This is a guest post by CA Karan Batra, Accounting and Tax Consultant based in New Delhi.

Mutual Fund Charges

We all know that investing in equities through mutual funds is a great option for an individual as mutual funds not only employ professional management but also have experience of investing in equities and are a safer and better bet as compared to directly investing in equities which have an inherent risk element attached with them.

A mutual fund employs highly qualified management, keeps a regular tab on the stock markets, buys and sells equities on our behalf and does everything to ensure that our money is put to best use while ensuring its safety. But what do mutual funds get in return for these services, in other words – how do mutual funds earn?

Many people have this feeling that it doesn’t matter how mutual funds earn till the time our money is growing in mutual funds. But the fact of the matter is that these mutual funds earn through your money only and mutual fund charges are an important factor while deciding whether to invest or not to invest in a specific mutual fund.

Let’s first have a look at the types of fees charged by mutual funds and then I’ll summarize the impact of these charges.

Types of Charges

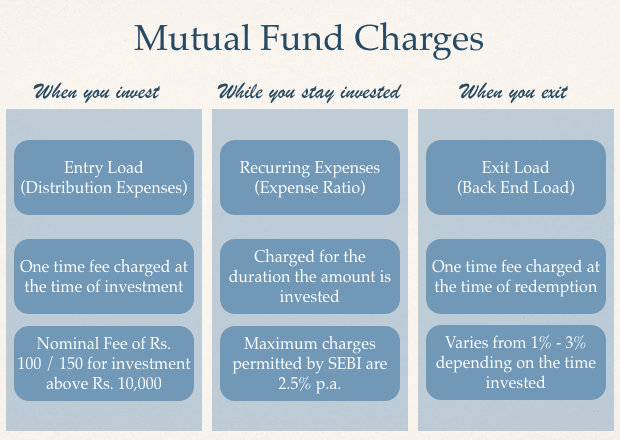

There are 3 types of fees which are charged by the mutual funds and these are explained below:

- Entry Load

- Exit Load

- Recurring Charges

ENTRY LOAD – DISTRIBUTION EXPENSE

As the name suggests, this fees is charged by mutual funds at the time of investing in the mutual funds. However, this fee does not go into the pockets of the Asset Management Company and is rather paid as distribution fee to the mutual fund agent through which the investor has applied for subscription.

Prior to August 2009, different funds used to pay different amounts as commission to the agent which could sometimes be as high as 2.5% as well. However, in Aug. 2009 SEBI abolished any entry load to be collected by AMC’s to be paid to agents but this didn’t go well within the industry as agents who usually do a lot of marketing and selling on behalf of the company weren’t compensated for their services as a result of which they were not actively working and promoting mutual funds.

Several representations were made by AMC’s in the year 2010 and 2011 to allow them to collect Entry Load as the whole industry was suffering because of this norm and finally in August 2011, SEBI allowed AMC’s to collect Entry Load but limited this fee to a very nominal amount. The maximum fee permissible to be collected as entry load by AMC’s wef August 2011 is as follows

| Particulars | Investment Amount | Commission Payable |

| First Time Investor | Less than Rs. 10,000 | Nil |

| More than Rs. 10,000 | Rs. 150 | |

| Existing Investor | Less than Rs. 10,000 | Nil |

| More than Rs. 10,000 | Rs. 100 |

In case of Systematic Investment Plan (SIP), where the total commitment towards the SIP is more than Rs. 10,000, a transaction charge of Rs. 100 will be levied payable in 4 equal installments starting from the 2nd to the 5th installment.

Points to be noted with respect to Entry Load

- This entry load is payable only in case the investment is made through an agent. In case of direct application being received by the AMC, no entry load is to be collected.

- This fee has to be properly reported in the mutual fund statement. For e.g. – If you are a first time investor and have made an investment of Rs. 20,000, you would be liable to pay Rs. 150 as entry load and your statement should report all these facts as:

- Gross Investment                                                20,000

- (Less) Entry Load                                                 __150

- Net Investment                                                       19,850

As the Net Investment received by an AMC is only Rs. 19850, you would be allocated Mutual Fund units for this amount only and not for the whole Rs.20,000

- Although these charges are collected by the AMC but are payable to the mutual fund agent and you are not liable to pay any other charges to the Mutual Fund Agents.

RECURRING CHARGES – EXPENSE RATIO

Recurring Charges are the charges which are collected by the AMC for professional portfolio management services provided to the investors. An AMC employs highly experienced and qualified staff whose prime concern is to take care of your investments and for providing such services the AMC collects fees which is also referred to as Expense Ratio.

There are a number of expenses which are incurred by AMC’s which have been mentioned below:

| 1. Fund Management Fees | At the discretion of the AMC subject toSEBI Guidelines |

| 2. Marketing/ Selling Expense | |

| 3.Audit Fees | Based on Actual Expense |

| 4.Registrar Fees | |

| 5.Trustee Fees | |

| 6.Custodian Fees |

Over and above these above stated expenses which are incurred on an annual Basis, AMC’s also incur expense at the time of New Fund Offer. To encourage individuals to invest in a mutual fund, an AMC incurs many onetime marketing expenses at the time of launch of the mutual fund. SEBI has prescribed a maximum ceiling on such expense being 6% of the total net assets and these expenses are amortized over a period of 5 years.

However, SEBI has prescribed the maximum expense that may be charged by the AMC and they are based on the Average Weekly Net Assets of the AMC:-

| Average Weekly Net Assets |

Percentage Limit |

|

|

Equity Scheme |

Debt Scheme |

|

| First Rs. 100 Crore |

2.50% |

2.25% |

| Next Rs. 300 Crore |

2.25% |

2.00% |

| Next Rs. 300 Crore |

2.00% |

1.75% |

| On the Balance Assets |

1.75% |

1.50% |

Assuming that an equity scheme generating 15% returns has net assets of Rs 100 crore, with the operating expense ratio at 2.50%, the effective return would be 12.5% (i.e. 15-2.5). Operating expenses are calculated on an annualized basis and are normally accrued on a daily basis and the NAV so computed is shown after deducting these Recurring Expenses.

EXIT LOAD

These are the charges which are liable to be paid in case an investor exits a fund before a specified time frame.

Mutual Funds have a long term horizon and invest with a long term view. However, if a large number of redemption is applied for within a short period of making the investment, it spoils the total corpus available with the mutual funds as a result of which they may have to make necessary changes to the whole portfolio.

To discourage investors from withdrawing funds within a short period, almost all mutual funds charge exit load of 1-3% based on the time within which an application for redemption is filed. They are usually in brackets of 6 months, 1 year etc. and the lower the time frame – the higher would be the exit load. There is no standard exit load fees charged by these AMC’s and it varies from scheme to scheme and is disclosed in the prospectus of every scheme.

Exit Load is also referred to as Back-End Load and the maximum fees that can be charged by Mutual Funds for premature withdrawal is 7%. However, most Mutual Funds charge exit load in the range of 1-3% depending on the time duration for which the funds were invested.

Mutual Fund Fees as a Deciding Factor

From this discussion it is clear that mutual funds charge recurring fees based on its asset base with the charges getting decreased as the fund corpus increases. Thus as the asset size increases, the expenses charge also decrease which would directly impact the NAV of a mutual fund scheme.

Please note that these are the maximum expense ratios permitted by SEBI and the actual may be a bit lower.

Although these charges keep changing from year to year, note that a difference of 1% expense ratio between 2 funds may turn out to be a difference of 10-15% over a period of 10 years. Moreover, it is also highly advisable to keep an eye on the exit load charged by these AMC’s while comparing two funds as different funds charge different exit loads.

This post was from the Suggest a Topic page.

Hi

I would like to know if the yearly recurring expenses are still charged if the funds are making losses ( negative growth) as is the case now. Most of my s except debt funds are making losses.

Thanks for your help

Bhuvanesh.

Please suggest some fund for investment. I wish to invest 6k pm as a SIP. Thanks

Mutual fund me invest Marne Ke liye agent ko kitna comission milta he

Hi, I have a doubt on the Commission Payable if amount invested is greater than Rs.10,000.

Suppose i invest Rs. 5000/- each in 2 different schemes at the same time through online(direct scheme), Will they charge me Rs.150 (or Rs.100) as Commission Payable charges. Please explain.

As far as I know, this commission is payable only if you invest more than 10 K and through an agent. And not if you invest, any sum, in a direct scheme, online or otherwise (filling paper application form).

wow… this is what i want….! thanks a lot..

I just came across this article..I read all the comments..

Here is my take on MF expenses and fees..

Case1: If the fund returns are more than 15% , expense ratios of 2% seems less .. Because your net return is more than the returns from traditional investments like PPF ( on average 8% with excellent tax benefits)

Case2: if the fund returns are around 7-8% then expense ratio of 2% is a lot..it can create huge impact on your corpus..as the market matures its not so easy to generate 15% returns consistently..if I am getting 8% returns with lot of risks ..it doesn’t make sense to put your money in MFs..

unfortunately in India we dont have very good index funds.. so many MFs lose money than make money..

just my two cents..

Hi,

I have invested 1 lakh in March 2012 with Max New York Life through Axis bank. At the time of contracting it, they told me I can withdraw any time with 1 or 2% cancellation fee. Now, I needed the money and they told me I cannot withdraw till after the completion of 5 years. Is that correct? If so, why did they tell me I can withdraw any time with a cancellation fee?

The answer to your query is, whenever you a buy a policy from any insurance company, it comes with a 5 year lock-in period. This unables you to withdraw money from the policy or to surrender it before compeltion of 5 policy years. If you have any query about the porduct you have bought from Max New York life, you can contact me am an employee with the company.

sir i m investing a sum of rs 7000 monthly through sip ,sir whether my investment is good or not tell me

Hi Team,

I am a new candidate in the mutual fund class. I want to go with 1000 as a sip for 10 & 15 yrs respectively. Could you please confirm on the funds that i need to choose.

I dont want to take much risk with my capital. Please help me.

Regards,

Sameer

I have a question

I want to start investment of abt 5000 in Mutual funds thru SIP for say 20 years.

I have been studing various websites on mutual funds, SIP calculators etc.

In all the SIP calculators, they ask for expected rate of return on mutual fund. What is this rate of return ?Is is same as the rate of return mentioned on the mutual fund website. For example HDFC too 200’s rate of return is say 20 % . How do I exactly calculate the amount that I ll fetch after 20 years from now by considering a rate of return say 20 %

Please help me . I am very much confused.

Minu – Mutual fund returns are based on how well the stock market performs, and how well the stock market will perform in the next 20 years – no one knows.

In absence of that – people make guesses based on the performance of last 20 years or 10 years or something like that and that’s why these tools don’t put in a rate themselves but ask you to put a rate based on your guess.

20% for 20 years is very very high, and it is very unlikely you get that kind of return. Something like a 10% will be a better number I guess but then again that’s my guess.

If you want returns with certainty (without any risk) then I think it is better for you to do a RD or a bank FD.

Please feel free to ask any questions that you may have.

I really appreciate for highlighting the crux. Good advice.

Bisvas, according to me you did good selection. Slight changes need. Reliance Growth currently not performing well. Hence if you avoid that then it is better idea. Instead of UTI Dividend yield, choose HDFC Top 200 fund then it is better choice. About portfolio review, yes you need to review it on yearly base but when you notice any downgrade in performance after 3-5 years means no need to change. Because funds you chose are good, may be due to market conditions they may under perform. As you are investing through SIP route and your goals are long term so no need to worry. Under DTC which may effective soon, ELSS is going to be out as tax saving option under Section 80C (not sure because it is still recommendation). Hence for time being i suggest you to avoid ELSS for your long term goals. Hope I cleared your doubts to the extent. Happy investment !!! 🙂

I have following selection of MF by SIP

HDFC Children gift fund

HDFC Growth fund

Reliance growth fund

FT Bluechip fund

UTI Dividend yield

Please can you advise whether this is good or any changes to be made and whyso?.

Two doubts please:

If I hav these, I know I hav to stay put for long for which i am ready, i am supposed to review once a year. In case of some downgrowth after 3-5 years, is it advisable to switchover or hold on till the long term goal.

If I have these selection of funds, should I go for ELSS for pure 80 C purpose or no

Thanks

As DTC is not implementing next year, go for ELSS, this FY and next FY.

ELSS is one of the best instrument with dual benefits, tax deduction under 80C with minimum lock in period (3 years) among other tax saver options and all tax free income after 3 years.

Only risk is, it is equity based, but when you are investing in mutual funds then why not in ELSS.

Karan Sir,

Sorry, I know that this is not a right place to ask you this question here, but on knowing that you are a CA, I could not control myself to ask it.

I want to know, how much interest earned from a bank account/instrument (like savings account or FD) is exempted from income tax, as my office tax personal says it is nil while in a post in this blog says that interest upto 10000 is tax exempted.

Please clarify.

Saumya, from the coming financial year upto Rs.10,000 interest you earn from savings account (only) is exempted. But interest what you earn from FDs are taxable as usual under the head of “Income from Other Sources”.

Karan, Thanks for the article.

I would like to have clarification on the Entry Load (Distribution Expense) in case of SIP. Is that the total committed amount which is considered (say SIP of 1000 Rs for 60 months = 60,000 > 10000) or total SIP investment in an year (1000 * 12 = 12000 > 10000).? If it is yearly SIP investment is what is accounted, the distribution fee of 100Rs will be deducted every year?

Arun,

There are no entry load now but transaction charges if opted by the distributor.It works in below manner:

Rs.100 is levied as transaction charge per subscription, for investment above Rs.10,000. No charge can be made for investments below Rs.10,000, though. An additional sum of Rs.50 (hence, a total of Rs.150) can be charged to first-time mutual fund investors.

However, no transaction charge would be levied on transactions other than purchase subscriptions relating to new inflows and direct transactions with the mutual fund house. For systematic investment plans (SIPs), transaction charges can be recovered in 3 or 4 installments. Hence, Rs.20 to Rs.25 can be deducted every month if the SIP is over Rs.1,000 per month. The transaction charges are in addition to the existing eligible commissions that are permissible to the distributors.

>> There are several ingredients that make a dish …. …Mutual Fund Expense Ratio is just 1 ingredient.

Please correct me if I’m wrong and pardon my brusqueness here. How would you feel if you were to make the perfect lamb curry and I were to add less than a pinch of saw dust to it and claim that that’s what makes your lamb curry perfect? Though the analogy isn’t perfect here, crediting the phenomenal success of a fund to its low expense ratio is akin to claiming that my saw dust is the magic ingredient that makes your curry special. Just as your phenomenal curry recipe will easily drown any unsavory taste that the small amount of saw dust might be bringing in, so too the stellar performance (13 – 18% CAGR) of a fund will easily dispel any talk of the meager 2.5% expense ratio of other funds being a reason for their mediocre performance.

>> Similiarly, Mutual Fund Expense Ratio is just 1 ingredient but relying solely on this would be a mistake and ignoring this ratio despite knowing about the same would be a blunder.

Comparing expense ratios of funds makes sense if you’re considering two NFO’s and are forced to invested in one of them. But investing in an NFO itself doesn’t carry any more of a potential reward than investing in an existing one does. Among those who haven’t realised this fact yet , the MF industry finds this expense ratio argument an easy sell — reason why they say a fool and his money are soon parted!

At the very least, monitoring this expense ratio is a distraction.

>> Pick a fund which is a consistent performer and you get a low enough exp. ratio.

The larger a fund gets, the lower *should be* its expense ratio — as mandated by the regulatory body. At any rate, it cannot exceed 2.5%

>> How is exit load calculated in case of SIP ?

Any money SIP-ed in 365+1 day ago would not carry a load; the rest would be saddled with the prescribed load — *I’d imagine*.

“The larger a fund gets, the lower *should be* its expense ratio” I see this is indeed the case.

>> If I put down a list of things to be considered before buying a fund, past performance, alpha, std dev, other ratios, performance history in a bull/bear market etc. where would you peg expense ratio in order of priority?

If your consideration of “past performance” is based on the fund’s NAV, then you could safely omit the expense ratio from the list of things to be considered. A fund’s NAV is computed AFTER factoring in the expense ratio. This means… say you find a fund that has given a CAGR of 20% over the last 10 years…. it doesn’t matter if the expense ratio was 0.25% or 2.5% or 25%; your money has appreciated at a 20% CAGR over the last 10 years — that’s an undeniable fact. Whether it’s *because of* the low 0.25% expense ratio or *in spite of* the 2.5% high expense ratio is for academicians to debate.

Thanks Ranga and Karan. See what you mean. Did some digging around and see precisely what you mean:

Pick a fund which is a consistent performer and you get a low enough exp. ratio.

@ S Rangan

There are several ingredients that make a dish and absense of any one of them makes the whole dish useless. It is always the perfect combination that should be taken into account.

Similiarly, Mutual Fund Expense Ratio is just 1 ingredient but relying solely on this would be a mistake and ignoring this ratio despite knowing about the same would be a blunder.

So it is always a combination that matters.

Informative article, Thanks.

How is exit load calculated in case of SIP ?

Usually entry will for applicable when you redeem within one year. Each SIP is considered as single investment. So, whichever SIP not completed one year then exit load will affect it. You can say first in first out(FIFO) applies for SIP

If I put down a list of things to be considered before buying a fund, past performance, alpha, std dev, other ratios, performance history in a bull/bear market etc. where would you peg expense ratio in order of priority?

I find the best funds usually have high or highest expense ratios. Personally I can live with an expense ratio related underperformance of 10% over 10 years. Can you give an example of how bad choice of funds wrt expense ratios adversely affects a portfolio?

Why are the expense ratios of Indian index funds (except NPS) nearly the same or only marginally lower than actively managed funds? In the US the index fund ratios are quite low.

Expense Ratio is only one of the criterion while deciding whether to invest in a fund or not.

And you are right, that there some funds which have a marginally higher expense ratio but are earning a good return. They are charging a higher expense ratio mainly because they have the bext management and at the end of the day, if you are getting a good return – I’m sure you wont mind a higher expense ratio.

But this is possible only for previously launched mutual funds. For NFO’s we cant say anything regarding how the performance of the Mutual Fund is going to be and that is where the Expense Ratio plays a major role.

The expense ratio for all mutual funds in india is almost the same to stay competitive in the market