This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

Of late, the market has been flooded with fixed maturity plans (FMPs). In fact, I have never seen such a huge number of FMPs getting launched in such a short span of time and that too with a variety of tenors going up to 5 years.

Mutual Fund houses, which have seen a big dip in their assets under management (AUMs) in the past couple of months due to huge outflow of money from their debt fund schemes, especially liquid funds, do not want this money to flow out of the mutual fund industry.

As the short-term interest rates have risen quite sharply during this period, these mutual fund companies are launching FMPs of shorter duration, like one month and three months and also of one year, in huge numbers with quite attractive indicative yields.

What is so attractive about these FMPs?

High Interest Rates: As mentioned above, fixed maturity plans are offering high indicative yields these days due to a sudden spike in interest rates, especially short-term interest rates. Though the market regulator SEBI has disallowed it to disclose the indicative yields of FMPs, some of the fund houses are privately quoting it to be in the range of 9.60% to 10.60% for 1 year period, which is quite attractive.

Ranged Indicative Yield: FMPs usually invest in certificates of deposits (CDs), commercial papers (CPs), NCDs and other securitized debt. As per SEBI regulations, an FMP cannot invest its money in instruments with maturity greater than the maturity of the FMP itself. Also, the mutual fund companies need to disclose it in the scheme’s offer document, in which all instruments it is going to invest the scheme’s corpus.

So, taking a cue from its planned investment in these instruments, the management team of an FMP is able to provide an indicative yield to be expected out of this scheme. The returns at the time of maturity are very close to this indicative yield, if the scheme does not suffer any credit default. So, unlike open ended mutual fund debt schemes like gilt funds, income funds or short-term funds etc., there is no uncertainty with regards to the holding period returns of these FMPs.

Fixed Maturity: As FMPs are closed-ended funds and get matured after some definite maturity period, their investors know well in advance when they are going to get their money back. Like bank fixed deposits, there is no uncertainty with regards to their holding periods.

Taxation Rules for FMPs – Before I proceed further with the positive points of FMPs, we first need to know the taxation rules applicable to FMPs.

Growth Option – FMPs, if held for more than one year, would fall under long-term capital gain tax and are taxed at 20% with indexation or 10% without indexation, whichever is less. If the holding duration is equal to or less than one year, then FMPs would attract short term capital gain tax and will be taxed at the slab rate of the investor.

Dividend Option – Dividends announced by the mutual fund houses for these FMPs are tax-free in the hands of the investors, but are subject to dividend distribution tax (DDT) of 28.325% i.e. 25% tax + 10% surcharge + 3% education cess.

Indexation or Tax Benefits: ‘Indexation’ or ‘Double Indexation’ benefit is one thing which makes these FMPs score highly over bank fixed deposits. Double-Indexation benefit accrues to those FMPs which run over to 3rd financial year. If an FMP is bought at the lag end of 1st financial year and gets matured in the beginning of 3rd financial year, then it makes your capital gains virtually tax-free.

Let me explain it to you: Say, you invest in an FMP at the NAV of Rs. 1,000 on September 5, 2013 and it matures on April 5, 2015, earning for you a return of say 15% in one and a half years. Cost inflation index for 2013-14 is ‘939’. Let us assume it comes out to be ‘1014’ for 2014-15 at 8% inflation and ‘1085’ for 2015-16 at 7% inflation. Then, your indexed cost of acquisition for your FMP would be Rs. 1,000 * 1,085 / 939 = Rs. 1,155 and the long term capital loss would be Rs. 1,155 – Rs. 1,150 = Rs. 5. So, there is no need to pay any tax on the gain of Rs. 150.

Even single indexation benefit makes taxation of these FMPs quite favorable and quite close to getting tax-free, if your holding period is close to 1 year plus i.e. 370 days or 368 days or 371 days etc.

Taking the above case forward for single indexation benefit, let us take the maturity date to be September 10, 2014 and one year return to be 10%. Cost of acquisition comes out to be Rs. 1,000 * 1014 / 939 = Rs. 1,080 and the long term capital gain would be Rs. 1,100 – Rs. 1,080 = Rs. 20. On this investment, capital gain tax would be either Rs. 4 i.e. 20% of Rs. 20 or Rs. 10 i.e. 10% of Rs. 100, whichever is less. So, the tax is Rs. 4 and your effective return would be 9.60%.

Factors to keep in mind while investing or selecting a fixed maturity plan (FMP) – Though FMPs are launched by different fund houses and probably have similar maturity period, say 370 days, but their portfolio investments may differ quite a lot. Here are the pointers which you should keep in mind while going for an FMP:

Where your money is getting invested – It is very important to know to whom your money is getting lent. This is what the scheme’s fund management is doing on your behalf. As per the SEBI regulation, the scheme’s offer document must have the details about the type of securities it intends to invest into.

As the corporate profitability is on a decline amid economic gloom, FMPs have started avoiding the riskier sectors in which they foresee some probability of a credit default, like real estate, airlines, gems and jewellery etc.

Credit rating of the securities – You should also check the scheme’s offer document for the minimum credit rating of the securities the fund management intends to invest into. The investors should also note that the higher the credit ratings of their securities, the lower the returns would be for the FMPs.

FMPs of shorter duration, like 30 days, 90 days or up to 370 days, typically invest in CDs issued by some of the banks or CPs issued by some of the corporates. FMPs of longer duration, like 1875 days, 1820 days or 1095 days, typically invest in NCDs issued by some of the corporates. CDs are considered the safest among these instruments as many of these CDs get issued by PSU banks and normally carry higher credit ratings like ‘AAA’ or ‘AA+’ depending on the issuer banks. CPs and NCDs normally carry lower credit ratings of ‘AA’ or ‘AA-’.

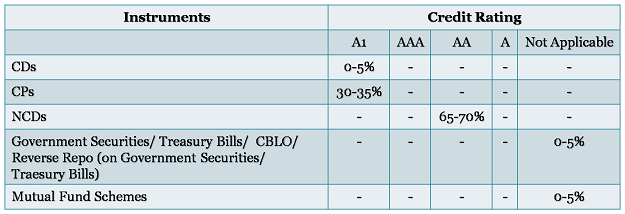

Let us take a look at the “Intended Portfolio Allocation” of Birla Sun Life Fixed Term Plan – Series HV, an FMP of 368 days, opened on September 2nd and closes on September 5th.

Expense Ratio of the scheme – These days mutual fund houses are attracting distributors to promote their long-term FMPs by offering them high distribution commissions. These high commissions they do not pay from their own pockets. These are charged from the investors’ money only. So, you should select a scheme which has a reasonable expense ratio as per the tenor of the FMP.

FMPs are tradable but closed-ended schemes – As per SEBI regulation, FMPs now get listed on the stock exchanges and are tradable at their respective NAVs. But, as there is not enough number of interested buyers and FMPs are closed-ended schemes, FMPs normally trade at a discount to their fair values and this should be kept in mind while investing in FMPs. Investors should choose these FMPs as per their time horizon and then should stay invested till their maturity to realize their full potential.

Investor’s Tax Bracket – Investors with zero tax liability or who are in the 10% tax bracket do not gain much from the tax differential between FMPs and FDs and that is why it is better for them to invest in FDs or NCDs themselves as compared to FMPs. It is the investors in the 30% or 20% tax bracket who gain maximum by investing in FMPs.

Equity markets are extremely volatile and interest rates are ruling higher, these two things set a perfect pitch for FMPs to gain investors’ confidence. But, turbulent times can affect financial condition of corporates quite badly and force some of them to default on their credit payments. So, it is always advisable to the investors to keep their portfolios well diversified with investments in various asset classes and also sub-heads of those asset classes.