I just ended up paying MCD property tax (also called house tax) for our residential property in South Delhi. As there were various links which I required to calculate the tax, make online payment, print the payment receipts and check previous years’ tax payments, I thought of writing this post to help property owners in Delhi in this process.

First of all, June 30, 2016 is the last date for availing 15% tax rebate benefit which MCD offers to the property owners in Delhi on lump sum tax payments. So, if you haven’t paid your property tax till date, do it now to avail this 15% rebate.

If you are paying your property tax for the first time, it might be a time consuming job for you. But, if you have gone through such an exercise in any of the previous years, then I think it should not take more than 5 minutes for you to do it again with the help of various links I am going to share here in this post.

3 Municipal Corporations in Delhi – As of today, Delhi has got divided into three municipalities – South Delhi Municipal Corporation (SDMC), North Delhi Municipal Corporation (NDMC) and East Delhi Municipal Corporation (EDMC). But, only SDMC and EDMC are allowing their residents to pay their property tax online. Due to its ongoing website maintenance work, NDMC has suspended its online payment facility for some time. But, residents falling under North MCD can still avail tax rebate by making their tax payments through the offline mode visiting the MCD office in their respective areas.

Know Your Jurisdiction – In order to calculate & pay your tax, you need to first know the municipality under which your colony falls. Here is the link to the website of MCD through which you can get to know your jurisdiction. As mentioned above, there are three municipalities in Delhi and you’ll find the list of colonies under these three zones – SDMC, NDMC and EDMC.

Calculating Property Tax – Here is the link to the Delhi Government’s website through which you can calculate and pay your property tax – Link.

Click on Calculate Your House Tax on the link pasted above and choose your municipality under which your area falls – South Delhi Municipal Corporation or East Delhi Municipal Corporation. You will find various terms & conditions listed there, which you can read if you have time to do so. Just check the T&C box there and click on the tab to pay your property tax for the current financial year 2016-17.

Property ID – For you to pay your property tax online, you need to have a Property ID or Ledger Folio Number, which gets provided by the respective municipal corporations to their residents. You can find your Property ID on your previous years’ property tax challans/receipts.

However, even if you don’t have a property id or ledger folio number, you can still pay your tax directly through these links – SDMC, NDMC and EDMC.

UPIC Cards – To make the process easier, SDMC had started allotting Unique Property Identification Codes (UPIC) to the property owners in December 2015. While making your property tax payment this year, you’ll find an additional charge of Rs. 35 for a UPIC card. These UPIC cards will be issued to you this year and get delivered to your address in the coming days.

Use Factor & Property Tax Rates – Now you need to enter your Property ID in the space provided and it will take you to the page where you need to enter your personal details and property details. Residential and self-occupied properties will attract lower tax and commercial and let out properties will attract higher tax.

Also, you’ll have to pay a higher tax if your property falls in a posh urban area as compared to a rural area. Colonies/Areas have been categorised in eight different categories, from A to H, based on their locations and amenities available around. Property owners in Category A areas will have to pay a higher property tax as compared to Category B areas and likewise.

Here are the links to find the Use Factors and Property Tax Rates as per the end use of the property and its location – SDMC, NDMC and EDMC.

Finally, the property tax you need to pay will depend on the Annual Value of your property. Here is the formula for calculating the annual value:

Annual Value = Covered Area * Unit Area Value * Age Factor * Use Factor * Structure Factor * Occupancy Factor

Don’t get intimidated with this formula. You are not required to memorise this formula or do any manual calculations. You just need to put some basic details of your property and the system will do the harder work on its own. It will calculate the annual value, the amount of rebate, online payment rebate and all other figures as soon as you provide the inputs.

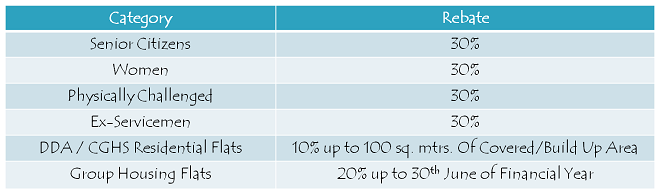

30% Rebate to Senior Citizens, Women, Physically Challenged & Ex-Servicemen – There are certain tax rebates which these corporations offer to certain categories of property owners. Here is the table having those categories of property owners:

Once the tax gets calculated, you just need to select the payment method and pay the tax and you are done. After the tax is paid, you’ll be asked to close the page as soon as possible. But, you would like to have a receipt/acknowledgement for the tax payment made. Don’t worry, here is the link to print your payment receipt – Payment Receipts Link

I hope this post makes it easy for you to pay your property tax online in Delhi. Please share it here if you have any query regarding property tax calculation or its payment or if you have any suggestion to make it an easier process for the property owners in Delhi.

I have paid excess payment to EDMC on line last year 2016-17 due to my own fault.Bank prove is available.Please help me how can i refund or adjust this year 2017-18 property TAX.After received EXCESS PAYMENT MCD did not informed me. Sir kindly help me to get back my old due.THANKS .

I have paid excess payment to EDMC on line last year 2015-16 due to my own fault.Bank prove is available.Please help me how can i refund or adjust this year 2016-17 property TAX.

Year 2017-18 house tax of sea flats which date deposited in paschim cigar ward 58 20.03.2017

I have paid excess payment to EDMC because they told me wrong amount and didn’t tell how to calculate house tax now they denied to refund so please could you tell me how can i get refund

I am leaving in a house of about 150 Sq.yard along with my elder brother family. The dais property is an ancestor property since 19o3. The build up area on ground flour and first flour is about 60 sq yd and 45 yard respectfully. Due to dispute between me and my brother family we could not renovate the same . Now the building is being very old more than 50 yr. and is giving us problems. Now we are planning to renovate the necessary repair to make leving condition by dividing front half to my brother family and back half to my self.

Kindly let me know the house Tax rule for both of us.

How can I pay previous years tax online.

How to pay property Tax arrears for 2 previous years for a residential builder floor purchased and registered in 2013. Property Tax has been paid for this property up to 2013-14.

Help me to tax my property

Pl. let me know how to get Property tax receipt of F.Y 2016—2017 in respect of my residential Floor no.3 , house no. 44 ,west zone , Janakpuri, property record no. 240440511390 . UPIC no. Not yet received. Property tax of Rs. 7130/-was paid on line on 17/6/2016.

I have owned my property since 2011, but need to pay property taxes for past years. How do I pay for past years. I am using the following link. It allows me to pay only for 2016-17.

http://www.mcdpropertytax.in/ptsdmc/intProperty.php

Thanks.

Hi,

Thanks for your article on Delhi MCD tax payment. It was quite helpful.

I have a query and I hope if you could provide me your insights to it. One of my relative owns a property in North Delhi and due to death of the important family member, they were not able to pay property taxes for past couple of years. They tried to pay arrears online but the online portal is not showing up any Arrears. It is showing amount for current FY only.

What should they do to pay the arrears?

Thanks

Anchit

to pay property tax on line for the year 2016-2017

My name vashnavi pandey

I live in khajuri colony

Someone pls help in knowing the process of how to get the house tax receipts of the last 2 financial years

PLEASE GO TO MCD WEBSITE. YOU ENTER YOUR PROPERTYID TO PAY TAX AND THEN AFTER THE PAGE OS OPENED YOU WILL SEE A HEADING IN THE NAME OF RECEIPT /PAYMENT.

YOU CAN GET RECEIPT OF ANY YEAR FROM THAT

pls tell me the covered area allocated for Nizamuddin West ND, then i can fill the form. or pls help area 200sq meters, Nizamuddin WESt, built in 1968. two floors and one barsati floor with a room 10X12 appx thats all self ocupied , senior citizens, how much will the tax be per floor, or for the whole house, then i can come & meet u thanks

tel 09815328802, 9013300649

property tax receipt against 2016-17 deposited on 3.5.2016 in East Delhi is not generated.

Property Tax Receipt against 2017-18 deposited on 29/06/2017 in South Delhi paid by debit card is not generated.

How can I pay previous years tax online.

I have been paying the property tax every year timely. I have received a notice from mCD that I have not paid. I have then submitted the the last 5 years receipt and am awaiting reply. But there is no responce.

How to follow up ? I am going to be 80 years and every time going to the office at Sangam Cinema is very tedius.

CAN YOU OR ANYONE GUIDE OR HELP?

NOW MCD HOUSE TAX HAS STARTED A SYSTEM OF UPLOADING THE PREVIOUS RECEIPTS SINCE 2004

SCAN ALL RECEIPTS AND UPLOAD YOURSELF ONLINE

You won’t get the ans of this question as it the main issue and you will need to go mcd office of your area and there you will be asked to pay bribe.

I have been filing property tax online for many years since they first issued the password and property ID. First time they gave me all the property information on paper and since then I have been using the same to file tax online. Its easy and quick. I avoid going to the office and standing in line.

i dont have ledger number

this is an old property of my parents in moti nagar allotted at the time of partition in exchange of what they left behind in pakistan( rehabilitation)

what will be the category ? group housing

the web page is not accepting and telling me to fill this column in line 1

Hi ish,

Moti Nagar falls under Karol Bagh Zone and it should be Category E as per this link – http://mcdonline.gov.in/tri/ndmc_mcdportal/colonylist.php

You should use this link to fill your property details, Property ID is not mandatory here – http://www.mcdpropertytax.in/ptndmc/intProperty.php

#Niveza #Review on MCD Property Tax ::

Paying your property tax in Delhi isn’t as cumbersome or annoying as you may think it is. The Municipal Corporation of Delhi (MCD), has made it really simple to make payments through their online portal. The department has been trifurcated into the North Delhi Municipal Corporation, East Delhi Municipal Corporation and South Delhi Municipal Corporation to ensure smooth and easy transactions, and to lower the burden of administration that falls on just one department.

Source :: http://goo.gl/8ouwrg