The US has recently introduced a bill on immigration and since US is the second largest home to Indian diaspora with about 3 million people of Indian origin residing there – this bill is of a lot of interest to Indians.

The bill is named “Border Security, Economic Opportunity, and Immigration Modernization Act” and it is still a long way from becoming law and according to the NYT it is too early to predict when it may get passed.Â

The bill is 844 pages long, and the primary focus is on immigrants who are already present in the US illegally, and providing them a way to citizenship. To that extent, large sections of the bill are not relevant to Indians, and in this post I’m going to discuss the parts of the bill which will have some meaningful impact on Indians.

1. Increase in the H-1B Visa Limit: Currently, the limit on H-1B visas is 65,000 per year for regular cases and an additional 20,000 for advanced-degrees. This limit got exhausted within 5 days this year as 124,000 petitions were filed within that time frame.

The bill proposes to increase the limit to 110,000 and the cap for advanced-degrees will be raised to 25,000. There is a provision in the bill to increase the quota of H-1B visas gradually based on what they are calling the “High Skilled Job Demand Index” and the limit may go as high as 180,000 in later years.

2. Spouses of H-1B Visa holders will be allowed to work based on reciprocity: Currently, the spouse of a H-1B visa worker who gets the H-4 visa is not permitted to work in the US. According to the bill, spouses will be allowed to work if the other country also allows this. As far as I know, India doesn’t allow the spouses of Americans to work in India, so this provision will not be applicable to Indians.

3. US employers to pay higher wages to H-1B workers: There is a concern that on occasion H-1B workers work on lower wages in the US when compared with what an American citizen would have got, and the new bill makes it necessary for the employer to pay them equivalent wage. It will also make it necessary to advertise the H-1B job one month prior to hiring a foreign H-1B worker and give first priority to Americans.

4. Companies with higher H-1Bs to pay more visa fees: If a US employer has more than 50 H-1B or L-1 workers and if they form 30 – 50 percent of the staff then the employer will have to pay an additional fee of $5,000 for each new H-1B. Similarly, if they have more than 50% staff on H-1B or L-1 visa then they will have to pay an additional fee of $10,000 for each new H-1B. After 75%, they will no longer be allowed to get a foreign employee to work in the US.

5. Siblings of US citizens no longer eligible for green card: Currently, US citizens can apply a green card for their siblings as well, but this bill seeks to eliminate that.

I’ve heard chatter from people that the passage of this bill will make it faster for people from India to get green cards under the EB-2 and EB-3 category, but there is nothing in the bill about that, and it is unlikely that anything will be added to make that long wait shorter.

I couldn’t find anything else that felt like it would be of significant interest to Indians, but if you see anything please leave a comment and I’ll update the post.

Also, worth repeating that none of this is law yet and there is still a long way to go.

A lot has been written on FDI (Foreign Direct Investment) and FII (Foreign Institutional Investor) already, and I found a great succinct explanation from Business Line explaining the difference between FDI and FIIÂ investments as one flowing into the stock market (FII) and the other flowing into the primary market (FDI), and all other differences emerging out of that one key point.

FDI (Foreign Direct Investment) is when a foreign company invests in India directly by setting up a wholly owned subsidiary or getting into a joint venture, and conducting their business in India.

IBM India is a wholly owned subsidiary of IBM, and is a good example of FDI where a foreign company has set up a subsidiary in India and is conducting its business through that company. What’s amazing about IBM is that, it is now the largest Indian IT company in India. It is serving Indian customers, and a large domestic market that was not tapped by the Indian players themselves.

Foreign companies partnering with Indian companies to set up joint ventures is more typical and Starbucks partnering with Tata Global Beverages Limited is a recent example of FDI through joint venture, but there are several others in the insurance, telecom, food industry etc.

FII is when foreign investors invest in the shares of a company that is listed in India, or in bonds offered by an Indian company. So, if a foreign investor buys shares in Infosys then that qualifies as FII Investment.

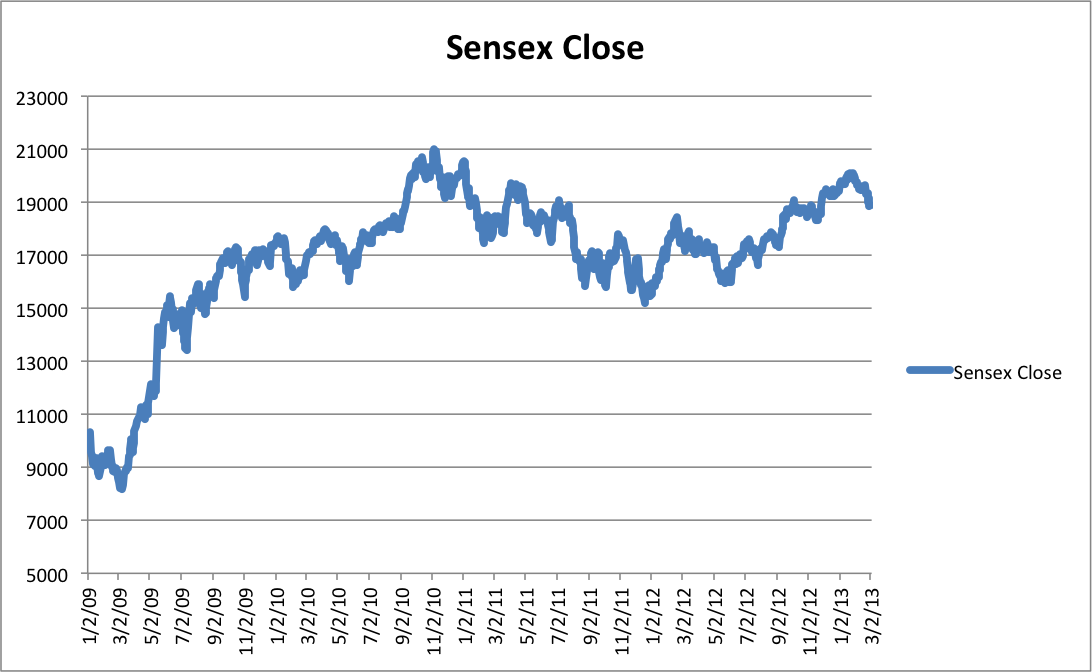

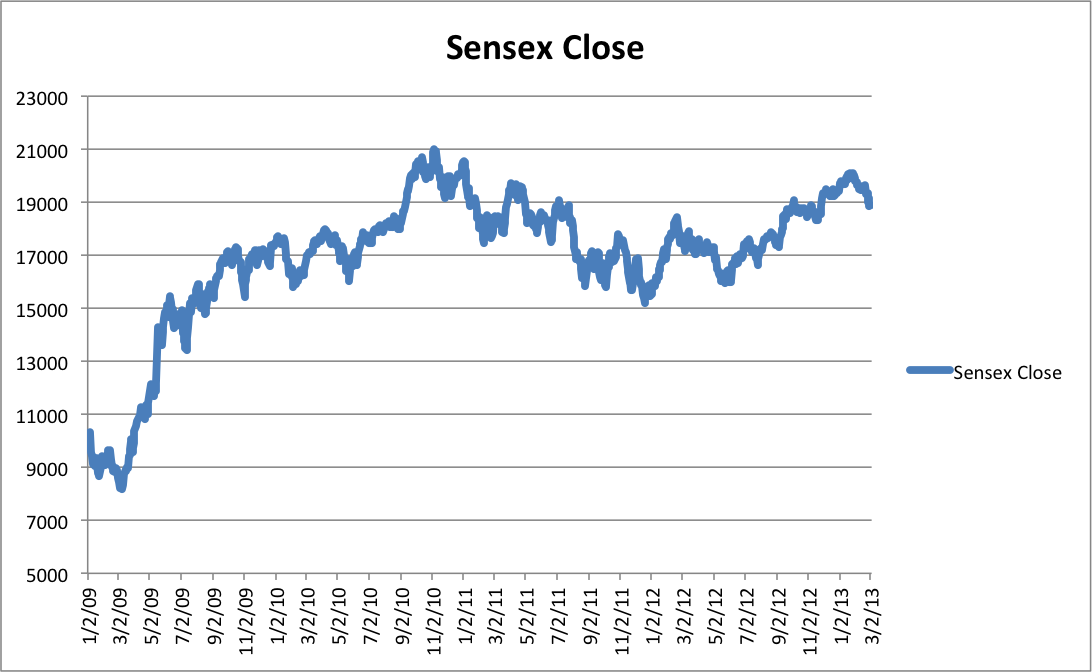

It is easy to see why you would prefer FDI to FII investments. FDI investments are more stable because companies like IBM set up offices, hire employees, and have a long term plan for the country. IBM can’t just pull out a few million dollars from India overnight, which is what FII investors do from time to time and that leads to market crashes.

In India, attracting FII has been easier than FDI because of the policy uncertainty and procedural delays. An RBI study has the following para on FDI slowdown and it is easy to see how it is tied to the politics in the country.

Both FDI and FII investments are good for the economy, but I feel that FDI is where the focus should be and this is where India is lagging behind badly. There are several things that can be done to improve FDI investments, and hopefully, things will get done before India hits another crisis.