This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

SB on July 1 asked me to do a post on investment options post Brexit. Here is what he had to say:

Hi Shiv, can you provide your expert comments /article on the following topics: 1) Investments advice in the current circumstances / post BREXIT era. 2) Real estate investments pros and cons post budget 2016.

Brexit has left most of us clueless about the future of the world economy. It is very difficult for somebody like me to guesstimate the impact of Brexit on any of India’s macroeconomic factors. But, with the clues I have got from whatever relevant I have observed so far, I would like to share my views about investment options we can consider in the present scenario. Here is what I think about such investment options.

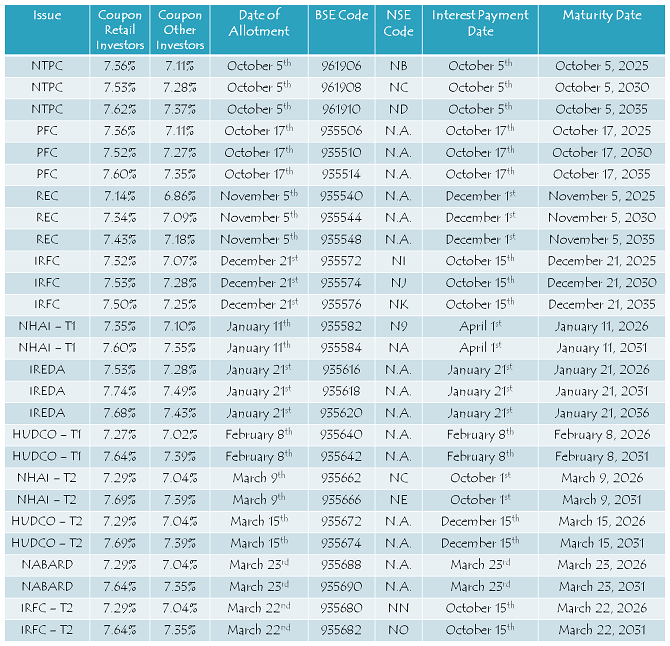

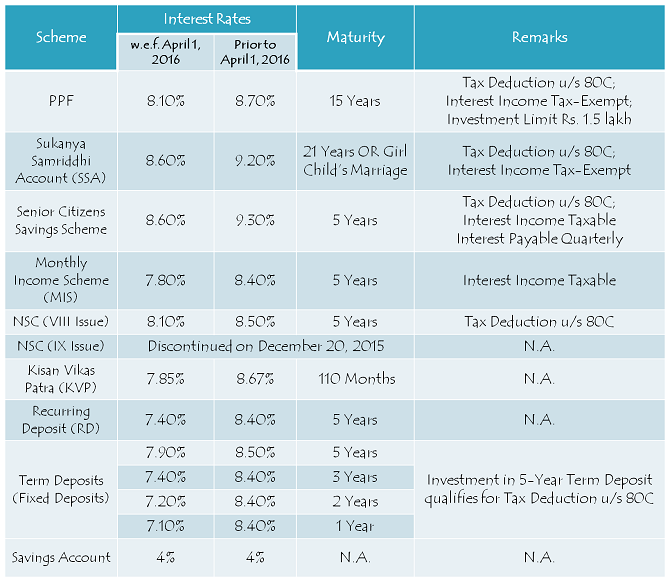

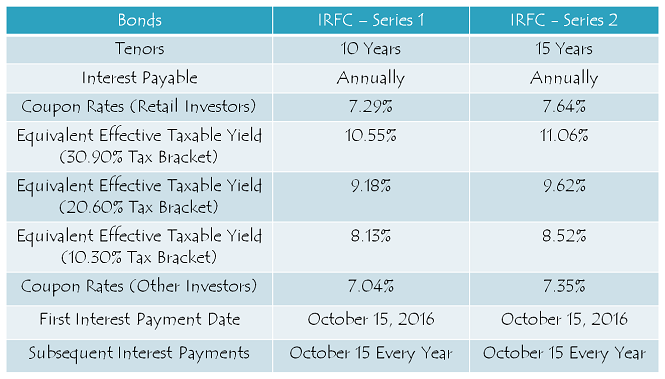

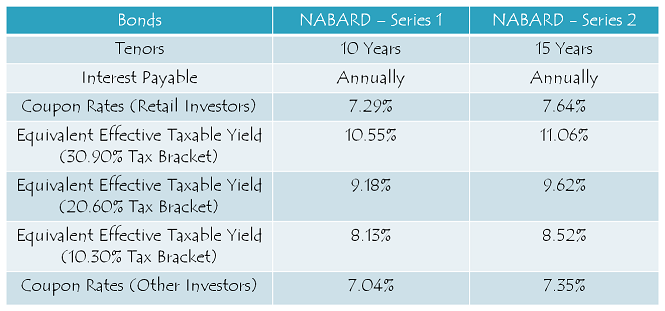

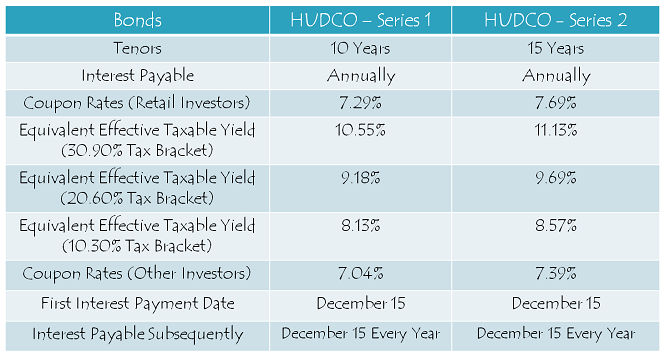

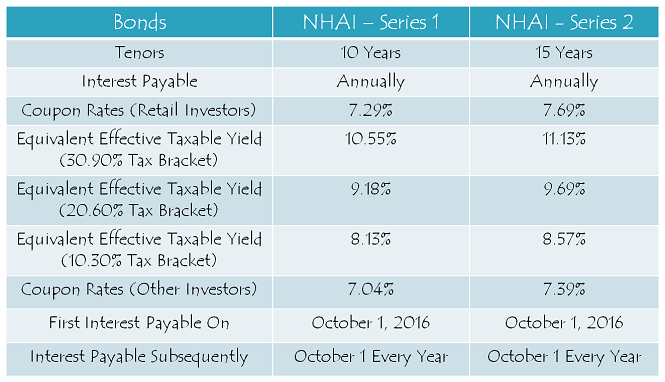

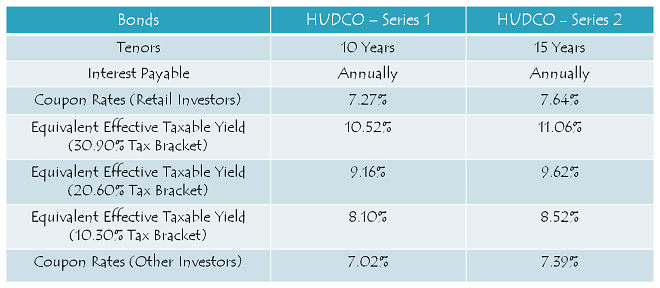

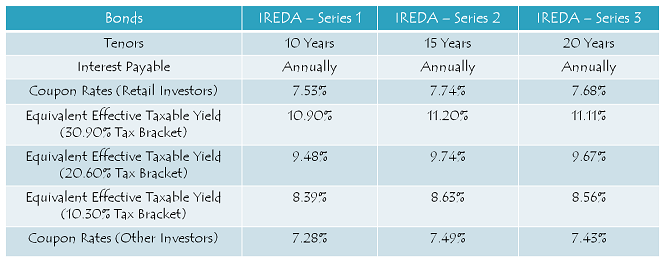

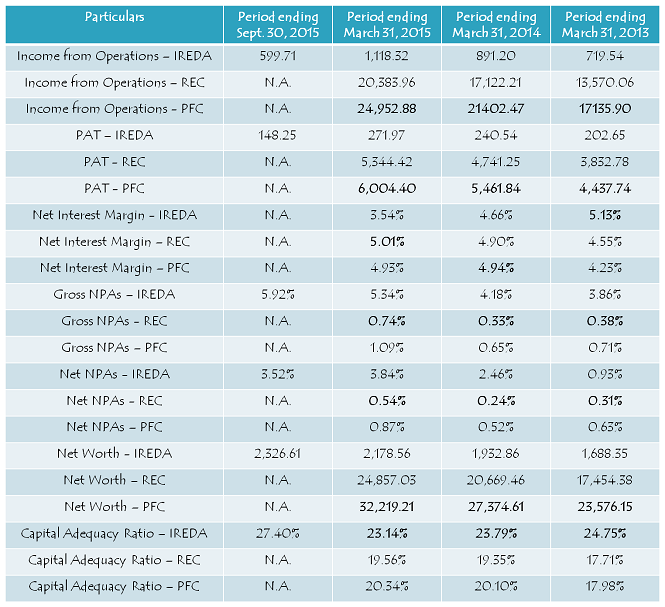

Fixed Income – Tax-Free Bonds, Debt Mutual Funds – Post Brexit, there is a panic in the bond markets the world over. Bond yields globally are falling like there is some kind of financial crisis. While German bond yield has moved into negative territory, bond yields in the U.S., the U.K., France, Switzerland, Denmark and Sweden, all have fallen to fresh historical lows.

All this had a negligible impact on the Indian bond yields so far. But, going forward, I think bond yields here in India should also fall to a range of 7% to 7.25% soon. This should result in a jump in bond prices and NAVs of debt mutual funds. So, it is still a good time to invest in debt mutual funds and tax-free bonds. But, the investors should be cautious on 2 fronts – monsoon rains & inflation. Disappointment with any of these two factors could again put pressure on the bond yields and it could jump to 7.60% to 7.75%.

Real Estate – Most major cities in India have seen a correction in real estate prices in the last 2-3 years. Delhi-NCR region has got 20-40% correction in prices from their peak levels. While there are a large number of reasons for this price correction and lack of demand, I would call it a sentimental U-turn to be the primary reason which has resulted in buyers turning their backs to make fresh investments in real estate these days.

I personally think that there was and there still is a requirement of a sharp correction in real estate prices across major Indian cities. Property prices had touched sky high during 2012-2014 period and the bubble had to burst sooner or later. Though we have seen a healthy correction in property prices in the last 1-2 years, I think they are still ruling at an unreasonably high levels. If we need a healthy growth in this sector and want sale-purchase transactions to resume again, we need the sellers to lower down their expectations to fairly reasonable levels and try to engage good real estate agents in our transactions.

I would advise people not to buy flats or builder floors for at least 1-2 years more as I think there is still a good scope of property prices falling further from here. If you still want to invest, you should try buying a piece of land after negotiating hard with the seller and then get it constructed on your own.

Invest in Construction/Renovation – As mentioned above, I think this is one of the best times to get your home renovated, get one or two rooms added to it or get it constructed if there is a vacant piece of land you have. Global commodity prices are under pressure due to a slowdown in China and a big uncertainty over macroeconomic impact of Brexit. This has resulted in a fall in prices of some of the key raw materials required to get your home constructed or renovated.

So, if you have been planning to get your home constructed or renovated, then this might be one of the best times to do it.

Gold – Nobody knows what will be the ultimate outcome of Brexit. But, everybody is certain that it has resulted in a huge uncertainty over its macroeconomic impacts. Whenever there is an economic uncertainty, gold prices start moving higher and the same has been the outcome this time as well. Gold prices have jumped to their highest levels this year and analysts are expecting a further 5-10% jump in the rest of this year.

But, I have a different view here. I think Gold prices should fall in the months to come. Sentimental shift towards gold should be short lived and I think investors should take this opportunity to cash in such gains.

Direct Equity & Equity Mutual Funds – Had you asked any of the analysts in the morning session of June 24 to guess the NSE Nifty levels of July 5, I am sure most of the analysts would have predicted it to go down to 7200-7800. But, it stands closed at 8,335.95 as of tuesday, a level which is actually higher than the Nifty closing of 8,270.45 as of Brexit voting day.

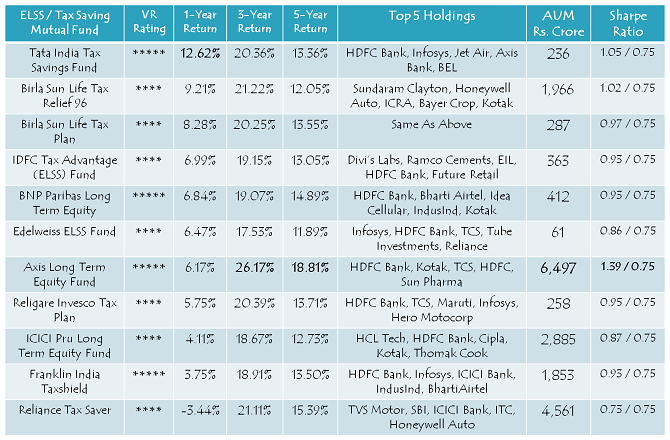

There are three primary reasons behind it – negligible impact of Brexit on the Indian economy, healthy monsoon rains in the last 10-15 days and hopes of GST getting passed in the Monsoon session of Parliament beginning July 18. I think all these are valid reasons for our markets to move up and we should remain cautiously optimistic going forward as well. Though markets may correct in the immediate short term, I think Indian markets should be up from these levels from 6-12 months perspective and substantially higher in 3-5 years from now.

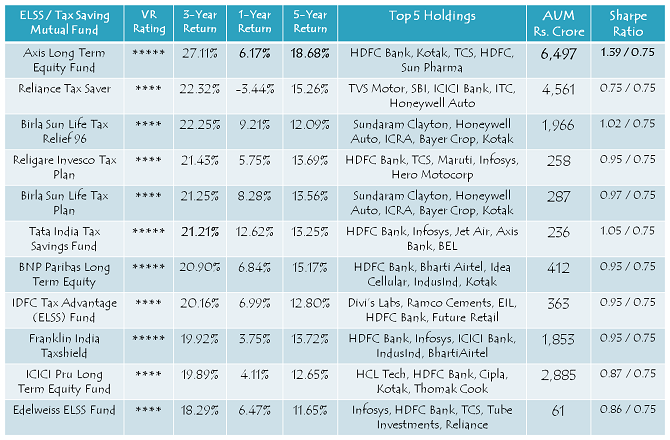

I think equity investment should outperform any other asset class from an investment perspective of 2-5 years and that is one of the reasons why Indian markets recovered very sharply post Brexit outcome. Risk-averse investors should take the SIP route to build their equity portfolios, passive investors should make lump sum investments in 3-4 installments whenever there is a quick correction in the markets due to any reason and active investors should invest in fundamentally sound businesses with a medium to long term horizon.

Till the time you take any of your investment decisions, you should keep your ideal funds in a liquid fund or a fixed deposit.

Please share your thoughts about any of the investment options you think makes sense in the present scenario.