This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

Demonetisation has resulted in a problem of plenty for the Indian banking system. Most banks are flushed with excess liquidity and have drastically reduced their deposits as well as lending rates. With such steep rate cuts, it is getting difficult for the conservative investors to park their money in safer investment options offering higher rate of interest.

In such a falling interest rate scenario, Muthoot Finance is launching its issue of non-convertible debentures (NCDs) of Rs. 1,400 crore from today. Muthoot is offering coupon rates of 8.25% to 9.25% for different maturities ranging between 400 days to 96 months having both Secured, as well as Unsecured NCDs. The issue is scheduled to remain open for a month to close on February 17.

Here are the salient features of this issue you should consider before taking a decision to invest or not:

Size of the issue – Muthoot Finance plans to raise Rs. 1,400 crore from this issue, Rs. 1,300 crore by issuing its Secured NCDs and Rs. 100 crore by issuing its Unsecured NCDs. Base size of the issue is Rs. 200 crore and the company will have the option to retain oversubscription to the tune of Rs. 1,400 crore, including the green shoe option of Rs. 1,200 crore.

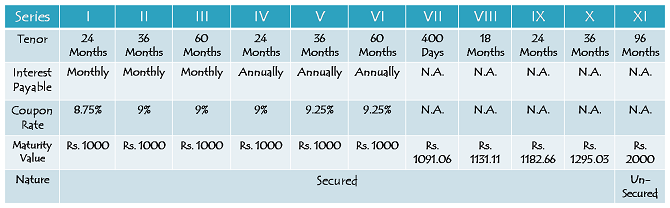

Coupon Rates – As interest rates have been falling with most of the fixed income investments, like fixed deposits, company deposits, NCDs etc., Muthoot has also decided to reduce its interest rates across maturities. These NCDs will carry coupon rates in the range of 8.25% for 400 days to 9.25% for 36-60 months. Series I-X will all be Secured NCDs and Series XI will have Unsecured NCDs.

Double your Money Option – Series XI NCDs will offer cumulative interest option and will earn you a 100% return on your investment in a period of 8 years or 96 months. It would translate to an effective yield of 9.06% per annum. But, NCDs issued under this option are ‘Unsecured’ in nature, thus carry a slightly higher risk than Secured NCDs.

You can check the rates offered for different maturities and different payment options from the table below:

Coupon Rates for Institutional Investors – Institutional investors will get 0.25% lower rate of interest on their investments with Secured NCDs and 0.15% lower for Unsecured NCDs.

Categories of Investors & Allocation Ratio – The investors have been classified in the following three categories and as always, each category will have certain percentage fixed for the allotment:

Category I – Qualified Institutional Buyers (QIBs) – 20% of the issue is reserved i.e. Rs. 280 crore

Category II – Non-Institutional Investors & Corporates – 10% of the issue is reserved i.e. Rs. 140 crore

Category III – Individual Investors, including HUFs – 70% of the issue is reserved i.e. Rs. 980 crore

NCDs will be allotted on a first-come first-served basis in all these categories.

NRI/QFI Investments – Non-Resident Indians (NRIs), foreign nationals and Qualified Foreign Investors (QFIs) among others are not allowed to invest in this issue.

Ratings & Nature of NCDs – CRISIL and ICRA, the two rating agencies involved in this issue, have assigned ‘AA/Stable’ rating to the issue, indicating the issue to be safe as far as timely payments of interest and principal investments are concerned. All these NCDs are ‘Secured’ in nature, except NCDs issued under option XI which offer to double your money in 96 months.

Demat Account Mandatory – Muthoot has decided to issue these NCDs compulsorily in demat form. So, if you don’t have a demat account, you won’t be able to apply for these NCDs.

Listing on BSE – Muthoot has also decided to list its NCDs only on the Bombay Stock Exchange (BSE). Allotment as well as listing of these NCDs will happen within 12 working days from the closing date of the issue.

Taxability & TDS – Interest earned on these NCDs will be taxable as per the tax slab of the investor. However, as these NCDs will be allotted compulsorily in your demat accounts, no TDS will be deducted from your interest income.

Minimum Investment – Minimum investment in this issue has been fixed at Rs. 10,000 i.e. 10 NCDs of face value Rs. 1,000 each.

Should you invest in Muthoot Finance NCDs?

Muthoot Finance is a prominent name in the business of gold financing. But, a strong US economy, a stronger dollar against most global currencies, falling gold prices, falling interest rates here in India, competition heating up among lenders here and demonetisation, all these factors make me believe that business environment will be tougher for the gold financing companies going ahead.

Moreover, gold finance business is relatively riskier as compared to the housing finance business. NCD issues by DHFL, Indiabulls Housing Finance and Reliance Home Finance carried interest rates in a similar range as Muthoot is offering. So, if I have to invest my money with Muthoot, I would seek a higher return as compared to the rates it is offering in this issue of NCDs. I think conservative investors should give this issue a miss and wait for some better issues to invest their money.

Application Forms – Muthoot Finance NCDs

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in Muthoot NCDs, you can contact us at +919811797407

Pl send details . Is it safe to invest in mothol ncd

Is it safe to invest in Muthoot finance NCD. Please advise ???

Shiv – Could you pls share your views on the Apr’17 NCDs issue by Muthoot Finance?

What is the allotment date of Muthufinance NCD-2017 ??

I applied for 1000 bonds on the first day. (Jan 17, 2017). But I was allotted ZERO. Something fishy. What actions to take?

Investment In this Moothut NCDs is safe for retired person @ the age of 70 as he don’t have other income sources pls suggest

Hi Monika,

Muthoot issue is getting closed today and it is of no use to invest in it now as it is already oversubscribed in the individual investors category. Moreover, a person of 70 years of age should invest in government schemes rather than private issuers.

In current scenario, where should a non-senior but prematurely retired person invest, keeping in mind Tax-Efficiency (I am in 20% bracket), convenience, liquidity & pre-maturity encashment convenience?

My possible alternatives are:

1) GOI 8% Bonds,

2) POST OFFICE NSC

3) Kisan Vikas Patra

4) Tax Free Bonds

5) Equity MF’s

6) Debt MF’s.

7) Post Office MIP Scheme.

Have already holdings of Tax Free Bonds & FD’s.

Hi S.K.,

Given the requirements above, if the investor can take risks, then Equity MFs are the best investment option in the present scenario, followed by Tax-Free Bonds, Debt MFs, GoI 8% Bonds, Post Office MIS, NSC and KVP.

Retail investors should not subscribe to this issue now onwards. It should close by tomorrow.

Hi Shiv, when is the ECLfinance NCD expected? Any more NCDs lined up?

Hi Kumar,

Only ECL Finance issue is lined up as of now and its dates are yet to be announced.

Day 1 (January 17) Subscription Figures:

Category I – Rs. 50 crore as against Rs. 280 crore reserved – 0.18 times

Category II – Rs. 39.79 crore as against Rs. 140 crore reserved – 0.28 times

Category III – Rs. 1,458.87 crore as against Rs. 980 crore reserved – 1.49 times

Total Subscription – Rs. 1,548.66 crore as against total issue size of Rs. 1,400 crore – 1.11 times

today’s subscription figures please I think already overscribed

will skip !!

Wise decision I think !!

Does Icici direct offer this NCD to apply online? I checked but could not find..

Hi Pavan,

Not sure whether ICICI Direct is servicing Muthoot NCDs or not. Please check it with ICICI Direct itself.

Yes.. ICICI is dealing with NCD’s. I have bought with ICICI direct couple of years before.

Generally the link for NCDs are opened on the day issue opens, so one may not be able to see it till that time. But, I am not sure whether ICICI offers it or not. One of the members in his reply has confirmed it.