This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

Last Year’s Post – Post Office Small Saving Schemes – FY 2015-16 Interest Rates – PPF @ 8.70% & Sukanya Samriddhi Yojana @ 9.20%

In a move which could disappoint many small savers here in India, Finance Ministry today decided to reduce interest rates on many of its small saving schemes, including Public Provident Fund (PPF), Sukanya Samriddhi Yojana (SSY), National Savings Certificate (NSC) and Senior Citizen Savings Scheme (SCSS) among others. These rates will be effective April 1, 2016 and will be subject to a quarterly revision based on a new formula to determine these rates.

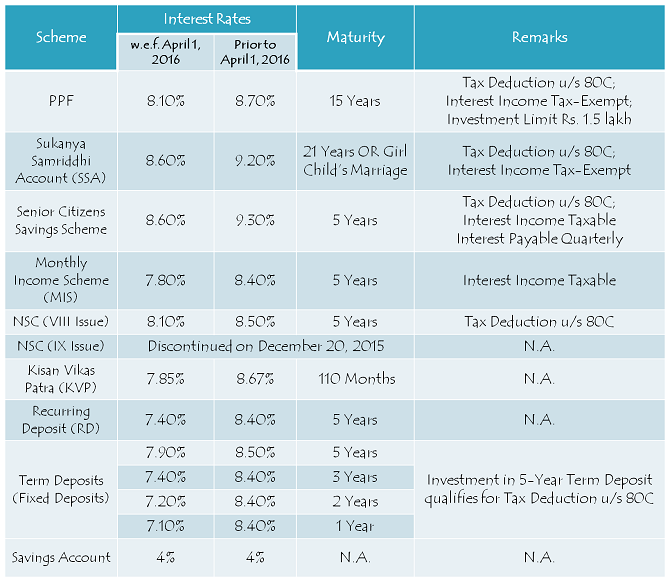

Here you have the table having all the small saving schemes with their applicable interest rates and tax benefits for the next financial year 2016-17:

Public Provident Fund (PPF) – Rate Cut from 8.7% to 8.1% – There has been a significant cut in the interest rate offered by PPF, India’s most popular small savings scheme. PPF will earn you 8.10% for the next financial year as compared to 8.7% for the current financial year. However, interest rate on PPF continues to remain tax-exempt on maturity and investment up to Rs. 1,50,000 will keep getting exemption under section 80C.

Sukanya Samriddhi Yojana (SSY) – Rate Cut from 9.2% to 8.6% – Government’s pet scheme for girl child, Sukanya Samriddhi Yojana, has seen a rate cut to 8.60% from its present rate of 9.20%. But, there is still a gap of 0.50% between this scheme and PPF, which would likely keep its popularity intact.

Interest earned on Sukanya Samriddhi Yojana is also tax-exempt on maturity and investment up to Rs. 1,50,000 will keep getting exemption under section 80C.

Senior Citizens Savings Scheme (SCSS) – Rate Cut from 9.3% to 8.6% – Senior citizens will also feel disappointed as the interest rate on Senior Citizen Savings Scheme has also been reduced to 8.60% from 9.30% earlier. The interest earned on this scheme is taxable and subject to TDS as well. But, the investment made gets you a deduction of up to Rs. 1,50,000 under section 80C.

Post Office Monthly Income Scheme (POMIS) – Rate Cut from 8.4% to 7.8% – Post Office Monthly Income Scheme will also have a steep cut in interest rate from an earlier 8.40% to 7.80% effective April 1. Following this rate cut, Post Office MIS will go out of favour with many of the investors.

National Savings Certificates (NSCs) – Rate Cut from 8.5% to 8.1% – Effective December 20, 2015, the government stopped issuing 10-year NSCs. Now even 5-year NSCs will have a rate cut, from 8.50% to 8.10%. Your investment in NSCs will keep giving you tax exemption under section 80C.

Kisan Vikas Patra (KVP) – Tenure Raised from 100 Months to 110 Months – Your investment in KVP was promised to get doubled in 100 months earlier. But, from April 1, you’ll have to wait for 10 months more to get the same benefits. Effectively, this scheme will earn you 7.85% now.

Impact of Rate Rationalisation on Small Savers, Borrowers and Indian Economy

Though the government would be criticised badly for this move and the opposition parties would try to take maximum benefit out of small savers’ emotions, I would term it as one of the best moves by the Modi Government. Why am I saying this? This move will send the right signals to the global investors as well as to the Reserve Bank of India (RBI) that the government is serious about removing anomalies existent in our systems and also meeting its fiscal deficit target of 3.5%. This move, along with an expected rate cut by the RBI, is going to put more pressure on the lenders to cut lending rates in the system. It will also reduce the borrowing costs of the government, as well as many of the corporates which are currently burdened with high debt in their books.

CPI Inflation, which matters to you and me the most and was ruling in double digits during the UPA tenure, has come down to 5.18% in February 2016. WPI Inflation, which measures wholesale prices of goods and services, has been ruling in the negative zone for a very long time now. This fall in inflation is a result of a slump in the global commodity prices and crude oil prices.

Small savers need to understand that interest rates on deposits and other investments have also come down in the last 2-3 years. During FY 2013-14, our favourite ‘AAA’ rated tax-free bonds carried as high as 9.01% rate of interest. These same ‘AAA’ rated tax-free bonds carried a maximum coupon of 7.69% in the current financial year. So, effectively a fall of 1.32%.

If you compare this fall of 1.32% with a 0.60% reduction in PPF’s rate of interest or 0.40% in NSC’s rate of interest, I think the cut is truly justified. Rest I think it is very difficult to keep everyone happy in the country and at the same time, carry out economic reforms for an overall development.

Ahead of polls in five states in April-May, I would call it a truly bold move by the government. This act of rationalising interest rates will benefit the borrowers immensely, which in turn will create a right balance in the economy.

Sir,

I start deposit in SSY in post office on last November(2015) @9.2% as yearly, Rs 150000/-(one time) Is the interest valid all through the year or to the end of scheme. Also should I wait up to coming November 2016 for the next year deposit or can I deposit now? If so will the interest rate will go to 8.6% for the year. Please explain as detail.

Thanks..!

Sir Please specify the maturity amount of NSC as per rae of interest 8.1%

(NSE for Rs. 10000/-)

Maturity amount of NSC for Rs 10000 is Rs 14761

Sir Please specify the maturity amount of NSC as per rae of interest 8.1%

My Dear Shiv

I cannot concur your opinion on the misuse of water for IPL fields and shifting them to no drought hit areas. This statement reminds me of a minister taking shameful “drought selfie” in Latur. If you have seen the pictures of fleeing farmers from souring heat and drought hit areas in 10 states of India, you will not say this. By these comments we are making mockery of the poor farmers.Some people call them “timid” but if this poor courageous farmers are kept alive and produce the crops, what will you metro guys eat for dinner?

Hi Shiv

Anuj says- “Govt just takes and does not give back public money”…

A good point made.

It is a time one should ask ourself what is being done by the Govt. to the drought hit areas of India these days?.

Villages after village is becoming like desert, not even a drop of water in sight. Humans and animals are fleeing or dying every day. This is a man made and climate disaster happening all over the world and mostly affecting our rural India.

We are all waiting for our investment get a decent return,including me, but don’t forget where we heading for a calamity if the climate gets worse year after year.

We are boastful of our economic growth in percentages and waiting for the Monsoon to come . We are all waiting for the inflation linkage to bountiful Monsoon. Suppose if less or no monsoon comes?

Most of the readers including me are sitting under the AC watching IPL in lush green field and we heard how much precious water was used there. This is a crime and its cruel.

We must not blame the Govt alone, every one of us has got a responsibility, plant a small plant in your balcony, or small tree in a road side or any public place, if you can.Who is bothered about it? We all have our eyes on the “returns” of our investment, don’t even want to discus or hear about any bad news from drought hit areas.

We all need cars and Acs and fridges, but just think of the poor suffering in drought hit areas.

Time to interospect….

(*Apologies if I have spoken out of topic…)

Hi Dr. Paulose,

I agree with you, every one of us has the responsibility to do something for the society, bigger or smaller. But, blaming/halting/shifting IPL matches for the drought hit areas is completely unacceptable. There are so many other things which we do to waste our natural resources, why only to blame IPL for this?

Yes, we need to introspect. But, when we are not ready to understand the problems this country as a whole is facing, then why to blame the government alone? Are we not responsible for the problems we are facing these days. We are moving from eating healthy fruits & vegetables to fast foods, from working hard in day to late night working, from Yoga to Gym, from waking up early to do meditation to late night parties, and many other such things.

We are exploiting the nature to live a comfortable life and air conditioners & cars are the biggest examples of it. More and more homes in Delhi/NCR these days are having multiple air conditioners, cars at their disposal. I think these are one of the biggest sources of pollution to our environment. Can we stop using these two things and contribute our savings to the drought hit areas of India? If yes, good for the countrymen, we should do that. If not, then we should stop blaming the government for not doing anything for the drought hit areas.

Hi shiv

I have a respect for you but such articles try to justify goonda govt and does not look apolitical. When it is about taking from aam admi then it is economics but when it is turn of paying it back then simply refusal and again economics.

If everything is to be market linked then fuel prices are not down?

Aam admi spends most of his money on food medical tution fees etc. All those things have inflation much above CPI.

When scams take place like bank NPA, Punjab food scam, over priced coal etc. then public money which is several times more is looted.

Why the tax slabs are not changed based on inflation?

Everything has to be looked in totality and if govt just takes and does not give back then it will be rightly called as luteri sarkar !!!

Hi Anuj,

Call it a politically motivated article or whatever you want, I still think it is an excellent move by the government to lower artificially high interest rates on small saving schemes. The government should have done it last year itself and I think not doing it last year was a politically-driven decision.

Now coming to your points, crude prices have gone up by 65% in the last 2 months from a low of around $26.50 per barrel to $43.50. Had this government cut the prices earlier, would you have allowed the government to increase the petrol/diesel prices by 65% in 2 months. No, nobody would have tolerated such a hike.

Now, compare your income with your expenses, I am sure you would find your living standards going up considerably in the last 10-15 years or so. Check these tax slab rates for FY 2004-05 – Income less than Rs. 50,000 – No Tax, Income Rs. 50,000 – Rs. 60,000 – 10%, Income Rs. 60,000 – Rs. 1,50,000 – 20%, Income above Rs. 1,50,000 – 30%.

Now, check these tax slab rates for the current financial year – Income less than Rs. 2,50,000 – No Tax, Income Rs. 2,50,000 – Rs. 5,00,000 – 10%, Income Rs. 5,00,000 – Rs. 10 lakh – 20%, Income above Rs. 10 lakh – 30%. There is a jump of at least 5 times in the tax exemption rates for every tax slab in the last 10 years.

Now, I would like to have your comments on these. Why don’t we raise our voice against schools raising their fees? Why don’t we raise our voice against cinema owners against raising their ticket prices? Why don’t we cut down out visits to restaurants, holidays and other places of entertainment to save money for our future? I don’t think food/milk prices produced by our farmers have gone up substantially in the last 10 years or so. So, if we have developed the habit of complaining, then it is the time to change our mindsets and work for the betterment of this country.

Are not fuel prices down? Please note that in the past, fuel prices were artificially kept low even when crude was at very high prices for petty political reasons. Now, since the prices are by and large market linked, when the crude has become lower, fuel prices are still at the same level. How can you compare the current market linked prices to the artificially suppressed prices of the past and cry foul? By the way, misplaced oil economics of congress governments and its populist policies even at the cost of country’s progress played havoc with the economy.

Surprised to note that you are trying to attribute the Bank NPA scam to the present government. It is the result of decades of corrupt policies of congress which has to come out at some point of time. Now when government is trying to do something on this monumental problem, you are trying to say that this has been created by them!!!!

By the way, depiction of Aam aadmi has become some sort of a joke, for his failure to look beyond and understand the truth(I may be little politically incorrect in saying this). Unfortunate that, politicians of some parties are trying to project Aam aadmis as greedy for everything free, timid and unintelligent. Do not fall into this trap.

Dear Srinivas

“Aam aadmi udaas hai, baaki sab first class hai” calling then timid and unintelligent shows clearly your upper class mindset. This attitude towards the common man of India is an insult to every “Indian”.

Making such comments are rude.I think you should appologize.

Dear paulose,

Looks like u have not read my comment or read it with a pre-conceived notion. My objection is to the opposition politicians trying to raise passions for everything the Government does, by branding them as anti aam aadmi, even though they are path breaking. Also, let us be clear that, pto-aam aadmi does not mean pro- populism. This sort of warped thinking has brought the country to this level. Years of fuel, ration, and fertiliser subsidies without proper supply chain has made our country one of the most corrupt in the world. Status quoism will only set the country backward. There is no need for me to apologise, but there is a need for you to not to fall prey to populistic , misplaced nehruvian – socialistic thinking. It is easy to be politically correct, but does not take us any where.

Dear paulose,

Looks like u have not read my comment or read it with a pre-conceived notion. My objection is to the opposition politicians’ trying to raise passions for everything the Government does, by branding them as anti -aam aadmi, even though they are path breaking. Also, let us be clear that, pro-aam aadmi does not mean pro- populism. This sort of warped thinking has brought the country to this level. Years of fuel, ration, and fertiliser subsidies without proper supply chain has made our country one of the most corrupt in the world. Status quoism will only set the country backward. There is no need for me to apologise, but there is a need for you to not to fall prey to populistic , misplaced nehruvian – socialistic thinking. It is easy to be politically correct, but does not take us any where.

Dear Srinivas

Point taken.

I sense what you are against? But what do you stands for-Catpitalism-Minority privileges and class rule?

8 changes in the Sukanya Samriddhi Yojana regarding withdrawal and maturity @ http://moneydial.com/8-changes-sukanya-samriddhi-yojana/

Dear Shri Shiv Kukreja

I follow you through your posts which are so informative and helpful to all. Many thanks for your excellent work. I need a clarification on the interest received from NHAI TFB Tranche I ,2015 issue on 2nd April 2016.I had applied 100 bonds 7.39% & 900 bonds 7.60% and have got full allotment on 11.1.2016. Hence,my yearly interest works out as Rs. 75790/-. So, for 80 days (from 11.1.16 to 31.3.16) the payble amount should be Rs.16611/- whereas I Have got only Rs.15325/. Why is this difference? In another case,in which my friend had applied and got 200 bonds 7.39% & 800 bonds 7.60%. He has got only Rs. 13622/- against payable amount of Rs. 16565/-. Please clarify the anomalies between these two cases also( as per calculation I have got less amount and my friend has got much lesser amount).With regards.

It is showing ‘ your comment is awating moderation’. If i required to do any moderation,how to do it?

Dear Shri Shiv Kukreja

I follow you through your posts which are so informative and helpful to all. Many thanks for your excellent work. I need a clarification on the interest received from NHAI TFB Tranche I ,2015 issue on 2nd April 2016.I had applied 100 bonds 7.39% & 900 bonds 7.60% and have got full allotment on 11.1.2016. Hence,my yearly interest works out as Rs. 75790/-. So, for 80 days (from 11.1.16 to 31.3.16) the payble amount should be Rs.16611/- whereas I Have got only Rs.15325/. Why is this differnce? In another case,in which my friend had applied and got 200 bonds 7.39% & 800 bonds 7.60%. He has got only Rs. 13622/- against payable amount of Rs. 16565/-. Please clarify the anomalies also. With regards.

Hi Mr. Bhattacharya,

I am not sure why such anomalies are there. You need to contact the Registrar for the same and check with them the reason for such a difference.

Hi Sir,

I need your help regarding my father’s investment, he was retired at March 2015 at age 58 but govt. of India & ITI (sick psu) giving his retirement fund by May mid 2016. His total corpus is 29 lacs (23 lacs as PF & 6 lacs from gratuity).As his age is 59 so he is not eligible Senior Citizen scheme.

I would be grateful please provide investment tips so he could get monthly income.

Some of the concerns & inputs are as follows:

a) As interest are decreases sharply and in future chances are there chances of more cuts, so he doesn’t wants to take risk now he needs safe and monthly income from interest.

b) Monthly expenses he needed atleast 30k per month. (25k for expenses & 5k for saving).

c) Other source income are

1) Getting pension Rs 2400 per month.

2) Getting Rent 5000 per month.

Some of the queries are:

1) Where to invest and what is best option to get the better interest return?

2) Our focus is more for senior citizen scheme available in market as interest rate is higher than and after 6 months he would be in senior citizen category as of now we think to invest in bank FD, Is it is a right decision?

3) Like MIS in post office/banks is Mutual Fund MIP is good to invest and as compared to bank/post office which gives higher return in short term and do this scheme giving monthly interest.

4) Investing in Non-Convertible Debentures (NCD), is this investment give better monthly income. (I don’t know anything about it just heard from someone)

5) Where to invest 5k in MF via SIP or 3k in MF and 2k in banks.

Fund selected: HDFC or Tata Balanced Fund

6) How much money to put for emergency fund 1.5 lacs or more please suggest?

Request you to please provide your input on the above query and which will help us to create a path for next upcoming few years.

Thanks,

Shalabh

Sorry Shalabh, I cannot take such individual queries here on this forum. You can mail me your queries on my mail id – skukreja@investitude.co.in Your queries would fall under our one time paid service for which our fee would be Rs. 2,000.

Hi Shiv,

I am a regular follower of your article and thanks a ton for valuable information that you are providing. The government has indeed taken a bold unpopular decision by reducing the interest rates. Jobs are the need of the hour and corporate lending rates needs to be reduced for us to be competitive. Though I am also affected by this ….. what is the use of wealth if there is social unrest in society due to unemployment. We should whole heartedly support central govenment.

One problem is bank depositis are reducing and to make it popular govt needs to make interest tax free or apply long term gains to interest income tax.

The lethargic behaviour of IT department towards me and your good suggestions made me move all my FD to tax free bonds.

I am waiting for your writeup on last years TFB’s and thier dividend payout dates.

Thank you

Srikumar

Thanks Srikumar for your kind words! These are steps in the right direction and I think the government will do everything to support corporates and the public at large.

sir

my rd acct in post office rs 300

0/APM from 31 mar 11.now after 5year what is the maturity amount.

Hi Mr. Nayal,

Your maturity amount will remain the same as it was promised in 2011.

It is not clear whether the lower interest of 8.6% is applicable for new SCSS S=Deposits post April 1, 2016 or to deposits made before that date.

Dr. K V N Rao

It is clear Mr. Rao, 8.60% rate of interest is not applicable for older deposits made prior to April 1, 2016.

Hello Shiv,

As now the ppf rates are revised for quarterly change, how is the interest calculated? Previously, it used to be the lowest balance between 5th to end of the month is considered for interest calculation.

Is it the same process considered for this year too?

Thanks

Hi Krishna,

Deposit & interest calculation rules have not changed, it is the same process for the current financial year as well.

Sir,

I have the following questions:

a) Kindly clarify whether the revision in interest rates is applicable for new accounts or for existing accounts also for SCSS AND SUKANAY SAMRIDHHI? There is some confusion on this.

b) Assuming that the revision is applicable for new accounts opened after 01/04/16, fresh contributions to the existing accounts opened before 31/03/16 will continue to fetch old interest or revised interest till maturity? In such a scenario what will be the applicable interest rate on contributions made till 31/03/16?

c)We know that in case of PPF account every year new rates are applicable, even for contributions made in previous years.

Hi Srinivas,

1. Quarterly revision in interest rates is applicable for all the PPF and Sukanya Samriddhi Yojana (SSY) accounts, but not applicable to older SCSS, NSCs, KVPs, MIS and other schemes opened prior to April 1, 2016.

2. Revised interest rates will be applicable to your fresh contributions in all the schemes opened after March 31, 2016. But, your older investments, except PPF and SSY, will continue earning higher rates.

Thanks shiv.

BJP will get the result of next assembly elections…BJP will loose all elections.

Let’s see what happens going forward!

It is amusing to read all the comments expressing angst on these steps. Inflation has come down by a lot more than the decrease in interest rate so even with the reduced rate, it is better than before when inflation was running higher. I guess not many people understand this.

But, the govt should be smart about this. They shouldn’t announce periodic revisions like this which make it seem discretionary. They should announce an inflation-based rate which will adjust automatically semi-annually or quarterly based on inflation and/or some other market indexes. Then people will atleast not blame the govt for something that the govt doesn’t (or rather, shouldn’t) control.

I completely agree with you here VS! Linking it with some index or inflation data or G-Sec rates would free the govt from making people understand the reasons behind such cuts/hikes.

If I invest in Senior Citizen Saving Scheme,2004 on or before 31st March,

would I get interest payable quarterly for the next 5 years?

Yes Mr. Dhingra, you’ll get 9.30% rate of interest payable quarterly. Interest will remain 9.30% for all 5 years.

If I invest in Senior Citizen Savings Scheme,2004 on or before 31st March,2016, would I get interest @ 9.3% payable quarterly for the next

five years?