This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

People are calling it a Pre-Diwali gift by Dr. Raghuram Rajan. Yes, I am talking about the Repo Rate cut of 50 basis points (or 0.50%) by the RBI Governor today. Indeed, it is a surprisingly positive move by Dr. Rajan for overall incremental growth of the Indian economy. Stock market and bond market, both cheered with joy after the announcement came in at 11 O’Clock in the morning. While Sensex closed up 162 points, the benchmark 10-year G-Sec yield fell sharply lower to close at 7.611% as against Monday’s 7.727%.

While it is an extremely cheerful event for the existing investors, it is not so good news for the investors waiting on the sidelines to invest in the upcoming tax-free bond issues, as it would mean the coupon rates would now fall further from here. Investors, who invested in these bonds in FY 2013-14, were already finding the current offered rates to be unattractive as compared to the rates offered at that time. So, a further fall from the rates offered during the NTPC issue last week would leave more disappointment for the investors.

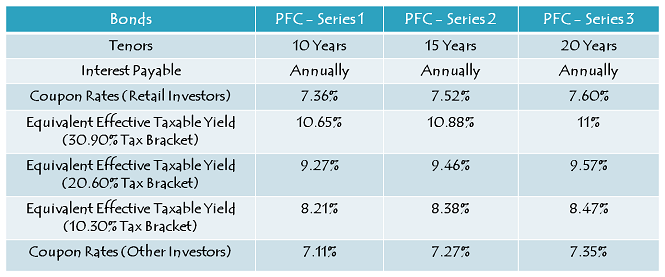

But, before an impact of the Repo rate cut starts getting reflected in future issues, Power Finance Corporation (PFC) would be giving you an opportunity to lock-in your investible surplus at a relatively higher rates. PFC is coming out with its issue of tax-free bonds from the coming Monday i.e. October 5th and it would be offering 7.60% rate of interest for the 20-year option, 7.52% for the 15-year option and 7.36% for the 10-year option.

Before we take a decision to invest in this issue or not, let us first quickly check the salient features of this issue:

Size of the Issue – PFC is authorized to raise Rs. 1,000 crore from tax free bonds this financial year out of which the company has already raised Rs. 300 crore by issuing these bonds in private placement. The company will raise the remaining Rs. 700 crore from this issue.

Coupon Rates on Offer – As mentioned above as well, PFC will offer yearly rate of interest of 7.36% for its 10-year option, 7.52% for the 15-year option and 7.60% for the 20-year option to the retail investors investing less than or equal to Rs. 10 lakh.

As always, these rates would be lower by 25 basis points (or 0.25%) for the non-retail investors.

Rating of the Issue – CRISIL, ICRA and CARE have assigned ‘AAA’ rating to the issue considering PFC to be a government company with reasonably good fundamentals. Also, these bonds are ‘Secured’ in nature and in case of any default, the bondholders would carry a right to make claim on certain assets of the company.

NRI Investment Allowed – Non-Resident Indians (NRIs) are also eligible to invest in this issue, on a repatriation basis as well as non-repatriation basis.

QFI Investment – Qualified Foreign Investors (QFIs) are not allowed to invest in this issue.

Investor Categories & Allocation Ratio – The investors have been classified in the following four categories and each category will have certain percentage of the issue size reserved during the allocation process:

Category I – Qualified Institutional Bidders (QIBs) – 10% of the issue is reserved i.e. Rs. 70 crore

Category II – Non-Institutional Investors (NIIs) – 25% of the issue is reserved i.e. Rs. 175 crore

Category III – High Net Worth Individuals including HUFs & NRIs – 25% of the issue is reserved i.e. Rs. 175 crore

Category IV – Resident Indian Individuals including HUFs & NRIs – 40% of the issue is reserved i.e. Rs. 280 crore

Allotment on First Come First Served Basis – Subject to the allocation ratio, allotment will be made on a first come first serve (FCFS) basis in each of the investor categories, based on the date of upload of each application into the electronic system of the stock exchanges.

Listing & Allotment – PFC has decided to get these bonds listed only on the Bombay Stock Exchange (BSE). The bonds will get allotted and listed within 12 working days from the closing date of the issue.

Demat/Physical Option – Unlike NTPC, it is not mandatory to have a demat account to apply for these bonds. You can subscribe to them in physical/certificate form as well. Interest payment will still get credited to your bank account through ECS.

Moreover, even if you get these bonds allotted in an electronic form, you have the option to rematerialize your holding in physical/certificate form if you decide to close your demat account in future.

No Lock-In Period – Many investors get these bonds confused with the tax-saving infrastructure bonds, which used to provide tax benefits, but carried a lock-in period of five years. So, here is the clarification – These tax-free bonds are freely tradable and do not carry any lock-in period. The investors may sell them at the market price whenever they want after these bonds get listed on the BSE.

Interest on Application Money & Refund – Successful allottees will earn interest at the applicable coupon rates on their application money, from the date of realization of application money up to one day prior to the deemed date of allotment. Unsuccessful allottees will get interest @ 5% per annum on their refund money.

Minimum & Maximum Investment – Investors are required to put in a minimum investment of Rs. 5,000 in this issue i.e. at least 5 bonds of face value Rs. 1,000 each. There is no upper limit for the investors to invest in this issue. However, an investor investing more than Rs. 10 lakhs will be categorized as a high networth individual (HNI) and will get a lower rate of interest as applicable.

Interest Payment Date – PFC will make its first interest payment exactly one year after the deemed date of allotment and the deemed date of allotment will be announced just before the listing date. I will update this post as and when it gets announced.

Should you invest in this issue?

This is what I mentioned during the NTPC bonds issue last week – “Personally, I feel there is a good scope of 50 basis points (0.50%) rate cut by the RBI in the next 6-9 months and as a result, the 10-year G-Sec yield should fall below 7% by April-June next year”. What I expected from Dr. Rajan to do in the next 6-9 months, he has done it within 6-9 days itself. Dr. Rajan has taken the decision to cut the Repo rate, now it is your time to take a decision, whether to invest in this issue with falling G-Sec yield or wait for some kind of panic to have a spiked G-Sec yield again.

One thing would be there for sure, with this Repo rate cut of 50 basis points and PFC providing investors the option to get bonds allotted in physical/certificate form, there would be a similar or even greater demand for PFC tax-free bonds than it was there for the NTPC bonds.

I think the investors are left with no choice, but to invest in this issue and again if it gets oversubscribed, which I think it will, to invest the refund amount in other upcoming issues. This way they can diversify their investments and get to invest in bonds with a relatively higher coupon rates.

Application Form for PFC Tax Free Bonds

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in PFC tax-free bonds, you can contact me at +919811797407

Dear Shiv

Reg PFC TFB october 2015 issue- I got allotment 100 plus bonds and the refund also, and it appears on the demat acccount INExxxxx39.but i have not yet received the allotment letter from the company, is it important to get the “physical”letter. If needed how to get it.

Please advice.

drpaulose

NABARD Tax-Free Bonds Issue Update:

Issue opens – 9th March, 2016, Issue closes – 16th March, 2016, Issue Size – Rs. 3,500 crore

Interest Rates for Retail Individual Investors investing upto Rs. 10 lacs:

10 years – 7.29% p.a.

15 years – 7.64% p.a.

HUDCO Tranche II update:

Issue opens – 2nd March, 2016, Issue closes – 10th March, 2016

Interest Rates for Retail Individual Investors investing upto Rs. 10 lacs:

10 years – 7.29% p.a.

15 years – 7.69% p.a.

Total Issue Size – Rs. 1,788.50 crore, including Green-Shoe Option to retain Rs. 1,288.50 crore

NHAI Tranche II update:

Issue opens – 24th February, 2016

Issue closes – 1st March, 2016

Interest Rates for Retail Individual Investors investing upto Rs. 10 lacs:

10 years – 7.29% p.a.

15 years – 7.69% p.a.

Total Issue Size – Rs. 3,300 crore, including Green-Shoe Option to retain Rs. 2,800 crore

Joining for comments

HUDCO 7.64% Tax-Free Bonds Review – http://www.onemint.com/2016/01/21/hudco-7-64-tax-free-bonds-tranche-i-january-2016-issue/

HUDCO tax-free bonds issue update:

Issue opens – 27th January

Issue closes – 10th February

Base Issue Size – Rs. 500 crore

Total Issue Size – Rs. 1,711.50 crore

Interest Rates for Retail Individual investors investing upto Rs. 10 lacs:

10 years – 7.27% p.a.

15 years – 7.64% p.a.