This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

2016 so far has seen a good amount of volatility in all the major financial markets in the world. The main cause of this volatility has been China. After having many years of high GDP growth, Chinese economy is taking a breather. How long this slowdown would last, it is something which only God can answer. In these uncertain times, risk averse investors want safety of their hard earned money and tax efficiency of their investments. Tax Free Bonds fulfil both of these requirements.

To satisfy our hunger for tax-free bonds, IRFC will join the company of NABARD from Thursday, March 10th. The issue will remain open for just 3 days to get closed on March 14. This is the shortest period of time a company has decided to keep its issue open even before it actually opens. It seems the merchant bankers are confident enough to get the required subscription numbers within a day or two, and we all know that they are right in their calculations.

Here are the salient features of IRFC Tranche II of Tax Free Bonds:

Size of the Issue – Indian Railways has been spending a huge amount on expanding its network and upgrading its existing infrastructure. IRFC is one of the sources through which Indian Railways gets its required funds for such high expenditure. IRFC has already raised Rs. 7,050 crore in the current financial year by issuing these tax-free bonds. To partly meet its funds requirements, IRFC will raise another Rs. 2,450 crore in this issue.

Rating of the Issue – CRISIL, ICRA and CARE have assigned ‘AAA’ rating to this issue and consider it to be the safest from timely payment of its debt obligations, including interest and principal investment. Moreover, these bonds are ‘Secured’ in nature and certain fixed assets of the company will be charged equivalent to the outstanding amount of the bonds.

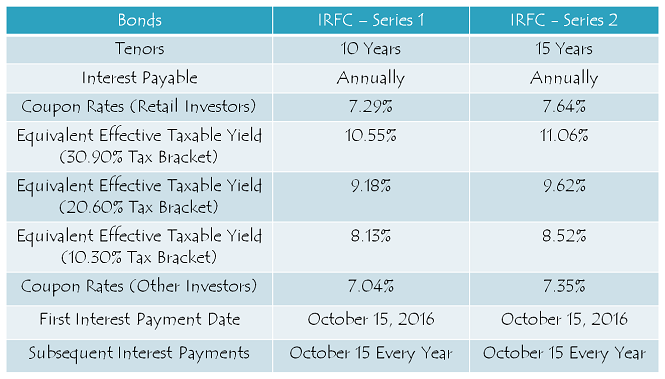

Coupon Rates on Offer – IRFC is offering yearly interest rate of 7.29% for its 10-year option and 7.64% for the 15-year option to the retail investors investing less than or equal to Rs. 10 lakh. These rates exactly match the rates offered by NABARD in its issue which is getting launched today.

For the non-retail investors, coupon rates will be lower by 25 basis points (or 0.25%) for the 10-year option at 7.04% and 29 basis points (or 0.29%) for the 15-year option at 7.35%.

NRI/FPI/QFI Investment Allowed – This issue will try to quench the thirst of some Non-Resident Indians (NRIs), Foreign Portfolio Investors (FPIs) and Qualified Foreign Investors (QFIs) as they have been allowed to invest in this issue either on a repatriation basis or a non-repatriation basis.

Investor Categories & Allocation Ratio – As compared to the earlier issues, this issue has a higher percentage allocation of 60% for the retail investors and as compared to the NABARD issue, a slightly higher percentage allocation of 15% for the high networth investors.

As always, the investors have been classified in the following four categories and each category will have certain percentage of the issue size reserved during the allocation process:

Category I – Qualified Institutional Bidders (QIBs) – 10% of the issue is reserved i.e. Rs. 245 crore

Category II – Non-Institutional Investors (NIIs) – 15% of the issue is reserved i.e. Rs. 367.50 crore

Category III – High Net Worth Individuals including HUFs – 15% of the issue is reserved i.e. Rs. 367.50 crore

Category IV – Resident Indian Individuals including HUFs – 60% of the issue is reserved i.e. Rs. 1,470 crore

Allotment on First Come First Served Basis – Subject to the allocation ratio, allotment will be made on a first come first served (FCFS) basis in each of the investor categories, based on the date of upload of each application into the electronic system of the stock exchanges.

Listing & Allotment – IRFC has decided to get these bonds listed on both the stock exchanges i.e. on the National Stock Exchange (NSE) as well as on the Bombay Stock Exchange (BSE). The bonds will get allotted and listed within 12 working days from the closing date of the issue.

Demat Account Not Mandatory – It is not mandatory to have a demat account to apply for these bonds. Investors have the option to subscribe to these bonds in physical form also. Whether you apply for these bonds in demat or physical form, the interest payment will still get credited to your bank account through ECS.

Also, even if you get these bonds allotted in an electronic form and sometime in future you decide to close your demat account, you will have the option to get them rematerialized in physical/certificate form.

No Lock-In Period – These tax-free bonds are freely tradable and do not carry any lock-in period. The investors may sell them at the market price whenever they want after these bonds get listed on the NSE and BSE.

Interest on Application Money & Refund – Successful allottees will earn interest at the applicable coupon rates on their application money, from the date of realization of application money up to one day prior to the deemed date of allotment. Unsuccessful allottees will get interest @ 5% per annum on their refund money.

Minimum & Maximum Investment – Investors are required to put in a minimum investment of Rs. 5,000 in this issue i.e. at least 5 bonds of face value Rs. 1,000 each. There is no upper limit for the investors to invest in this issue. However, an investor investing more than Rs. 10 lakhs will be categorized as a high networth individual (HNI) and will get a lower rate of interest as applicable.

Interest Payment Date – IRFC will make its first interest payment on October 15 this year. Subsequent interest payments will also be made on October 15 every year.

Should you invest in this issue?

For a large number of retail investors, tax-free bonds have remained their favourite investment option for all these years since they first got allowed to be issued in 2011-12. As the finance ministry has decided to end this channel of fund raising for all these big and reliable government companies in the infrastructure financing or development space, we all have been very disappointed.

But, there is nothing we can do about it. The only thing we can do is to utilise these last couple of opportunities to subscribe to these bonds and just hope for the government to reintroduce these bonds again in the next year’s budget. Till then, risk-averse investors should subscribe to these bonds and other investors should invest their money in good mutual funds for infrastructure development to gather pace through a different funding channel.

Application Form for IRFC & NABARD Tax Free Bonds – Resident Indians and NRIs

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in IRFC or NABARD tax-free bonds, you can contact/whatsapp me at +919811797407 or mail me at skukreja@investitude.co.in

Hi Shiv, by when are IRFC & NABARD bonds likely to be allocated and credited to our demat accounts?

Hi SG,

IRFC and NABARD bonds are likely to be credited on March 28.

Should it take so long?. At least they should make allotment to retail, investors before Holi, as everyone is going to get hands full quantity (lol)

Refund/Basis of Allotment would get initiated by 23rd I think, but actual allotment should happen by March 28th.

and what about n5 9.95% will they will purchase back this series bonds also I have 40 bonds and today they are trading at 10950 waiting for your valuable answer

Yes Nitesh, SBI will buyback these bonds as well after 10 years.

Sir, have you noticed SBI NCD Retail 9.75% (NSE SBINN3 ?) were bought back by SBI recently, is this true ? The said NCD not trading on BSE too. Please respond.

Yes Naeem, that is right! SBI N3 Bonds carrying 9.25% coupon have been purchased back by SBI using its call option. The day SBI issued these bonds I knew that they will exercise this option after 5 years (10-year N3 bonds) and after 10 years (15-year N2 bonds). It doesn’t make any sense for SBI to pay 9.75% or 10.25% in the current scenario.

Thanks Sir, can I now buy SBINN5 (9.95% 15yr NCDs from 2010) so as I get better interest ?

Also, are there Ttax free bonds of reliable companies giving better int than the current IRFC, Nabard ? pls advise.

Yes Naeem, you can buy these bonds from the secondary markets. Please check this link for NSE listed tax-free bonds – https://www1.nseindia.com/live_market/dynaContent/live_watch/equities_stock_watch.htm?cat=SEC

Thank you Shiv for this information. For members in family who dont have any taxable income, this (SBIB N5) still is a very good option. Yield right now is 8.4%.

Hi Abhishek,

Yield is higher than 8.4% actually. These bonds are trading “Ex-Interest” now. However, 8.4% yield is not considering this event. After April 2, when the interest gets paid to the bondholders, its actual yield will start getting reflected on the NSE.

Received refunds for HUDCO Tranch II. Looks like I will be alloted 520 bonds out of 1000 that I applied.

Yes Vasu, must be 521 or 520 bonds for 1,000 bonds applied.

Got the HUDCO Refunds credited just now at around 8.50am in my Bank Account through RTGS.

Must be a good news for you S.K., you were eagerly awaiting this refund!

Received refund of HUDCO in ICICI Bank just now (Today, 15-March,8.50 am)

Thanks a lot Mr. Singh for sharing this info!

I received my refund from HUDCO tranche 2today. It was ASBA.

Thank you Shiv, you helped me invest it today in irfc and I hope to get full allotment

Thanks Finto for sharing this info! Yes, you should get 100% allotment in IRFC issue along with all other successful applicants.

Has the issue closed today officially? Thanks

Hi Ash,

There is no official communication of extension of this issue, so it is safe to assume that the issue stands closed now.

Request all to please share news of Refunds received on their Bank Accounts through RTGS transfer payments on account of HUDCO Tranche-2 March 2016 IPO issue.

I don’t see any refunds issued today.

RTGS/NEFT refunds should get credited by tomorrow.

Shiv,

Seems IRFC already tried to deduct the amount of that offline application, so my bank balance shows negative now. So will IRFC reject my application (as we were hoping they will deduct after 2-3 days by then HUDCO refunds should be there).

And will there by any further issue due to cheque bounce?

Whats the status for your other clients who followed this approach?

Chaitanya, can you please share with us when exactly did you deposit/submit your offline application and did you deposit it directly in the Bank or through a Broker?

If more details are shared by you we can understand the reason for this unexpected early debit leading to a negative balance in your bank account.

I deposited yesterday 1pm in HDFC bank using the bid id u gave me in morning. Wud u be able to chk with tht bid id

I deposited yesterday 1pm in HDFC bank using the bse bid id shiv gave me in morning.

Hi Chaitanya,

I have responded to you on WhatsApp, please check.

Yeah saw it yesterday later in the day. Damn! could have used that refund amount although I did apply for the other issues. It was just 50% allocation despite applying in the first day. Thanks

That’s ok Ash, now you can utilise it for other investments.

Tax-free bonds prove to be a huge draw this fiscal – http://www.business-standard.com/article/markets/tax-free-bonds-prove-to-be-a-huge-draw-this-fiscal-116031401033_1.html

Hi Raja,

1) No tax-free bonds in next FY after march.

Will have to wait till next year´s budget to know Govt´s plan for 2018.

Only way is to buy from Secondary Market. But need to put Limits, as

they are not very liquid and purchase price can´t be predicted.

2) TFB can never me made taxable , as they were declared under special

notification in Budget and thru a CBDT circular , till their end of term.

Govt can not go back and change rules, for those instruments which are

already issued.

Vasu

Thanks Vasu for your responses!

Hi Shiv,

You might have answered these questions, Since I am not monitoring the email chains, it will be great if you can answer the below ones

1) Is any TFB expected after March this year? When is the next release of TFB?

2) Is it true that going forward, all TFB’s will be taxable?

1412-1265 about 147 hundreds crore retailer have subscribed today not bad at all isn’t it shiv

Yes, I agree, it is a decent number Nitesh!

Thank you Shiv for your blog. You’ve helped a lot to us to invest wisely!

You are welcome Man! 🙂

Final Day (March 14) subscription figures:

Category I – Rs. 3,992 crore as against Rs. 245 crore reserved – 16.29 times

Category II – Rs. 3,148.14 crore as against Rs. 367.50 crore reserved – 8.57 times

Category III – Rs. 1,293.45 crore as against Rs. 367.50 crore reserved – 3.52 times

Category IV – Rs. 1,411.5534 crore as against Rs. 1,470 crore reserved – 0.96 times

Total Subscription – Rs. 9,845.14 crore as against total issue size of Rs. 2,450 crore – 4.02 times

Dear Shiv

As a newcomer, I gathered lot of information from this lively forum.

Great job.

Thanks a lot Dr. Paulose for your kind words! I hope we have you as a regular visitor here now !! 🙂

Last half an hour left now!

Rs. 1,355.26 crore subscribed in the Retail Category as at 3:39 p.m. as compared to Rs. 1,470 crore reserved.

Thanks.

Hi Shiv, Many thanks to you for providing guidance to small retail investors like us. With your support i was able to make investments in IRDEA, NABARD and IRFC. I am delighted to know that i will get full allotment in Nabard & IRFC. Since i started late i have not been able to fully invest my savings in TFB. Can you please advise if i can pick up few more units from secondary market closer to issue price of 1000.. Many Thanks..Abhishek

Thanks Abhishek!

Yes, you can invest your balance funds in these tax free bonds through secondary markets. Please consult your financial advisor or broker to suggest you a few of them which have recently listed on the BSE or NSE. I’ll soon share a post having all the tax free bonds issued during the current financial year along with their BSE/NSE codes and other details.

Thank you Shiv.

HUDCO Refunds have come via ASBA applications. 52.1% allotments.

Mr. Shiv & Mr. Pankaj & other readers of this blog, does that mean ASBA Refunds are released earlier than other Refunds? Should they not be crediting all types of HUDCO Issue Applicants simultaneously? Could Mr. Shivv & other readers kindly share their experiences in this regards?

For some strange reason ICICI Direct does not have ASBA facility for Tax Free Bonds, I wonder why? Despite writing to them several times they have failed to clarify.

Hi S.K.,

ASBA funds get released by the bank as soon it gets the intimation for the same by the Registrar of the issue. ASBA applicants are the first to get access to their funds. Afterwards, RTGS/NEFT refunds get processed. So, you can expect your refunds to come either today evening or tomorrow.

Hi Shiv,

Are IRFC and NABARD in a hurry to close the issue today because generally 8-10 days are required for listing and a mini vacation commences from 24 march with only 4 days remaining for FY year end ?

Yes Aashish, that is the only reason we can make out for such an early closure!