This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

Sukanya Samriddhi Yojana has received a great initial response from the general public. As the scheme offers 9.1% tax-free rate of interest, investors are finding this scheme to be extremely attractive and want to invest in it as soon as possible. They also need handholding to invest in this scheme. But, due to lack of required information with the post offices and authorised bank branches, people are finding it difficult to do so.

I have posted two articles about this scheme and both have received over hundred comments from the visitors. I have been getting many queries regarding the maturity value of this scheme. People want to know the value of their investment as the scheme gets matured after 21 years.

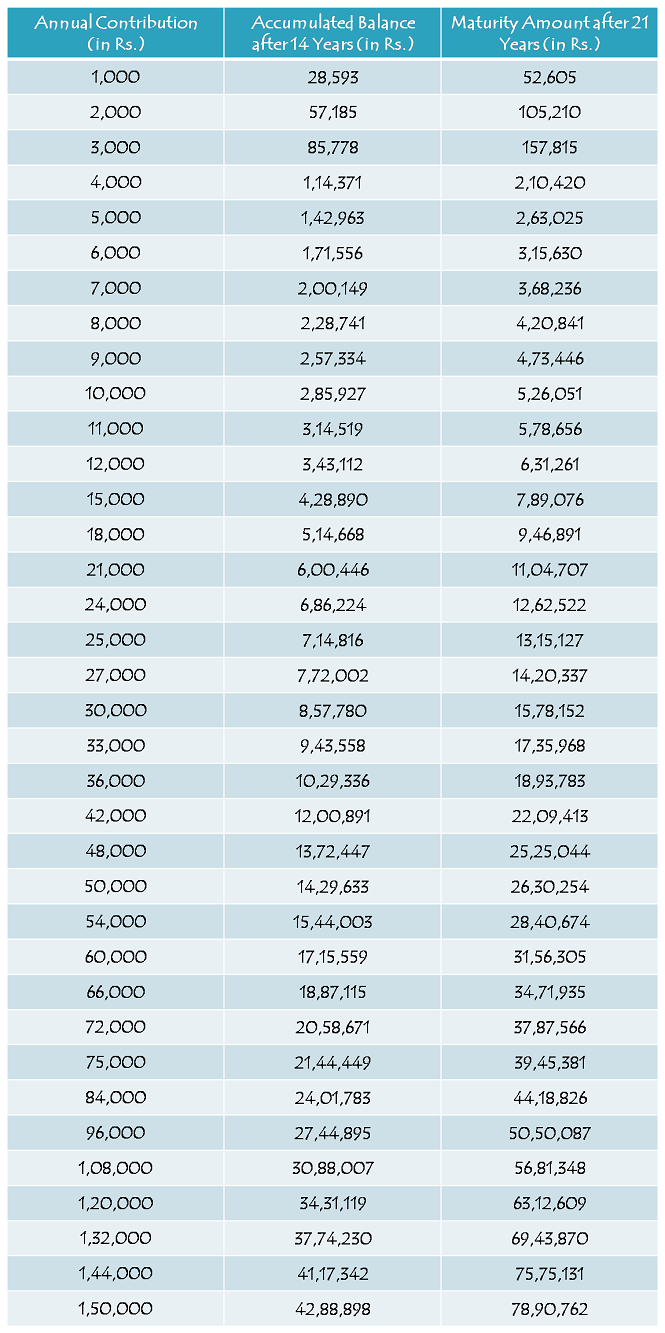

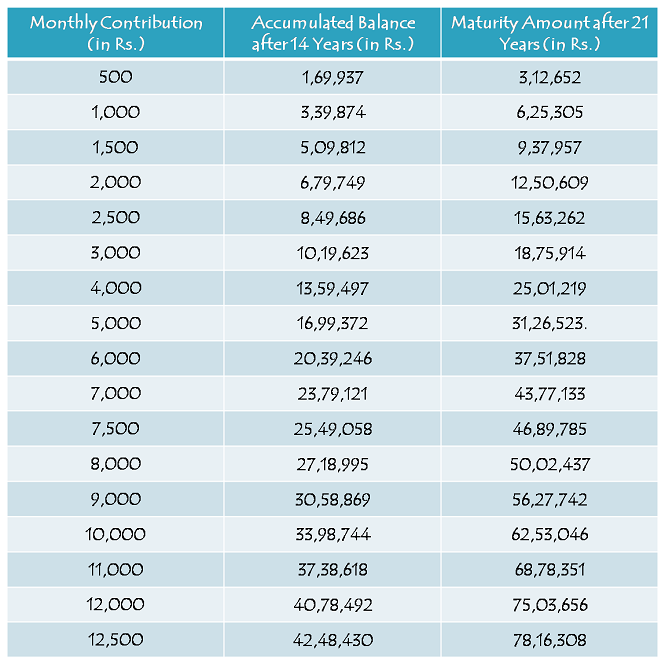

Though it is almost impossible to calculate a precise maturity value of this scheme as there are many variables on which its maturity value will depend, I have tried to make a couple of tables in which the maturity value has been calculated keeping those variables to be constant and yearly & monthly contribution to be the only variable.

Certain assumptions have been made for calculating these maturity values and those assumptions are:

* Rate of Interest has been assumed to be 9.1% for all these 21 years.

* Yearly contributions have been assumed to be made on April 1 every year i.e. the beginning of the financial year.

* Monthly contributions have been assumed to be made on 1st day of every month.

* Although it is not mandatory, a fixed amount of yearly/monthly contribution has been assumed.

* It is also assumed that no withdrawal is made throughout these 21 years.

Here you have the tables:

Yearly Contribution Table

Monthly Contribution Table

I hope these two tables help people in deciding how much amount they would like to contribute to this scheme in order to achieve their girl child’s marriage and/or higher education goals.

Before you go ahead and plan to get an account opened, I would like to again highlight the main features of this scheme:

Who can open this account? – Parents or a legal guardian of a girl child up to the age of 10 years, can open this account in the name of the girl child. Up to December 1, 2015, one year grace period has been provided to allow this account to get opened for a girl child who is born on or after December 2, 2003.

9.1% Tax-Free Rate of Interest – This scheme offers 9.1% rate of interest, which has also been exempted from tax in this year’s budget. But, this rate is not fixed at 9.1% for the whole tenure and is subject to a revision every financial year.

Scheme Matures in 21 years or on Girl’s Marriage, whichever is earlier – The scheme gets matured on completion of 21 years from the date of opening of the account or as the girl child gets married, whichever is earlier. Please note that the girl attaining the age of 21 years has no relevance to maturity of this scheme.

Deposit for 14 years only – You need to deposit a minimum of Rs. 1,000 and a maximum of Rs. 1,50,000 only for the first 14 years, after which you are not required to deposit any amount. Your account will keep earning the applicable interest rate for the remaining 7 years or till it gets matured on your daughter’s marriage.

Documents Required – You need birth certificate of the girl child, along with the identity proof and residence proof of the guardian, to open an account under this scheme. You can approach any post office or authorised branches of some of the commercial banks to get this account opened.

You can check the rest of the features of this scheme from this post – Sukanya Samriddhi Yojana – Tax-Free Small Savings Scheme for a Girl Child

You can also download the application form to open an account from this post – Sukanya Samriddhi Yojana – Application Form & List of Banks to Open an Account. If you still have any query or something related to discuss, please share it here.

Hi sir , my daughter birthday is 23.7.2008….If I opened account with monthly 1000 in year.Then upto which year I have to deposit the same and which is the maturity year..???

You need to deposit money for 14 years. So, if you open this account now, then you’ll have to contribute to this account till 2029. Maturity year will be 2036 or whenever your daughter gets married, whichever is earlier.

DEAR SIR I HAD ALREADY OPENED PPF ACCOUNT FOR MY DAUGHTER. CAN U SAY ME WHICH IS THE BEST PLAN IN PPF ACCOUNT OR SUKANYA SAMRIDHI YOJNA.

I think Sukanya Samriddhi Yojana is better than PPF.

To mai jo amount deposit karunga usper hi mujhe intrest milega na.

Yes

1000 per month ka account hai

agar hum ise aane wale samay me kuch jyada amount nahi dal sakte hai

ya apana premium amount 2000 se 3000 tak kar sakte hai ya nahi

Kam se kam Rs. 1,000 daalna zaroori hai, zyaada bhi daal sakte hain.

Mere bitiya ka date of birth hai 27th September 2003

kya mai sukanya samriddhi yojna ka account betiya ke nam se dal sakta hu

Ajayji, aapki beti is scheme ke liye eligible nahin hai.

Meri beti ka birth 31Mar15 ka hai.abhi uska naam nahi rakha gaya hai to kya mujhe wait krna hoga.kya mai kisi mahine 1000 kisi mahine 2000 ya jyada ker sakta hu.ya phir jis amount se maine shuru kiya hai wahi amount hi jama karna hoga.

Yes, aapko naam decide karne tak wait karna hoga. Aap amount change kar sakte hain.

my daughter age 8 years i am open that account how age (daughter) will give the full maturity benifit

Shaadi ke time aapki beti ko declaration dena hoga balance amount withdraw karne ke liye.

sir pls remove my mail id I was getting notification daily it was my official mail id…I request you pls help…

You can do that yourself Mohsin. Check this line with a link in your mail – “To manage your subscriptions or to block all notifications from this site, click the link below”.

Respected Sir,

I have one doubt.

If i can’t deposit money regularly for 14 years or in case of any death of father or daughter occurs, then what happens?

Please kindly clarify my doubt.

In case of death of the depositor, the girl child can withdraw the whole balance or continue funding the account. In case of girl child’s death, the depositor can withdraw the whole balance. In case you don’t deposit money in a financial year, the account will become inactive.

Hi Sir,

Actually my daughter stays with her mother and i don’t have her photograph, Inorder to open the account is that mandate to have her photo also please advise can we deposit the monthly amount at any date of the month or the date should be consistant for every month. Kindly advise…

Hi Mohammed,

Girl child’s photo is not required. You can deposit money on any date of the month or year.

If I had to pay fix amount on fixed dates annually or is there any flexibility on opening account with Rs.1k

There is a complete flexibility of depositing money. The total amount in a financial year should not be less than Rs. 1,000.

Could we open an account of girl having dob 2/06/2003

No, girl child having DoB 02/06/2003 is not eligible for this scheme.

Sir

Can we dopsit first month rs 2000 and next month rs 8000?

Yes Anuj, you can do that, though it is not a monthly deposit scheme.

my daughter is 9 years old now.i have todeposit for 5 years from today or 14 years

Hi Ajay, you need to deposit money for 14 years.

Sir I would like to ask you about depositing monthly would.be.beneficial or lumpsum amount of say 1 lac.If monthly what should.be the ideal.date of depositing the.amount in sukanaya account.How they.calculate.interest?

If invested at the start of the financial year, then lumpsum investment is better. Interest calculation will be similar to the PPF interest calculation method, so it is best to deposit money between 1st and 5th of evry month.

Sir, if my daughter is married before 21 yrs, will she get full maturity amount as after 21 yrs

No Dinesh, you’ll get money as per the balance in the account and not what you are supposed to get after 21 years.

Sir meri beti ka date of barth 4-11-2004 hai kya mai acount khulba sakta hu

Yes Manoj, aap ye account khulwa sakte hain.

?? ???? ???? ?? date of barth 4-11-2004 ?? ?? ?? acount ????? ???? ??

Sir,

Rate of interest for this scheme is 9.1% this year.can u tell what will be the minimum ROI throughout the scheme.

Also,Is there any alternative scheme better than this?

For FY 2015-16, rate of interest has been hiked to 9.2% – http://www.onemint.com/2015/04/04/post-office-small-saving-schemes-fy-2015-16-interest-rates-ppf-8-70-sukanya-samriddhi-yojana-9-20/

There is no minimum ROI set for this scheme. I have no idea if there is any other alternative better scheme available.

Meri beti 12/4/2015ko 6 Mah ki ho jayegi mujhe kis palan ko lena cahiye.

Aapko is scheme mein invest karna chahiye.