This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

Despite being a big issue, ICICI Prudential Life IPO sailed through quite comfortably yesterday. Post this IPO, ICICI Bank has been able to successfully raise Rs. 6,057 crore from its stake sale in ICICI Pru Life. Not only it got subscribed comfortably, the issue got oversubscription to the tune of 10.48 times its issue size. That is the kind of liquidity the equity and debt markets are dealing with these days.

Spotting such an opportunity to comfortably raise money from the investors, HPL Electric & Power Limited is launching its IPO for subscription from today. The company plans to raise Rs. 310 crore from its share sale to the prospective investors. The issue would remain open for three working days and you will have time till 5 p.m. on 26th of September to invest in this IPO.

Price Band & Size of the Issue – HPL Electric has fixed its price band to be between Rs. 175-202 per share and no discount will be given to the retail investors. With this price band, HPL targets to raise Rs. 361 crore in this issue and the stake to be offloaded would depend on the allotment price fixed by the management after the issue gets closed.

If the issue gets a good response from the investors and the company fixes its allotment price to be Rs. 202 a share, the company will issue 1,78,71,287 shares to the investors. However, if the company decides to fix the allotment price at Rs. 175 due to a poor response or any other reason, in that case it will have to issue 2,06,28,571 shares to raise Rs. 361 crore.

Objective of the Issue – HPL currently carries an outstanding debt of around Rs. 590 crore and it plans to pay off around Rs. 130 crore debt out of the issue proceeds. A further Rs. 180 crore HPL plans to use for the working capital purposes.

Retail Allocation – 35% of the issue size has been reserved for the retail individual investors (RIIs) i.e. 62.55 lakh shares out of 1.79 crore shares or 72.2 lakh shares out of 2.06 crore shares. 15% of the issue is reserved for the non-institutional investors and the remaining 50% shares will be allocated to the qualified institutional buyers (QIBs).

Bid Lot Size & Minimum Investment – Minimum bid quantity of this issue has been fixed at 70 shares and in the multiples of 70 shares thereafter. That would result in a minimum investment of Rs. 12,250 at the lower end of the price band and Rs. 14,140 at the upper end of the price band.

Maximum Investment – Individual investors investing up to Rs. 2 lakh are categorised as retail individual investors (RIIs). So, to be categorised as a retail investor, you can apply for a maximum of 14 lots of 70 shares @ Rs. 202 i.e. a maximum investment of Rs. 1,97,960. However, at Rs. 175 per share, you can apply for 16 lots of 70 shares, thus making it Rs. 1,96,000. Investors opting for the “Cut-Off Price” option would be able to apply for a maximum of 14 lots of 70 shares.

Listing – HPL will get its shares listed on both the stock exchanges i.e. National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) within 6 working days after the issue gets closed on 26th September. October 4th is the tentative date for its listing.

Here is the list of all the important dates relevant for this issue:

Issue Opening Date – September 22, 2016

Issue Closing Date – September 26, 2016

Finalisation of Basis of Allotment – On or about September 29, 2016

Initiation of Refunds – On or about September 30, 2016

Credit of equity shares to investors’ demat accounts – On or about October 3, 2016

Commencement of Trading on the NSE/BSE – On or about October 4, 2016

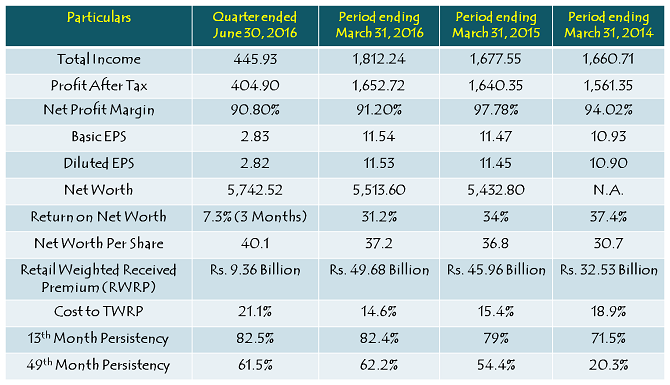

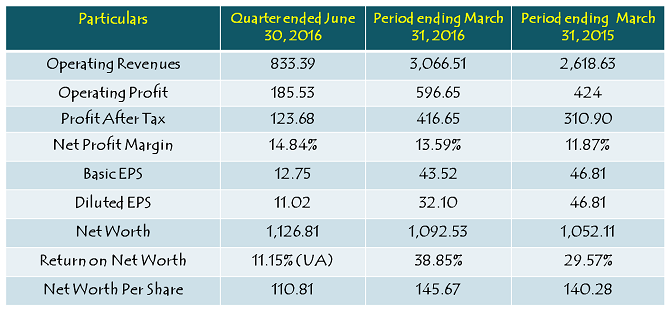

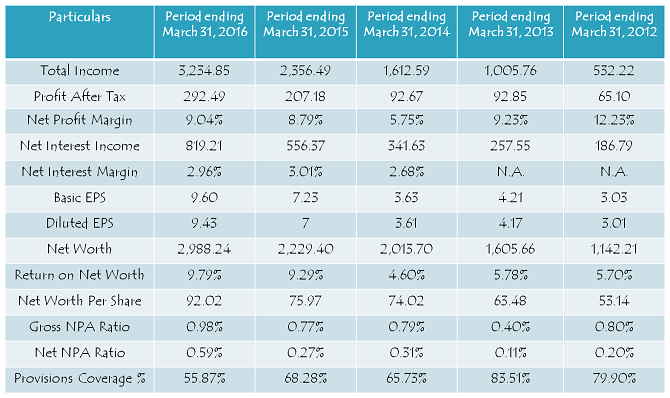

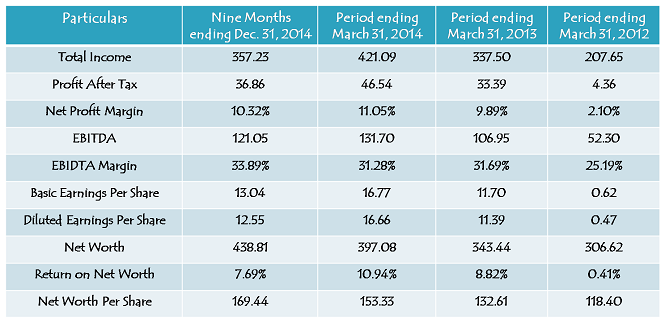

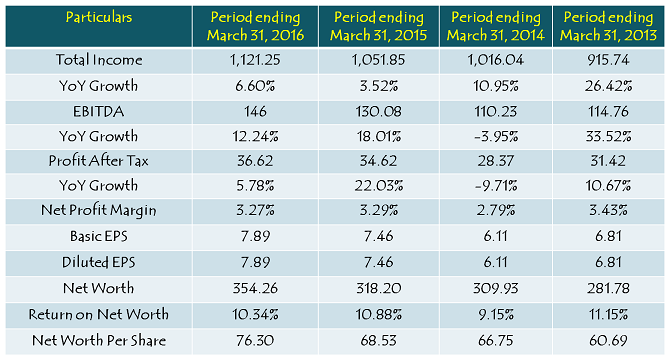

Financials of HPL Electric & Power Limited

Note: Figures are in Rs. Crore, except per share data & percentage figures

Should you subscribe to HPL Electric & Power IPO?

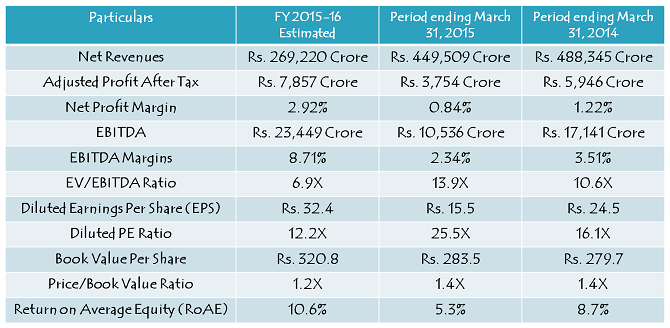

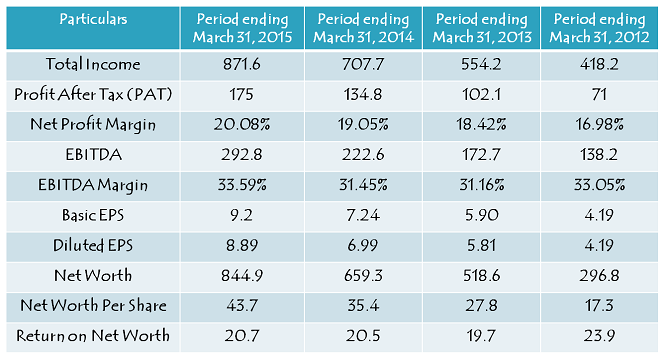

HPL reported a growth of 6.60% in its revenues during FY 2015-16, up from Rs. 1,051.85 crore to 1,121.25 crore. It recorded a 12.24% jump in its EBITDA, from Rs. 130.08 crore to Rs. 146 crore and 5.78% growth in its profit after tax (net profit), from Rs. 34.62 crore to Rs. 36.62 crore. Looking at the kind of growth it has been reporting in the past few years, it is not up to my satisfaction and doesn’t push me to invest in this company.

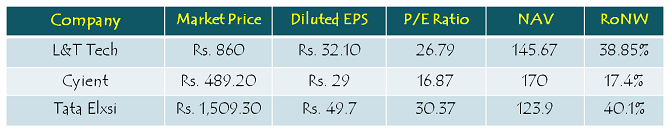

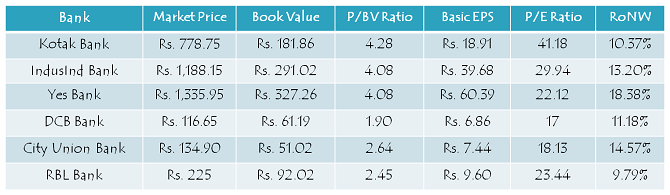

Moreover, HPL recorded an EPS of Rs. 7.89 during the last financial year. At Rs. 202, the company would trade at a P/E ratio of 25.60 its trailing 12 month earnings. However, in a falling interest rate environment, with a reduced outstanding debt, and its 97.15% subsidiary, Himachal Energy’s financials getting incorporated, HPL should be able to generate an EPS in the range of Rs. 9.5-10. This would make HPL trade at a slightly comfortable P/E ratio of around 20-21 times its FY17 EPS.

Moreover, this industry in which HPL is operating is getting extremely competitive and requires a dynamic management to take on some of the disruptive forces and take care of the technological changes. Considering its financials and other valuation parameters, the issue seems expensive and unattractive to me in the present scenario.

However, post this IPO and incorporating Himachal Energy’s financials with itself, HPL will have an opportunity to make its balance sheet look less stretched and also turn around the business dynamics in its favour. How efficiently it is implemented would be worth a wait before one should make an investment with the company.

Despite its estimated valuations to be slightly reasonable, I would recommend the investors to avoid this IPO at this point in time and wait for at least 2-3 quarters more for the company to deliver an improved financial performance.