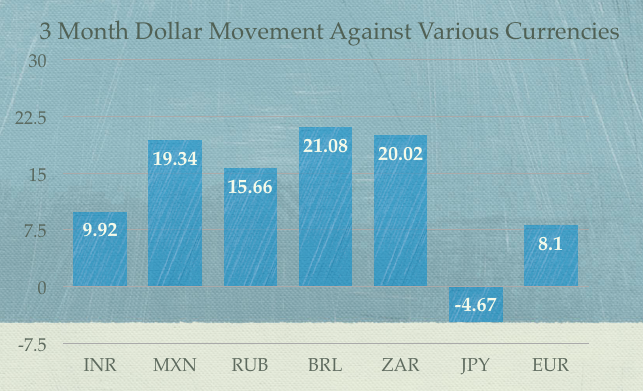

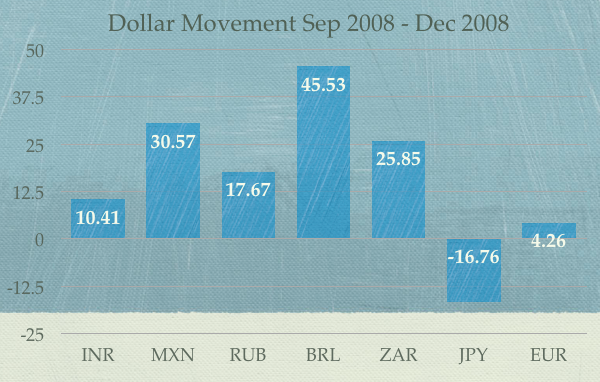

I think one of the more interesting things that have happened during this market fall and the panic that surrounds is it that there is a lot more hysteria than the actual downfall itself.

It seems to me that the parallels to the 2008 crash are quite exaggerated, and personally things don’t seem nearly as bad as they were during the Lehman crash.

The Nifty has fallen a little over 20% and the Dow has fallen less than 5% for the year, but when you look at all the doom and gloom stories you would feel that the fall must be much steeper.

This sentiment made me curious to see how the major world stock markets have performed year till date. The worst that I could find was Greece that has fallen about 46% and the only one that I could see positive was New Zealand with about 1.7% gain this year.

The best source for global stock market indices data is Bloomberg, and I used data from there combined with mapping tools from Chartsbin to create this world map that shows how the major market indices fared this year.

Looking at this data on a map nicely illustrates three points:

- Europe’s woes.

- Emerging markets have fallen a lot more than the developed ones.

- Maps are cooler than graphs.

via chartsbin.com

Also, here is the raw data in a tabular format if you wanted to use this for something else. This can also make for an easy reference for the names and countries of major stock market indices in the world, and here is the link to the Google Spreadsheet.

| Country | Index | Current Price | Beginning Year Price | YTD Gain / Loss | YTD Gain / Loss % |

| Americas | |||||

| US | Dow Jones Industrial Average | 11,103.10 | 11670.75 | -567.65 | -4.86% |

| US | S&P 500 Index | 1,155.46 | 1271.89 | -116.43 | -9.15% |

| US | NASDAQ Composite Index | 2,479.35 | 2691.52 | -212.17 | -7.88% |

| Canada | S&P TSX Exchange | 11,588.40 | 13395 | -1,806.60 | -13.49% |

| Mexico | Mexico IPC Index | 33,005.10 | 38542.16 | -5,537.06 | -14.37% |

| Brazil | Brazil BOVESPA | 51,243.60 | 70317 | -19,073.40 | -27.12% |

| Europe | |||||

| UK | FTSE 100 Index | 5,303.40 | 6043.86 | -740.46 | -12.25% |

| France | CAC 40 Index | 3,095.56 | 3916.03 | -820.47 | -20.95% |

| Germany | DAX Index | 5,675.70 | 6975.35 | -1,299.65 | -18.63% |

| Spain | IBEX 35 Index | 8,798.40 | 9888.4 | -1,090.00 | -11.02% |

| Italy | FTSE MIB Index | 15,529.00 | 20547.03 | -5,018.03 | -24.42% |

| Portugal | PSI 20 Index | 5,921.13 | 5,921.13 | ||

| Netherlands | AEX Index | 288.31 | 358.86 | -70.55 | -19.66% |

| Stockholm | OMX Stockholm Index | 918.28 | 1165.8774 | -247.6 | -21.24% |

| Norway | OSE Benchmark Index | 395.59 | -395.59 | ||

| Switzerland | Swiss Market Index | 5,652.23 | 6494.31 | -842.08 | -12.97% |

| Ireland | Irish Overall Index | 2,562.74 | |||

| Denmark | OMX Copenhagen Index | 294.45 | |||

| Greece | Athens Stock Exchange General Index | 744.37 | 1390.9 | -646.53 | -46.48% |

| Israel | Tel Aviv Exchange | 1,036.76 | |||

| Russia | MICEX Index | 1,351.42 | 1759.46 | -408.04 | -23.19% |

| APAC | |||||

| Japan | Nikkei | 8,605.62 | 10228.92 | -1,623.30 | -15.87% |

| China | Hang Seng Index | 17,707.00 | 23436 | -5,729.00 | -24.45% |

| Taiwan | Taiwan TAIEX Index | 7,211.96 | |||

| India | Sensex | 16,232.50 | 20950.5 | -4,718.00 | -22.52% |

| India | Nifty | 4,888.05 | |||

| South Korea | KOSPI | 1,759.77 | 2085.14 | -325.37 | -15.60% |

| Thailand | Stock Exchange of Thailand SET Index | 636.07 | 733.98 | -97.91 | -13.34% |

| Singapore | FTSE STRAITS TIMES INDEX | 2,640.30 | 3250.29 | -609.99 | -18.77% |

| Pakistan | Karachi 100 Index | 11,853.80 | 12110.26 | -256.46 | -2.12% |

| Australia | S&P ASX 200 Index | 4,162.90 | 4714.9 | -552 | -11.71% |

| New Zealand | NZX 50 Index | 3,383.64 | 3326.71 | 56.93 | 1.71% |

As always I am interested to hear what you say, but this time I’m also interested to hear from you if this data surprised you and if you felt that the fall was really a lot more than the 20 odd percent that we have seen yet?