This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

2016 so far has seen a good amount of volatility in all the major financial markets in the world. The main cause of this volatility has been China. After having many years of high GDP growth, Chinese economy is taking a breather. How long this slowdown would last, it is something which only God can answer. In these uncertain times, risk averse investors want safety of their hard earned money and tax efficiency of their investments. Tax Free Bonds fulfil both of these requirements.

To satisfy our hunger for tax-free bonds, IRFC will join the company of NABARD from Thursday, March 10th. The issue will remain open for just 3 days to get closed on March 14. This is the shortest period of time a company has decided to keep its issue open even before it actually opens. It seems the merchant bankers are confident enough to get the required subscription numbers within a day or two, and we all know that they are right in their calculations.

Here are the salient features of IRFC Tranche II of Tax Free Bonds:

Size of the Issue – Indian Railways has been spending a huge amount on expanding its network and upgrading its existing infrastructure. IRFC is one of the sources through which Indian Railways gets its required funds for such high expenditure. IRFC has already raised Rs. 7,050 crore in the current financial year by issuing these tax-free bonds. To partly meet its funds requirements, IRFC will raise another Rs. 2,450 crore in this issue.

Rating of the Issue – CRISIL, ICRA and CARE have assigned ‘AAA’ rating to this issue and consider it to be the safest from timely payment of its debt obligations, including interest and principal investment. Moreover, these bonds are ‘Secured’ in nature and certain fixed assets of the company will be charged equivalent to the outstanding amount of the bonds.

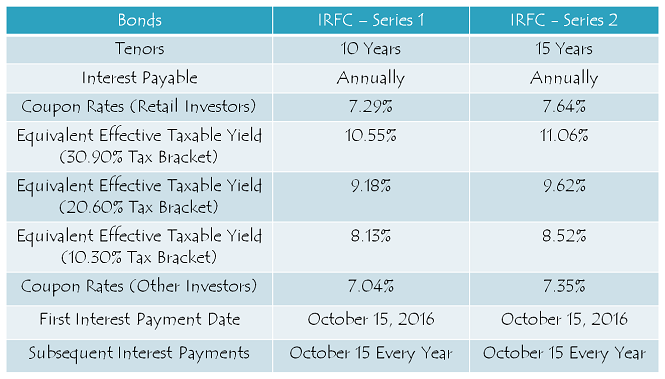

Coupon Rates on Offer – IRFC is offering yearly interest rate of 7.29% for its 10-year option and 7.64% for the 15-year option to the retail investors investing less than or equal to Rs. 10 lakh. These rates exactly match the rates offered by NABARD in its issue which is getting launched today.

For the non-retail investors, coupon rates will be lower by 25 basis points (or 0.25%) for the 10-year option at 7.04% and 29 basis points (or 0.29%) for the 15-year option at 7.35%.

NRI/FPI/QFI Investment Allowed – This issue will try to quench the thirst of some Non-Resident Indians (NRIs), Foreign Portfolio Investors (FPIs) and Qualified Foreign Investors (QFIs) as they have been allowed to invest in this issue either on a repatriation basis or a non-repatriation basis.

Investor Categories & Allocation Ratio – As compared to the earlier issues, this issue has a higher percentage allocation of 60% for the retail investors and as compared to the NABARD issue, a slightly higher percentage allocation of 15% for the high networth investors.

As always, the investors have been classified in the following four categories and each category will have certain percentage of the issue size reserved during the allocation process:

Category I – Qualified Institutional Bidders (QIBs) – 10% of the issue is reserved i.e. Rs. 245 crore

Category II – Non-Institutional Investors (NIIs) – 15% of the issue is reserved i.e. Rs. 367.50 crore

Category III – High Net Worth Individuals including HUFs – 15% of the issue is reserved i.e. Rs. 367.50 crore

Category IV – Resident Indian Individuals including HUFs – 60% of the issue is reserved i.e. Rs. 1,470 crore

Allotment on First Come First Served Basis – Subject to the allocation ratio, allotment will be made on a first come first served (FCFS) basis in each of the investor categories, based on the date of upload of each application into the electronic system of the stock exchanges.

Listing & Allotment – IRFC has decided to get these bonds listed on both the stock exchanges i.e. on the National Stock Exchange (NSE) as well as on the Bombay Stock Exchange (BSE). The bonds will get allotted and listed within 12 working days from the closing date of the issue.

Demat Account Not Mandatory – It is not mandatory to have a demat account to apply for these bonds. Investors have the option to subscribe to these bonds in physical form also. Whether you apply for these bonds in demat or physical form, the interest payment will still get credited to your bank account through ECS.

Also, even if you get these bonds allotted in an electronic form and sometime in future you decide to close your demat account, you will have the option to get them rematerialized in physical/certificate form.

No Lock-In Period – These tax-free bonds are freely tradable and do not carry any lock-in period. The investors may sell them at the market price whenever they want after these bonds get listed on the NSE and BSE.

Interest on Application Money & Refund – Successful allottees will earn interest at the applicable coupon rates on their application money, from the date of realization of application money up to one day prior to the deemed date of allotment. Unsuccessful allottees will get interest @ 5% per annum on their refund money.

Minimum & Maximum Investment – Investors are required to put in a minimum investment of Rs. 5,000 in this issue i.e. at least 5 bonds of face value Rs. 1,000 each. There is no upper limit for the investors to invest in this issue. However, an investor investing more than Rs. 10 lakhs will be categorized as a high networth individual (HNI) and will get a lower rate of interest as applicable.

Interest Payment Date – IRFC will make its first interest payment on October 15 this year. Subsequent interest payments will also be made on October 15 every year.

Should you invest in this issue?

For a large number of retail investors, tax-free bonds have remained their favourite investment option for all these years since they first got allowed to be issued in 2011-12. As the finance ministry has decided to end this channel of fund raising for all these big and reliable government companies in the infrastructure financing or development space, we all have been very disappointed.

But, there is nothing we can do about it. The only thing we can do is to utilise these last couple of opportunities to subscribe to these bonds and just hope for the government to reintroduce these bonds again in the next year’s budget. Till then, risk-averse investors should subscribe to these bonds and other investors should invest their money in good mutual funds for infrastructure development to gather pace through a different funding channel.

Application Form for IRFC & NABARD Tax Free Bonds – Resident Indians and NRIs

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in IRFC or NABARD tax-free bonds, you can contact/whatsapp me at +919811797407 or mail me at skukreja@investitude.co.in

Can Mr. Shiv or the other readers of this extremely helpful Blog please update us, who are quite anxious, through this forum, as soon as they receive the refunds from HUDCO Bonds application money?

very well said shiv people blame that they did not get reasonable allotments in all previous issues and know the retail categories have been extended then definitely we must us al these facilities and at ahigher tate of interest then all other categories

Thanks Nitesh, yes, that’s right!

I am writing for the first time to you. Thanks for all your timely updates.

Do you think that IRFC date will be extended by a day or two. I have small amout left with me which I can invest today. In case HUDCO will refund by tomorrow then I will like to wait and then invest. I will be applying by ICICI direct.

Thanks JP!

It is very difficult to take a call whether IRFC or NABARD will get extended or not. Earlier they were delaying these issues unnecessarily and now they are closing it within 3-4 days of issue opening dates. I think it is best to invest via a physical application today rather than waiting for these issues to get extended. Cheque for a physical application will get presented on Wednesday and by that time your HUDCO refund would be there in your bank account.

Please if you can updated the % subription of retain category by 15:00 hours so that some of us can take a decision whether to apply today or wait for the probability of some extensions for IRFC and Nabard.

Hi JP,

I think you should get the bidding done for your application. Even if its gets extended or not, you’ll have a reasonable time to get the HUDCO refunds credited. If it gets extended, then you’ll have additional time to submit your application. In case you require any help, please drop a mail to me on skukreja@investitude.co.in or message me on this no. +91-9811797407

I am to apply by ICICI DIRECT which allows only one application. So I apply either today and loosed the chance to apply for higher amount at later date (in case there is extension by IRFC). If there is no extension then I loose the chance to apply on smaller amount that I possess today. Can you clarify….

Thanks for all your updates.

Hopefully we will be active on this blog for taxfree bonds in 2017-18!!!!!

You are welcome Mr. Maheshwari! I wish the government allows these companies in Budget 2017 to issue tax-free bonds in FY 2017-18!

Shiv,

Seems most-likely they wont be tax-free, even if bonds are allowed, so really look forward to your regular posts in some other topics on this blog… you made this lively.

Thanks for your help in bidding my application today.. glad we were able to connect offline also that way and for the last TFB of the year 🙂

My pleasure Chaitanya to serve you offline as well !! Whether the government allows tax-free bonds or taxable bonds, I hope they are good for the investors as well as for the country! I’ll definitely try to keep the current momentum going by posting other interesting articles!

I’ll also update the retail subscription numbers by 3 p.m.

Dear Shivji,

Thank you for your guidance. I am awaiting issue size for retail investors in NABARD and IRFC tax free bonds. I wish, what you had guessed should come true.

Regards,

Chandramouli

Thanks Chandramouli!

You are awaiting “issue size for retail investors” in NABARD and IRFC or something else? Issue size is already known.

Hi Shiv,

I seems retail users are not much interested in IRFC bonds this time….any specific reason do you think? Otherwise normally it gets oversubscribed on day1 itself. I have invested some amount in these bonds….But after seeing its current state, i have serious doubt if this is a good investment.

Thanks

Hi Saurabh,

Low subscription is a measure of poor investment for you? Then probably the bonds issued a couple of years ago offering around 8.90% to 9.01% too would qualify for a bad investment, just because they remained open for subscription for more than 2-3 days, probably 7-10 days also in some cases. Isn’t it? No, that is not the case. Its just that most people have exhausted their cash levels. I think it is a case of loss of appetite. I am not hungry doesn’t mean that food is not tasty. I hope you would agree!

the link for tax exempt bonds in U.S. on wiki:

https://en.wikipedia.org/wiki/Municipal_bond#Types_of_tax-exempt_bonds

Hi Shiv,

I had read a report while googling TFB’s for FY2015-16,

that there are TFB’s in America which are issued by States for their local bodies for various infra,redevelopments,schools,sewage systems,etc..

I believe it would be a novel idea in country like ours where the centre has no co-ordination with the states (for example- the various Metro-Train projects many cities).

Each and every part of our country requires basic infrastructure for its progress and also this would resolve the perennial issue of deficit of funds which many states display for their poor health and well-being…

I am from a city and for the METRO project their was a complete lack of co-ordination between the Local Body , State and Centre.

I still remember the company building the Metro had to wait for 6-7 months to get a clearance to pass the railway track and more delay to pass the highway…

I drive daily 10 kms for my workplace.. time taken to travel minimum 50mins to 75 mins…

Development at local level can be the answer for better standard of living which each an every tax-paying citizen of country earns for….

Displays of signing high value MOU’s to show bragging rights with full page adverts in newspapers,media are pointless…

The Centre really needs to introspect its role w.r.t. the citizen of this country.

Your thoughts Shiv…

Do you think bonds issued by debt burdened state governments would be rated AAA and would you risk investing in them? Do you think huge projects like metro is developed for public good? Proably you are from Bangalore city. I came to Bangalore in 2008 and used to travel on outer ring road (ORR) smoothly. Then the government came up with the idea of traffic signal free ORR till the new airport and constructed the stupid designed flyovers at various places. My daily commute time doubled while the construction was going on and i remember L&T’s poster saying “today’s pain is tomorrow’s gain”… Fast forward to today and the badly designed flyovers cause huge traffic jams. Public buses foolishly stop before the flyovers, people get down and try to cross the road in front of them.. then they change lane to go under the flyover.. cars have to stop creating a domino effect. Buses/Lorry breakdown in the middle of the road. If there was active traffic policing all these problems would be solved — there was no need for the money to be spent on the flyovers.

I for one wont invest a single paisa of my money in state government bonds even if it has AAA ratings currently.

Hi Bhaskar,

The point i am trying to make here is that a tax-payer in city pays various taxes like municipal, state, central (directly or indirectly) yet the accountability of funds are never questioned. Poorly designed infrastructure for the want of showcasing progress should not be the goal, rather a properly planned future ready infrastructure is the need of the hour. After years driving on pot holed ridden roads only to know that a flyover constructd doesn’t solve the traffic woes instead manifolds the issue is the result of poorly planned infrastructure.

And the reason i stress on CITY is bcause my city boasts of having the biggest budget in INDIA (bigger than some states). why to hold the centre/state responsible when your own local body has the funds (as shown as allocation in the budget). yes, the state and centre should intervene where there is scarcity to collect funds…

The tax free bond has a cost attached. 10 year G Sec is trading @ 7.61%. The govt gets tax 2.28/1.46 so the effective cost is 5.33/5.83 vs a 10 year tax free bond @ 7.29.

Additionally allowing the Local Govts to issue bonds may not be a good idea. Some of the biggest defaults (Orange County) etc are in this category. Puerto Rico is headed for a big bust up.

For your local goverment, the issue is linked with administration inefficiencies and vested interests, not merely fund paucity so throwing more money will not really solve the issue. We all are aware of the pre monsoon cleaning issues..i am in the same city.

Hi Aashish,

I think everything should be privatised here in India and left to open competition. Bidding and auction processes should be made highly transparent and private players should be made accountable for every project they get awarded. At the same time, the private players should be given a reasonable margin to execute these projects. No need of any kind of subsidies or reservations.

Thanks again Shiv for a sincere and honest reply!

I hope the authorities work for a better future than bicker about the past… and try not to make this country fall into a abyss…

Thanks Aashish!

Yes, it is “Now or Never”. I think if this government is not able to take India to the next level, no government would be able to do that. Current global factors are favouring India for a medium to long term economic upturn, what we just require now is efficient execution. I think India is well positioned to take off for one of its best decades in the history of economic growth.

Well said, Shiv! It is a truly a “now or never” window for us Indians. I hope we (all Indians) can keep aside politics, for next 5-10 years, and concentrate on reforms and development. -KS

Thanks KS, we all have high hopes from this government! But, we have responsibilities also and we all should be responsible to our country! This country is our Mother and our Home, we all should respect it and keep it as our home! But, do we do that? I have serious doubts and probably that is why we never progress well despite having everything in our favour.

Shiv, Rs.204.36 crore worth of bonds are still up for grab (and not Rs.184.36 crore worth of bonds), if the subscribed bond value is Rs.1265.64 crore, as mentioned by you. (1470.00 – 1265.64)

Thanks Shubh for pointing it out, I erroneously used Rs. 1,450 crore for calculating Rs. 184.36 crore. I’ll just make the change.

Is there a possibility of IRFC closure date getting extended beyond March 14?

Hi Janaki,

Though IRFC is not required to extend its closing date, they can do so. But, I don’t think they will extend it.

Hi Shiv,

Thanks to you again…You have been so helpful to others who are need of advise. In today´s busy life, it´s hard to allocate time even to be in touch with friends n family members..however, you spend so much of your time for others.

I have a question – Can I get IRFC Bonds that are allocated in my friend´s account , into my DMAT account ? Are these bonds transferable ?

Kindly advise ASAP, I have only one day left to subscribe thru my friend.

Best Regards,

You can make a offline transfer. Your friend will need to fill in a transfer slip and submit it to your depository (icici/hdfc etc) for transfer you your demat account.

Thanks Vasu! 🙂

Yes, you can transfer these bonds offline to and from your friend’s account.

Many thanks to Shiv and Nn for your advise – Very useful info.

You are welcome Vasu!

Rs. 204.36 crore worth of bonds still up for grabs and Monday is the last day for subscription. I think Day 3 applicants should also get 100% allotment.

HUDCO retail refunds are approx 700 crores. Any idea if they will be released on Monday.. since the reinvestment into irfc of even a part of refund will exhaust the balance of 184 cr. The allocation ratio for Monday investment ,in that case, will be worse than HUDCO.

It may be a better idea to split investment into IRFC and NABARD on Monday. Investors who have subscribed till today are assured of 100% allocation ?

Hi Nn,

I am hopeful that HUDCO refund process would get started on Monday. But, how soon Non-ASBA investors would get their refunds is a question mark. I think IRFC issue would remain undersubscribed in the retail category on Monday. Investors should focus on the NABARD issue as and when the refund amount gets credited.

Day 2 (March 11) subscription figures:

Category I – Rs. 3,992 crore as against Rs. 245 crore reserved – 16.29 times

Category II – Rs. 3,146.87 crore as against Rs. 367.50 crore reserved – 8.56 times

Category III – Rs. 1,291.44 crore as against Rs. 367.50 crore reserved – 3.46 times

Category IV – Rs. 1,265.64 crore as against Rs. 1,470 crore reserved – 0.86 times

Total Subscription – Rs. 9,695.95 crore as against total issue size of Rs. 2,450 crore – 3.96 times

Dear sir,

Assuming the issue will be closed on 14 th March , when we can expect the bond allocation & refund?

Thanks & Regards

Firoz

Dubai

Firoz – It should be 12 business days from the issue closure date.

Here’s a copy/paste from the prospectus –

‘In terms of Bonds issued in dematerialised form, our Company will take requisite steps to credit the demat accounts of all Bondholders who have applied for the Bonds in dematerialised form within 12 Working Days from the Tranche-II Issue Closing Date….’

‘…..the unutilised portion of the Application Amounts will be refunded to the Applicant within 12 (twelve) Working Days of the Issue Closing Date….’

So you can do the refund date calcs basis the actual issue closing date – 14Mar or sooner 🙂

Thanks Bobby…

Hi Firoz,

I think IRFC bonds will get allotted by March 23 and the refund process should end by March 25-26.

Thanks a lot sir…

You are welcome Firoz!

Anyone aware of today’s subscription in IRFC bonds??

Shiv – Thanks for sharing that for next fiscal Fin Min has clarified that the Infra Bonds would not be tax-free. Given your experience, what is your sense of the range of coupon rate and tenure that may be offered?

Thanks Once again for the wonderful support you’ve always provided. It’s indeed a pleasure to know that genuine & sincere folks like you still exist 🙂

Thanks a lot Bobby for your kind and encouraging words! It is these words that I am working for !! 🙂

Moreover, I am not sure whether infrastructure bonds would be offered to the general public or not. I think if these bonds are not tax-free, then probably they will be issued to QIBs and Corporates only on a private placement basis.

Awaiting for your today’s subscribe details. .

today’s subscription figures please

Dear shiv sir,

I have already applied under catagory III & chances are 28%.Now still the retail catagory under subscribed. Can I apply under retail catagory on Monday?

Thanks & Regards

Firoz

Yes Firoz, you can do so. But, you will have to withdraw your Category III application.

Thanks a lot sir…

Dear Mr. Shiv,

If a subscription order is executed already, how can one withdraw it? Such a option/facility & even the option/facility of subscribing through more than one IPO Application/order are not available with even ICICI Direct, which is a leading brokerage house. Your comments will be appreciated please as which service provider has all these options.

Hi S.K.,

I think you can call the ICICI Direct customer care and cancel or modify your order.

Dear Shiv,

The comment i posted in the morning regarding “AIR Reports” has been shown as “Awaiting Moderation”. Kindly look into it plz.

It has been moderated now.

Any chance to get full allocation today for IRFC bonds?

Hi Raja,

It seems Day 2 and even Day 3 applicants will get 100% allotment.