This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

RBI on March 11 issued a Circular to the authorised commercial banks to start observing the rules and regulations of Sukanya Samriddhi Yojana as per the Government of India Notification dated December 2, 2014. This circular has been marked to the Chairman & Managing Directors (CMDs) and Managing Directors (MDs) of some of the commercial banks operating in India.

These banks include most of the public sector banks, including State Bank of India (SBI), Bank of Baroda (BoB) and Punjab National Bank (PNB) and a few private sector banks also, including Axis Bank and ICICI Bank.

RBI has instructed these banks to approach Central Account Section, Reserve Bank of India, Nagpur for necessary arrangements to report Sukanya Samriddhi Account transactions with immediate effect. I think it means the RBI wants these banks to start opening accounts under this scheme without any further delays and the subscribers will not have to wait more to open their accounts. They can now approach these authorised banks to open an account.

Though it is still not clear if only these banks would act as the agency banks to open accounts under this scheme or some other banks would also join in, but it seems the following 28 banks would definitely be among all those banks authorised to open Sukanya Samriddhi Accounts (SSA).

Updated List of Banks to Open Sukanya Samriddhi Yojana Accounts

- State Bank of India (SBI)

- State Bank of Patiala (SBP)

- State Bank of Bikaner & Jaipur (SBBJ)

- State Bank of Travancore (SBT)

- State Bank of Hyderabad (SBH)

- State Bank of Mysore (SBM)

- Allahabad Bank

- Andhra Bank

- Axis Bank

- Bank of Baroda (BoB)

- Bank of India (BoI) – Branches; Contact – 022-40919191 / 1800 220 229

- Bank of Maharashtra (BoM)

- Canara Bank

- Central Bank of India (CBI)

- Corporation Bank

- Dena Bank

- ICICI Bank

- IDBI Bank

- Indian Bank

- Indian Overseas Bank (IOB)

- Oriental Bank of Commerce (OBC)

- Punjab National Bank (PNB) – Website Link; Contact – 011-25744370

- Punjab & Sind Bank (PSB)

- Syndicate Bank

- UCO Bank

- Union Bank of India

- United Bank of India

- Vijaya Bank

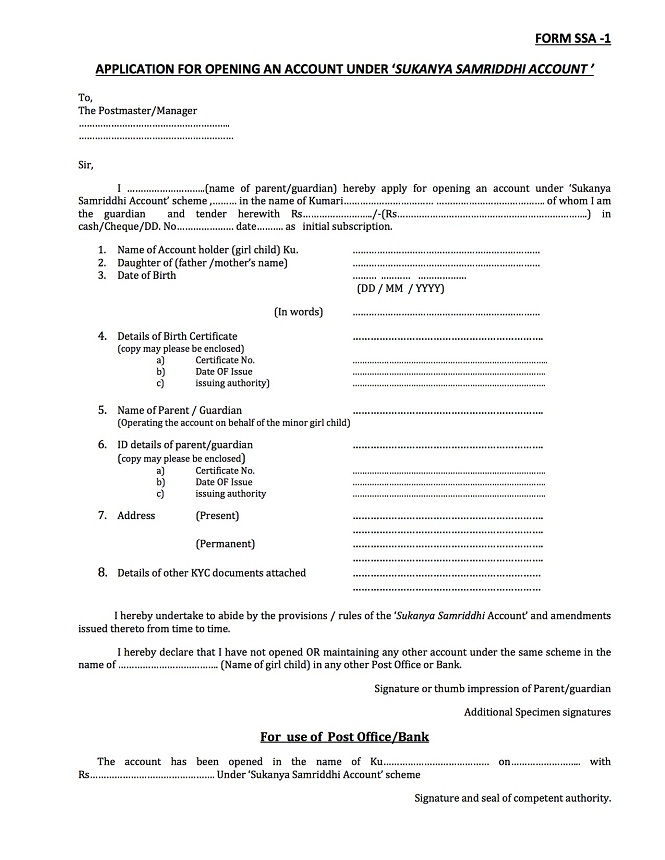

RBI also issued a specimen of application form and the passbook for opening an account under this scheme. Unlike the post office application form, this application form would be applicable just for this scheme only.

Here you have the specimen of the application form which the authorised banks/post offices will be using for opening Sukanya Samriddhi Accounts – Application Form

Also, here you have the specimen of the passbook which the authorised banks/post offices will be issuing to the parents/legal guardian of the girl child – Passbook

You can also refer to the following posts for the complete details about this scheme:

Sukanya Samriddhi Yojana – Tax-Free Small Savings Scheme for a Girl Child

Sukanya Samriddhi Yojana – Application Form & List of Banks to Open an Account

Sukanya Samriddhi Yojana – Calculating Maturity Value after 21 Years

Sukanya Samriddhi Yojana – Sample Filled Application Form

If any of you have anything to share or ask about this scheme, please let us know.

please advice about income tax benefits in the schem. Whether interesf or maturity amount paid will be liable to pay incometax. Kindly clearify income tax benefits, if so. Thanks.

suru kab Huwa kab se kab Tak Kya Intresht tha

Hi,

I am Ajay kumar. I understood the scheme, suppose the depositor is die and then unable to deposit money, what will be the next steps?

The scheme will continue for my Daughter without paying anything?

The reason of my question is my wife is a housewife.

Thank you in advance.

Please if possible reply to my email address at kumar.ajay.bgl@gmail.com

Regards,

Ajay kumar

wonderful put up, very informative. I’m wondering why the other specialists of this sector don’t

notice this. You must continue your writing. I’m sure, you have a great readers’ base already!

Hi All,

What are the documents required to open SSY account. BOI is asking me to submit the below documents.

1) Child’s DOB certificate

2) Parent’s PAN and Adhar Card

3) also they are asking me for Girl PAN card.

Do I need to submit the Child PAN Card.

Every time they are asking me to submit a new documents. Not happy with the BOI staffs… Can someone please suggest me which bank will be good to Open SSY account for my child?

Thanks

Vishal

mygrantdouter 6months oldka account sukanyasamriddiyojanaq in hanamakondapleese send bank adress

Dear sir,

sir, mane apne doter ka account sukanya samriddi yojanaya kalyanpur kanpur (u.p) post office ma form jma kiya thaa leakin abhi tak khata khola nahi gya hai jab bhi jataa hu tab ham see yha kaha jata hai ki doo din baad aoo our one month ho gya hai abhi tak .

Tanks

Deepak

Please visit your nearest bank and open account there. I think its better to open in bank as you will online money transfer facility.

sukya yojana kab se suru huoa & Intresht Ret

Good Day Sir,

My name is prerna .I want to ask about the SSY .I have one cousin under age 10.I am quit interested for this scheme. Please make it clear about this SSY.So that I can open my account thought SSY as soon as possible.

and also wants to know its applicable all state in India……..or some specific. Waiting for your reply.

Thanks

Prerna

I opened SSA account with IDBI bank. Very smooth. Next day I got SSA passbook. But no online account or transfer.

Hi Shiv,

I recently opened SSS accounts for both my daughters in Axis bank. After following with the bank for 2 months, I was given the account nos over a call.

There is no facility to view the account statement. No provision of a pass book. No online transfer facility.

I am still following up with the bank, but even they have no idea on how to handle SSS accounts.

Should I continue with Axis or transfer to some other bank? Also please suggest the best bank to open SSS accounts.

Regards

Jayant

Even I have the same issue with Axis Bank what to do?

Even I have the same issue with Axis Bank what to do?

Hi Shiv,

I recently opened SSS accounts for both my daughters in Axis bank. After following with the bank for 2 months, I was given the account nos over a call.

There is no facility to view the account statement. No provision of a pass book. No online transfer facility.

I am still following up with the bank, but even they have no idea on how to handle SSS accounts.

Should I continue with Axis or transfer to some other bank? Please suggest the best bank to open SSS accounts.

Regards

Jayant

Very well-written and informative article. The calculation table is further useful. Thank you so much.

Hi… just i approached icici branch in bangalore.First they asked me to open savings account in the name of my kid (min balance Rs2500/-). after that only they will open SSY account. is it necessary to open savings account for my kid? cant i directly open SSY account in icici bank? Pls clarify me…

I have opened the account in ICICI BANK bank also confirmed that account is open now how can i track my account and will bank will provide and passbook for that.

Hi Amit, did you open savings account for your kid , before opeing SSY account??? because just i approached icici branch in bangalore.First they asked me to open savings account in the name of my kid (min balance Rs2500/-). after that only they will open SSY account. is it necessary to open savings account for my kid? cant i directly open SSY account in icici bank? Pls clarify me…

I have opened accounts under SSY in post office for my two daughters five months back @ Rs 1000/- month. Plz let me know whether I can enhance the monthly amount or not.

With regards

Dear All,

Is there anybody who has opened the account in PNB.As I have opened the SSA account in PNB at Punjabi Bagh, New Delhi.But they have not provided me SSA account book .

Thanks

Hi Suresh,

Banks like PNB are slow in providing passbook for this scheme. You should talk to the branch manager and make a request to provide the passbook as soon as possible.

Sir plz tell if suknya scheme is available in burari new delhi either postoffice or bank

Hi Sunder,

We are not aware whether this scheme is available in Burari or not.

kya sbp mohindergarh code 50105 me ssy open h please rply soon 9354262070

This information we do not have Nikhil.

Dear sir,

Kya ye baat sahi hai ki govertment change ho gayi to scheme bhi stop ho jayegi changw means abhi BJP hai ye aur next time congress aati hai to kya scheme band ho jayegi plz muze reply dijiye..

Nahin Kamlesh, aisa kuch nahin hoga. Ye scheme PPF ki tarah chalti rahegi.

Hi what is differance to opening account in Banks or Post office. Can we diposite monthly , quaterly , six monthly or annually. Please share.

Hi Mr. Ram,

With banks, you can deposit money anywhere in its bank branches in India. Banks also provide online funds transfer facility, which is not there with post offices. You can deposit money any no. of times you want.