This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

Mahindra Logistics is entering the primary markets with its initial public offer (IPO) of Rs. 675 crore. The issue is getting opened for subscription from today, October 31 and will remain open for three days to close on November 2. This IPO is a 100% offer for sale (OFS) and hence, the company will not get any money out of this IPO for its further expansion.

The company has fixed its price band in the range of Rs. 425-429 a share and no discount has been offered to the retail investors. The offer would constitute 27.17% of the company’s post-offer paid-up equity share capital.

Here are some of the salient features of this issue:

Size of the Issue – As mentioned above as well, this IPO is in the form of an offer for sale (OFS) of 1.93 crore shares, out of which 96.66 lakh shares have been offered by the promoter Mahindra & Mahindra Limited (M&M), 92.71 lakh shares by its shareholders Normandy Holdings Limited and 3.95 shares by Kedaara Capital AIF 1. This makes it a Rs. 675 crore IPO at the upper end of the price band i.e. Rs. 429.

Price Band – Mahindra Logistics has fixed its IPO price band to be between Rs. 425-429 a share and the company has decided not to offer any discount to the retail investors.

Retail Allocation – 35% of the issue has been reserved for the retail individual investors (RIIs), 15% for the non-institutional investors (NIIs) and the remaining 50% shares will be allocated to the qualified institutional buyers (QIBs).

No discount for Retail Investors – The company has decided not to offer any discount to the retail investors. But, a discount of Rs. 42 a share will be offered to the employees of the company.

Bid Lot Size & Minimum Investment – Investors need to bid for a minimum of 34 shares in this offer and in multiples of 34 shares thereafter. So, a retail investor would be required to invest a minimum of Rs. 14,586 at the upper end of the price band and Rs. 14,450 at the lower end of the price band.

Maximum Investment – Individual investors investing up to Rs. 2 lakh are categorised as retail individual investors (RIIs). As a retail investor, you can apply for a maximum of 13 lots of 34 shares each @ Rs. 429 a share i.e. a maximum investment of Rs. 1,89,618. At Rs. 425 per share, you can apply for a maximum of 13 lots of 34 shares, thus making it Rs. 1,87,850.

Listing – The shares of the company will get listed on both the stock exchanges i.e. National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) within 6 working days after the issue gets closed on November 2nd. Its shares are expected to get listed on November 10th.

Here are some other important dates as the issue gets closed on November 2:

Finalisation of Basis of Allotment – On or about November 8, 2017

Initiation of Refunds – On or about November 9, 2017

Credit of equity shares to investors’ demat accounts – On or about November 9, 2017

Commencement of Trading on the NSE/BSE – On or about November 10, 2017

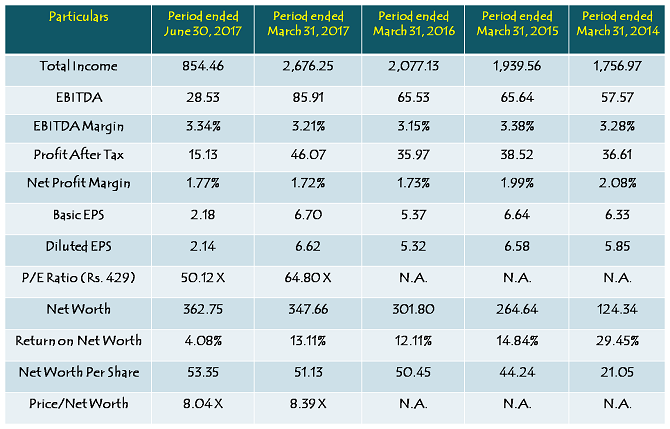

Financials of Mahindra Logistics

(Note: Figures are in Rs. Crore, except per share data & percentage figures)

Should you invest in Mahindra Logistics IPO or Not @ Rs. 429?

During the financial year 2016-17, Mahindra Logistics reported total revenues of Rs. 2,676.25 crore and profit after tax (PAT) of Rs. 46.07 crore as against Rs. 2,077.13 crore and Rs. 35.97 crore in the previous financial year, thereby generating a net profit margin of 1.72% in 2016-17 vs. 1.73% in the previous year. At Rs. 429 a share, the company is valued at 64.80 times its reported diluted EPS of Rs. 6.62 for the financial year 2016-17 and 50.12 times its annualised diluted EPS of Rs. 8.56.

The company is running its business with some wafer thin profit margins and they have been on a declining trend since FY 2013-14. During FY 2013-14, it reported profit margins of 2.08%, which have fallen to 1.72% in FY 2016-17. The company reported 29.45% as return on net worth (RoNW) during FY 2013-14, which has fallen to 13.11% in the previous year. Despite operating in such low margins business, I think seeking a multiple of 50+ times is not justified. I think it is the market euphoria which is making these companies price their issues on a higher valuations than what they deserve.

The valuations Mahindra Logistics is seeking are on a higher side for me to invest in this IPO. But, given its unique business model, there is a huge scope for the company to improve on its profitability and margins. I’ll wait for the company to report healthier financials going forward before investing my money for it to grow further. Till then, I’ll just wait and watch.

will it get better profit gain in mahindra logistic ipo

Thanks Shiv

Skipping this.Surprising that Logistics is such a high growing sector for past 3-4 years yet Mahindra has not done remarkably well.

I agree Harinee, they should have done better. Probably, competition has taken its toll on the company. However, most Mahindra group companies are not doing well over the past few years and I think it is due to their weak managements. I think it is high time for Anand Mahindra to revamp its operations.

Hi Shiv, Thanks very much for your review, however will there be any listing gain in this IPO ?

Hi Ninad,

Listing gains depend on the pricing of the IPO, as well as market sentiment on the listing day. Given its valuations are rich, listing gain will depend on the sentiment on the day it lists.