of the issues has lasted for more than one day to get oversubscribed, except for the NHAI Tranche I in December. Though I think for any issue to last for more than one day the quota for the retail investors has to be more than Rs. 2,000-2,500 crore, this issue has only Rs. 715 crore for the individual investors investing Rs. 10 lakhs or less.

Here are the main features of HUDCO Tax-Free Bonds Tranche II:

Size of the Issue – Out of Rs. 5,000 crore allocated to HUDCO to be raised this financial year, 70% i.e. Rs. 3,500 crore should be raised through public issues. HUDCO raised Rs. 1,711.50 crore through its first public issue in January and it will raise the remaining Rs. 1,788.50 crore in this issue.

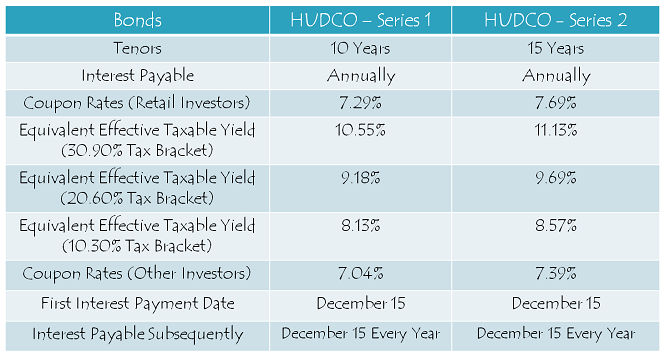

Coupon Rates on Offer – HUDCO issue will carry coupon rates which are absolutely same as offered by NHAI in its issue which got closed yesterday – 7.29% for the 10-year option and 7.69% for the 15-year option. Like the NHAI issue, this issue also will not offer the 20-year option.

For the non-retail investors, coupon rate will be lower by 25 basis points (or 0.25%) for the 10-year option and 30 basis points (or 0.30%) for the 15-year option, as it was the case in the NHAI issue as well.

Rating of the Issue – CARE and India Ratings have assigned ‘AAA’ rating to the issue, indicating that the issue is quite safe to invest and the company is highly likely to pay its debt obligations in a timely manner. Also, these bonds are ‘Secured’ in nature and in case of any default, the bondholders would carry a right to make claim on certain assets of the company.

NRI/QFI Investment Not Allowed – Again, Non-Resident Indians (NRIs) and Qualified Foreign Investors (QFIs) are not eligible to invest in this issue.

Investor Categories & Allocation Ratio – The investors have been classified in the following four categories and each category will have certain percentage of the issue size reserved during the allocation process:

Category I – Qualified Institutional Bidders (QIBs) – 20% of the issue is reserved i.e. Rs. 357.70 crore

Category II – Non-Institutional Investors (NIIs) – 20% of the issue is reserved i.e. Rs. 357.70 crore

Category III – High Net Worth Individuals including HUFs – 20% of the issue is reserved i.e. Rs. 357.70 crore

Category IV – Resident Indian Individuals including HUFs – 40% of the issue is reserved i.e. Rs. 715.40 crore

Allotment on First Come First Served Basis – Subject to the allocation ratio, allotment will be made on a first-come-first-served (FCFS) basis in each of the investor categories, based on the date of upload of each application into the electronic system of the stock exchanges.

Listing & Allotment – HUDCO bonds will get listed only on the Bombay Stock Exchange (BSE). The company will allot the bonds and get them listed within 12 working days from the closing date of the issue.

Demat A/c. Not Mandatory – It is not mandatory to have a demat account to apply for these bonds. Investors have the option to subscribe to these bonds in physical form as well. Whether you apply for these bonds in demat or physical form, the interest payment will still be credited to your bank account through ECS.

Also, even if you get these bonds allotted in an electronic form, you have the option to rematerialize your holding in physical/certificate form if you decide to close your demat account in future.

No Lock-In Period – These tax-free bonds are freely tradable and do not carry any lock-in period. The investors may sell them at the market price whenever they want after these bonds get listed on the stock exchanges within 12 working days of the closing date.

Interest on Application Money & Refund – Successful allottees will earn interest at the applicable coupon rates on their application money, from the date of realization of application money up to one day prior to the deemed date of allotment. Unsuccessful allottees will get interest @ 5% per annum on their refund money.

Minimum & Maximum Investment – Investors are required to put in a minimum investment of Rs. 5,000 in this issue i.e. at least 5 bonds of face value Rs. 1,000 each. There is no upper limit for the investors to invest in this issue. However, an investor investing more than Rs. 10 lakhs will be categorized as a high networth individual (HNI) and will get a lower rate of interest as applicable.

Interest Payment Date – HUDCO will make its first interest payment on December 15 this year and subsequent interest payments will also be made on December 15 every year, except the last interest payment, which will be made to the bondholders along with the redemption amount on the maturity date.

Record Date – For the payment of interest or the maturity amount, record date will be fixed 15 days prior to the date on which such amount is due to be payable.

Should you invest in this issue?

Budget 2016 will be presented in the parliament on February 29 and we will get to know whether we will have these tax-free bonds available or not for the next financial year. In case the finance minister Mr. Arun Jaitley decides against extending this facility to these public sector units, then I think there will be a rise in the demand for the already listed tax-free bonds and hence, we can expect a rise in their market value as well.

Also, a higher fiscal deficit number will result in an increase in bond yields, which in turn will result in a higher coupon rates for the IRFC and NABARD issues. So, in case there is a jump in bond yields, then you should wait for the these two issues to decide on your final investments. I’ll update this post on March 1 after the climax of Budget 2016 gets revealed.

Expected Launch Date of IRFC and NABARD Issues – 2nd week of March

Application Form for HUDCO Tax Free Bonds

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in HUDCO tax-free bonds, you can contact me at +919811797407

Can Mr. Shiv or the other readers of this extremely helpful Blog please update us, who are quite anxious, through this forum, as soon as they receive the refunds from HUDCO Bonds application money?

Will do that S.K. as and when I have any info.

any update on Hudco refund

No news on HUDCO refunds/allotment as of now Mukesh!

I HAVE APPLIED FOR HUDCO,NABARD AND IRFC TAX FREE BONDS AT 10.OOAM TO 10.30 AM ON EACH BONDS OPENING DATE.WILL I GET FULL QUANTITY OR PROPORTIONATE.

Hi DCA,

You will get 100% allotment in the NABARD and IRFC issues, but only around 52% allotment in the HUDCO issue.

THANKS.SAME AS YOU HAVE SAID 52% IN HUDCO.HOPE WILL GET 100% IN NABARD AND IRFC.

That’s great DCA!

When is HUDCO II refund expected? Will it happen atleast on 14th so that there’s chance to apply for IRFC?

Hi Chaitanya,

I am expecting HUDCO refunds to get credited by Monday. Let’s see whether it happens on Monday or gets delayed further.

Mr. Shiv, any further news on the refunds from HUDCO? Do you think we can get refunds by Monday morning? How much amount will we get back if 10L were applied for?

Do you think there are any chances of us deploying the refunds for NABARD & IRFC (Tranche 2) before closing?

Hi S.K.,

I think HUDCO refunds should come either on Monday or Tuesday. If it comes on Monday, it could be used in either of IRFC issue or NABARD issue. But, if comes on Tuesday, only NABARD would be available.

Dear Mr. Shiv,

Thank you. Can I go ahead & issue cheques against both applications, since manual cheques will take couple of days for clearing? What will happen to our applications if cheques bounce if the refunds do not arrive in time?

Hi S.K.,

Yes, offline applications will give you an additional couple of days for arranging funds. You can stretch it to a maximum of Wednesday morning by when you should have funds in your bank account.

Dear Mr. Shiv,

What will happen to both our applications if cheques bounce in case the refunds do not arrive in time? Will it adversely affect or lead to cancellation of our earlier online application submitted through ICICI Direct on Day#1?

Mr. Shiv,

Could you please respond and oblige?

Thank you.

Hi S.K.,

In case of cheque bounce, your offline applications will get rejected, but it will not affect your online applications submitted on Day 1.

Mr. Shiv, Even upto yesterday i.e. Wednesday, both IRFC & NABARD offline application cheques were still not presented through clearing & hence my bank accounts have still not been debited so far. Hope that does not mean that both my offline, 2nd Applications were rejected by their systems.

No S.K., if your broker has successfully placed bid for your application and the application has been accepted by the bank, then clearance of cheque is not a problem. It will get cleared sooner or later and bonds will be allotted to you.

Hi Shiv, I understand from Karvy that NABARD is also closing on March 14 (as per the date given on the application form). How do you say that it would remain open on Tuesday?

Thanks a lot Janaki for pointing it out! You are right, the closing date is March 14th only. There is a big confusion here. The product note I received while writing the NABARD post had March 16 as the closing date, but it is March 14 on the form and the prospectus as well. So, it is closing on March 14. I’ll just make the necessary changes on the NABARD post. Thanks again for this info!

Thank you Shiv. I think since both NABARD and IRFC came up in the same week even before the refunds from HUDCO came in, these remain under subscribed till date. I only wish if NABARD gets extended even by couple of days, HUDCO refunds would be in and we can subscribe for the same. Do you suggest we take chances by submitting offline applications tomorrow for the calculated refund amount from HUDCO (about 45%) for NABARD / IRFC assuming that the refunded amount will be available in our bank account on Wednesday morning?

Yes Janaki, I think one should do that, it is worth taking such a chance. I am making many of my clients do that.

Good idea Janaki & Shiv!!

Thanks Chaitanya!

NHAI refund/allotment process has started, please check your bank accounts for ASBA applications.

Can some one tell me what is the procedure to get NABARD tax free bonds in physical form? I don’t have a demat account.

you have to file physcial application

Can you tell me the procedure? Where can I get the application and where should I submit?

down load from registrar to issue

Hi Muthu,

Just download the application form from the link pasted above in the post itself, duly fill it and mail me the scanned copy on my email id skukreja@investitude.co.in

that is the only reason why I have invested in nhai irfc & nhb because this all are AAA by all three credit agencies icra care & crisil &also they lists on nse as well as bse and are large issue of above 2000 to 10000 of bonds which makes us to buy and sell easier am I correct shiv

Rated ‘AAA’ by all the rating agencies and listed on both the stock exchanges is a minor positive for these bonds.

I agree with Shiv. IRFC raises money exclusively for the Indian Railways and there is no chance of Railways defaulting on its loans. NABARD provides credit support for rural development and prosperity and there is a possibility of a default on the loans it gives. Otherwise, it is a well managed bank which is almost 100% owned by the Govt.

how many times retail investor portion oversubscribed

Retail portion got oversubscribed by 1.96 times Mr. Varma.

I have applied for 150 bonds in Hudco on first day.

What are chances of full allotment?

Hi Mr. Varma,

You can expect around 52% allotment.

thanks

I also have the same doubt. Why you consider IRFC better than NABARD.??

Awaiting for your reply,

Hi PS,

I consider IRFC issue to be better than the NABARD issue as I think Railway Ministry is working very professionally these days under the supervision of Mr. Suresh Prabhu. NABARD is related to the agricultural sector and rural development and we all know how these government companies like NABARD are made to subsidize and/or forego their lending book in the name of working for poor/economically weaker sections (for politics). So, my first preference would be IRFC over NABARD.

Thanks Shiv for that. But then why it has been given AAA rating. Aren’t the rating agencies professional.

NABARD has been assigned ‘AAA’ rating as there is a strong government backing and low NPAs.

Thanks for your reply and guidance.

will invest in IRFC.

My main important factor is to protect my principal amount.

once again thank you.

You are welcome PS!

Hi,

I need to correct my earlier post about capital gains. I have since learnt that in the case of TFBs, the holding period to qualify for long term capital gain is 1 year and long term capital gains are taxed at 10% plus the surcharges etc and that indexation is not not allowed.

That’s correct Vin!

In today’s Economic Times, there is a mention that for the IRFC and NABARD issues, 60 % of the bonds will be reserved for retail investors. If that happens, keeping the size of the issues, as indicated by Shiv, in view, retail investors may get good allotment.

There was an earlier post about long term capital gains in the period of holding was mentioned as 2 years. I think it is 3 years like in the case of debt funds, and the rate of taxation is 10% without indexation and 20% with indexation. Am I right?

I will also like to share my thoughts about buying TFBs in secondary market. Buying bonds in secondary market does not make much sense. I recently bought NHAI 10 year bonds issued in 2012 with 8.20 as rate of interest at average cost of 1085. (It closed at 1090 on 4 March.) After 6 years, on maturity I will get back only Rs 1000 resulting in a yield of about 7%. The lesson I have learnt is that the best option is to buy TFBs in public issue and the best duration is 15 years because 15 year bonds are more easily tradable, if one needs to sell them.

Your ?90 premium takes care of accrued interest from the last interest payment date.

Additionally if you were to buy the bonds at today rate, you would get say 7.64 whereas on these bonds you get 8.20. This difference is also priced in to the premium. Alternatively if you were to buy a irfc 7.04, after accounting for accrued interest, you would be buying it at a discount

Thanks Nn for your kind comments. I do realise that about Rs 34 of the Rs 90 premium is the accrued interest and the real premium is about 55 rupees. Even if one takes into account the current interest of TFBs of 10 year duration ie 7.29 against 8.20, don’t you think it makes better sense to apply for bonds in the public issues. Once the public issues are not available, one may buy in secondary market…

Buying in secondary involves a 1% cost.

8.20-7.29 = 0.91..so over the lifetime of the bond you get Rs 0.91 extra per year. Assuming the bonds are maturing in 2022 (and your interest calculations are correct cos it seems to be a huge premium)..you are likely to get Rs 6-7 more but you have paid Rs 55 more. So the bonds would seem to be overpriced in the secondary.

The reason may be that to move a huge amount of bonds, the institutions price it at close to the maximum interest rate allowed (linked to the gsec of a similiar maturity) so ideally a buyer would buy in the primary rather than pay a high premium.

The bonds are sold in the marked on a concept of YTM leading to a discount/premium and you seem to have paid a high price than neccessary. There are cases where the bonds are sold cheaper due to distress sales. For secondary buying..you need to set your price and wait rather than buying at seller price.

Thanks nn for your analysis. I now realise my mistake in paying such a huge premium. I now know that it is almost certain that one will get 100 allotment in NABARD as well as IRFC. Had I known this earlier, I would have waited for these issues.

You have also provided a very valuable tip which should be kept in mind when buying Bonds in secondary market ; don’t buy at the seller’s price but at your price.

dear vin and nn

difference of 0.91% will amount to rs.9.1 and not rs. 0.91 as bond is of 1000 and not rs.100.

so dear vin you got the bonds at a fair price

Thank you very much, drpuneet for your valuable input. The fact that the current price of these NHAI bonds is 1089/1090, and I bought them at 1085 which included 3 as brokerage, I paid fair price for these bonds.

Actually with a fair price, you get a additional benefit.

The premium you pay will be returned in the form of “tax free” income. But on the cost of 1090, the refund of capital will be only 1000. So you have a long term capital loss.

thanks. normally used to working with percentages..so messed up.

need to be careful : > )

Thanks, nn for providing another valuable input. On debt funds, long time cap gain is taxable at 20%. Long term loss from sale of these bonds will save me 20%.

Dear All, if I sell these bonds (e.g., NHAI) in the middle of a year, will I be paid interest?

No Malcom, you will not get the interest paid.

Interesting. So, need to sell it after the interest is paid, assuming the bond price is at a premium at that point.

Hi Malcom,

On the “Ex-Interest Date”, the market value of the bond will fall by the interest amount paid.

NABARD Tax-Free Bonds Issue Update:

Issue opens – 9th March, 2016, Issue closes – 16th March, 2016, Issue Size – Rs. 3,500 crore

Interest Rates for Retail Individual Investors investing upto Rs. 10 lacs:

10 years – 7.29% p.a.

15 years – 7.64% p.a.

Thanks for the confirmation Shiv.

Between Nabard and IRFC if you had to invest only in one which one would it be?

I would prefer IRFC over NABARD, but you might not get full allotment with IRFC.

Thanks Shiv and any specific reason for preferring IRFC?

I also have the same doubt. Why you consider IRFC better than NABARD. Any way , from a diversification perspective, I would consider investing some amount in NABARD considering that I have some investment in IRFC. Thinking of skipping IRFC.

I have also the same question

I have similar thoughts. Am thinking to invest in Nabard only (from diversification perspective).

Shiv – Do we know if IRFC wld provide TFBs for 20 yr period?

Hi Bobby,

IRFC issue does not carry the 20-year option.

IRFC opens on 10th march 2016

http://moneydial.com/tax-free-bonds-from-irfc-of-worth-rs-500-crore/

Thanks Pradeep!

Nabard will open on 9th only. NABARD and IRFC will have 60% of the issue for retail investors.

Thanks George for the info!

Dear Sir,

Waiting for tax free bonds details of NABARD and IRFC , as early as possible.

Thank you for everything. .

http://moneydial.com/tax-free-bonds-from-irfc-of-worth-rs-500-crore/

Hi PS,

I’ll share the IRFC issue post by today evening. Here you have the NABARD issue link – http://www.onemint.com/2016/03/06/nabard-7-64-tax-free-bonds-march-2016-issue/

http://moneydial.com/tax-free-bonds-from-irfc-of-worth-rs-500-crore/

http://moneydial.com/tax-free-bonds-from-nabard-of-worth-rs-3500-crore/

Thanks George. And this should be the last in this FY?

Thanks for sharing!

I noticed now that on this website along with NABARD there is information for IRFC tax free bonds.

http://moneydial.com/tax-free-bonds-from-nabard-of-worth-rs-3500-crore/

http://moneydial.com/tax-free-bonds-from-irfc-of-worth-rs-500-crore/

I was hoping that NABARD would open after HUDCO returns the money. But now that it is opening on Mar 8 and funds are locked up with HUDCO, it will not be possible for investors like me to apply for NABARD. NHAI and HUDCO have got oversubscribed on day 1. I assume the same with NABARD also. The last option could be IRFC now to reinvest the funds that are returned by HUDCO.

Investors should try getting overdraft facility against their existing investments in tax-free bonds or fixed deposits for a few days.