As we come close to the end of the year and gold has another great year, it’s only natural to do an update on the best gold funds in India.

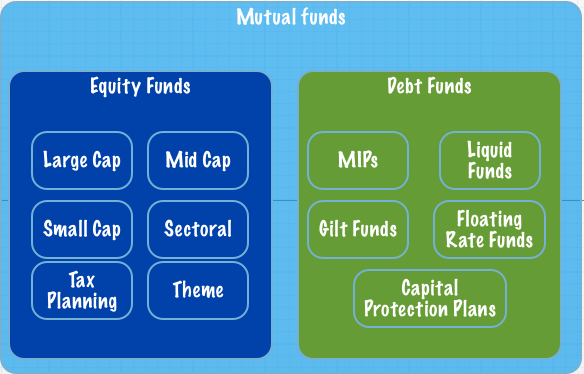

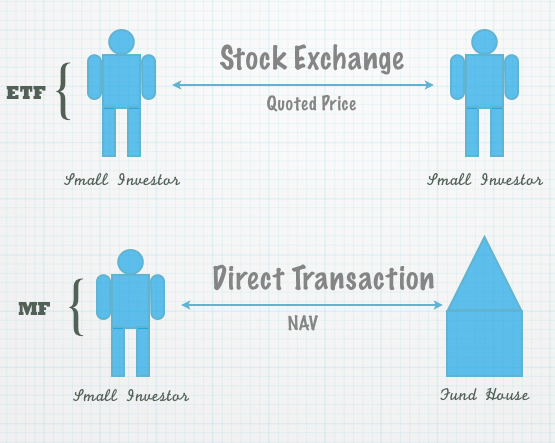

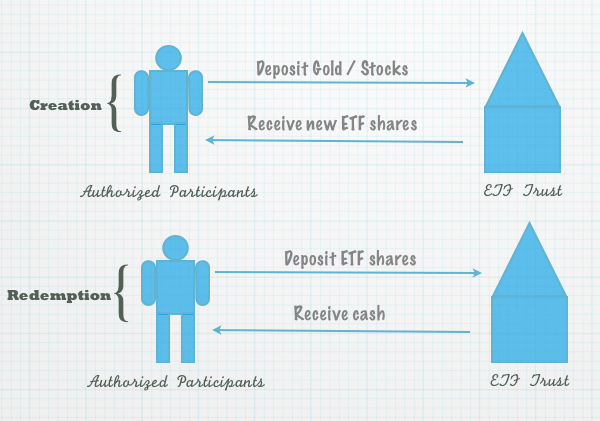

In the past I’ve called these posts, best gold ETFs but now there are so many fund of funds that I’ve called this year’s post the best Indian gold fund and will include both gold ETFs and fund of funds. There are no gold mutual funds in India perhaps because it is not easy to run a mutual fund with gold as the underlying asset as you would require physical gold sales and purchases virtually every working day.

I have combined gold ETFs and gold mutual funds mainly because they both invest in gold, and theoretically gold ETFs should return higher than gold fund of funds but I’d like to see if there are any gold fund of funds that are doing better than gold ETFs and if that’s the case then it shouldn’t make any difference whether you buy a gold ETF or a gold fund of fund.

I say that gold ETFs should do better than gold funds because gold funds in India invest in gold ETFs of their fund house and have expenses over and above the gold ETFs own expenses so the expenses are charged twice. However, if a fund has low expenses and the fund house is doing a good job managing its funds it is possible that some funds are doing better than even the ETFs.

That being said, here is a table that shows the returns for all of these funds in the last one year. All data from Value Research.

| S.No. |

Fund |

ETF (E) or Fund of Funds (F) |

1 Year Return |

|---|---|---|---|

| 1 | SBI GETS | E | 11.62% |

| 2 | Religare Gold ETF | E | 11.59% |

| 3 | Reliance Gold ETF (R*Shares Gold ETF) | E | 11.51% |

| 4 | UTI Gold ETF | E | 11.50% |

| 5 | Quantum Gold ETF | E | 11.49% |

| 6 | HDFC Gold ETF | E | 11.48% |

| 7 | ICICI Prudential Gold ETF | E | 11.48% |

| 8 | Kotak Gold ETF | E | 11.47% |

| 9 | Goldman Sachs Gold ETF | E | 11.47% |

| 10 | IDBI Gold ETF | E | 11.44% |

| 11 | Birla Sun Life Gold ETF | E | 11.33% |

| 12 | Axis Gold ETF | E | 11.30% |

| 13 | Quantum Gold Savings | F | 10.78% |

| 14 | Axis Gold | F | 10.36% |

| 15 | Reliance Gold Savings | F | 10.33% |

| 16 | SBI Gold | F | 10.33% |

| 17 | Kotak Gold | F | 10.15% |

| 18 | ICICI Prudential Regular Gold Savings | F | 10.02% |

| 19 | HDFC Gold | F | 9.89% |

| 20 | Religare Gold | F | Less than a year old |

| 21 | Birla Sun Life Gold | F | Less than a year old |

| 22 | Motilal Oswal Gold ETF | E | Less than a year old |

| 23 | IDBI Gold | F | Less than a year old |

| 24 | Canara Robeco Gold ETF | E | Less than a year old |

| 25 | Canara Robeco Gold Savings | F | Less than a year old |

There are two clear trends that you can discern looking at the table above:

1. All ETFs have performed more or less similarly, and there is very little difference in their returns. If you look at some of the earlier posts on the best gold ETFs even there you will notice that as far as returns are concerned, there are no clear winners.

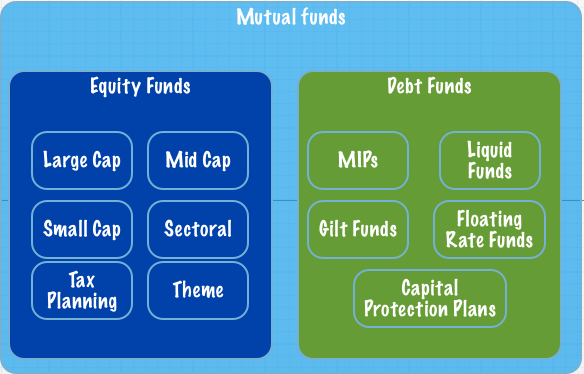

2. Fund of fund returns are lower than ETF returns because they have an additional layer of cost. However, what these figures don’t show is the transaction cost of ETFs and mutual funds, and that can make a difference to your returns because you could be buying mutual funds for free whereas you will always need to pay the broker for buying ETFs.

Fund of funds also make it easier to set up a SIP for a gold ETF. You can very well do that with an ETF as well, but it won’t be automated and simple to the extent of a mutual fund.

Do gold ETF volumes matter?

In the past I’ve said that since performance of gold ETFs is about the same, you can look at volumes and invest in the ones that have the most liquidity but in the past few years gold funds have grown so much that for retail investors this parameter has really become irrelevant.

Now, I would say it is hard to say which is the best gold ETF or fund of fund and it really depends on what you are most comfortable with. If you are okay with the lower return that fund of funds give in lieu of no transaction costs and convenience of a SIP then go for fund of funds.

If your transaction costs are low trading shares because of quantity or because of the broker you use, then buy gold ETFs.

Whatever you do, I think it’s best to spread your money around and use two or more fund houses instead of just one. If there is a big tracking error any year in any of the funds then spreading your money can help with that but other than that I don’t see any reason why gold ETFs should perform any differently in 2013 than they have done this year or the years before this.

Hi ,

I wish to invest in mutual funds. I am an amateur and am completely lost in the numerous schemes offered by all companies. I wish to know the co relation between interest rates and stocks, debentures and money market instruments. Kindly guide on the same.

Thanking you ,

Ankita

Reply