This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

Sukanya Samriddhi Yojana has received a great initial response from the general public. As the scheme offers 9.1% tax-free rate of interest, investors are finding this scheme to be extremely attractive and want to invest in it as soon as possible. They also need handholding to invest in this scheme. But, due to lack of required information with the post offices and authorised bank branches, people are finding it difficult to do so.

I have posted two articles about this scheme and both have received over hundred comments from the visitors. I have been getting many queries regarding the maturity value of this scheme. People want to know the value of their investment as the scheme gets matured after 21 years.

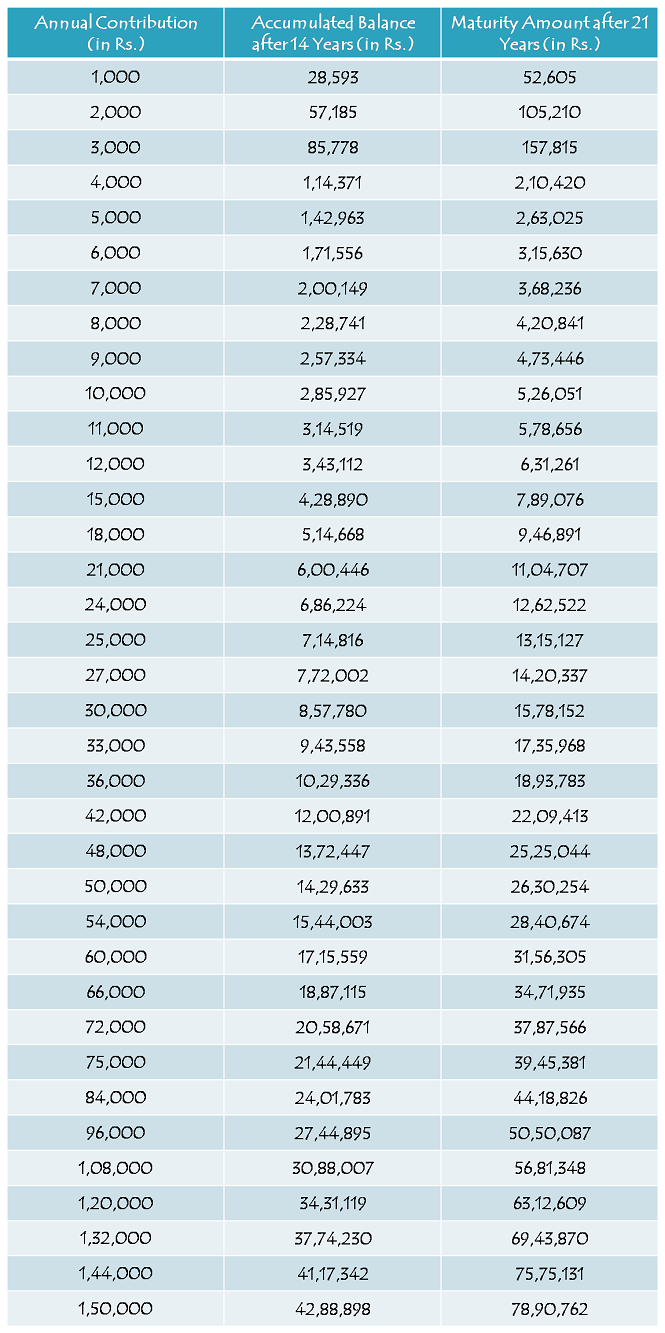

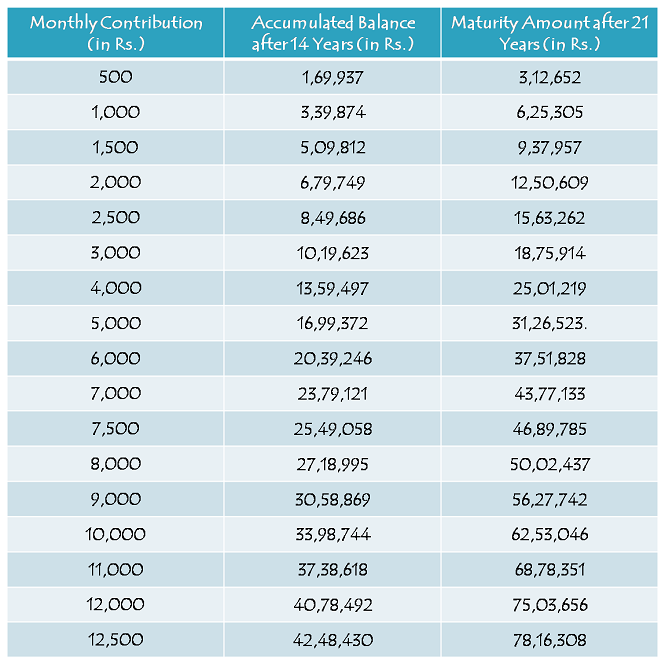

Though it is almost impossible to calculate a precise maturity value of this scheme as there are many variables on which its maturity value will depend, I have tried to make a couple of tables in which the maturity value has been calculated keeping those variables to be constant and yearly & monthly contribution to be the only variable.

Certain assumptions have been made for calculating these maturity values and those assumptions are:

* Rate of Interest has been assumed to be 9.1% for all these 21 years.

* Yearly contributions have been assumed to be made on April 1 every year i.e. the beginning of the financial year.

* Monthly contributions have been assumed to be made on 1st day of every month.

* Although it is not mandatory, a fixed amount of yearly/monthly contribution has been assumed.

* It is also assumed that no withdrawal is made throughout these 21 years.

Here you have the tables:

Yearly Contribution Table

Monthly Contribution Table

I hope these two tables help people in deciding how much amount they would like to contribute to this scheme in order to achieve their girl child’s marriage and/or higher education goals.

Before you go ahead and plan to get an account opened, I would like to again highlight the main features of this scheme:

Who can open this account? – Parents or a legal guardian of a girl child up to the age of 10 years, can open this account in the name of the girl child. Up to December 1, 2015, one year grace period has been provided to allow this account to get opened for a girl child who is born on or after December 2, 2003.

9.1% Tax-Free Rate of Interest – This scheme offers 9.1% rate of interest, which has also been exempted from tax in this year’s budget. But, this rate is not fixed at 9.1% for the whole tenure and is subject to a revision every financial year.

Scheme Matures in 21 years or on Girl’s Marriage, whichever is earlier – The scheme gets matured on completion of 21 years from the date of opening of the account or as the girl child gets married, whichever is earlier. Please note that the girl attaining the age of 21 years has no relevance to maturity of this scheme.

Deposit for 14 years only – You need to deposit a minimum of Rs. 1,000 and a maximum of Rs. 1,50,000 only for the first 14 years, after which you are not required to deposit any amount. Your account will keep earning the applicable interest rate for the remaining 7 years or till it gets matured on your daughter’s marriage.

Documents Required – You need birth certificate of the girl child, along with the identity proof and residence proof of the guardian, to open an account under this scheme. You can approach any post office or authorised branches of some of the commercial banks to get this account opened.

You can check the rest of the features of this scheme from this post – Sukanya Samriddhi Yojana – Tax-Free Small Savings Scheme for a Girl Child

You can also download the application form to open an account from this post – Sukanya Samriddhi Yojana – Application Form & List of Banks to Open an Account. If you still have any query or something related to discuss, please share it here.

VERY VALUABLE INFORMATION BY YOU SIR PLEASE SAY IF UNFORTUNATLY DAUGHTER AND PARENTS GET DIED THEN WHAT ABOUT MONEY COZ THER IS NO PROVISION FOR NOMMINEE

Thanks Santosh,

In case of a mishappening with the girl child as well as the parents, the legal heir(s) will get the balance amount.

dear sir,

i have approched sbi branch but they are refusing to open the account and say they don’t have guidelines. please guide how to know which branches of which bank can open the account.

thank you .

We are also trying to get the list of bank branches where these accounts are getting opened. I’ll update these posts whenever I get to know about it.

Sir, my baby is 3 Montb old. How can i apply for this scheme. My job is transfer based. So can i continue this from different post offices.

Yes, you can open this account for your daughter. Also, you can transfer this account from one post office to any other post office or bank branch.

Is there a TDS on maturity ammount?

As the interest income is tax-free, there is no question of any tax getting deducted.

Dear Sir,

I have opened the SSY account (in Post Office) on 18-03-2015 with initial balance 1.5 Lacs. I will be depositing yearly 1.5 Lacs every March for 14 years. Below care my queries (Please Consider the interest 9.1%)

1) I deposited at the end of financial year 2014-15 so when shall I get the interest. Is it in March 2015 (for 14 Days-from 18-03-2015 to 31-03-2015) or in March 2016 (Full 12 months interest).

2) If I get interest in March 2015 then it will be only for 14 days (From 18-03-2015 to 31-03-2015) which means I lost the interest rate of another 351 days (11.5 moths) right?

2) Did I made a mistake by depositing early. Do you think that I should have deposited in April 2015 to get full interest benifit.

3) can you send me the calculation considering March deposit with 9.1% Interest

Thanks in advance

Hi Harsh,

1, 2 & 3. Interest will be cumulative & payable on maturity. Also, I think interest will be calculated as per the PPF rules.

Hi Shiv,

Plz help me to understand,

1> how is this scheme better than investing in LICs n others…

2> can we open account in april 2015? as some say 31st is the last day for it in Post office ( as currently available in Post off only).

plz clarify…

Hi Vishal,

1. I don’t want to create a controversy by comparing LIC plans with this scheme. But, I can categorically say that any insurance plan is not good from investment perspective. It is better to have a term plan for insurance and equity/debt mutual funds/PPF/Tax-Free Bonds/Sukanya Samriddhi Scheme for your investments.

2. Yes, you can very well open this account next year. There is no last date as such for opening this account.

Hi sir,

Samajo Maine saal main 1000 rupies bharake 14 saal main 14 hajar deposit kiye to as per 9.1 % interest muze around 21 saal ke bad around 50 ya 60 hajar milenge. Par what about value of that 50 or 60 thousands rupies after 20 years. It may be same as 14 thousands.

Hi Nilesh,

The government will try to keep the interest rate at 2-3% above inflation. So, keeping inflation and tax-free interest in mind, this scheme is still better than FDs or other taxable instruments. It is a known fact that the money loses its value with high inflation.

Sir My daughter DOB is 31/05/2005 kya me ye scheme apni beti ke leye joint kar shakta Hu.? What is the locking periods after 14 year of premium of this schemes.between my doughter’s marriage.Please telling about me.

Rajeshji, appki beti is scheme ke liye eligible hai. This scheme will mature at the time of your daughter’s marriage or 21 years from the account opening date, whichever is earlier.

sir,agar kuch Saal ham Monthly 3000 jama karte hai Aur bad me monthly 1000 jama kiye to chalega kya

Hi Musa,

Bilkul chalega.

Sir new paper m to aya tha ki 1000 per year diposit 14 year tak karne par 21year m 6 lack rs ayege

Sir

My daugter DOB is 5 jul 2004 .can i open this sukyana yogana a/c no .and how many amt i deposite in first time.

Yes, your daughter is eligible for this scheme. You can deposit any amount up to Rs. 1.5 lakh.

Sir

Kya ye plan sabhi states me lagu h. Maine Bihar mr quirey kiua to kisi v post office me pta nahi lga .mai bakk me v gya per wo v is plan ke bate me kuch nhi bta paye.so please do nacessary advice.

Yes, ye scheme sabhi states mein shuru ho gayi hai.

i would like to deposit 1000 per month whenever i have more money can I add that amount for the monthly installment. My daughter age is 7 years old if i invest 1000 how much can i get.

Yes, you can do so.

Dear sir

My sister date of birth is 21/07/2000

Can I invest money in this scheme pls

Explain me.

Regard

Prabhakar tikhe

No, she is not eligible for this scheme.

Sir my elder daughter’s born date 25-03-2004 can you tell me she is eligible for this scheme

Yes, she is eligible for this scheme.

sir , my daughter is 9 years old if i deposit premium for 14 years ,what will be the maturity period because by that time my daughter will be 23 years old please clarify

Date of Maturity would be 21 years from the date of opening this account or when the girl child gets married, whichever is earlier.

dear sir

mujhe is scheeme ke baare me poori jaankari

chahiye Hindi me or isse juda koi helpline no. thank you

Asharamji, hamein helpline no. ke baare mein koi jaankaari nahin hai. Hindi mein jaankaari ke liye is Circular ko check keejiye – http://www.indiapost.gov.in/dop/Pdf%5CCirculars%5Csukanya_samriddhi_SB_Order_2.pdf

Sir I have two daughters one is 4 years old & second is 3 months old can I deposit one time payment 150000 . Is it best for my daughters

Yes Jasmeet, you can deposit Rs. 1,50,000 at one go. Moreover, you need to decide if this scheme fits best with your financial goals.

Meri beti 9 sal ki hai 6000 rs sal me bharne ke bad 21 sal pure hone per kitne rs milenge

Vinodji, is post ko check keejiye – http://www.onemint.com/2015/03/09/sukanya-samriddhi-yojana-calculating-maturity-value-after-21-years/

Is post ki table ke according maturity amount Rs. 3,15,630 milega.

Sir i want to know that after 21years total amount girl hi niklwa sakti hai ya only patents hi niklwa sakte h and girl ko after 21year ke baad identified kaise kerenge

Manishji,

Girl child is account ki owner hai, so maturity amount girl child ko hi milega.