I’ve wanted to write about the New Pension Scheme (NPS) a lot sooner, but never got around to it. Reader Gaurav sent me some great material on it, and got me started.

The stuff that he sent me was an entire post in itself, but I thought I’d add to it, and create a comprehensive post on the New Pension Scheme.

First off, you can call it New Pension Scheme, National Pension System, New Pension System or NPS, anything you like. They’re all the same; I’ve seen different articles call them different names, so that might get a bit confusing, but you’ll soon get used to it.

Next up, some of the things this post will address, are:

- What is the New Pension Scheme?

- What are Tier I and Tier II accounts in the NPS?

- What are the three categories in the NPS?

- Fees and Expenses related to the NPS?

- What is the minimum amount needed to invest in the NPS?

- What are the tax implications of NPS?

- How can I open a NPS account?

- Why hasn’t this become popular?

What is the New Pension Scheme?

The NPS was introduced by the government last year to give people a way to get a pension during their old age. Employees of the government sector already get a pension, so this scheme was introduced as a social security measure that enables people from the unorganized sector to draw a pension as well.

The working mechanism is quite simple – you contribute a certain sum every month during your working years, which is then invested according to your preference. You can then withdraw the money when you retire, which is currently set at 60 years old.

When I say you invest according to your preference, I mean that there are a couple of different options that you need to select from. These options pertain to your preference on withdrawal, and asset allocation.

What are Tier I and Tier II accounts in the NPS?

The NPS is meant to be a pension scheme, so it is geared towards giving you a steady stream of income on your retirement.

That means that NPS makes it difficult to withdraw your money during your working years or till the age of 60 in this case.

Tier I and Tier II are two options under the scheme where you can invest your money, the primary difference between them is how they differ in allowing you to withdraw your money before retirement.

NPS Tier I

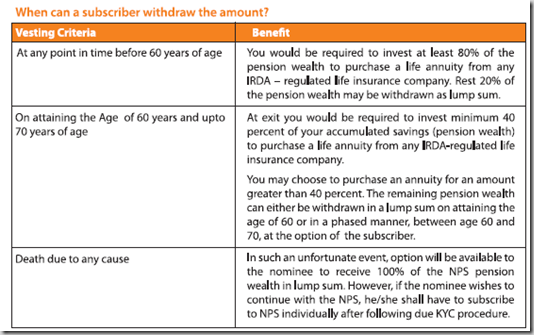

There is severe restriction on withdrawing your money before the age of 60, because it is necessary to invest 80% of your money in an annuity with Insurance Regulatory Development Authority (IRDA) if you withdraw before 60. You can keep the remaining 20% with you.

When you attain the age of 60, you have to invest at least 40% in an annuity with IRDA; the remaining can be withdrawn in lump-sum or in a phased manner.

Here are the details of how your money can be withdrawn in a NPS Tier I account.

Death is another way of getting the money, but that might come in the way of other plans you have.

NPS Tier II Account

The first thing about the NPS Tier II account is that you need to have a Tier I account in order to open a Tier II account.

The Tier II account makes it easy for you to withdraw your money before retirement because there is no limit on the withdrawals you can make from the Tier II account.

You need to maintain a minimum balance of Rs. 2,000, and you can transfer money from the Tier II account to Tier I account, but not the other way around.

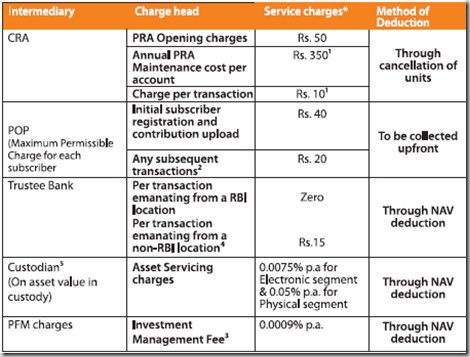

There is a Rs. 350 CRA (Credit Record Keeping Agency) charge which is not present in the Tier II account, but the rest of the fees remain the same.

Asset Allocation and Categories in the NPS

There is an Active Choice option, and an Auto Choice option. If you select Auto Choice then your money is invested in a certain percentage in the various classes based on your age.

Here are the three investment classes:

| Class | Risk Profile | Description |

| G | Ultra Safe | Will only invest in Central and State government bonds. |

| C | Safe | Fixed income securities of entities other than the government |

| E | Medium | Investment in equity related products like index funds that replicate the Sensex. However, equity investment will be restricted to 50% of the portfolio. |

In the Active Choice you can select how much of your money will be invested in the different classes with a cap of 50% in Class E.

Now, there are pension funds that will manage your money, and in either of these options you have to select the fund manager who will manage your fund. So even if you select the Auto Choice, you still have to tell them which fund manager you want to manage your money.

Fees and Costs related to the NPS

I talk about expenses a lot here, and the expenses on the NPS are really low. The annual fund management charge is 0.0009%, which is probably the lowest in the world.

There are some other expenses associated with the NPS, but as you will see all of them are quite low as well. Here is a list of the other expenses.

What is the minimum amount needed to invest in the NPS?

For a Tier I NPS account you need to contribute a minimum of Rs. 6,000 per year, and make at least 4 contributions in a year. The minimum amount per contribution can be Rs. 500.

Minimum amount for opening Tier II account is Rs. 1,000, minimum balance at the end of a year is Rs. 2,000, and you need to make at least 4 contributions in a year.

What are the tax implications of NPS?

The revised Direct Tax Code proposes to make the NPS tax exempt at the time of withdrawal. Initially NPS was going to be taxed at the time of withdrawal, and that had put it at a disadvantage to other products like ULIPs and Mutual Funds. But the revised code proposes it to be exempt from tax, and that really adds to its lure.

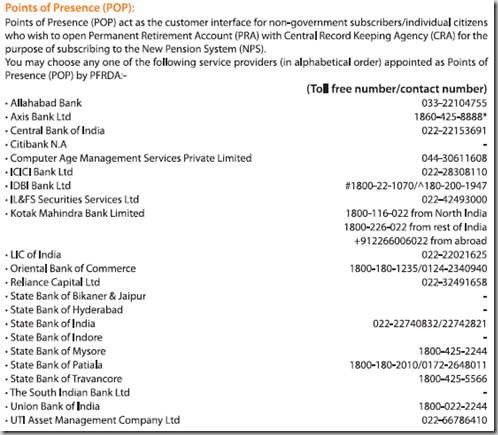

How can I open a NPS account?

You can open a NPS account by going to the bank branches of the banks that are authorized to sell this.

Conclusion

This is quite a good option for people who wish to invest for their retirement, and the government has done good to come up with such an option. It is still early days for the scheme so there are going to be some teething troubles, and I am sure you have come across several articles that write the NPS off completely, or suggest major changes.

While it has not gained in popularity the way you would’ve expected with the low cost structure, a primary reason of that is there is no real incentive for anyone to push this to consumers, so it has not gained any real traction.

That being said, the scheme is a good initiative, and given enough time, the chinks should be ironed out in its favor.

As a final word – a big thank you to Gaurav who sent me all the material, and pushed me to write about the NPS. Thanks Gaurav!

I am born in 1958 dec.How much should i invest in nps pa to get 15000 pm.

you are born 1958 and will compleate 60 yrs in 2018 so you have still 7 years of contribution . you need 15000 pm so 180000 per year .

you will have to have a corpus of 18,00,000 with a return of 10% per year

to get 15000 pm so invest 2,57, 000 or 21400 per month for 7 years to accumulate 18 lacs

assuming 10 % is on bit higher side but simple for you to understand . as yo are likely to get around 8 to 9 % (considering some 10 % investment in equity) ALL THE BEST and best part you cant withdraw till 60 yrs

Dear Manshu Ji

IIT Roorkee is a Central Govt. Institute giving pension benefits to all its emplopyees at par with Central Govt. Employees. It has also arranged opening of account for new entrants who are below the age of 55.

The question is whether I am entitled for NPS benefits or not as I have joined after the age of 55. IIT has no objection to allow me NPS benefits subject to rule framed under NPS. Please clarify with exact ruling.

Dear Sir – I do not know of an age restriction. Could be that I am not completely aware of some detail, but as far as I know there is no exclusion on the basis of age. You can see this page which has list of exclusions but age is not a factor here.

http://pfrda.org.in/faqdetails.asp?fid=228

Iam central government employer can i join in the NPS Scheme. please detail me

Yes, in fact for new joinees NPS is compulsory instead of the old PF as far as I know. Have you joined the government service recently or do you already have a PF account going?

My date of birth is 12.05.1954. I have joined IIT Roorkee as Assistant Registrar since 13.10.2010 much after attaining the age of 55. Earlier I had worked with a GOI Undertaking and I am also getting pension from EPFO. Can I avail the benefit of NPS.

Sorry I don’t know the answer to that. What account has IIT Roorkee opened for you though? Since NPS is present for new govt. joinees they would have opened one for you if they fall under the government.

And nothing stops you from doing it on your own, but in that case there won’t be a match from your employer which is what I think the implicit question is.

I got very useful information about NPS. In some previous comments it was mentioned that the scheme can be made through CAMINDIA. If it is subscribed through them, what are the options to make regular premium payments?. Are they authorized SOP? Is there any other option for NRIs?

Thanks

I guess opening an account through ICICI Direct will be a convenient option for NRIs since it is online.

What is CAMINDIA ?? pl. abbreviate

it is good scheme for non govt.employes and i think i will got good plan for future security

It is a nice write up.

Pl. add to it about govt. contribution to the account. like Amount, %age, Duration, Time of credit, max. / min. limits,etc.

Also add about Return On Investment.

Thanks.

Thanks for your feedback – I’ll incorporate that in a future post I guess. As far as the returns are concerned that depends on how the underlying funds perform, so there is no fixed number for that.

I would like to join this scheme

You will have to contact a bank or use ICICIDIRECT to enrol in the scheme.

what happen if i stop payment to nps after 5 years

Tier 2 money can be withdrawn, but you’ll have to wait before you get the Tier 1 money.

Pls. send me more the details for NPS and which bank is better in service.

Based on all the comments here I’d say that ICICI Bank seems to be the one which has better service with respect to this product Vaibhav.

Hi,

I am little worried about putting 40% of your corpus, at maturity, in the annuity schemes which gives just 4-5%. Is there any annuity schemes where we can select the funds? Are there any annuity schemes which gives more than 8% returns?

Thanks

There aren’t a lot of great annuity products right now, but given the longish time frame (at least for most people), and the fact that you can open a Tier 2 account without any restriction – you can open a Tier 1 account with a min balance, and establish a Tier 2 account for most of your funds Raj.

Please can you let me know whether this NPS scheme is allowed for Overseas Citizens of India.

Thanks

NRIs can invest who have Indian passport. I don’t know for sure if people holding OCI cards can invest or not.

hi,

i was having an NPS account in place of my pf account as it was enforced to all the new joinees in india post at the time but i worked there for nearly 5 months and an amount of approximately 1500 rs was deducted every month towards NPS or PF now i have quit that govt job and is working in a private organisation but now that account is not operative and the amount is in pending state so what can be done with that can i continue with that or that money is wasted.

Your money is not lost Sumit. You can continue the account yourself. Actually this scheme is in fact for people who want to invest and save for retirement on their own.

is there any change in NPS coz i have heard that what we r giving the money only that will be considered for saving not the same money given by govt.

That doesn’t sound right. There are some additional tax benefits which are good, but what you’re saying about govt.’s part not being considered – that doesn’t sound right, and I haven’t heard anything like that.

VERY USEFULL INFORMATION FOR EVERY ONE,THANKS DR.SHETTY.

plese send information of NPS scheme

NPS CORPUS CALCULATOR

we can approximately plan a corpus by following following link and putting our figures of contributions

http://www.camsonline.com/PensionSystemServices.aspx

Great – thanks for the link!

Thanks for the link. Though I have one from ICICIDirect, I’m planning to have one for my spouse. Any feedback on CAMS customer service?

any one who wants to open can find this link useful just put details online and send adress proof documents to CAMS branches all over india http://www.camsonline.com/PensionSystemServices.aspx

NPS – ONE OF BEST SCHEMES for those who are working independently/ professionals , enterpruners , jobholdres in private . INindia we dont have govt support in old age and this is only scheme which one can start in india at age of 20 yrs and continue till 60 yrs and is great scheme beacuse WE CANT WITHDRAW . its everyones experiennce that we all invest origianny for retirement but do withdraw for higher education of children, health expences or marraige of kids . NPS invests in equity , corp bonds and g ove sec as per age and hence its ONE OF BEST SCHEMES for everyone . awareness is not much beacuse agents/ bank dont earn anything on this but once people are aware this will pick up

i have opened online today with icicidirect and with 25000 per month contribution i should get 48 to 50 lacks in 10 yrs to take care of me after 60!

Thank you for your comment Dr Shetti.

Hi,

Its an informative article. There has not been enough publicity to push this product. Recently I went to one of the PoPs (ICICI Bank) for information and how can I open an account for this. I experienced that the staff is completely unware of this. I did not even a find person who can help me out.

I also called up to LIC Pension Fund office, learned that LIC is no more a fund manager for this scheme.

I find lots of chaos at the moment. A scheme is successful only if it is implemented properly. The scheme deserves lot more attention.

Can any one let me know if you have an NPS account and how did you open.

any one who wants to open can find this link useful just put details online and send adress proof documents to CAMS branches all over india http://www.camsonline.com/PensionSystemServices.aspx

Thanks dr shetti – did you follow this procedure yourself? What happens after one sends the documents?

i have satrted via icici direct its very easy and convnient no need to submit any documents .however one recieved only letter from CRA and not PRAN CARD . with cams they have 194 branches allover india where u can submit documents . in any case CAMS AND ICICI DIRECT are best for NPS

Hi,

I subscribed via ICICIDirect.com ( already had an account for MF/Stock) and found no issues subscribing for the NPS through the same.

-Chris