This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

2016 so far has seen a good amount of volatility in all the major financial markets in the world. The main cause of this volatility has been China. After having many years of high GDP growth, Chinese economy is taking a breather. How long this slowdown would last, it is something which only God can answer. In these uncertain times, risk averse investors want safety of their hard earned money and tax efficiency of their investments. Tax Free Bonds fulfil both of these requirements.

To satisfy our hunger for tax-free bonds, IRFC will join the company of NABARD from Thursday, March 10th. The issue will remain open for just 3 days to get closed on March 14. This is the shortest period of time a company has decided to keep its issue open even before it actually opens. It seems the merchant bankers are confident enough to get the required subscription numbers within a day or two, and we all know that they are right in their calculations.

Here are the salient features of IRFC Tranche II of Tax Free Bonds:

Size of the Issue – Indian Railways has been spending a huge amount on expanding its network and upgrading its existing infrastructure. IRFC is one of the sources through which Indian Railways gets its required funds for such high expenditure. IRFC has already raised Rs. 7,050 crore in the current financial year by issuing these tax-free bonds. To partly meet its funds requirements, IRFC will raise another Rs. 2,450 crore in this issue.

Rating of the Issue – CRISIL, ICRA and CARE have assigned ‘AAA’ rating to this issue and consider it to be the safest from timely payment of its debt obligations, including interest and principal investment. Moreover, these bonds are ‘Secured’ in nature and certain fixed assets of the company will be charged equivalent to the outstanding amount of the bonds.

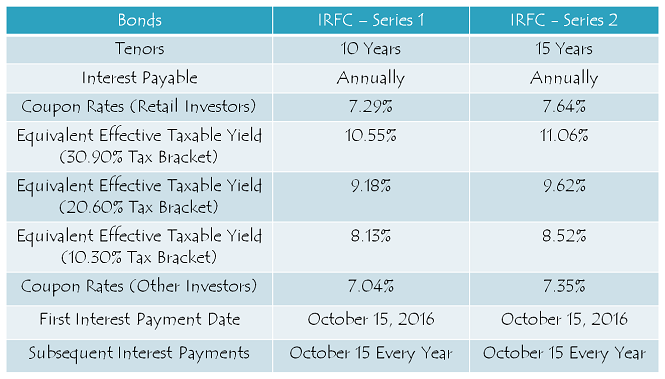

Coupon Rates on Offer – IRFC is offering yearly interest rate of 7.29% for its 10-year option and 7.64% for the 15-year option to the retail investors investing less than or equal to Rs. 10 lakh. These rates exactly match the rates offered by NABARD in its issue which is getting launched today.

For the non-retail investors, coupon rates will be lower by 25 basis points (or 0.25%) for the 10-year option at 7.04% and 29 basis points (or 0.29%) for the 15-year option at 7.35%.

NRI/FPI/QFI Investment Allowed – This issue will try to quench the thirst of some Non-Resident Indians (NRIs), Foreign Portfolio Investors (FPIs) and Qualified Foreign Investors (QFIs) as they have been allowed to invest in this issue either on a repatriation basis or a non-repatriation basis.

Investor Categories & Allocation Ratio – As compared to the earlier issues, this issue has a higher percentage allocation of 60% for the retail investors and as compared to the NABARD issue, a slightly higher percentage allocation of 15% for the high networth investors.

As always, the investors have been classified in the following four categories and each category will have certain percentage of the issue size reserved during the allocation process:

Category I – Qualified Institutional Bidders (QIBs) – 10% of the issue is reserved i.e. Rs. 245 crore

Category II – Non-Institutional Investors (NIIs) – 15% of the issue is reserved i.e. Rs. 367.50 crore

Category III – High Net Worth Individuals including HUFs – 15% of the issue is reserved i.e. Rs. 367.50 crore

Category IV – Resident Indian Individuals including HUFs – 60% of the issue is reserved i.e. Rs. 1,470 crore

Allotment on First Come First Served Basis – Subject to the allocation ratio, allotment will be made on a first come first served (FCFS) basis in each of the investor categories, based on the date of upload of each application into the electronic system of the stock exchanges.

Listing & Allotment – IRFC has decided to get these bonds listed on both the stock exchanges i.e. on the National Stock Exchange (NSE) as well as on the Bombay Stock Exchange (BSE). The bonds will get allotted and listed within 12 working days from the closing date of the issue.

Demat Account Not Mandatory – It is not mandatory to have a demat account to apply for these bonds. Investors have the option to subscribe to these bonds in physical form also. Whether you apply for these bonds in demat or physical form, the interest payment will still get credited to your bank account through ECS.

Also, even if you get these bonds allotted in an electronic form and sometime in future you decide to close your demat account, you will have the option to get them rematerialized in physical/certificate form.

No Lock-In Period – These tax-free bonds are freely tradable and do not carry any lock-in period. The investors may sell them at the market price whenever they want after these bonds get listed on the NSE and BSE.

Interest on Application Money & Refund – Successful allottees will earn interest at the applicable coupon rates on their application money, from the date of realization of application money up to one day prior to the deemed date of allotment. Unsuccessful allottees will get interest @ 5% per annum on their refund money.

Minimum & Maximum Investment – Investors are required to put in a minimum investment of Rs. 5,000 in this issue i.e. at least 5 bonds of face value Rs. 1,000 each. There is no upper limit for the investors to invest in this issue. However, an investor investing more than Rs. 10 lakhs will be categorized as a high networth individual (HNI) and will get a lower rate of interest as applicable.

Interest Payment Date – IRFC will make its first interest payment on October 15 this year. Subsequent interest payments will also be made on October 15 every year.

Should you invest in this issue?

For a large number of retail investors, tax-free bonds have remained their favourite investment option for all these years since they first got allowed to be issued in 2011-12. As the finance ministry has decided to end this channel of fund raising for all these big and reliable government companies in the infrastructure financing or development space, we all have been very disappointed.

But, there is nothing we can do about it. The only thing we can do is to utilise these last couple of opportunities to subscribe to these bonds and just hope for the government to reintroduce these bonds again in the next year’s budget. Till then, risk-averse investors should subscribe to these bonds and other investors should invest their money in good mutual funds for infrastructure development to gather pace through a different funding channel.

Application Form for IRFC & NABARD Tax Free Bonds – Resident Indians and NRIs

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in IRFC or NABARD tax-free bonds, you can contact/whatsapp me at +919811797407 or mail me at skukreja@investitude.co.in

Subscribing to comments

Shiv, Thnks for all the prompt responses to such a variety of queries …

In the last 2 0r 3 TFB series some comments are targeted w.r.t “A.I.R reporting”.

what is that? and does one have to file any return on the same …

also what is the bank’s role in AIR?

can u make a detailed post later sometime in april (since it is March, u must be a hell lot busier) to elaborate the same

Thanks again…

AIR

Annual Information Return (AIR) of ‘high value financial transactions’ is required to be furnished under section 285BA of the Income-tax Act, 1961 by ‘specified persons’ in respect of ‘specified transactions’ registered or recorded by them during the financial year. The due date of filing of the return is the 31st of August of the following year. The ‘specified persons’ and the ‘specified transactions’ are listed in Rule 114E of the Income-tax Rules, 1962.

you can run ..but you cannot hide. AIR includes Interest on Fixed Deposits, Credit Card transactions etc, Dividends paid by mutual funds etc.

The IT then correlates this with your returns using PAN #. If a person has declared a Rs 10 lakh income and investing 2-3 lakhs, the person should be worried. Even if AIR for investment reporting does not catch the transaction this year, maybe interest receipts/cumulative interest receipts eventually will. And if your reported income is commensurate with the investment, 99.9% questions will not be asked.

Pay the devil his due and you know what belongs to you.

” And if your reported income is commensurate with the investment, 99.9% questions will not be asked.”

Absolutely spot on !!!

Since everyone is commenting on AIR reports on the previous TFB’s that I had not heard of before, I wanted some detailed info which Shirish help to certain extent,

however a complete post (by Shiv) on the variety of investments with examples as per current rules and regulations would be welcome and would paint a proper picture since many of us may not be from a finance background…

See this link for more info:

http://articles.economictimes.indiatimes.com/2011-05-04/news/29509250_1_fund-tax-payers-high-value-transactions

Shirish, this is a year 2011 article & possibly invalid. Perhaps a competant person like Mr. Shiv, could explain in detail in an easy to understand manner about AIR, its impact on Taxpayers & its resolution in filing ITRs.

Hi Aashish,

AIR reporting is something I’m not interested to cover as I think nobody who is clean should be afraid of it. I don’t even want to discuss it on any of my forums here. But, still if you want, I’ll do a post on the same in the first fortnight of April.

+1

Spot on!

Yes, Dear Shiv, all your readers will be extremely grateful for this write-up/article on INCOME TAX & AIR. Will be grateful if you can also post other helpful articles on Income Tax, on Filing of Returns, since many of us file our iwn returns online and at times we are not sure if we are doing it right.

Sure S.K., I’ll try to cover all that in the next quarter.

Believe, multiple applications are rejected based on scrutiny thru PAN.

This is not true. Multiple applications are accepted for same PAN. There is no restriction that there should be only one application per PAN

Thanks Ramadas!

I mean, one can not make multiple applications under retail quota(exceeding 10 Lacs) PAN provides such tracking.

I applied in icicidirect today. Can i apply again using the kotak netbanking ASBA facility by proving details of Icici demat account. Will it be rejected citing duplicate appln?

Another question is can i apply using multiple DPs ie., one appln using icicidirect NSDL and another Angel broking CSDL on the second day

Yes Kumar, you can do so.

Hi Shiv

Thanks. Application for TFBs above what amount gets reported in AIRs?

Hi Kumar,

It is Rs. 5 lakhs for bonds/debentures/NCDs.

is it per Issue or total .

If i have purchased more than 15 lakh TFB this year then whether is it reported provided total allotment is 2 lakh per TFB issue

I want to know this as well.

I wished I knew about the 5L limit. I should have applied for 499 bonds instead of 500 bonds :-(. I made several TFB applications this year most of which would be reported in AIR :-(. I feel having too many AIR transactions can lead to scrutiny.

Just for clarification: I am not hiding anything. I even report 100 Rs interest if I got it in some savings account.

I got scrutiny few years back. I spent *so* many weekends annotating my bank statements, preparing CG sheets, computation of income statement … – such a colossal waste of my time. I am not afraid of scrutiny. Just the paperwork involved in it in replying to it. IT dept is lazy. They make us do all the work. I don’t remember where I read but most of the scrutiny cases for middle class folks hardly recovers much tax for IT dept.

Any new Tax free bonds coming out in March

Hi Kumar,

After NABARD and IRFC issues, no new tax-free bond issues will be there during the current financial year as well as next financial year.

Thanks Shiv.

I am a retail investor. If I purchase this bonds from retail investor through secondary market, should I get interest of retail category viz.7.64% ?

Yes Shishir, you will get the same rate of interest of 7.64%. There is no “Step-Down Interest” clause now with these bonds.

Dear Mr. Shiv,

By indicating in your above comment: ‘no step-down clause in these Bonds’, do you mean that retail investors can buy more than 10L worth of thus particular issue of IRFC Tranche-2 TFBs & still get the higher rate of 7.69%?

Please clarify.

No S.K., I did not mean that. With Step Down clause, even a retail investor buying from a retail investor would get a lower rate of interest. This clause was put in place some time back to encourage retail investors to hold on to their bonds and discourage trading in these bonds.

Mr. Shiv, can you please share the names of such issues & the year in which this strange rule was enforced. That means unsuspecting Investors who purchase such Bonds will be at a considerable loss since they will get less than the displayed Coupon Rate. Are their market prices lower & yields higher than others in comparison?

Shiv – Is there a way I cld subscribe to comments (email updates) without putting a comment?

No Bobby, there is no way it can be done in the existing system. We introduced DISQUS a few years ago, but it was more troublesome to use it.

Thank you Shiv for the regular updates in TFB…Helped me a lot as a new comer…Sorry I could not catch up with you earlier….I missed a lot…But better late than never!!!

Thanks once again..Keep the good work.

Thanks a lot Dr. Paulose for your encouraging words! 🙂

If Qualified Institutional Bidders (QIBs) oversubscribe their portion to such an extent, what is the sole purpose of investment if one gets allocation in tune of mere 4.6% in PFC OCT15 and now 6.14% in IRFC MAR16? It baffles me that they ready to lock their funds of around 95% only to get them back !!!

Hi Aashish,

QIBs need to invest their money in good quality instruments. These bond issues are one of them. So, probably they don’t mind blocking money for a short duration.

Hi Shiv, Since it is 0.72 subscription in Retail category, can those of us who applied in Day 1 get Full allotment. Kindly clarify

Hi Kumar,

Yes, Day 1 applicants will get full allotment.

Hi Shiv, I missed applying for these bonds on day 1. How much allotment can I expect if I apply on day 2? I am trying to compare the cost of “AIR reporting” vs allotment. If I am going to to apply for 5L and only get 50K worth of bonds, then maybe the AIR report is not worth it. It might lead to a scrutiny :-(. I have applied to several bonds this year.

Hi Vikas,

I think Day 2 applicants will also get 100% allotment.

Thank you so much.

You are welcome Mr. Bala!

Day 1 (March 10) subscription figures:

Category I – Rs. 3,992 crore as against Rs. 245 crore reserved – 16.29 times

Category II – Rs. 3,129.40 crore as against Rs. 367.50 crore reserved – 8.52 times

Category III – Rs. 1,271.80 crore as against Rs. 367.50 crore reserved – 3.46 times

Category IV – Rs. 1,059.28 crore as against Rs. 1,470 crore reserved – 0.72 times

Total Subscription – Rs. 9,452.48 crore as against total issue size of Rs. 2,450 crore – 3.86 times

Shiv, … any guesstimate you can make of getting higher / better allocation in Retail Categ Application to be made on March-11 … between IRFC (on 2nd Day) and NABARD (on 3rd day) for same amount of application say Rs 1 Lac ??

Thanks a lot Shiv for this information as well as all advises so far..!

You are welcome Vasu!

Hi KS,

I think you will get 100% allocation in both the issues, with a better chance with the NABARD issue.

final subscription figures please

Dear Sir,

How much HNIs can expect from this IRFC bond?

Firoz

Hi Firoz,

It will be around 21-22% allotment for Category III investors.

No sir,

As per my calculation allotment should be around 28 to 29 %.Because it is oversubscribed by 3.46 times.It means 100/3.46=28.90.Per 1 lakh application one should get 28,000/-.Waiting for ur clarification…

Thanks

Firoz

Sorry Firoz, you are right! I think I did some goof up in calculation.

Thanks sir…?

final figures please

why not regional rural bank have not applied for IRFC TFB till 4.00 P.M

Sir does it mean that they will buy from market after listing or they are not interested ?

please resolve query

That only regional rural banks would be able to tell.

starting was not so good but the end will be splendid looking the pace of subscription status isn’t correct shiv

IRFC retail category subscription should end the day between Rs. 1,000 to Rs. 1,050 crore.

The mystery behind the two numbers of issue size 500 crores & 2450 crores is

“Rs 50,000 lakhs with an option to retain oversubscription upto Rs 1,95,000 lakhs aggregating upto Rs 2,45,000 lakhs”

So till the day retail subscription reaches 1470 crores (60% of 2450), one can expect full allotment. So far it has reached 669 crores at 3:15 pm.

You are checking only BSE subscription numbers Shirish, you need to add NSE subscription numbers as well to it. It has crossed Rs. 950 crore in the retail category.

How come IRFC has got much more subscription as compared to NABARD ?

Is it due to IRFC going to be listed on NSE as well or is there some other reason for this difference ?

IRFC subscription figures are based on the base issue size of Rs. 500 crore. One should not misjudge the actual subscription.