This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

Sukanya Samriddhi Yojana has received a great initial response from the general public. As the scheme offers 9.1% tax-free rate of interest, investors are finding this scheme to be extremely attractive and want to invest in it as soon as possible. They also need handholding to invest in this scheme. But, due to lack of required information with the post offices and authorised bank branches, people are finding it difficult to do so.

I have posted two articles about this scheme and both have received over hundred comments from the visitors. I have been getting many queries regarding the maturity value of this scheme. People want to know the value of their investment as the scheme gets matured after 21 years.

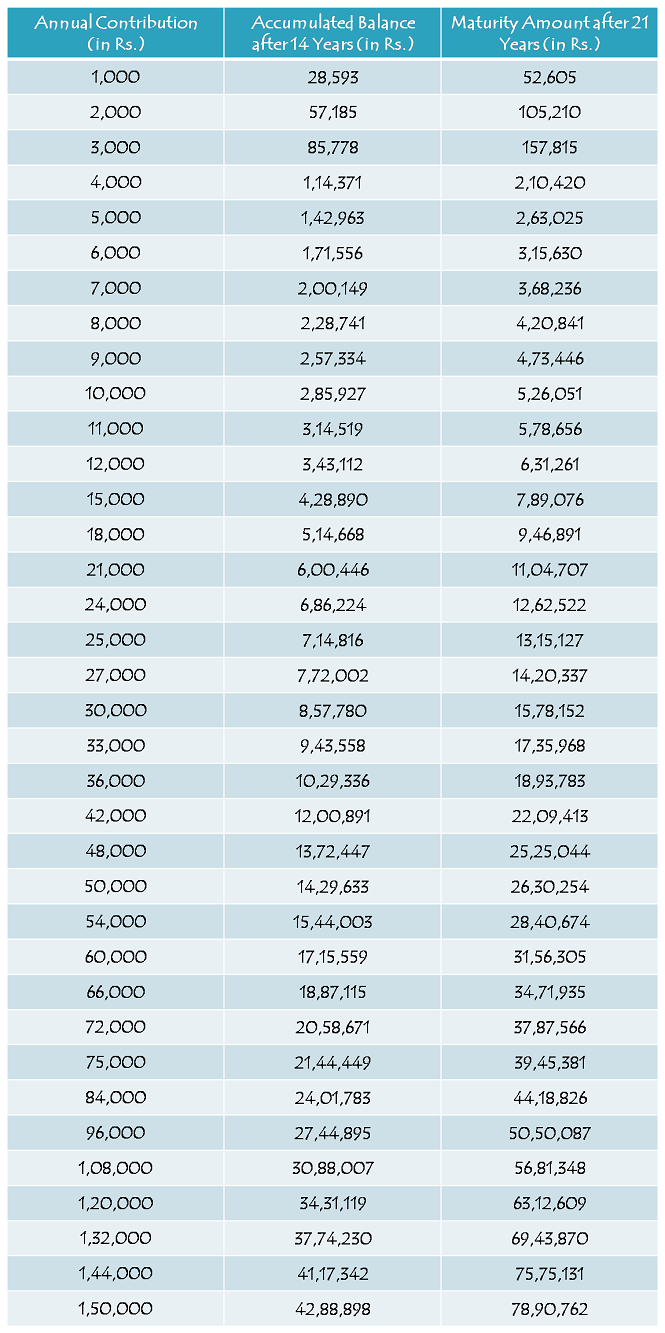

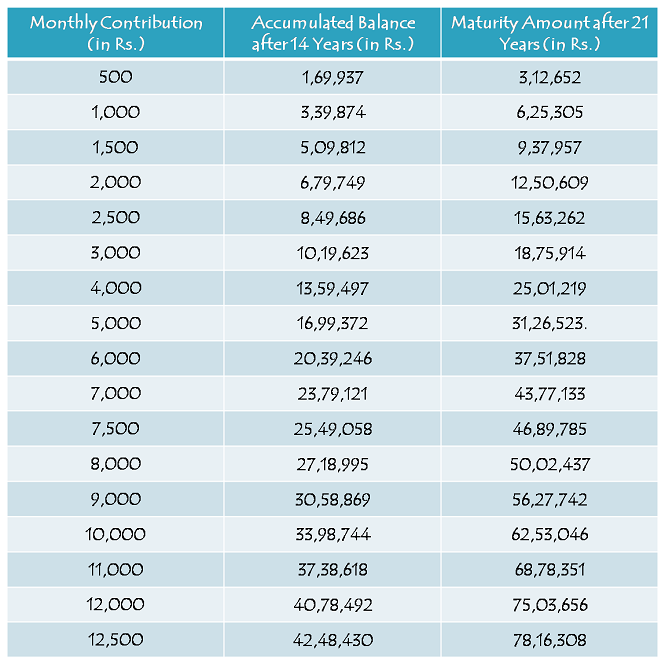

Though it is almost impossible to calculate a precise maturity value of this scheme as there are many variables on which its maturity value will depend, I have tried to make a couple of tables in which the maturity value has been calculated keeping those variables to be constant and yearly & monthly contribution to be the only variable.

Certain assumptions have been made for calculating these maturity values and those assumptions are:

* Rate of Interest has been assumed to be 9.1% for all these 21 years.

* Yearly contributions have been assumed to be made on April 1 every year i.e. the beginning of the financial year.

* Monthly contributions have been assumed to be made on 1st day of every month.

* Although it is not mandatory, a fixed amount of yearly/monthly contribution has been assumed.

* It is also assumed that no withdrawal is made throughout these 21 years.

Here you have the tables:

Yearly Contribution Table

Monthly Contribution Table

I hope these two tables help people in deciding how much amount they would like to contribute to this scheme in order to achieve their girl child’s marriage and/or higher education goals.

Before you go ahead and plan to get an account opened, I would like to again highlight the main features of this scheme:

Who can open this account? – Parents or a legal guardian of a girl child up to the age of 10 years, can open this account in the name of the girl child. Up to December 1, 2015, one year grace period has been provided to allow this account to get opened for a girl child who is born on or after December 2, 2003.

9.1% Tax-Free Rate of Interest – This scheme offers 9.1% rate of interest, which has also been exempted from tax in this year’s budget. But, this rate is not fixed at 9.1% for the whole tenure and is subject to a revision every financial year.

Scheme Matures in 21 years or on Girl’s Marriage, whichever is earlier – The scheme gets matured on completion of 21 years from the date of opening of the account or as the girl child gets married, whichever is earlier. Please note that the girl attaining the age of 21 years has no relevance to maturity of this scheme.

Deposit for 14 years only – You need to deposit a minimum of Rs. 1,000 and a maximum of Rs. 1,50,000 only for the first 14 years, after which you are not required to deposit any amount. Your account will keep earning the applicable interest rate for the remaining 7 years or till it gets matured on your daughter’s marriage.

Documents Required – You need birth certificate of the girl child, along with the identity proof and residence proof of the guardian, to open an account under this scheme. You can approach any post office or authorised branches of some of the commercial banks to get this account opened.

You can check the rest of the features of this scheme from this post – Sukanya Samriddhi Yojana – Tax-Free Small Savings Scheme for a Girl Child

You can also download the application form to open an account from this post – Sukanya Samriddhi Yojana – Application Form & List of Banks to Open an Account. If you still have any query or something related to discuss, please share it here.

Sir agar me 1000 par year jama karunga toh meri 14 year baad kitni mechurety banegi plz rply

Maturity 21 saal baad hogi, 14 saal baad nahin.

Dear sir,

Thanks for ur co-operation.

Sir my doubt is , my daughter 8months old now, i will contribute the amount till14 years after that my duaghter gets married in the 19years old then we eligible to get the matured amount in 19years?

Yes, you’ll get the maturity amount as & when your daughter gets married.

Sir.

Meri beti 8 sall ki hai .1000 se act open kar ke usme jyada amoun v dal skta hu.18 hone ke bad mai usme se kitna amnount nikal skta hu.

Yes, aap is account mein Rs. 1,000 se zyaada amount bhi daal sakte ho. 18 saal complete hone pe 50% balance aap withdraw kar sakte ho.

First of all, thanks for sharing the details. My question is suppose I start this scheme with depositing 15ooo per annum. Now, is it mandatory to keep the amount constant OR depending on financial postion, I might increase/decrease the amount. Hope to hear from you.

Thanks Somnath,

It is not mandatory to deposit a constant amount every year, you can deposit whatever amount you like as per your comfort, subject to a minimum of Rs. 1,000.

Sir,

My doughter DOB is 27/05/2007,every month I want to invest

1000rs. I will do marriage for my daughter at the age of 22 year

(2029). So kindly tell me how much amount I will get at 2029,which

Is 15 the year from stating .

Regards,

Vijaya kumar

It will vary as per the rate of interest & time of deposit.

Dear sir, here any guarantee for maturity amount if i will deposit every year rs.1,50,000/. if yes tell me how much minimum.

It is a government of India scheme, so it is guaranteed. But, I cannot calculate what minimum amount you’ll get on maturity.

Meri batie 2-8-2013 ko hui ha mena 12-3-15 ko acount khol diya ha plz sir muja kab tak ja karna ha .monthlai ya yerli plz uski michyourti kini hogi

Aapko saal mein ek baar deposit karna zaroori hai, monthly zaroori nahin hai. Minimum Rs. 1,000 aur maximum Rs. 1,50,000 jama karwa sakte hain. 14 saal tak jama karana hoga aur 21 saal baad paisa milega interest ke saath mil jaayega. Jab bhi aapki beti ki shaadi hoti hai, to aapko saara paisa mil jaayega.

Sir Sukanya ki detal post office me koi nahi bata pa raha ha plz help

Vikasji, jahaan account khulna hai wo hi help nahin karenge, to aap bataiye hum kaise help karenge?

What are the document needed to open this a/c.

You need birth certificate of the girl child, along with the identity proof, residence proof & 2 photographs of the guardian, to open an account under this scheme.

my daughter is born on December 2007 how much i should pay and how many terms how much i will receive after maturity

You need to deposit a minimum of Rs. 1,000 & maximum Rs. 1,50,000 for 14 years. After 21 years, you’ll get the maturity amount depending on your contribution & rate of interest.

Dear Sir,

My daughter is new born. and if i invest in this scheme now. and this scheme is about 14 years. and the maturity will claim after 21 years. toh 14 years k baad account kaise rahega. active ya regular chalta rahega.

Regular chalta rahega till maturity i.e. 21 years or till your daughter gets married.

Sir mai agar a/c open karane ke baad agar parent expire ho jaye yaa beti hi expire ho jaye to in paiso ka kya hoga plz tell me

Agar beti ko kuch hota hai, to balance aapko mil jaayega. Agar Aapko kuch hota hai, to balance beti ko mil jaayega.

sir please tell me how you calculate the 14 years amount and 21 years amount.

sir please tell me how you calculate the 14 years amount and 21 years amount.

I’ve calculated it in excel, which I cannot show to you here.

Hello Sir,

Is there any time period given by GOV. to apply for this sukanya scheme or any suggestion from your side to enroll with this scheme. i.e. any financial year onwards we can use or engage with this scheme.

Regards,

SEEMA

Hi Seema,

There is no time period for this scheme. It will remain open throughout this year and in future as well.

OK, THANKS !

You are welcome!

hello sir,

i would suggest you to please add one more assumptions in your table i.e. you open the ssy a/c in the daughters birth year.

and a diclamer:

maturity amount will wary according to your dauhters age.

Hi Samkit,

Both your suggestions are welcome, but both of these are not required to be added here. Girl child’s age does not matter and also, it is not necessary to open this account in the birth year of the girl child.

I have 2 daughters and opened 2 SSA accounts. Please let me know if i can deposit 1.5 lacs (yearly deposit) per child or limit is overall 1.5 lacs.

Hi,

As per the wordings of the Circular – “the total money deposited in an account on a single occasion or on multiple occasions shall not exceed one lakh fifty thousand rupees in a financial year”. So, I think one can contribute a total of Rs. 3 lakh in two accounts. We will get further clarity on this in a few days time.

Thank you Sir.Please keep me informed if you get further clarity on this.

Sure, I’ll inform you.

Can I gate a agency for work with this ssy.

You need to contact post office for that.

ntpc bonus debenture issue please let me know how I can apply & weather I have to be a share holder of this company &weather I am eligible to get debenture if I purchase only 1 share today

Record date is March 23. You need to have its shares in the demat account on or before this date to be eligible for these debentures.

Hi sir

meri beti ki birth date 21 Feb 2009 hai agar main sukanya samridhi scheme me 1,50000 rs yearly deposit krti hu to Iska benefit kya hoga

Hi Jyoti,

Please check the table above, maturity amount as per the table is approximately Rs. 78,90,762. Ye amount aapko 21 saal baad milega, agar interest rate 9.1% rehta hai.

Sir, can I withdraw from this A/c or it will be in lockin period of 21 years.

Hi Prakash,

You can withdraw 50% of the balance as the girl child attains 18 years of age. The account will get matured after 21 years or when your daughter gets married, whichever is earlier.