This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

2016 so far has seen a good amount of volatility in all the major financial markets in the world. The main cause of this volatility has been China. After having many years of high GDP growth, Chinese economy is taking a breather. How long this slowdown would last, it is something which only God can answer. In these uncertain times, risk averse investors want safety of their hard earned money and tax efficiency of their investments. Tax Free Bonds fulfil both of these requirements.

To satisfy our hunger for tax-free bonds, IRFC will join the company of NABARD from Thursday, March 10th. The issue will remain open for just 3 days to get closed on March 14. This is the shortest period of time a company has decided to keep its issue open even before it actually opens. It seems the merchant bankers are confident enough to get the required subscription numbers within a day or two, and we all know that they are right in their calculations.

Here are the salient features of IRFC Tranche II of Tax Free Bonds:

Size of the Issue – Indian Railways has been spending a huge amount on expanding its network and upgrading its existing infrastructure. IRFC is one of the sources through which Indian Railways gets its required funds for such high expenditure. IRFC has already raised Rs. 7,050 crore in the current financial year by issuing these tax-free bonds. To partly meet its funds requirements, IRFC will raise another Rs. 2,450 crore in this issue.

Rating of the Issue – CRISIL, ICRA and CARE have assigned ‘AAA’ rating to this issue and consider it to be the safest from timely payment of its debt obligations, including interest and principal investment. Moreover, these bonds are ‘Secured’ in nature and certain fixed assets of the company will be charged equivalent to the outstanding amount of the bonds.

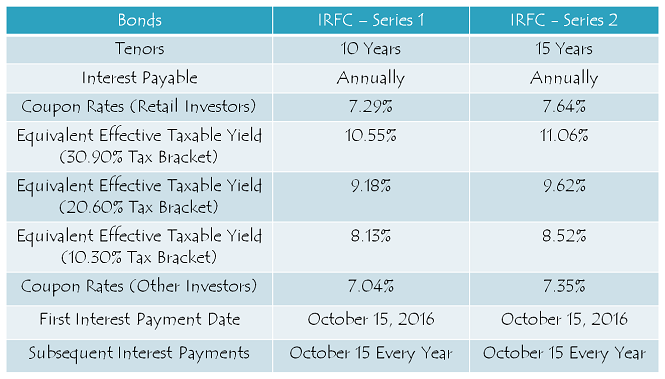

Coupon Rates on Offer – IRFC is offering yearly interest rate of 7.29% for its 10-year option and 7.64% for the 15-year option to the retail investors investing less than or equal to Rs. 10 lakh. These rates exactly match the rates offered by NABARD in its issue which is getting launched today.

For the non-retail investors, coupon rates will be lower by 25 basis points (or 0.25%) for the 10-year option at 7.04% and 29 basis points (or 0.29%) for the 15-year option at 7.35%.

NRI/FPI/QFI Investment Allowed – This issue will try to quench the thirst of some Non-Resident Indians (NRIs), Foreign Portfolio Investors (FPIs) and Qualified Foreign Investors (QFIs) as they have been allowed to invest in this issue either on a repatriation basis or a non-repatriation basis.

Investor Categories & Allocation Ratio – As compared to the earlier issues, this issue has a higher percentage allocation of 60% for the retail investors and as compared to the NABARD issue, a slightly higher percentage allocation of 15% for the high networth investors.

As always, the investors have been classified in the following four categories and each category will have certain percentage of the issue size reserved during the allocation process:

Category I – Qualified Institutional Bidders (QIBs) – 10% of the issue is reserved i.e. Rs. 245 crore

Category II – Non-Institutional Investors (NIIs) – 15% of the issue is reserved i.e. Rs. 367.50 crore

Category III – High Net Worth Individuals including HUFs – 15% of the issue is reserved i.e. Rs. 367.50 crore

Category IV – Resident Indian Individuals including HUFs – 60% of the issue is reserved i.e. Rs. 1,470 crore

Allotment on First Come First Served Basis – Subject to the allocation ratio, allotment will be made on a first come first served (FCFS) basis in each of the investor categories, based on the date of upload of each application into the electronic system of the stock exchanges.

Listing & Allotment – IRFC has decided to get these bonds listed on both the stock exchanges i.e. on the National Stock Exchange (NSE) as well as on the Bombay Stock Exchange (BSE). The bonds will get allotted and listed within 12 working days from the closing date of the issue.

Demat Account Not Mandatory – It is not mandatory to have a demat account to apply for these bonds. Investors have the option to subscribe to these bonds in physical form also. Whether you apply for these bonds in demat or physical form, the interest payment will still get credited to your bank account through ECS.

Also, even if you get these bonds allotted in an electronic form and sometime in future you decide to close your demat account, you will have the option to get them rematerialized in physical/certificate form.

No Lock-In Period – These tax-free bonds are freely tradable and do not carry any lock-in period. The investors may sell them at the market price whenever they want after these bonds get listed on the NSE and BSE.

Interest on Application Money & Refund – Successful allottees will earn interest at the applicable coupon rates on their application money, from the date of realization of application money up to one day prior to the deemed date of allotment. Unsuccessful allottees will get interest @ 5% per annum on their refund money.

Minimum & Maximum Investment – Investors are required to put in a minimum investment of Rs. 5,000 in this issue i.e. at least 5 bonds of face value Rs. 1,000 each. There is no upper limit for the investors to invest in this issue. However, an investor investing more than Rs. 10 lakhs will be categorized as a high networth individual (HNI) and will get a lower rate of interest as applicable.

Interest Payment Date – IRFC will make its first interest payment on October 15 this year. Subsequent interest payments will also be made on October 15 every year.

Should you invest in this issue?

For a large number of retail investors, tax-free bonds have remained their favourite investment option for all these years since they first got allowed to be issued in 2011-12. As the finance ministry has decided to end this channel of fund raising for all these big and reliable government companies in the infrastructure financing or development space, we all have been very disappointed.

But, there is nothing we can do about it. The only thing we can do is to utilise these last couple of opportunities to subscribe to these bonds and just hope for the government to reintroduce these bonds again in the next year’s budget. Till then, risk-averse investors should subscribe to these bonds and other investors should invest their money in good mutual funds for infrastructure development to gather pace through a different funding channel.

Application Form for IRFC & NABARD Tax Free Bonds – Resident Indians and NRIs

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in IRFC or NABARD tax-free bonds, you can contact/whatsapp me at +919811797407 or mail me at skukreja@investitude.co.in

Just Posted – Should You Invest in NPS Post Budget 2016? – http://www.onemint.com/2016/03/25/post-budget-2016-should-you-invest-in-nps/

It is highly unlikely that any govt tries to change the TFB isdued taxable. May be they will not allow such bonds in future. Unwanted worries on our investments will give rise to anxiety related illness. That way what is the guarantee that we will get our capital in Fd or these investments back if the economic conditions worsens as happened in Cyprus and Greece. It is highly recommended to adopt a diversified portfolio in terms of investments. Having high exposure in one investments are risky. Those looking for debt bonds I suggest investing in Gilt bonds or similar highly protected funds with exposure to AAA bonds.

Mr. George/Mr. Shiv,

1) Please share more information on GILTS, how to select/invest, interest rate, period, liquidity etc.

2) Please share which good DEBT FUNDS have AAA only invested? Will be grateful for such AAA best 5-6 Debt Fund Scheme names please.

Sorry S.K., I won’t be able to name any such fund here on this forum. Please check this link for the factors to consider while choosing a debt/gilt fund – http://www.onemint.com/2012/11/06/how-to-choose-a-debt-fund-factors-to-consider-while-investing/

Mr. Shiv, normally you are helpful, & your blogs are focussed on investment related issues, but at certain times you are somewhat reticent in sharing information which may be of considerable help to all readers of your blog. Curious to know why you had not shared information on names of best TFB picks from secondary market earlier on my query?

Now, again on my query on Top Debt Funds you have skirted the issue and deprived your loyal readers of your extremely valuable inputs.

That is due to SEBI regulations. I can provide such kind of advisory services to my clients only.

SK, Shiv is a Financial consultant and he is also running a business on investments. It will be better you contact him directly so that he can help you in your MF investments. He may have limitations in sharing all the info in this blog and I am also not suppose to do that considering he is running this blog which is part of his business. He will also have to keep in mind about the regulators.

I do not agree with both Mr. Shiv & Mr. George regarding the ‘regulations’ bit as an excuse to avoid responding to my query. One finds so called ‘experts’ the entire day on TV & print media recommending all sorts of investments, does that mean that they are going to land behind bars for breaking such ‘regulations’?

Yes, at the same time I do appreciate the reality that Shiv too needs to make a living. I also appreciate that this blog is a visible means to attract prospective clients and Shiv will only share information if such clients are willing to pay for his expert advice.

1) Request you to kindly advise best 5-6 Debt Mutual Funds Growth Option where we can safely invest retirement savings for few years and which lend to safe companies. Also please advise MF DEBT FUNDS Short term & long term Capital Gains & suggest which option to choose.

2) Please advise best TFB’s buys in secondary market from earlier lots which are available at favorable prices, good yields & above all GOOD LIQUIDITY.

Can anyone give the icicidirect code for IRFC TFB getting listed on Monday, 28th March.

Irfc code no -935682 in Bse

Dear Amit,KS and Paulose Ko,

I agree with Shiv Kukreja that there is no prospect of the central government suddenly imposing tax on TFB interest.I believe that you three may have been influenced by the recent aborted attempt to impose tax on EPF withdrawal with prospective effect.But please note that even in that original Union budget announcement,the annuity option offered tax free treatment as a direct incentive to generate a pensionable society.Every Union finance minister,regardless of political affiliation,relies on principles of fairness and equity,though the logic may be different.India is inevitably moving towards a consumption-led economy and low interest rate regimen akin to the western economies.Some celebrities may have invested in TFB issues but haven’t so many more qualified institutional bidders and middle class investors like you and me also invested?I am sure that our central finance ministry deploys a sense of proportion while considering any controversy. So Shiv, with his amazing insights and deep exposure,must be right in affirming the high credentials of TFB issues.

Dr.Sharma, thanks for the valuable inputs. Few days some of the readers mentioned here that India is developing country and can’t be compared with Japan or another developed country. You have rightly mentioned that India is inevitably moving towards a consumption-led economy and low interest rate regimen akin to the western economies should happen. I agree with you fully.

Thanks, Dr Sharma and Amit for your comments. I too am an Optimist. In the past 50+ years I have seen India developing and transforming dramatically with my Own Eyes. Even though the pace has been excruciatingly slow. Many countries ravaged by Wars, have made dramatic improvements and development. But our hugely diverse population has made it a slow-paced development; in order to carry everybody along in a democratic way. Even our politicians often do see value for fair and principled reforms, when elected to high positions (except when a reform decision is likely to hit the Vote Bank adversely). I do agree moving towards a consumption society and low Interest regime is best for us. Looking forward to the day (hopefully, in my life-time, before these 15-Year TFBs mature) to move ahead of China in terms of development and modernization. Cheers. -KS

Sorry… by Amit I meant Asahi in above reply. -KS

Thanks Dr. Sharma for your inputs, I agree with your views here!

Nabard 1000 bonds allotted. Thank you Mr.Shiv

You are welcome Asahi!

IRFC tax-free bonds to get listed on the BSE & the NSE on Monday, March 28th – http://www.bseindia.com/markets/MarketInfo/DispNewNoticesCirculars.aspx?page=20160323-7

Here are the BSE and the NSE codes for the same:

7.29% 10-year bonds – BSE Code – 935680, NSE Code – NN

7.64% 15-year bonds – BSE Code – 935682, NSE Code – NO

Deemed date of allotment has been fixed as March 22, 2016. Interest will be paid on October 15th every year.

TFBs are to be seen as bonanza for those who got allotted. We bought right, let us sit tight. Our only prayers should be the government in the coming years honour the promise given to us.

Yes Asahi, these bonds are great investments! Also, can you please share what government promise you are talking about?

It might be tax free status given to these bonds. Government should not come with clause like those who are getting more than rs 50,000 as interest from TFB should pay the tax on interest earned over rs 50,000. There is more uproar in the media like only rich ppl are investing in TFB.

No Amit, nothing of this sort will happen.

Shiv … You may be right … or wrong! How are you so sure? If you have some reasons for thinking so would like to know.

(btw: I used to think that Debt Funds LTCG cannot be increased to 3 years but it happened. I am thinking Equity-funds LTGG tax-free beyond 1 year will remain so; but it got seriously discussed before 2016 budget, but did not happen this year). I feel Tax Exemption “Limit Amount” for Interest from Tax-free Bonds would/could be raised.)

I am fairly confident KS that this will not happen.

Thanks for reply, Shiv. I also believed so really. But now with much publicity to “celebrities” putting crores in TFBs, I am not 100% sure anymore.

Hi KS,

I don’t see any connection between the two, but you might be right!

Shiv

Can the Govt. amend the law to tax the TFB NRE deposits etc ? How can we trust this and future govt in this regard?

I join the concern of Amit and KS.

I don’t think Govt will may ever say the TFBs are now Taxable (that will be an oxymoron!) .. but they may say “all” Interest Income above a limit (say, Rs 2+ Lacs p.a.) will be Taxable starting on April Fools Day (1-APR-20xx). Ostensibly, to tax the super rich.

Hi Dr. Paulose,

Yes, the government has the authority to amend the laws to make TFBs and NRE deposits taxable. The investors have no authority to stop the government from doing that. But, this government has promised not to implement any such move retrospectively. So, I don’t think this government will take any such move.

Hi Shiv,

I have one general question.

Interest rates are currently on the decline and these tax free bonds are offered at 7.64% coupon rate for 15 years.

In 15 years the interest rate cycle could turn around and the interest rates could increase (as seen previously).

Isn’t it an loss then since I believe these TFB will still be at the same rate (7.64%)?

Thanks,

Venu

Hi Venu

Like Jesus said, do not be anxious about tomorrow. Yesterday’s the past, tomorrow’s the future, but today is a gift. (That’s why it’s called the present).

The truth is no one knows what will happen tomorrow.

That’s correct Dr. Paulose!

Hi Venu,

Interest rates can go up or down in the next 15 years and the returns may get averaged out. One needs to take a calculated risk in this regard. Please note that if you are in a 30% tax bracket and are likely to step down to lower brackets in the next 15 years, then you would get an assured returns of about 10.9% which you cannot get consistently for the low risk investments. Also, for some, investing in TFBs is a matter of pride to be a part of building the nation.

Thanks,

Janaki

Thanks Janaki for your inputs! But, I did not get your 10.9% assured returns logic, can you please throw some light?

Shiv, I meant the equivalent effective taxable yield for 30.9% bracket even if the coupon rates are lower. I gave a very approximate number though we see that many of the TFBs have yields more than 11%.

Shiv, I have one question. In the listing (NSE), I find that the coupon rates are lesser than what it was when issued initially. Why is it so?

Can you please share one such example Janaki?

Hi Shiv, I guess I made a mistake of referring to various different series like N3, N4 etc., On checking again, I found that for retail customers (Category 4) the IRFC “NJ” series has the same coupon rate as the ones that came out this year. Similarly NHAI has “NA” and the coupon rates are the same.

Shiv, what does YTM at LTP (Last traded price)% means? Also, please let us know how one should go about deciding which TFBs to buy from the NSE.

Hi Janaki,

YTM at LTP means that if you buy the bond at the last traded price (LTP), your investment in that bond will effectively earn you the yield to maturity (YTM). One should buy the TFBs from the secondary markets keeping YTMs, liquidity, profile of the company and his/her requirements in mind.

Thank you very much Shiv. Appreciate your expert advise for all the TFBs.

You are welcome Janaki!

Hi Venu,

Yes, interest rates could go up again in future and in that case, the market price of these bonds would come down. But, then anything can happen and there is a possibility that you may not see these high rates again for a very long period of time. In that situation, it would be very fruitful to have these bonds in your portfolio.

Thanks everyone for the clarifications.

You are welcome Venu!

I got alloted 1000 bonds of IRFC. Thank You Mr.Shiv.

You are welcome Asahi!

hudco 7.64% is trading today at 1055 so can we accept listing near about this shiv

I don’t think so Nitesh!

Shiv – Since the reduction of interest under small savings/PPF schemes – may lead to an increased demand for TFBs – what’s your guesstimate around the secondary market price for the IRFC & NABARD TFBs (on the day trading is allowed)?

Is 28Mar still the expected date for secondary market listing for these 2 TFBs?

Hi Bobby,

IRFC tax free bonds are getting listed on the BSE and the NSE on Monday. I think these bonds should get listed at around Rs. 1,030 +/- Rs. 5 on the exchanges.

I’d applied in non-ASBA on day 2 and received 100% allotment.

Thanks for sharing that Bobby!

128 applied and got 128 dear shiv

That’s great Nitesh!

Applied for full lot under retail category & full amount debited. Means 1000 bond allotted. Once again thanks to Mr. Shiv for his timely advice. In current situation where interest rate is fallen this will be certainly good long term investment..

Thanks Smita for sharing this info and your kind words! 🙂

IRFC Tax free bond has been alloted for the ASBA applicants. Amount has been debited.

Thanks a lot Pankaj for this info, it will be useful for many investors!

Hello Shiv,

I wanted to purchase bonds from the secondary market and wanted to know if there is any database which lists the current YTM. the ones on ICICI direct are not accurate

Thanks.

Hi Ashwin,

Here you have the link to the bonds listed on the NSE – https://www1.nseindia.com/live_market/dynaContent/live_watch/equities_stock_watch.htm?cat=SEC

Many thanks, is there a similar listing for bonds traded on the BSE ? Also noticed that for large number of tax free bonds don’t have a YTM @ LTP in the link you provided.

Hi Ashwin,

Here you have the link to the bonds traded on the BSE –

http://www.bseindia.com/markets/debt/tradereport.aspx?expandable=0

Mr. Shiv, strangely both NSE & BSE the YEILDS for all TFB’s are not displayed at all. Any reason why? Don’t these stock exchanges have a responsibility to maintain data integrity and completeness? Difficult to understand the ‘chalta-hai’ attitude of both NSE & BSE.

Mr. Shiv, sorry, typo error. Meant to say in nearly half the TSB’s the YIELD is not displayed on both NSE & BSE.

Hi S.K.,

Don’t know whether it is their responsibility or not, but surely that is something these exchanges need to work on.

and now the chances of a huge premium in irfc 7.40% can’t be ignored and I am waiting for my allotment when will it starts dear shiv

I think IRFC refund/allotment process should start by Wednesday.

Dear Shiv

Reg PFC TFB october 2015 issue- I got allotment 100 plus bonds and the refund also, and it appears on the demat acccount INExxxxx39.but i have not yet received the allotment letter from the company, is it important to get the “physical”letter. If needed how to get it.

Please advice.

drpaulose

Hi Dr. Paulose,

It is not that important to have the allotment letter if you have already received your bonds in the demat account. If you still require it, you should contact the Registrar of the PFC issue.

Thank You Shiv…

You are welcome Dr. Paulose!

post and ppf interest rates have been heavily reduce by the government they have even touced senior and girl child scheme so al these tfb will rally on Monday isn’t it shiv important comments on this news please

Other day when I went to bank to take loan on FD to apply for TFBs. The manager causally asked any urgent expense? I told him about NABARD TFB. Believe me or not, he asked under which section it was tax free?. That was the level of awareness of TFBs outside. After 3 years, when you say 8.9 % interest TF, people would be shocked.

Yes Mr. Bala, all these tax-free bond investments would command a high premium when inflation and interest rates stabilise at lower levels in a few years from now.

Yes Nitesh, it would result in a sharp rally in all the listed bonds/NCDs and many of the debt mutual funds.